![]()

If you’ve only got a minute:

- DBS Multiplier Account is designed to help you make the most from your financial commitments through a tiered rewards system.

- It rewards you for taking action on your financial journey via key aspects of financial planning.

- For married couples, consider using a joint Multiplier Account to achieve higher tiers more effortlessly.

![]()

You probably spent most of your 20s building your career, found a significant other and eventually settling down with your partner.

Now that you’ve reached your 30s, you may be grappling with an increasing number of financial obligations such as servicing a home loan, managing protection plans for your loved ones, thinking of how to grow your wealth and occasionally envisioning your retirement days.

We see ourselves in your shoes too. That’s why we’ve designed DBS Multiplier Account to complement the key aspects of financial planning, rewarding you for your commitments.

Additionally, to complement your lifestyle, the account is entirely digital and accessible at any time and location.

DBS Multiplier rewards you for taking action on your financial journey

1. It earns you higher interest rates

Having saved your hard-earned money is a good thing but leaving it to sit idly in your bank account means that it will inevitably lose its value to inflation.

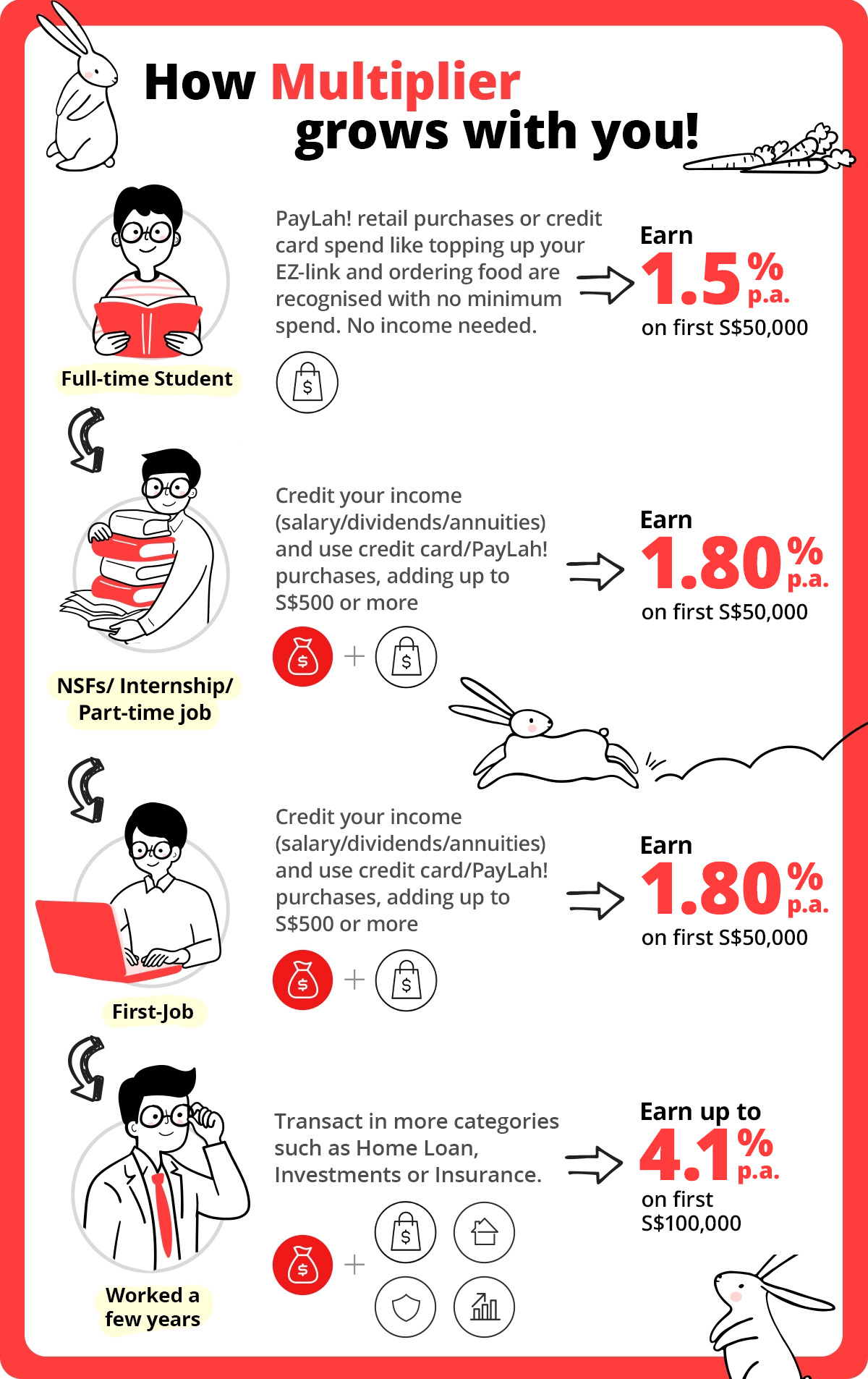

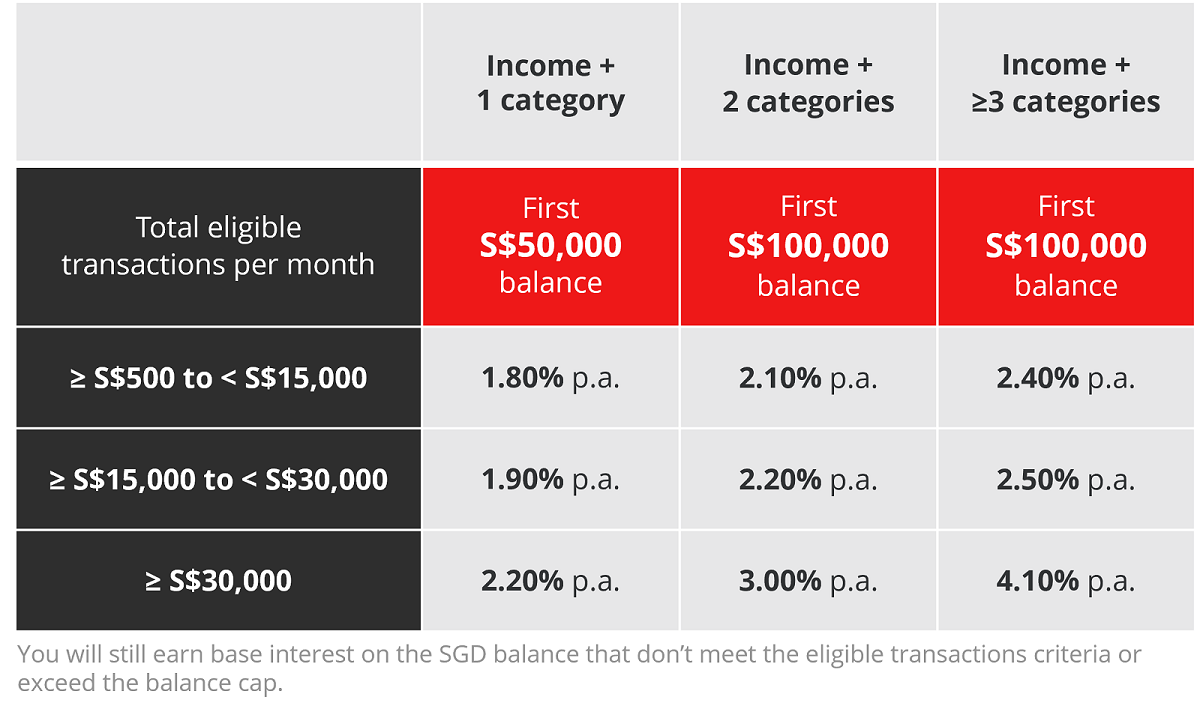

You can earn up to 4.1% p.a. with Multiplier Account by crediting your income into your DBS/POSB account and meeting 1 or more of the qualifying categories. You can also use the interest calculator to get an estimate on the interest could earn each year.

Since everyone’s circumstances are unique, the range of options available to qualify for higher interest rates have been expanded. Here’s how:

If you’re a freelancer and don’t have a regular salary, you can still make use of any investment dividends or annuities as part of the “income” category. Just make sure they are tagged with the qualifying transaction codes or descriptions.

If you’re married, it is likely you already have a joint account to manage savings and household expenses with your other half. Maximise the interest you earn by crediting both of your salaries into the joint account, while maintaining your separate DBS Multiplier accounts.

Read more: 3 ways joint accounts work for couples

Find out more about: DBS Multiplier Account

2. It puts your home loan to work for you

Getting a cosy home might be a top priority if you’re looking to settle down or have your own place.

Most of us take up a home loan to make this a reality, but it should not stop with servicing a loan. With a DBS/POSB home loan, you are automatically eligible for bonus interest rate on your Multiplier account.

