Should you Buy Now Pay Later?

![]()

If you’ve only got a minute:

- Buy Now, Pay Later (BNPL) scheme is a method of payment which allows consumers to pay for their purchases in short instalment periods without any interest charges or fees.

- The scheme does not require a credit card, unlike Instalment Payment Plans (IPP).

- BNPL plans are probably not a good idea for those who are often low on cash.

![]()

With the rise of e-commerce, the “Buy Now, Pay Later” (BNPL) scheme is quickly becoming a popular payment method. It is a method of payment which allows consumers to spread their purchases over short instalment periods without any fee payments within a specified period.

At one glance, the BNPL scheme may look like a newer version of the traditional “Instalment Payment Plan” (IPP) which is popular among credit card holders. The difference is that IPPs are only available at certain retailers and used typically for bigger ticket items like furniture, electrical appliances, travel bookings and spa packages.

There is also another type of payment method known as My Preferred Payment Plan. It is quite similar to an IPP, except that IPP is done at the point of sales at a merchant whereas My Preferred Payment Plan is post sales for any transactions above S$100, charged to the credit card account. Customers can combine up to 10 transactions with minimum transaction of S$100 each into a My Preferred Payment Plan.

This can be useful if you decided post-purchase that you would prefer to split up your purchases into smaller payments, stretched over few months.

On the other hand, BNPL schemes do not require you to have a credit card and allow you to pay for things like shoes and bags, depending on the partnerships with the payment company.

With its low barriers to entry and convenience, should you then, tap on this form of flexible payment? Let’s check out its pros and cons:

| Advantages | Disadvantages |

|---|---|

| No interest charges and fees during instalment period | Late fees can pile up if you do not repay within the stipulated instalment period |

| Do not need to apply for a credit card | Delaying payment is still chalking up debts |

| Low barrier to entry – minimum age of 18; easy to open an account with a BNPL provider | May encourage impulsive buying |

| Can be useful in managing cash flow, especially during tough times or for those who have irregular income | |

| Available at many retailers |

Advantages

BNPL schemes can be useful for consumers who are financially responsible and are able to pay off the instalments within the stipulated periods. This can help in managing your personal cash flow.

For the younger generation who may not have substantial savings, using this scheme can empower them to make necessary purchases such as laptops and computers without the need of a credit card.

Of course, affordability is key. Do ensure that the purchase is within your budget and that you will be able to repay them.

As most providers partner with brand name retail stores like Sephora, Zara and other international stores, it allows one to shop for their merchandise without having a credit card.

Disadvantages

The disadvantages of the BNPL scheme are obvious – delaying debt is still chalking up debt.

What’s more, by making an item more “affordable” in the short term, it may encourage impulsive buying and overspending. Since you are breaking down your purchases into smaller payments, it's harder for you to track your exact spending, which can result in mismanaging your budget and finances.

In addition, late payments will incur additional charges, which add on to the outstanding debt.

Read more: Going cashless without overspending!

BNPL can be a good option, but only if you can pay it back

Compared to other payment plans such as IPP, credit cards or personal loans, the BNPL scheme can be a good option since they typically do not charge any fees and provide an interest-free instalment period. This can be useful in months where you need to buy an expensive item (such as a laptop) immediately but want to reduce the amount of expenditure or credit for that particular month.

That said, BNPL plans are probably not a good idea for those who are often low on cash. By paying a little bit of your purchases each month, you might lose track of your monthly expenditures and accumulate debt unknowingly. It could also tempt you into buying things out of impulse. For this group of people, it would be best to wait until you can pay for what you want upfront to avoid the risk of getting into debt.

What to do when debt spins out of control

If you find yourself using multiple forms of credit (i.e., credit cards, BNPL, personal loans) to fund your monthly spending and are struggling to repay your bills every month, then it’s time to take a hard look at your finances and seek help.

Read more: Rolling over credit card debt is no game

Loans or purchases funded by credit can accumulate through interest charges and fees, becoming a constant source of distress. If you find that your debts are spiralling out of control, you may want to consider a Debt Consolidation Plan (DCP) offered by the banks or a Debt Management Programme (DMP) from Credit Counselling Singapore.

Remember that paying your purchases in smaller amounts over time does not work for everyone. Some of you will be better off saving and buying later.

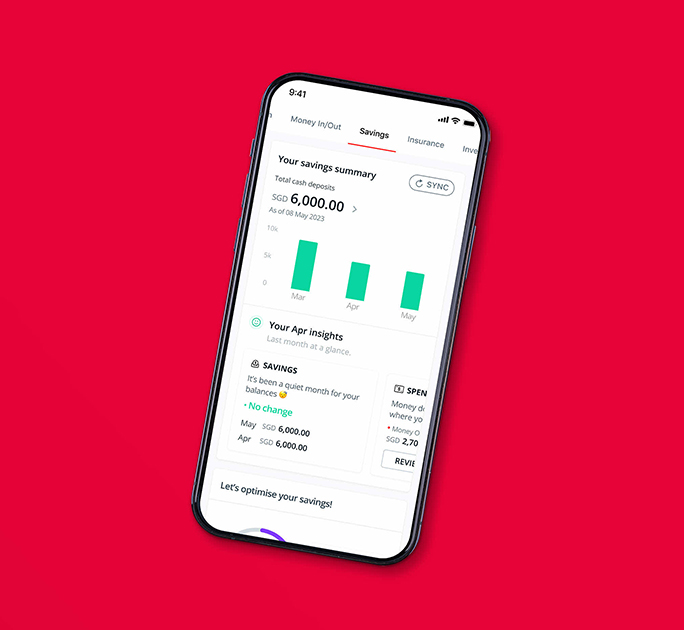

Start your financial plan by setting up a realistic budget as well as savings and spend targets to achieve your short- and long-term financial goals using the digital financial advisory tool DBS digibank app.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)