![]()

If you’ve only got a minute:

- The Lease Buyback Scheme (LBS) aims to help you to monetise your flat to receive a monthly income in your retirement years while living in your own flat.

- The Silver Housing Bonus (SHB) helps eligible lower-income elderly supplement their retirement income with a cash bonus of up to S$30,000.

![]()

Your property is an important asset that you can monetise for retirement. There are a few ways in which you can monetise your property for your golden years.

Let’s take a look at 2 different ways – the Lease Buyback scheme (LBS) and rightsizing using the Silver Housing Bonus (SHB).

Lease Buyback Scheme

The LBS aims to help you to monetise your flat to receive a monthly income in your retirement years while living in your own flat.

The scheme allows you to sell a portion of your flat’s lease to HDB and receive an LBS bonus. You can choose to retain the length of the lease based on the age of the youngest owner.

The proceeds you get from selling a part of your flat’s lease will go into your CPF Retirement Account (RA). The CPF RA savings can be used to join CPF LIFE to provide you a monthly retirement income for life. You will not be eligible to join CPF LIFE if you are 80 years old and above.

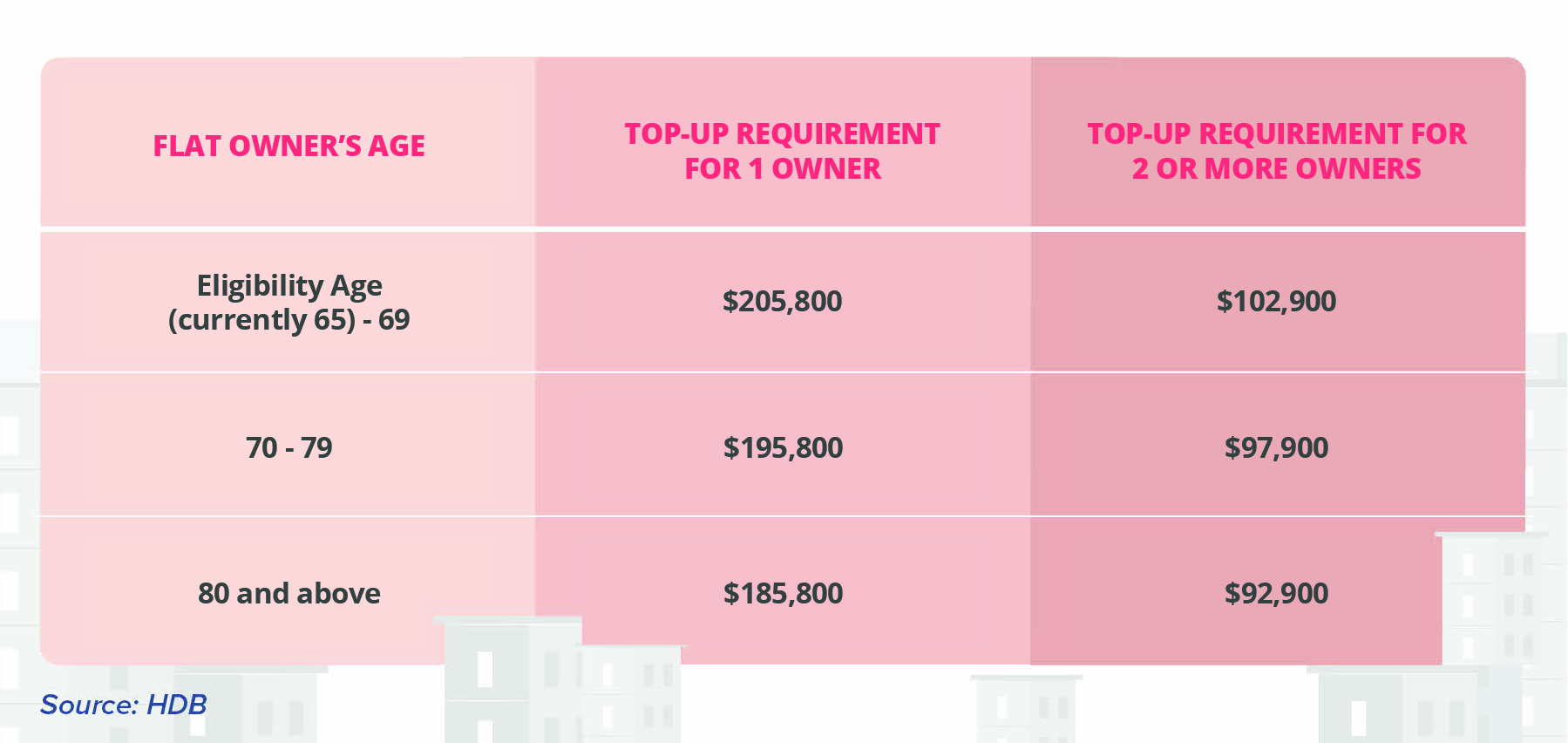

For single-owner households, the proceeds must be used to top up the RA to the prevailing Full Retirement Sum (FRS).

For households with 2 or more owners, each owner must use their share of the proceeds to top up their RA to the prevailing Basic Retirement Sum (BRS).

