500

Please enter only a-z,A-Z,0-9,@!>$&-()',./Latest scams & frauds

Scammers and fraudsters constantly find ways to trick consumers into giving up their banking details to provide access to their accounts. Being aware of their scam methods can help keep you safe.

6 security tips to protect yourself online

Banking online can be safe if you stay vigilant. Learn how to protect yourself against scams with these 6 simple security tips!

Be Web Wise - Think before you Act

- Be careful of links and attachments sent through emails or SMS or posted online on social media sites. Such links and attachments may lead to phishing pages or install malware onto your device without your permission.

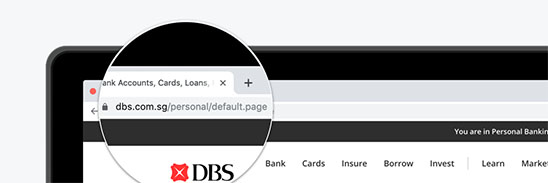

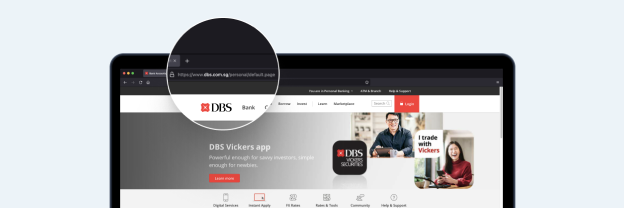

- Always go to our website by typing https://www.dbs.com.sg to ensure you’re reaching DBS's website.

TIP: If you wish to visit a webpage, it is safer to type the URL on the address bar of your browser than to click on it from an email or another site. - Stay current with latest news, check our Security Alerts & News frequently to be in the know of the latest threats and scams targeting DBS and POSB customers.

- Avoid performing online transactions on public or shared devices or devices that you suspect are compromised.

- Never reply to unsolicited emails or SMSes. Responses to such emails or SMSes could be used by fraudsters to socially engineer information or trick users into performing unwanted actions.

- Verify any odd or suspicious requests through official contact numbers or channels. Ensure that you're communicating directly with official DBS accounts on social media, especially when asking for assistance.

Stay Alert – Be Informed

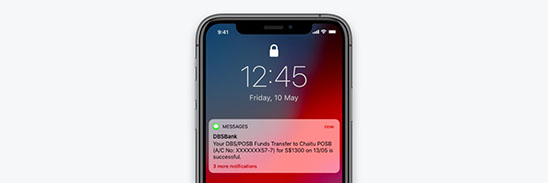

- As part of the E-Payment User Protection Guidelines, ensure your Transaction Alerts are enabled so that you can be informed instantly of transactions on your account via SMS or email.

- Read the transaction details in the SMS or email alerts carefully. Validate that the messages, for example, check that the account number is correct, or the transaction reflects your request. Do not provide a One-Time Password (OTP) or DBS digital token authorization if the details in the SMS or email alerts do not match the transaction you initiated. Inform the bank immediately if in doubt.

- Check your transaction history regularly for any abnormal transaction and notify us immediately, if you notice unknown transactions appearing on your account.

Personal Banking: 1800 339 6963 or +65 6339 6963 (Overseas)

Business Banking: 1800 222 2200 - Keep your contact details updated with the Bank. Learn more.

- When accessing digibank, never leave your session unattended and log out after use.

Healthy Device – Keep it updated & protected

- Avoid jailbreaking or rooting your devices. Doing so makes your device more prone to security vulnerabilities like viruses and malicious software.

- Protect your device, web browser and Operating System (OS) with the latest anti-virus software

- For optimal app stability and security, ensure that you update your device’s operating system (OS) to the latest version.

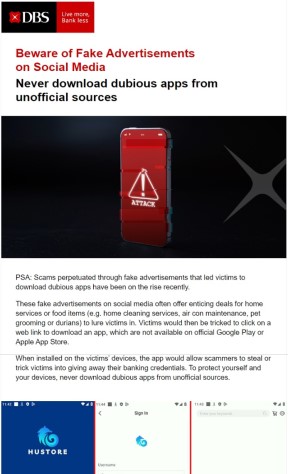

- Be mindful of the applications you install on your devices. Install apps from official app stores such as Apple App Store or Google Play Store. Unofficial app stores may modify and inset malware into legitimate, non-malicious apps.

