Documents Submission Guideline

- Name and address/email address on all submitted documents should match that on your application form.

- Signatures and authority stamps should be captured clearly, if applicable.

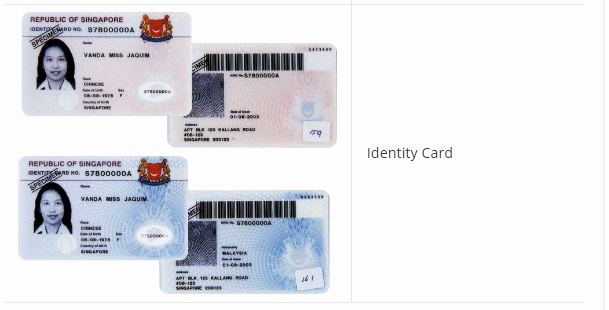

Identity Document

- NRIC (front & back) for Singaporean/Permanent Residents

- Passport for Foreigner (minimum validity of 6 months at the time of application)

Work Pass

- List of eligible work passes: Employment Pass, S Pass, Personalised Employment Pass, Long-Term Visit Pass with LOC, Tech. Pass, International Organisation Pass, Overseas Networks & Expertise Pass

- Employment Pass must have a minimum validity of 6 months at the time of application

Computerised payslip

- Document must be dated within 3 months before the date of application

- Please provide the latest 2 years of Income Tax Notice of Assessment

- Login to your myTax Portal using your Singpass

- Under “Notices/ Letters” section, select “Individual”

- Select the latest available “Notice of Assessment (Individual)” to generate your Income Tax Notice of Assessment in PDF

Bank statement

- Document must be dated within 3 months before the date of application

Proof of Residential Address

- Document must be dated within 3 months before the date of application

- Local utility/ telecommunication bill or

- Local bank statement/ credit card statement

Note:

- Tenancy agreement is not acceptable proof of residential address

- P.O.Box, Care-of, Office and School address are not acceptable forms of Residential Address.

Document Specifications

Image File Type: jpeg, pdf, or png file extension

Image Size Limit: Up to 5MB per document

1. Submit documents that match your application form

Tip: Ensure that your document is valid. Review details (e.g. expiry dates, visibility of details) before you submit your application.

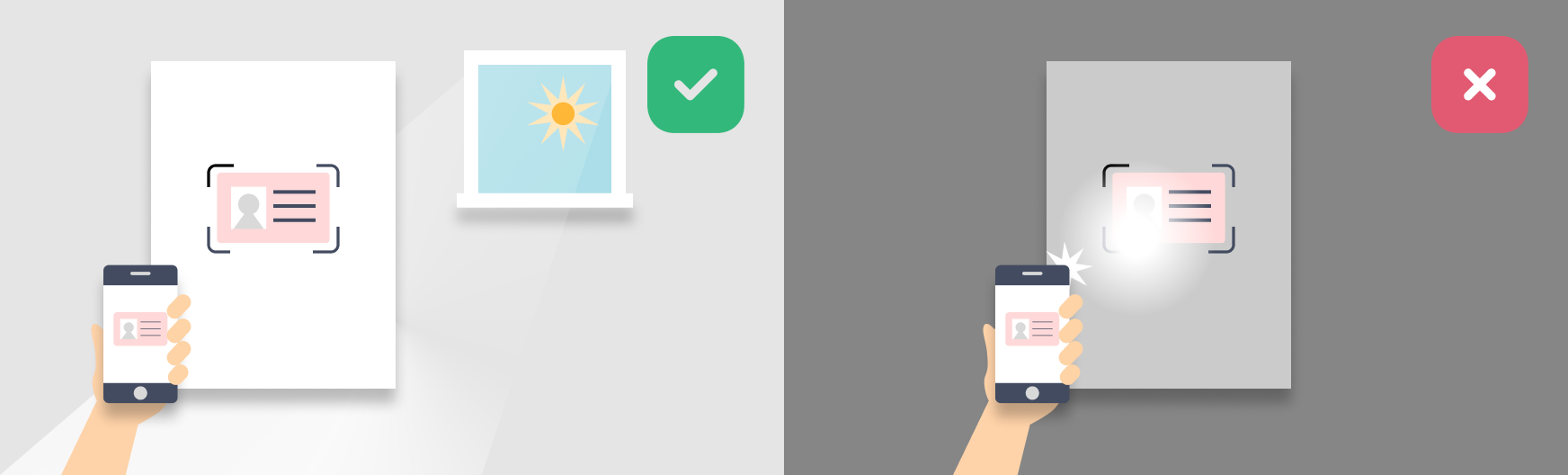

2. Avoid blurring/blocking document details

Tip: Use natural light (instead of flash mode on your camera) or position your document where reflection does not blur any part of the image.