If you have an existing home loan, consider if it’s worth refinancing with a DBS home loan to enjoy a potentially lower interest rate, while earning more interest on your Multiplier account.

Read more: Refinancing vs Repricing: What to do with my home loan?

Find out more about: Two-In-One Home Loan

3. It takes into account your insurance commitments

From protection plans for your parents to endowment plans for your child’s education, insurance is an important aspect of personal finance that you will be spending on – especially as life’s commitments add on.

Therefore, insurance is included as one of the categories for you to earn higher interest rate with - because you should be rewarded for ensuring sufficient coverage for yourself and your loved ones.

Simply open your Multiplier Account before purchasing any of the qualifying regular premium or single-premium policies! You’ll check off on this category even if the single-premium policy was purchased with money in your Supplementary Retirement Scheme (SRS) account.

Read more: Insurance needs for different life stages

4. It rewards you for taking action to grow your wealth

Compared to when you were in your 20s, you are now more likely to have a higher earning capacity and feel more ready to invest.

It’s never too late to start, be it with $100 a month into a Regular Savings Plan such as DBS Invest-Saver, a Unit Trust lump sum contribution, a robo-advisor such as digiPortfolio, or actively investing through a DBS Vickers Online Trading Account, bonds, and structured deposits.

For equity and unit trust investments, you will be rewarded with purchases made with cash, CPF or SRS.

There are many investment options from DBS to suit your needs, and some of these can count towards the eligible transactions in your Multiplier account. Easily grow your savings and wealth at the same time.

Read more: I’m ready to invest, how can I start?

Find out more about: DBS Invest-Saver

5. It understands your spending needs and requires no minimum spend

We’ve saved the best for the last - the simplest category to fulfil is that of credit card/PayLah! spend.

Unlike other accounts out there, there’s absolutely no minimum spend. Just ensure that your qualifying income and credit card/PayLah! purchases add up to at least $500 each month.

You can earn cash rebates on your grocery spend with POSB Everyday Card or accumulate miles camp, racking up miles with the DBS Altitude Card even from daily essentials such as public transport.

As the cherry on the icing, with DBS Multiplier, you'll be able to earn extra interest on top of the cash rebates, miles, and points you’re already collecting.

DBS Multiplier makes it worth your while

Designed with you in mind, the DBS Multiplier Account rewards you for taking action on financial planning and helps you make the most from your financial commitments. It’s the easier way to multiply your money, whether it’s in cash, CPF, or SRS.