- When installing applications, verify that the permissions granted to the application are necessary and avoid downloading unnecessary applications as these applications may contain malicious code or social engineering scams.

- Regularly backup critical data.

Download the ScamShield App (For Singaporean customers only)

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council, and more information can be found at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield’s in-app reporting function.

Aware - Be mindful of what you share

- Be aware of what information you share and how it can be used by a receiving party.

- Avoid sharing personal details such as your identity card information, address, phone number, DBS account details, or other personal information unnecessarily.

- Consider setting your social network profile to private or use custom audience settings. This way, only people you invite can see what you post.

- Consider using a nickname instead of your real name. This can help reduce the chances of you being harassed online.

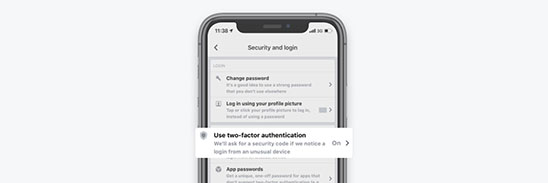

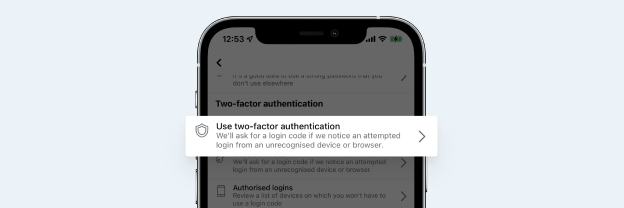

- When using public Wi-Fi, avoid accessing websites that require you to login. Consider limiting your activities to only non-sensitive ones. Enable security settings such as 2FA whenever possible adds an additional layer of security.

- Stop and consider before sharing any posts as information posted may cause harm to yourself or people around you.

Responsible - Be a good citizen

- Review your privacy settings and practice good social media etiquette. Enable security settings such as 2FA whenever possible as an additional layer of security

- Think before sharing and post online, what you share online can be re-shared and made public by others. You cannot take it back or delete it later.

- Treat others the way you would like to be treated. Practise kindness in both the physical and digital world.

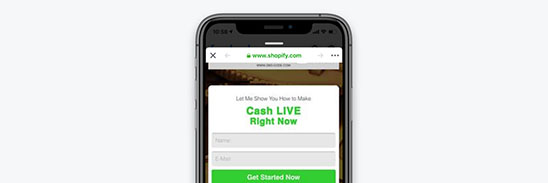

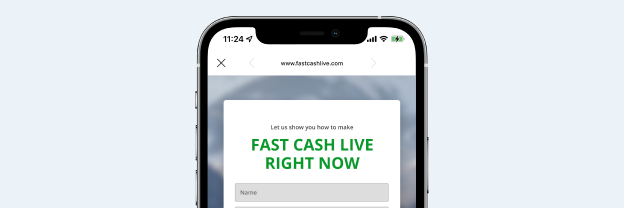

- Be cautious when you come across promotional offers that sound too good to be true.

- Apply a healthy dose of scepticism if you read any news articles that are sensational and discern if the articles come from a credible source.

Protect Your Information

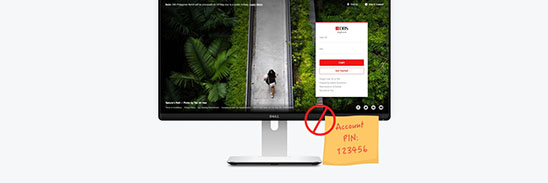

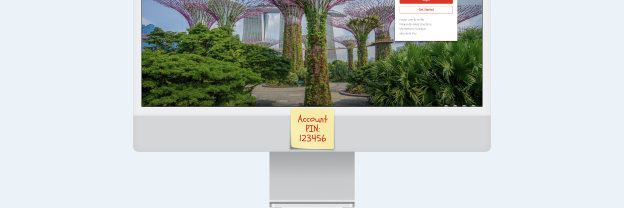

- Secure your device with a strong password, PIN or a relevant mechanism to prevent unauthorised use.

TIP: A strong password is one that is difficult to guess and contains a mix of letters, numbers or symbols. You can use this on top of your device’s biometric security feature (if available). - Never disclose your digibank User ID, PIN & One-Time Password (OTP) to anyone. DBS will never request for your PIN, password or OTP.

