DBS digibank

Review your portfolio at a glance

Track your trades at any time

Sort by market value, performance, or currency

Leverage on DBS’ house view easily through our model portfolio

Get personalised notifications and timely price alerts

- Your budget for investments is kept separate from daily expenses

- When opportunities arise, topping up funds to trade is quick and easy

- Easy monitoring and reviewing of your wealth management portfolio

- Timely notifications and price alerts help you stay on the pulse of the market

- Make better decisions with insights and research based on your preferences and holdings

Get alerts to significant price movements in your holdings

See similar stocks that match your preferences.

Equity ideas you can act on.

Seize market opportunities in a few clicks.

Create your personal Equity Watchlist.

- 7 global equity markets - Australia, Canada, Hong Kong, Japan, Singapore, the United States and the United Kingdom

- Get latest Global Equity ideas and monitor our Singapore Equity model portfolio

- Get alerts to significant price movements in your holdings

- See similar stocks that match your preferences

- Customise charting tools to analyse stock performance

Buy funds at a click of a button.

Gain access to Funds Insights.

View our top picks on positively-rated funds.

- View detailed fund information

- Funds Insights with top performing funds based on your risk appetite

- Access thematic funds digest

Receive alerts when currency rates of your major holdings change.

Choice of global currencies.

Currency pairing made easy.

Global diversified portfolios from $1,000

Select your preferred risk level

and view the holdings for each level.

View projected and historical performance.

Use the slider to select the investment value and view projected returns

Learn what’s in the portfolio and why.

digiPortfolio is designed for you if:

- You want investing to be straightforward

- Don’t have time to track the market

- Want professionals to manage your investment

- Want to diversify your portfolio and get global exposure

- Use this as your long-term strategy to supplement your other investments

Take your pick from 11 currencies.

Choose your own tenure.

Market insights and ideas at a glance.

Customised market research.

- View our latest global equity ideas

- Monitor DBS Singapore Equity Model Portfolio

- Explore top performing funds based on your risk profile

- Get customised research related to your portfolio holdings

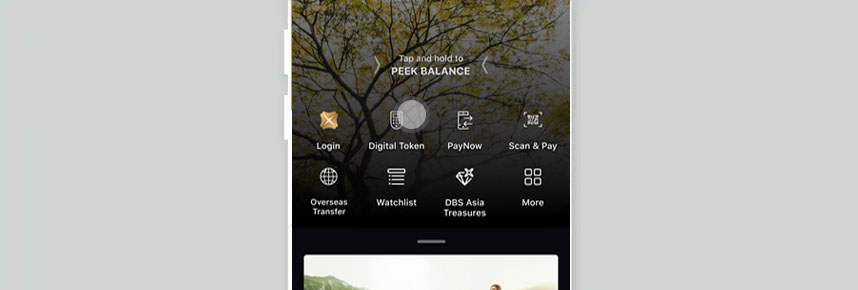

Access your most used features conveniently

Explore the new insights feature

See the details of the insight

Facial and biometric login via the mobile app

Scan to make payments

- Facial and biometric login via the mobile app for extra secure access to your account. For convenience, quick view of your portfolio P&L is available without login.

- Banking made simple with our full suite of online banking services accessible through a single login.

- Scan to pay at over 30,000 PayLah! and NETS QR code-enabled merchants.

- Remit funds 24 hours a day. Enjoy same day transfers and preferential rates for large transfers let you enjoy greater savings.

Step 1

Launch your DBS digibank and tap on 'Digital Token'

Step 2

Tap on 'Set up Now' and login

Step 3

Tap on 'Set up Now' and enter your email and SMS OTP

Not a DBS Treasures client?

Frequently Asked Questions

DBS digibank is available to clients of:

- DBS Treasures

- DBS Treasures Private Clients

- DBS Private Bank

You will need a personal or joint-alternate account of the following:

- DBS Autosave/Current/Savings Plus or POSB Savings/Current Account

- DBS or POSB Credit Card/Debit Card

- DBS Cashline/Home Loan with Servicing Account

You are also required to provide DBS with your mobile number and email address during registration. For information about iBanking online registration, click here.

Facial and Biometric Login

DBS digibank uses state-of-the-art Face ID and fingerprint technologies. This gives you secure yet fast access. Simply scan or touch to unlock your account.

Transaction Alerts

You will be notified by email, SMS, or both each time a selected transaction is performed via DBS digibank or other channels. Click here to learn more.

Money Safe Guarantee

DBS is the 1st bank in Singapore to guarantee that your money will be 100% safe when you bank online. This means you will get back your money in the highly unlikely event that it is lost through an unauthorised transaction. Click here to learn more.

DBS digibank OTP

DBS digibank OTP is an additional security feature using One Time Password authorisation. Register your mobile number with us to enjoy the added assurance of DBS digibank OTP.

Certain function available over web browsers are not featured in the mobile app. They include:

- Investment Portfolio Allocation by Geography and Sector

- Investment Portfolio Analysis by Income and Expense View, Fixed Income Maturity View and Portfolio Performance Benchmark

- Our comprehensive suite of equity trading tools and resources, such as Stock Screeners, Stock Comparer and Charting Tools

- Exchange agreements to trade equities in the US and Canada markets

- SMS and email notification settings

- Live Chat

For now, users who do not can continue to use the older version of the DBS digibank app. However, as bug fixes and enhancements are introduced on the DBS digibank mobile app continuously, there will be a point in time where we will implement a forced upgrade.

Unfortunately, it is not possible to revert to the previous DBS digibank mobile app interface.

You may register the DBS digibank mobile on as many devices as you want. However, do note that you will have to set up all your personalization settings again (Fingerprint login, Face ID, Peek Balance).

We sincerely apologise for the inconvenience caused. Please fulfil your banking needs using our DBS digibank internet banking while we fix these issues. Meanwhile, please contact our contact centre at 1800 111 1111.

Yes. These settings will be retained to ensure a seamless experience when you update to the latest version of DBS digibank.

digibank apps are compatible with operating system (OS) versions Apple 15.0, Android 12.0 and above. For optimal app stability and security, please ensure that you update your device OS to the latest version. For more information, click here.

Users with an outdated iOS/Android version will not see the update option in their respective mobile stores. Please ensure that your phone meets the minimum system requirements for a secured banking experience and compliance to the latest regulatory requirements.

Do check to see if your phone has sufficient memory or storage space for the latest update. If there is sufficient storage on your phone but you are still unable to update your mobile, please contact our contact centre at 1800 111 1111.