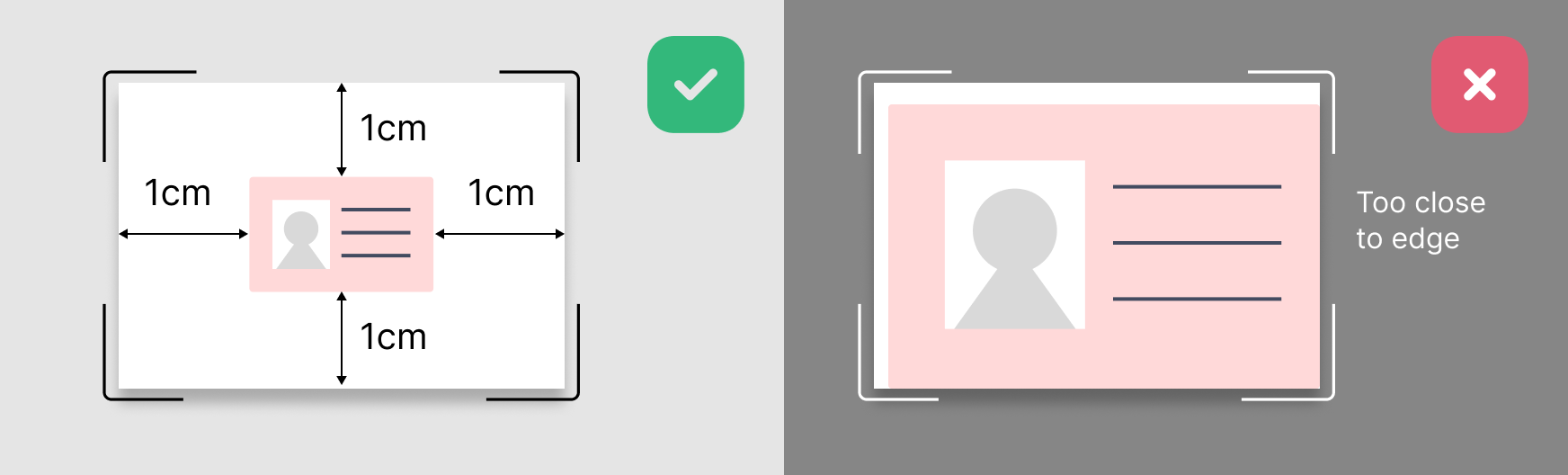

3. Prevent details of documents from being cropped out

Tip: Frame your image by leaving at least 1 cm gap on each side of the document when you photograph it digitally.