- Avoid providing your account details (such as passwords and PIN) to third-party financial aggregator applications as these applications may not be secure.

- Avoid registering other people’s biometrics such as facial or fingerprint registration on your devices if you use biometrics to access DBS applications.

- Use a different PIN or password for web-based services such as email, online shopping or subscription services.

Latest Campaigns

Stay updated on the latest security news that might affect the way you bank online.

SPF x DBS Red Flags Ep 1 – How to spot a phishing scam

Past Videos

SPF x DBS Red Flags Ep 2 – How to spot a job scam

SPF x DBS Red Flags Ep 3 – How to spot an e-commerce scam

SPF x DBS Red Flags Ep 4 – How to spot an investment scam

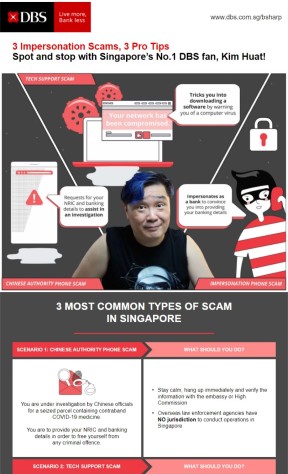

What happens during a tech support impersonation scam

Don’t get phished

#BSHARP – Protect Your Information

#BSHARP – Be Web Wise

#BSHARP – Stay Alert

Recent Scams & Frauds

Stay updated on the latest security news that might affect the way you bank online.

Phishing Alert

Scammers are using phishing emails to steal and perform unauthorised transactions on your DBS and POSB accounts and cards.

Date: 21 Jan 2026

What this scam looks like:

Scammers use phishing emails urging you to resolve critical issues with your DBS or POSB accounts or digital tokens. These phishing emails direct you to sites imitating DBS or POSB digibank.

These sites aim to steal your login credentials, card details, and OTPs or digital token approvals before conducting unauthorised fund transfer or card transactions.

Protect Yourself:

- Always use DBS' and POSB's official hotline number, website, and mobile apps to conduct DBS bank-related requests

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- Always verify directly with DBS Bank for any investment-related deals.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Deepfake Scams Alert

Scammers are using deepfake videos on social media and phishing sites to promote investment scams.

Date: 8 Jan 2026

What this scam looks like:

Scammers use deepfake videos of DBS Staff and senior leadership or fake affiliate courses to promote scams on social media and fake investment websites.

These scams could trick you into transferring your personal information or funds to scammers.

Protect Yourself:

- Remember: if it seems too good to be true, it's likely a scam.

- Always use DBS' and POSB's official hotline number, website, and mobile apps to conduct DBS bank-related requests

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- Always verify directly with DBS Bank for any investment-related deals.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scams & Frauds Alert Archives

2025

Phishing Scams

Phishing and Impersonation Alert

Scammers are using phishing emails and impersonating DBS staff via voice calls to steal your personal data and perform unauthorised transactions on your DBS and POSB accounts and cards.

Date: 12 September 2025

What this scam looks like:

Scammers use phishing emails asking you to confirm your login location. These emails have a phishing link and urge you to contact a scammer-controlled number for further help. The scammer impersonates DBS staff and asks for your personal data like your name, number of bank accounts and credit card details.

These scammers aim to use your personal data to steal your login credentials, card details, and OTPs or digital token approvals before conducting unauthorised fund transfer or card transactions.

Protect Yourself:

- Always use DBS' and POSB's official hotline number, website, and mobile apps to conduct DBS bank-related requests.

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any requests.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Phishing Alert

Scammers are using phishing emails to steal and perform unauthorised transactions on your DBS and POSB accounts and cards.

Date: 15 August 2025

What this scam looks like:

Scammers use phishing emails urging you to resolve critical issues with your DBS accounts or digital tokens. These phishing emails direct you to sites imitating DBS digibank.

These sites aim to steal your login credentials, card details, and OTPs or digital token approvals before conducting unauthorised fund transfer or card transactions.

Protect Yourself:

- Always use DBS' and POSB's official hotline number, website, and mobile apps to conduct DBS bank-related requests.

