Our solutions

-

Financing

We offer a range of solutions to support your loan syndication and working capital needs

-

Advisory

Leverage our expertise in strategic advisory, deal making, project finance and acquisition financing

-

Global Financial Markets

Access innovative hedging solutions to mitigate foreign exchange and interest rate risks

-

Transaction Services

Cash management, trade finance, supply chain finance and custody services all in one place

-

Capital Markets

We are a leader in offering global debt and equity financing through our full-service solutions

Client stories

Deals

Research and Insights

-

From Reserves to Global Reach

Partnerships Driving Indonesia’s Critical Minerals Transformation -

Malaysia's Key Role in Rare Earths

Within the US-led rare earth alliance, Malaysia has emerged as a crucial processing and manufacturing hub, strategically positioned to help build a supply chain outside of China. But it remains to be seen if China’s dominance in this field can be easily broken. -

Unlocking Market Advantage

Indonesia’s Pathway in the Evolving Critical Minerals Landscape -

Reshaping Global Supply Chains

Insights from the DBS Metals and Mining Forum 2025 -

Indonesia's Rise in Green Aluminium

Driving growth through sustainable aluminium for a greener global future -

Forging a Sustainable Path Forward

Steel overcapacity, emissions woes spur urgent transition need to sustainable production future. -

Asia’s move to low-carbon steel picks up pace

Read more on the emerging decarbonization strategies and challenges and the future of steel -

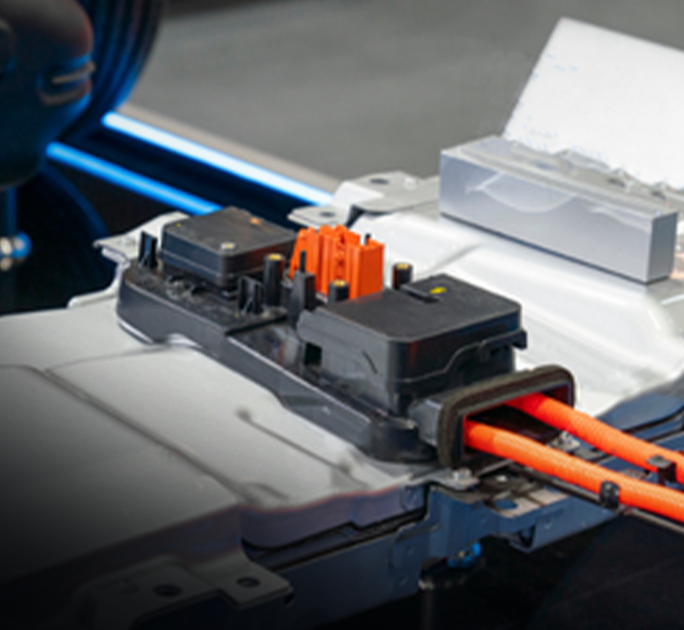

Supporting Metals & Mining Push to Net Zero

The emerging ecosystem for EV batteries in Asia will be more and more important.