For applications received from 1 Jan 2024:

How to determine the LBS Bonus

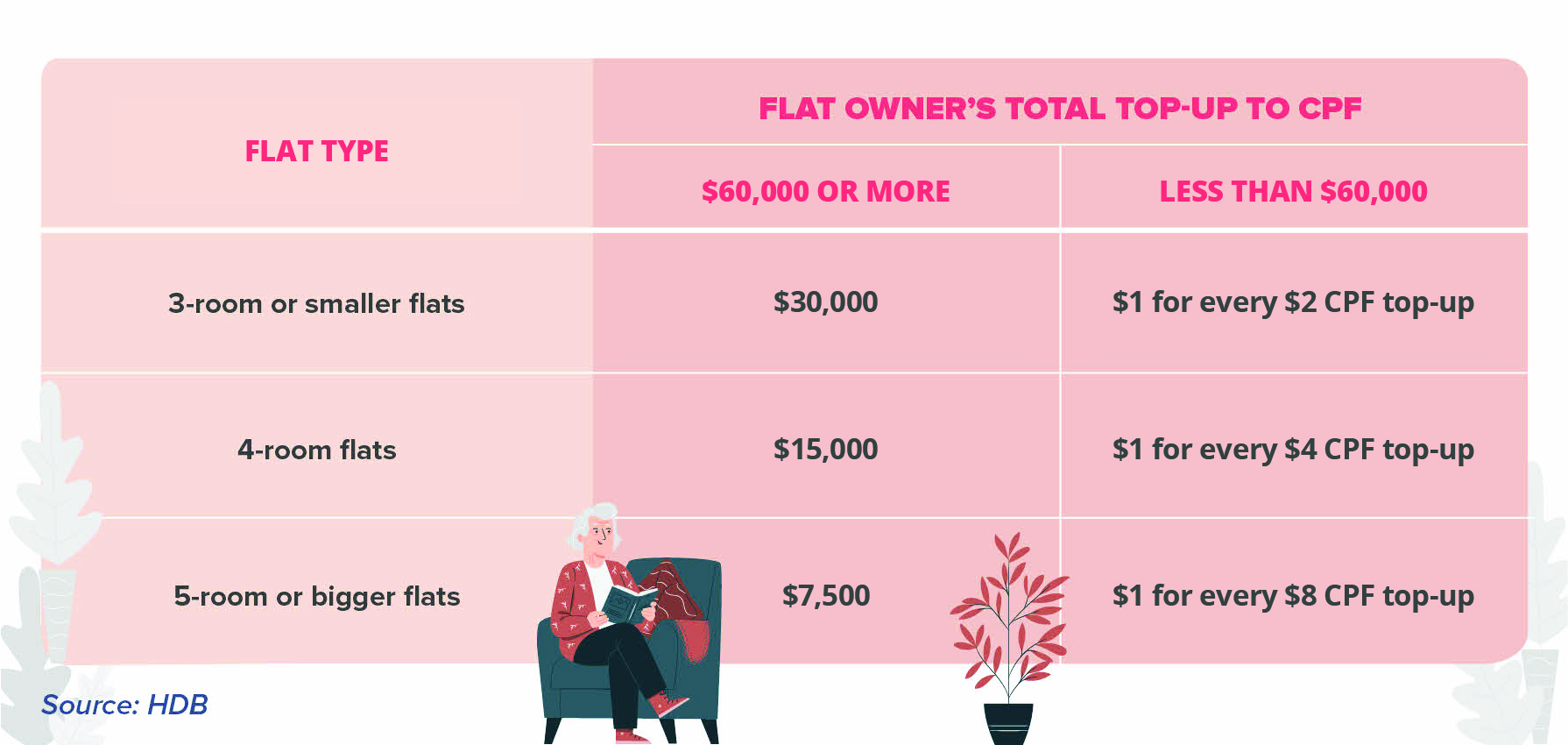

If the total top up to the flat owner’s RA is S$60,000 and above, your household will be entitled to the full bonus.

If it falls below S$60,000, you will receive a pro-rated bonus.

LBS bonus amount

Do note that if all owners in your household have already reached the FRS prior to joining the LBS and no top up to the CPF RA is required, then you won’t be eligible for the LBS bonus.

Read more: Everything you need to know about the Lease Buyback Scheme

Right-sizing with Silver Housing Bonus

The SHB helps you to supplement your retirement income when you right-size to a 3-room (excluding 3-room terrace) or smaller flat from HDB or the resale market.

By participating in the SHB scheme, net proceeds from the sale of the current flat will be used to top up your CPF RA to boost your lifelong monthly payouts under CPF LIFE. Doing so allows you to receive up to S$30,000 cash bonus per household.

Eligibility Criteria

- At least 1 owner must be a SC

- The SC is aged 55 or above

- Gross monthly household income must be within S$14,000

- Owns an HDB flat for at least 5 years MOP for resale or a private property with an annual value not exceeding S$21,000

- Does not own a 2nd property

- Purchase price is below selling price of the current/last sold property

- Booking of new HDB flat or application to buy resale flat must be before sale of current property or within 12 months of completing sale of existing property

- Application must be submitted within 1 year from date of completion of the 2nd housing transaction (sale of purchase)

Required top-up amount

To qualify for SHB, you are required to contribute your proceeds (selling price of the current property minus the sum of any outstanding loan on the current property, the purchase price of the next flat, and resale levy payable) to your CPF RA and join CPF LIFE.

