![]()

If you’ve only got a minute:

- Raising a child is no easy feat, especially with all the newly minted parenthood responsibilities such as sleep deprivation and having to juggle between naps and feeding schedules.

- With the weight of a young family on our shoulders, it is vital to plan and prioritise our time and efforts to achieve the best outcome not only for our loved ones, but ourselves too.

- Keep your finances in check and on track while planning for your child’s milestones and for your retirement.

![]()

Having a child and starting a family is exciting and is likely one of the most rewarding things you will experience in your life. However, raising a child is no easy feat and costly to boot. For most new parents, focusing on the big picture can often be challenging, especially with all the newly minted parenthood responsibilities such as sleep deprivation and having to juggle between naps and feeding schedules.

With the weight of a young family on our shoulders, it is vital to plan and prioritise our time and efforts to achieve the best outcome for our loved ones. More importantly, with milestones on the horizon, it is important to prepare for them while keeping finances in check and on track.

Here are 5 tips to enhance your finances.

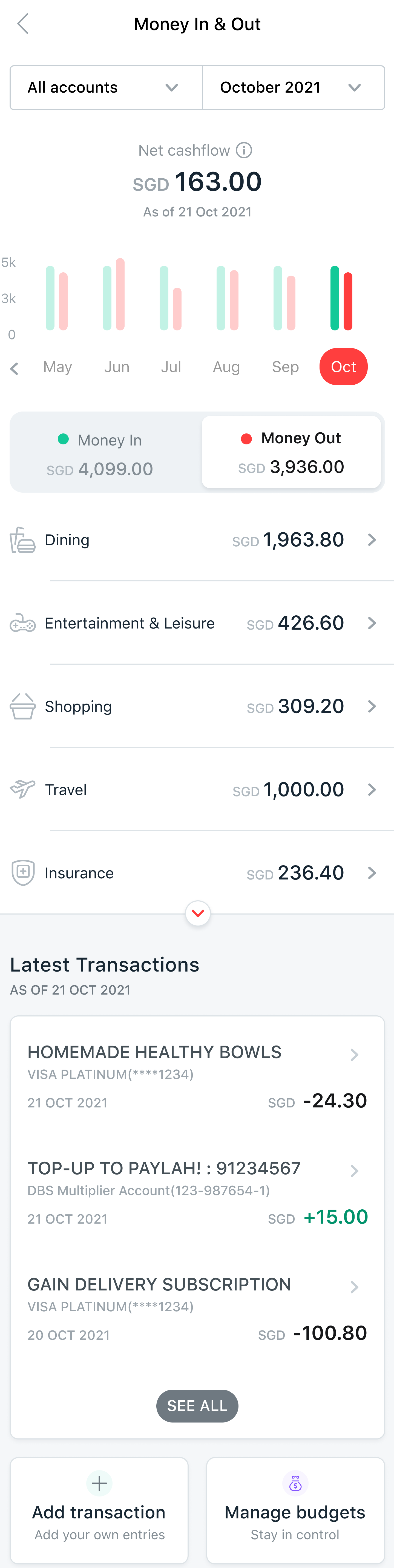

1. Get a good overview to stay afloat each month

The simple rule of staying afloat: Your Money Out (i.e. transport, investments such as a Regular Savings Plan, transfer-outs, food, credit card payment, bills, insurance, etc) cannot be more than your Money In (i.e. salary, dividends, interest, transfer-ins).

You will eventually end up in deficit if your total money out continuously exceeds your money in. This scenario will often lead to undesirable consequences such as a depletion of your hard-earned savings or your child’s education fund, over time. Therefore, it is crucial to note the things you shouldn’t be touching: A rainy day/emergency fund, your child’s education fund, and your retirement nest-egg.

Advanced digital tools like the DBS digibank comes with a Money In & Out (MIMO) feature, which helps you keep track of money flows conveniently.