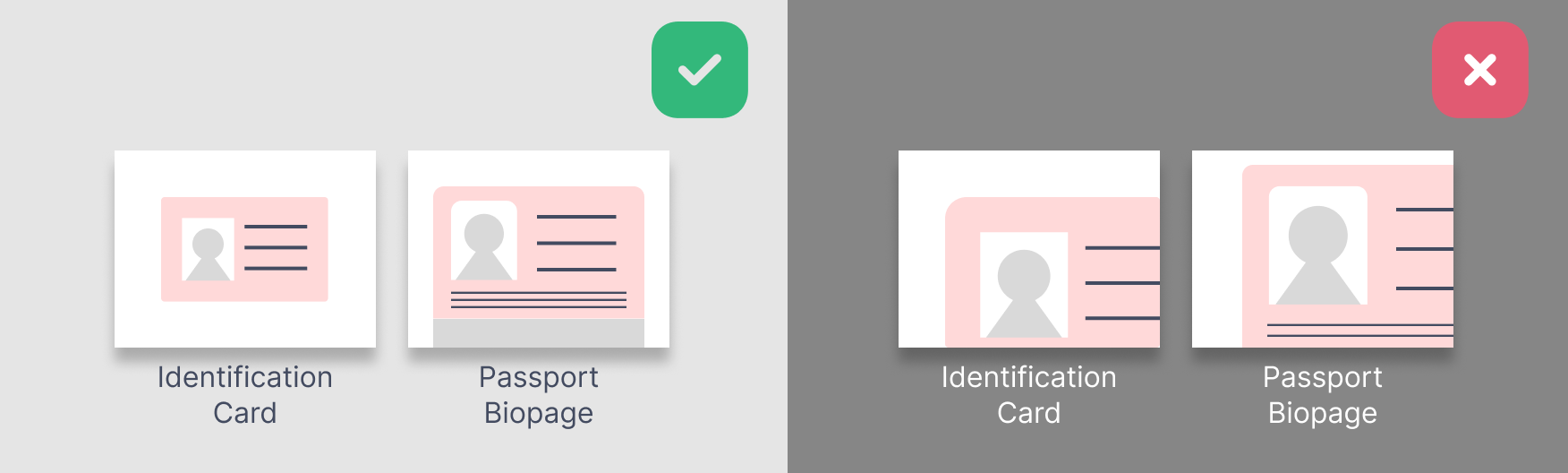

4. Submit complete identity document

Tip: Capture both the profile picture and all printed details. Do not block or crop out any of the details.

5. Submit images that are in focus

Tip: When using mobile phone, tap the screen to correct the camera’s focus before taking the picture.

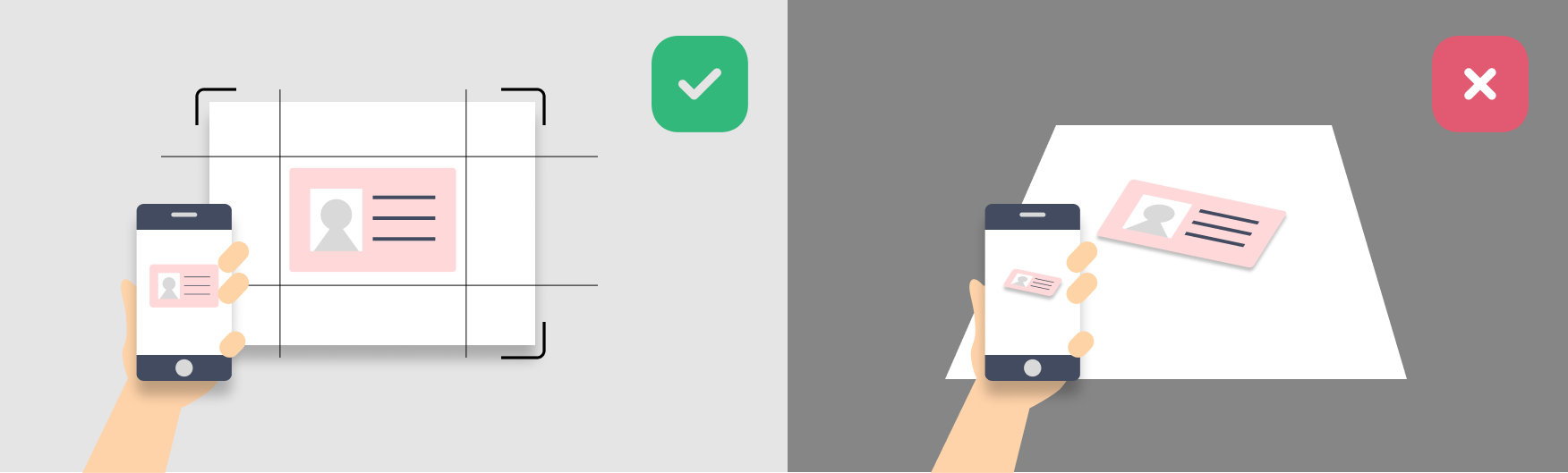

6. Avoid skewed distortions of your image

Tip: Ensure your phone is parallel to your document when taking the picture. Try placing your document against a white piece of paper and use it as a parallel frame.