Ease your financial burden with a DCP

If you’ve only got a minute:

- A DCP combines all your existing unsecured debt into a single loan at potentially lower interest rates, helping you to manage your overall unsecured debts better.

- Offered by financial institutions, DCP is a term loan, involving fixed monthly repayments for an agreed period.

- The DCP amount you can get is your total outstanding debt, plus interest and any other fees.

- DCP is bundled with a credit card of 1x credit limit for daily expenses.

No one wants to be caught in a debt trap. The inability to repay loans and the corresponding accumulation of interest charges can be a constant source of distress.

And yet, sometimes, debt can spiral out of hand due to, for example, spending on various credit cards, snowballing interest, or a personal emergency that forces us to drain our savings and requires us to borrow funds.

If you find yourself in that situation, or worry about your ability to repay your unsecured loans, you may want to consider a DCP.

What is a Debt Consolidation Plan (DCP)?

First of all, DCP is only applicable to unsecured debt. Unsecured debt refers to loans taken that are not backed by any asset. As the lender does not have any collateral to repossess in the event you fall behind on repayment, interest charges are typically higher than secured debts such as a home loan or car loan.

If you are currently servicing multiple unsecured loans such as credit card expenses across several banks and personal loans, a DCP combines all these into a single loan at potentially lower interest rates compared to a credit card or other unsecured debt. It is a term loan, which means there are fixed monthly repayments for an agreed period, usually up to 10 years.

Some types of loans are excluded from a DCP. These include renovation loans, education loans, medical loans and credit facilities granted for business purposes.

One advantage of a DCP is that it allows you to monitor multiple outstanding debts in a single place, so you can (hopefully) better manage your debt situation. In addition, it also allows you to pay off your debts over a fixed period and at a fixed interest rate—but this also requires discipline and commitment to repay your loans.

Where to apply for a Debt Consolidation Plan

DCPs are offered by financial institutions that provide unsecured credit facilities and/or credit cards.

Once your DCP has been approved, all your loan facilities with other banks—and even within the same bank—will be closed or suspended, with your outstanding debt balances transferred to the DCP account. This is to help prevent you from falling deeper into debt.

However, you will still be given a credit facility, capped at one month of your income, so that you can pay for daily expenses. Both are bundled as a single product. Still, you can choose not to use the facility if you do not need it.

You are eligible to apply for a DCP if you are:

- A Singaporean or Permanent Resident

- Between 21-65 years old

- Holding interest-bearing debt more than 12 times your monthly income

- Earning between S$30,000 and S$120,000 a year

The DCP amount you can get is your total outstanding debt, plus interest and any other fees. If you are a first-time DCP recipient, you can also receive an additional allowance of up to 5% above the total DCP amount.

How much interest does a DCP charge and how much can I save?

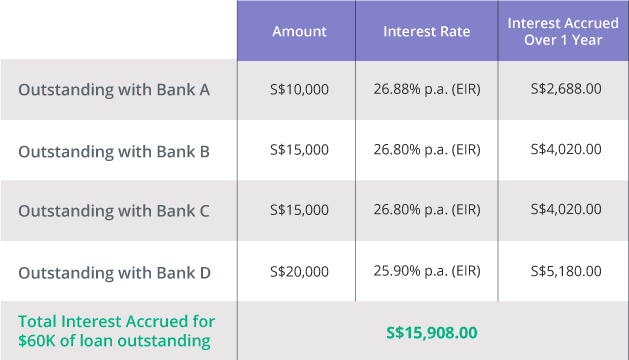

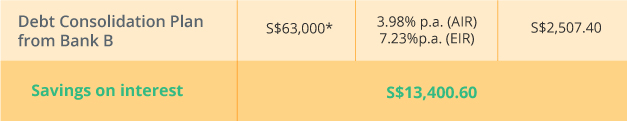

A DCP’s typical annual interest rate can range from as low as 3.98% per annum (p.a.) or Effective Interest Rate (EIR) of 7.23% p.a. The EIR takes into account processing, administrative, and other fees.

The interest rates charged on a DCP depend on your credit rating. The better your credit rating, the lower the interest rate you can get.

Here’s an example of how a DCP helps consolidate your unsecured borrowings and lower your interest charges:

Notes: *An additional buffer of 5% allowance over and above the total DCP amount for first-time DCP recipients. Calculations are for illustrative purposes only. Interest rates and amounts may differ, depending on the DCP structure and provider.

Apart from interest, some financial institutions may also charge processing fees, either as a fixed amount or as a percentage of the approved loan amount. Banks also charge an early settlement or prepayment fee, as well as a late payment fee.

Do remember that if you have other secured debt, such as a housing or car loan to repay, you will still have to service those loans, on top of the DCP.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Alternatively, check out NAV Planner to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)