Card Rewards

All DBS Credit Cardmembers are eligible for DBS Points Redemption Programme. However, the Programme does not apply to the following cards:-

- DBS Corporate Liability Card (MasterCard Corporate/ Executive and Visa Corporate/ Business)

- DBS Purchasing Card

- Country Club Corporate Card

- DBS Live Fresh Card

- DBS Takashimaya Card

- DBS Esso Card

- DBS yuu Card

- SAFRA DBS Credit/Debit Card

- POSB Credit Card

- DBS and POSB Debit Cards

You earn 1 DBS Point for every S$5 retail purchase charged to your DBS Credit Card. DBS Points are calculated on per transaction basis and rounded down to the nearest whole number.

DBS Points will not be awarded for:

- Bill payments and all transactions via AXS, SAM, eNETS

- Payments to educational institutions

- Payment to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here)

- Payment to insurance companies (sales, underwriting, and premiums)

- Payments to financial institutions (including banks and brokerages)

- Payments to hospitals

- Payments to utilities

- Payment to non-profit organisations

- Betting (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel

- Any top-ups or payment of funds to payment service providers, prepaid cards, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay, Razer Pay, ShopeePay, Singtel Dash and Transit Link)

- Any transaction with transaction description “AMAZE*”

- Instalment payment plan purchases, preferred payment plans, balance transfer, fund transfer, cash advances, annual fees, interest, late payment charges, all fees charged by DBS, miscellaneous charges imposed by DBS (unless otherwise stated in writing by DBS).

Supplementary Cardmembers will earn DBS Points, and these points will be accumulated in the Principal Cardmember's account, and only the Principal Cardmember can redeem DBS Points for rewards. However, Supplementary Cardmembers may also utilise the Rewards Vouchers issued to the Principal Cardmember.

Your DBS Points will expire one year from the quarterly period in which they were earned.

| DBS Points Earned Between | DBS Points Expiry Date |

|---|---|

1 Jan - 31 Mar 2024 | 31 Mar 2025 |

1 Apr - 30 Jun 2024 | 30 Jun 2025 |

1 Jul - 30 Sep 2024 | 30 Sep 2025 |

1 Oct - 31 Dec 2024 | 31 Dec 2025 |

Your DBS Points appear on your monthly Credit Card statement. You may also log in to our online DBS Rewards redemption website or DBS PayLah! app to check your available points and make a redemption.

You will receive your voucher within 7 working days. This includes time required for processing your request and delivery to your billing address by normal surface mail.

We regret that cancellations of redemptions and requests for voucher exchanges will not be accepted. Expiry dates are clearly stated on each voucher and no extensions will be granted.

Yes. You may use your DBS Points for a full waiver of both your Principal & Supplementary Card annual fees. Redemption must be made ONE month before your annual fee is due.

Please note that the annual fee will be reflected in your Credit Card statement, upon its due date, but will be reversed in the following month's statement. (E.g. your annual fee is due in May. You make your redemption in April (one month before due date). The annual fee is then reflected in your May account statement, and reversed in your June account statement.)

For transfers to KrisFlyer, Asia Miles or Qantas Points, conversion rate of 1 DBS point to 2 miles applies and transfers are accepted in blocks of 5,000 DBS Points (or 10,000 miles). For AirAsia points, transfer is at the conversion rate of 1 DBS Point to 3 AirAsia points and transfers are accepted in blocks of 500 DBS Points (or 1,500 AirAsia points). Each conversion of DBS Points to miles by Cardmember to his/her designated airline’s programme will be subjected to a S$27.25 administration fee (inclusive of GST). For AirAsia points conversion, the administrative fee is waived till 31 Dec 2025.

To redeem your DBS Points to miles, redemption can be made through our Rewards website or simply call our Customer Service Hotline at 1800-221-1111. Please note that the transfer process takes approximately 1 - 2 weeks.

Card Application

You will need to be 16 years old and above with a signature-operated DBS Savings Plus, DBS AutoSave or POSB Passbook Savings Account. To open one of these accounts, click here.

To apply for a credit card, you will need to be at least 21 years old.

For Singaporean or Permanent Resident in Singapore, you’ll need a min. income of S$30,000 a year. For selected cards, the income requirements may be higher. You may wish to check the Application Details for the card which you’re interested in.

If you’re a foreigner, you’ll need a valid employment pass with a min. income of S$45,000 a year unless otherwise stated.

The type of document you’ll need varies. Click here for more details.