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any requests.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

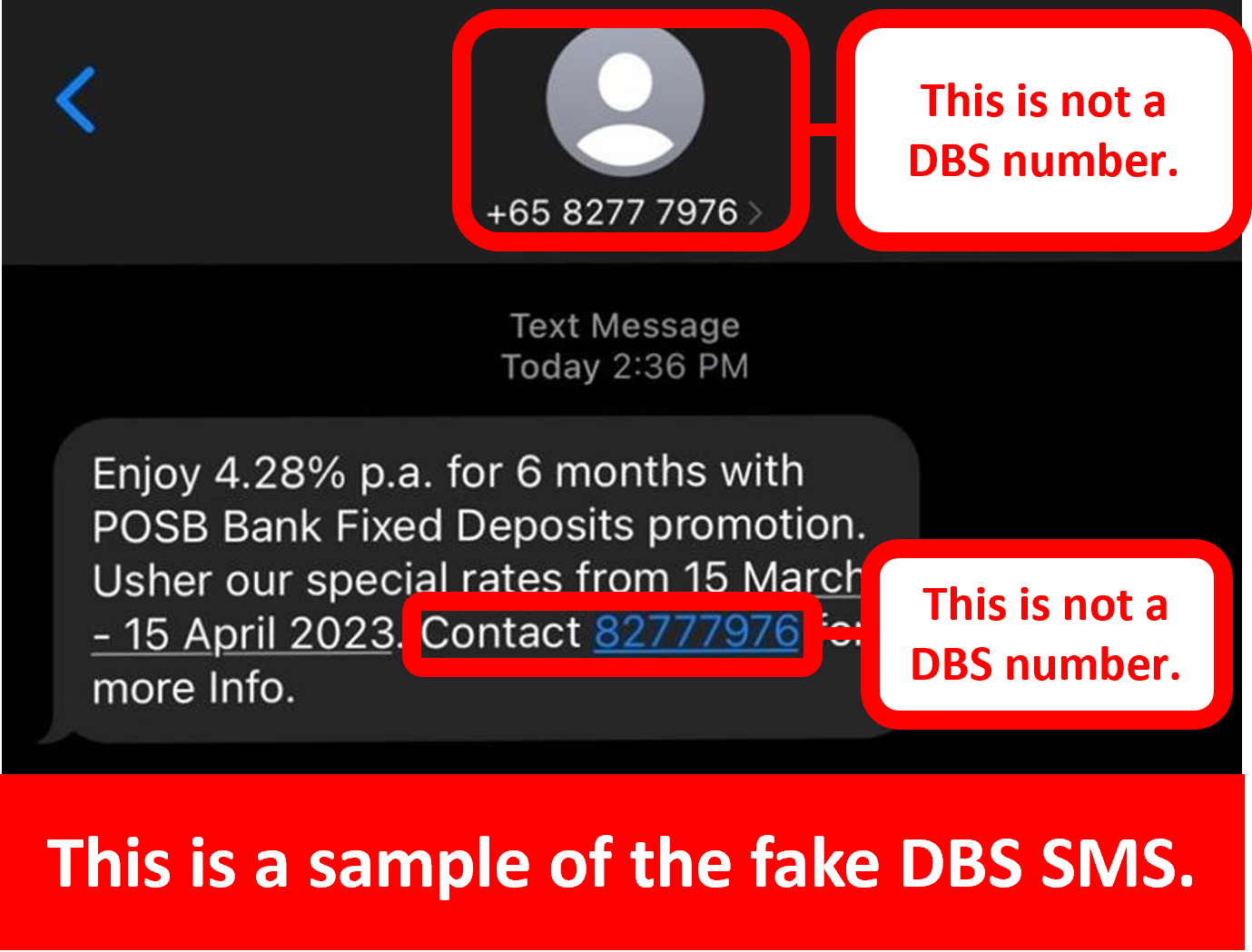

DBS SMS Phishing Alert

Scammers are impersonating DBS through SMS to steal and perform unauthorised transactions on your DBS and POSB accounts.

Date: 06 April 2023 (Updated 30 April 2025)

Description: Beware of phishing SMSes targeting you with fake DBS promotions, such as DBS Fixed Deposits offering 4.38% p.a. for 6 months. These SMSes may ask you to contact a phone number to learn more. However, these SMSes are scams, and the person on the other end is not a DBS representative.

The scammer may attempt to trick you into transferring money to their bank account, or they may request your DBS login information and digital token approval code. If they acquire this information, they can use it to steal your bank funds or access your account without your permission.

