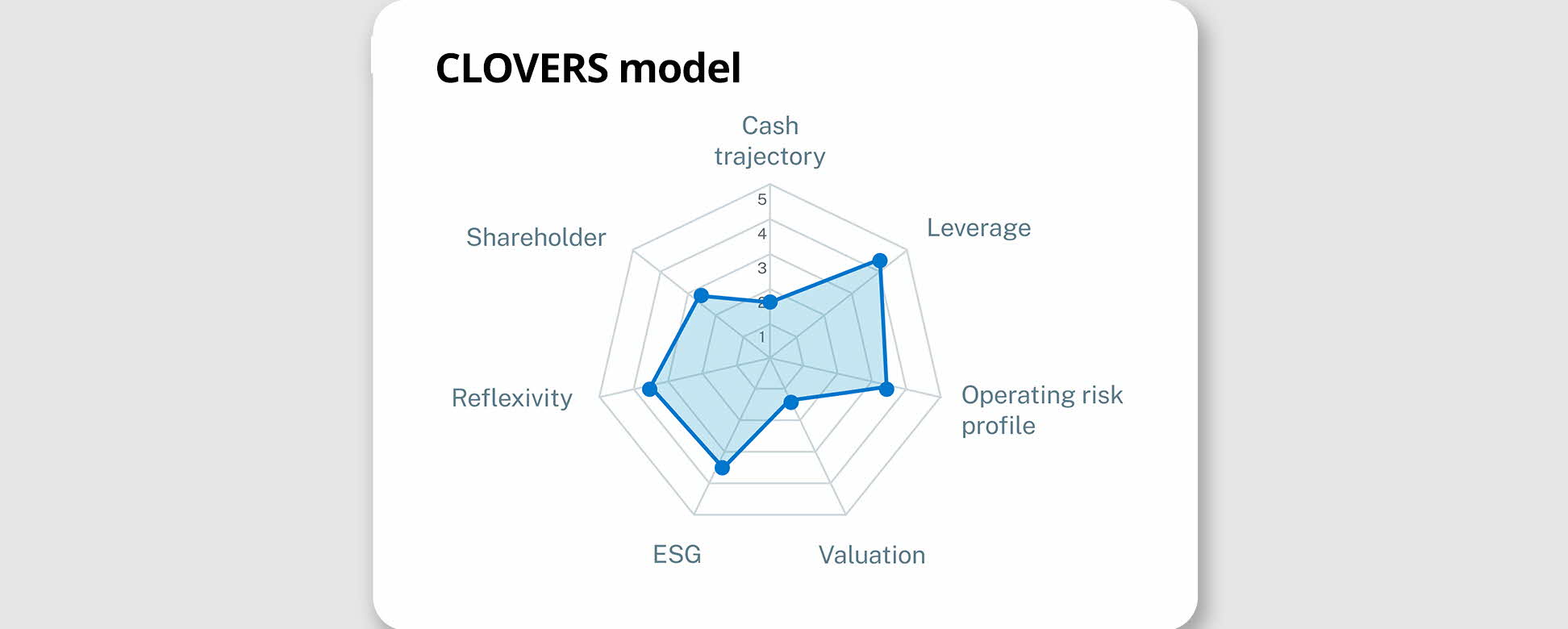

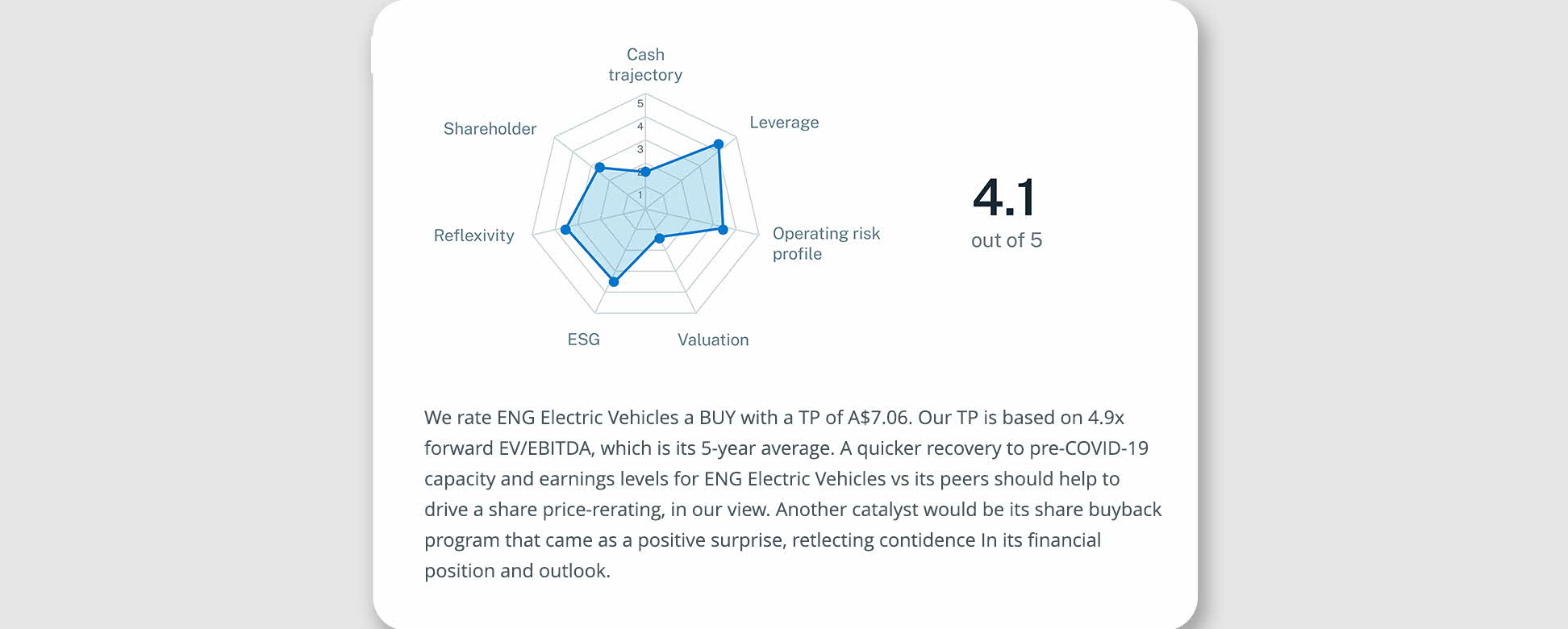

Get the expert view, in a glance.

Visualise and assess a stock quickly.

Get a numerical rating and summary of the thinking behind it.

Dig into a company’s key metrics.

What it measures:

A company's inherent ability to generate free cash flow.

Why it matters:

It reflects a company’s financial health and is a valuable measure of its profitability and long-term growth prospects.

What it measures:

A company's ability to cover interest payments and fulfil debt obligations. It also encapsulates a company's liquidity position and capital structure.

Why it matters:

It helps investors determine a company’s financial position — whether its debt level is sustainable, and if it has the ability to meet its financial obligations.

What it measures:

The degree of operating leverage present in a company’s business model, and the historical volatility of its operating margins.

Why it matters:

It helps investors determine the level of uncertainty a company’s business operations faces, which can significantly impact its performance and investment value.

What it measures:

If a company is under- or over-valued, considering its justified valuation relative to fundamentals, and current valuation relative to historical band.

Why it matters:

It provides investors with an idea of when to buy or sell an asset and how much they should buy or sell for.

What it measures:

A company’s performance across various ESG barometers given the shift towards sustainable investing.

Why it matters:

It helps investors determine a company’s long-term resilience and worth. Companies with better ESG performance are increasingly seen as less volatile and better positioned for the future.

What it measures:

The sentiment of the market and the street on a company by studying technical indicators, changes in short interests, and revisions to consensus estimates.

Why it matters:

As an investor, it helps you understand how share pricing can be influenced by market sentiment and alert you to price vs. reality divergences.

What it measures:

A company’s ability to create value for shareholders.

Why it matters:

It is a way for a company to signal to investors its fundamental strength, financial health, and confidence in future growth prospects.