Please allow 7 working days for processing. Application not accompanied with required documents or with incomplete information will cause a delay in processing.

All applications go through an approval process. For confidentiality reasons, we can’t reveal why your particular application was unsuccessful.

However, we may not be able to process your debit card application if your designated DBS savings or current account is not signature-operated, or if your signature differs from our records. In these instances, we will notify you via an sms or letter and advise you to re-apply at the branch or call us back for further verification.

Yes, Login to Internet Banking. Go to Apply > More Application Services > Select “View Application Status”. Alternatively, you may chat with our Virtual Assistant or Live Chat agents at dbs.com.sg/livechat. Please allow 7 working days for processing. Application not accompanied with required documents or with incomplete information will cause a delay in processing.

Click Credit Card or Debit Card to select the card you wish to apply for.

Card Replacement

If your debit or credit card is lost or stolen, you should report it immediately. We’ll cancel it and arrange a new card for you.

Once you report that your card is lost or stolen, you will not be liable for any fraudulent transactions on your lost or stolen card from the time you notify us.

Visit our Cards Digital Services Page at go.dbs.com/sg-digitalservices to block and replace your card. Alternatively, you may call our Customer Service Centre at 1800 111 1111 (from Singapore); or +65 6327 2265 (from Overseas).

Visit our Cards Digital Services Page at go.dbs.com/sg-digitalservices to cancel your card. Alternatively, you may write in to us.

There's no need to give a reason but please include your card account number & signature so we can cancel it. Our address is:

DBS Cards

Orchard Road

P.O. Box 360

Singapore 912312

For security reasons, please cut each card in half and dispose of them straight away. If there are outstanding balances remaining, your monthly statement will continue to be sent to you until full payment has been made.

Visit our Cards Digital Services Page at go.dbs.com/sg-digitalservices to replace your card. Alternatively, you can call our 24-hour Customer Service Centre on 1800 111 1111 to request for a replacement card.

If you’ve forgotten your ATM/Debit/Credit Card PIN, you can reset instantly via:

- DBS/POSB Internet Banking:

Login to Internet Banking >> Cards >> Reset Card PIN - DBS/POSB Digibank app:

Login to Digibank App >> Card Service >> Reset Card PIN - If you do not have Internet or Mobile Banking, you can set here.

Card Cash Advance

For Cash Advances, there will be a 6% or S$15.00 fee, whichever is greater, levied for each amount withdrawn. In addition, a finance charge of effective interest rate 28% p.a. (subject to compounding if the charges are not repaid in full) on the amount withdrawn, is chargeable on a daily basis from the date of withdrawal until receipt of full payment (minimum charge of S$2.50) will apply.

With the DBS Balance Transfer, you can transfer your balances from other banks' credit cards or lines of credit to your DBS Cashline / credit card(s).

To apply for DBS Balance Transfer, you can do so online at the following link.

After the interest-free period, the prevailing interest rate on the DBS Cashline / Credit Card(s) will apply.

Card Disputes

You may chat with our Virtual Assistant or Live Chat agent at dbs.com.sg/livechat or contact us at 1800 111 1111. We’ll request a retrieval of the charge slip and mail it to you for verification. This may take from 6 to 8 weeks and costs S$5.00 per copy.

You may call our 24-hour Customer Service Centre at 1800 111 1111 to register your dispute.

For FAQ, please click here for more infomation

Card Upgrade

Yes – as long as you stay with the same card. For example you can go from Visa to Visa Gold or Visa Platinum. Just write to us. Include your card account number, signature and copies of your latest income documents (Income Tax Notice of Assessment, IR8A, a computerised payslip or employer's letter). If it’s approved, your new card will be with you within 2 weeks.

Yes, but because each card has different terms you have to apply again. It’s up to you whether you want to cancel your old card or keep it.

Pay Your Credit Card Balance

There are plenty of options available. Check the following table for details:

| Payment Channel | Payment credited on | Remarks |

|---|---|---|

| DBS iWealth® Internet Banking/mobile app | Payment is immediate | For DBS/POSB account holders only |

| Phone Banking/ATM | Next working day (if payment is made before 11.30pm from Mon-Sat, & before 8pm on the last working day of the month) | For DBS/POSB account holders only |

| SMS Banking | Next working day (if payment is made before 11.30pm from Mon-Sat, & before 8pm on the last working day of the month) | Minimum/ Full payments can be made via SMS Banking after successful one-time registration. |

| AXS Stations | Next working day (if payment is made before 4.55pm on Weekdays). Payment made on Friday (after 4.55pm) and on weekends will be credited to your Card Account on Tuesday (provided it is a working day). | - |

| Quick Cheque Deposit | 3rd working day | If you drop the cheque in by 1pm |

| Cheque Mail-in | 3rd working day after we receive the cheque | Please make cheques payable to ‘DBS-Cards’ |

| Cash Payment at DBS/POSB branches | Next working day | - |

| InterBank GIRO | 3rd working day | You will need to complete GIRO application form |