Never reveal sensitive details to scammers, such as your login credentials or PINs, as they can use this information to conduct unauthorized transactions on your cards or bank account.

If you have shared your Username-PIN Code combination with any non-DBS websites or mobile applications, we strongly advise changing your PIN Code immediately.

You may do so by following the instructions here.

Customers are advised to be mindful of such scams.

Protect Yourself:

- Always use DBS' and POSB's official hotline number, website, and mobile apps to conduct DBS bank-related requests.

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any requests.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Phishing Alert

Scammers are using phishing emails to steal and perform unauthorised transactions on your DBS and POSB accounts and cards.

Date: 11 April 2025 (Updated on 25 April 2025)

What this scam looks like:

Scammers use phishing emails urging you to resolve critical issues with your POSB accounts or digital tokens. These phishing emails direct you to sites imitating POSB digibank.

These sites aim to steal your login credentials, card details, and OTPs or digital token approvals before conducting unauthorised fund transfer or card transactions.

Protect Yourself:

- Always use DBS' and POSB's official hotline number, website, and mobile apps to conduct DBS bank-related requests.

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any requests.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Phishing Alert

Scammers are using phishing emails to steal and perform unauthorised transactions on your DBS accounts and cards.

Date: 21 February 2025

What this scam looks like:

Scammers use phishing emails urging you to resolve critical issues with your DBS accounts or digital tokens. These phishing emails and messages direct you to phishing sites which imitate DBS sites, such as iBanking or PayLah.

These sites aim to steal your login credentials, card details, and OTPs or digital token approvals before conducting unauthorised fund transfer or card transactions.

Protect Yourself:

- Always use DBS' official website and mobile apps to conduct DBS bank-related requests.

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any requests.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Impersonation Scams

Deepfake Investment Scams Alert

Scammers are using deepfake videos on social media to promote investment scams.

Date: 20 May 2025 (Updated on 28 August 2025)

What this scam looks like:

Scammers use deepfake videos of DBS senior leadership and staff to promote investment scams on social media.

These scams could lead to phishing sites or trick you into transferring your funds to scammers.

Protect Yourself:

- Remember: if it seems too good to be true, it's likely a scam.

- Always use DBS' and POSB's official hotline number, website, and mobile apps to conduct DBS bank-related requests

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- Always verify directly with DBS Bank for any investment-related deals.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Job Scam Alert

Scammers are using fake DBS Bank and DBS Bank subsidiaries job offers to trick you into conducting fund transfers to scammers' accounts.

Date: 28 August 2025

What this scam looks like:

Scammers post fake job offers purporting to be DBS Bank or DBS Bank subsidiaries on job portals such as LinkedIn.

These fake job offers promise high pay and attractive benefits. However, the scammers will ask you to deposit your funds into a scammer's live trading account as a condition to confirm your offer.

Protect Yourself:

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any requests.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Other Scams

There are no archived scams here for 2025

SafeGuard Your E-Payments

How do the Guidelines protect me?

We will provide you with transaction notifications and a reporting channel so that you may be alerted of unauthorised transactions and report them when they happen.

We will investigate claims of unauthorised transactions with the aim of achieving a fair and reasonable resolution. The Guidelines do not apply to transactions which you initiated because of a scam or fraud. Such transactions will be investigated by the police.

How can I report an unauthorized transaction?

Please call our 24-hour DBS Customer Service Hotline at 1800 339 6963 or +65 6339 6963 (Overseas) immediately for assistance. Our customer service officer will ask you to provide more details about yourself, your protected account and the transaction in order for us to commence investigations and update you.

How can I report an erroneous transaction?

Please call our 24-hour DBS Customer Service Hotline at 1800 111 1111 or +65 6327 2265 (Overseas) immediately for assistance. Our customer service officer will ask you to provide more details about yourself, your protected account and the transaction in order for us to commence investigations and update you.

What happens after I report an unauthorised transaction?

After receiving the information required to facilitate the investigation, we will complete an investigation of any relevant claim within 21 business days for straightforward cases or 45 business days for complex cases.

Complex cases may include cases where any party to the unauthorised transaction is residing overseas or where the Bank has insufficient information from you to complete the investigation. We will update you of the outcome of our investigation. If it has been assessed that you are not liable for any loss from the unauthorised transaction, we will credit your account as soon as our assessment is complete.

For erroneous or unauthorised transactions on credit cards, charge cards or debit cards, the dispute resolution process established under the respective card scheme will apply.

What happens after I report an erroneous transaction?

We will endeavour to assist to recall the funds from the recipient and update you of the outcome. Longer time may be taken for more complex cases.

What are my liabilities for losses arising from unauthorised transactions?

You will not be liable for any loss that arises from any action or omission by us, if you have complied with your duties as an account holder. For losses due to any other independent third party other than you and us, subject to the below, you will also not be liable if the outgoing transaction value is within S$1,000.

You will, however, be liable if it is ascertained that the primary cause was recklessness on your part, such as failing to protect your access code, login credentials or access to your protected account. Your liability will be capped at the transaction limit or daily payment limit, where applicable.

In all cases, we will conduct an assessment to determine the appropriate liabilities and work towards a fair and reasonable resolution.

For transactions on credit cards, charge cards and debit cards issued in Singapore, the apportioning of liabilities is governed by the ABS Code of Consumer Banking Practice.

What is a protected account?

Protected accounts are those that:

- Are held by either individuals or sole proprietors, including those held jointly by multiple account holders; and

- Can hold a balance of more than S$500 (or equivalent amount in another currency) at any one time, or is a credit facility, which can be used for electronic payment transactions.

What type of transactions are covered by the Guidelines?

The Guidelines cover all payments from protected accounts initiated through electronic means, and where funds are received through electronic means.

The Guidelines do not apply to transactions which you initiated because of a scam or fraud.

What are my duties as an account holder or account user?

The Guidelines set out your duties as an e-payment user to adopt good security practices. These include:

- Keeping your contact details such as Singapore mobile number and email address with us up to date so that we can send you transaction alerts by SMS or email;

- Opting to receive transaction notifications for all outgoing transactions of any amount.

- Enabling alerts on any device used to receive such alerts;

- Monitoring your transaction alerts and account statements for any unauthorised or erroneous transactions;

- Practicing good digital security habits by protecting your access codes and not sharing with it anyone. If you need to record your access codes, keep it securely and make sure that it is only known to you and unlikely to be found by a third party;

- Protecting access to your protected account. Find out more about digital security tips on #BSHARP;

- Report to us immediately if you notice any unauthorised or erroneous transactions;

Make a police report and furnish a copy of the report together with information about the unauthorised transaction us so that we can begin the investigation process;

What are transaction notifications for?

They safeguard you against unauthorised and erroneous transactions. They are to alert you of such transactions so that you may report them to us for quicker resolution.

The Monetary Authority of Singapore has issued the E-Payments User Protection Guidelines (“Guidelines”) to protect users of electronic payments and encourage wider adoption of e-payments in Singapore. The Guidelines establishes a common baseline protection that financial institutions will provide to individuals or sole proprietors from losses arising from isolated unauthorised or erroneous epayment transactions from their protected accounts. Here are some common questions about the Guidelines.

For more information on MAS’ Guidelines, you may refer to the FAQ on E-Payments User Protection Guidelines by ABS.

ScamAlert and Anti-Scam Quiz by NCPC

Visit scamalert.sg, an initiative by the National Crime Prevention Council and learn how to protect yourself from different types of scams.

Anyone can be scammed and suffer financial loss. Complete this NCPC Scam Buster Bank Quiz to learn how to guard against scams.

Cybersecurity Awareness by CSA

Visit go.gov.sg/bettercybersafe, an initiative by the Cyber Security Agency of Singapore and learn about their cybersecurity awareness campaign.

|

DBS Bank is the inaugural organization certified under the Cyber Trust Mark certification scheme. We have been awarded the prestigious 'Advocate' tier as a testament and recognition of our robust cybersecurity practices and measures across the bank's digitalised business operations. Learn more about our security compliance certifications at https://www.dbs.com/securitycompliance/default.page. |

Need Help?

Call us immediately at our 24-hour DBS Fraud Hotline at 1800 339 6963 or +65 6339 6963 (Overseas) to report fraudulent transactions, unauthorised access to your banking account and loss of credit/debit cards.

If you wish to report an alleged scam or fraud attempt to prevent others from being a victim, you can do so using our DBS digibot here.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?