You may drop your cheque into any Quick Cheque Deposit box at any of our DBS/POSB branches. Kindly indicate on the back of the cheque the Card Account number(s) and the corresponding amount(s) payable for each Card Account. You may also mail in your cheque to: DBS CARDS, Orchard Road P.O. BOX 360, Singapore 912312

Click here to download a copy of the Business Reply Envelope

You will have 20 interest-free days to make payment before your next Statement of Account is generated. After which, if you have not made full payment by the payment due date, you will be billed for interest, calculated daily from the date your transaction(s) were posted to your card account until full payment is received, subject to a minimum S$2.50.

For partial payment or non-payment by the due date, there will be Finance Charges computed at the prevailing interest rate of 26.80% per annum levied. Finance charges are calculated daily from the date each transaction is posted to your card account until full payment is received. A minimum finance charge of S$2.50 is applicable.

A late payment charge of S$100 will be levied if minimum payment is not received by the payment due date, provided your outstanding balance is above S$50.

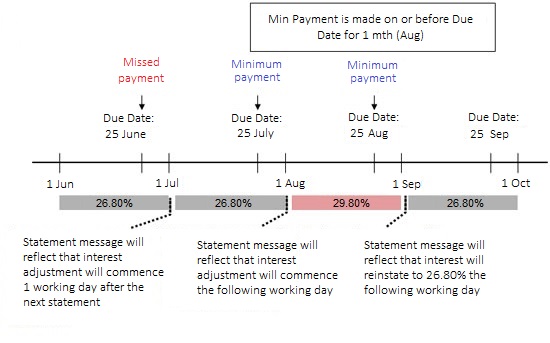

If the bank does not receive the required minimum payment by its due date (for example, due date on 25 June as illustrated in the example below), the interest rate applicable to your Credit Card account will be increased by 3% p.a. on top of the prevailing interest rate (”Increased Interest Rate”). This Increased Interest Rate shall be applied to the outstanding balance in your Credit Card account from the first working day after the date of the subsequent Credit Card account statement following your Credit Card account statement (i.e. from August’s statement), and used to compute the finance charges applicable to your Credit Card account.

This additional interest rate shall be applied even if minimum payment is received by the Bank on or before the due date of the following month (i.e. in July).

In the event that the minimum payment is made in full on or before the due date for the next statement (for example for August statement), the Increased Interest Rate shall be reinstated to the prevailing interest rate on the first working day after your next Statement Date (i.e. from September’s statement).

Example:

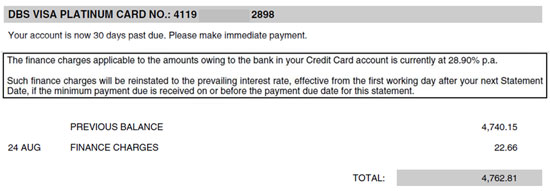

Any adjustment/reinstatement to the prevailing interest rate will be reflected in your monthly statement under your Account number.

Example:

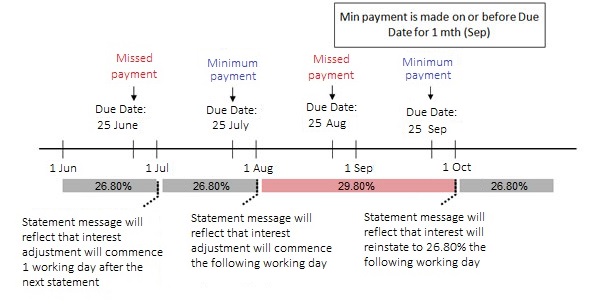

If you miss your payment again during the period of the 1 month during which you must maintain minimum payment in order for the Increased Interest Rate to be reinstated to the prevailing interest rate, the Increased Interest Rate will continue to apply until minimum payment is made in full for 1 month period. Using the example above, the prevailing interest rate will only be reinstated from October’s statement.

Example:

- If you pay your credit card balance in full each month by the due date.

- If you pay the minimum amount each month by the due date, you can avoid late payment charges.