The top-up amount required depends on the proceeds, capped at S$60,000 per household.

You are eligible for the maximum cash bonus of S$30,000 if you top-up S$60,000 to your CPF RA.

If, if the top-up amount is less than S$60,000, you will receive a pro-rated cash bonus based on a 1:2 ratio, i.e. S$1 cash bonus for every S$2 top-up made.

How the SHB works:

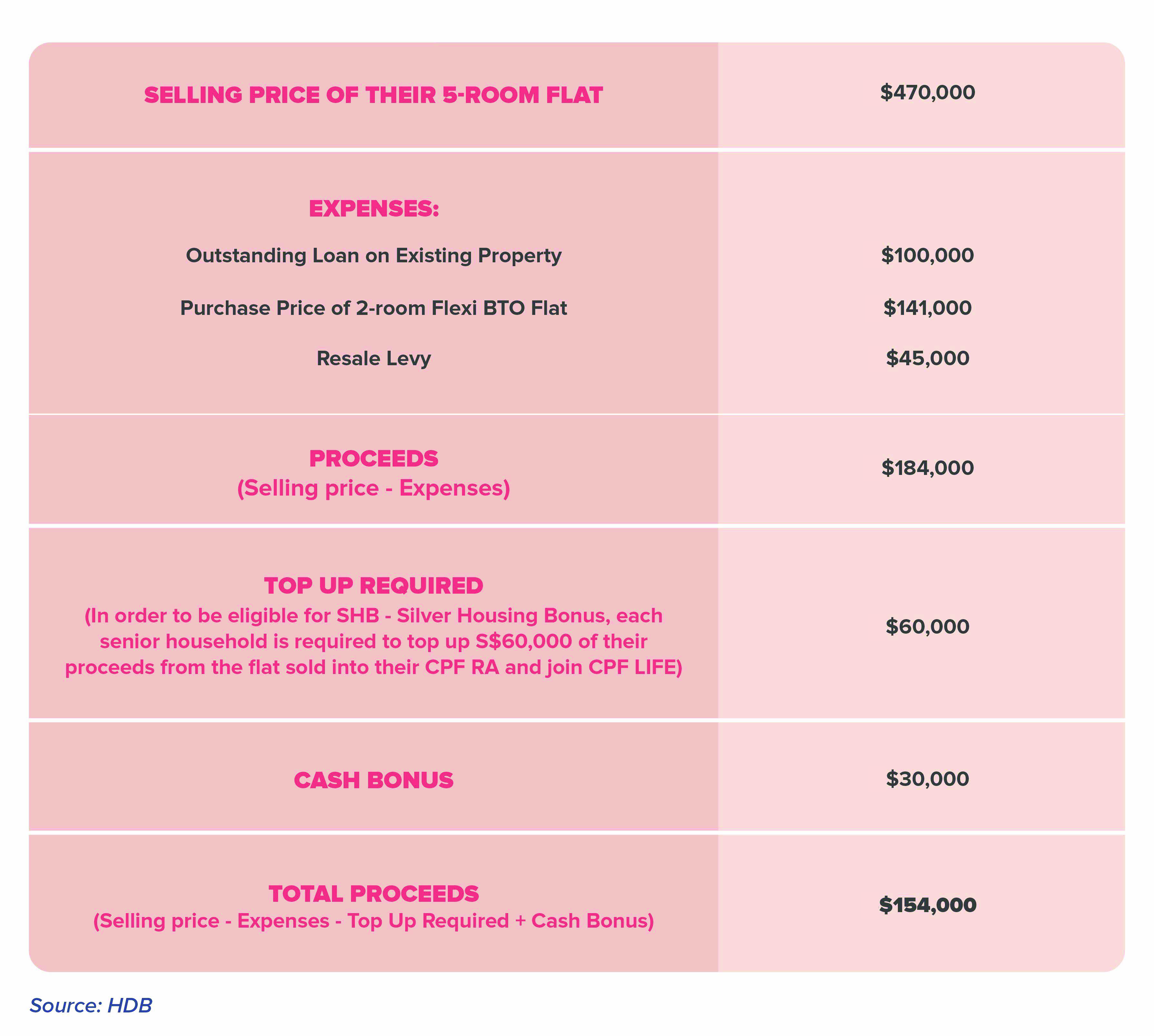

Scenario 1: Top up S$60,000 to your CPF RA (Full Cash Bonus)

Mr and Mrs Lee are selling their 5-room flat in Khatib for S$470,000 and are planning to buy a 2-room Flexi BTO flat in Woodlands for S$141,000. They each have S$20,000 in their CPF RA. Based on their proceeds (assuming Mr and Mrs lee will each top up S$30,000 to their respective RA), they will enjoy a SHB of S$30,000 if they use their cash proceeds to top up S$60,000 to their CPF RA (per household).

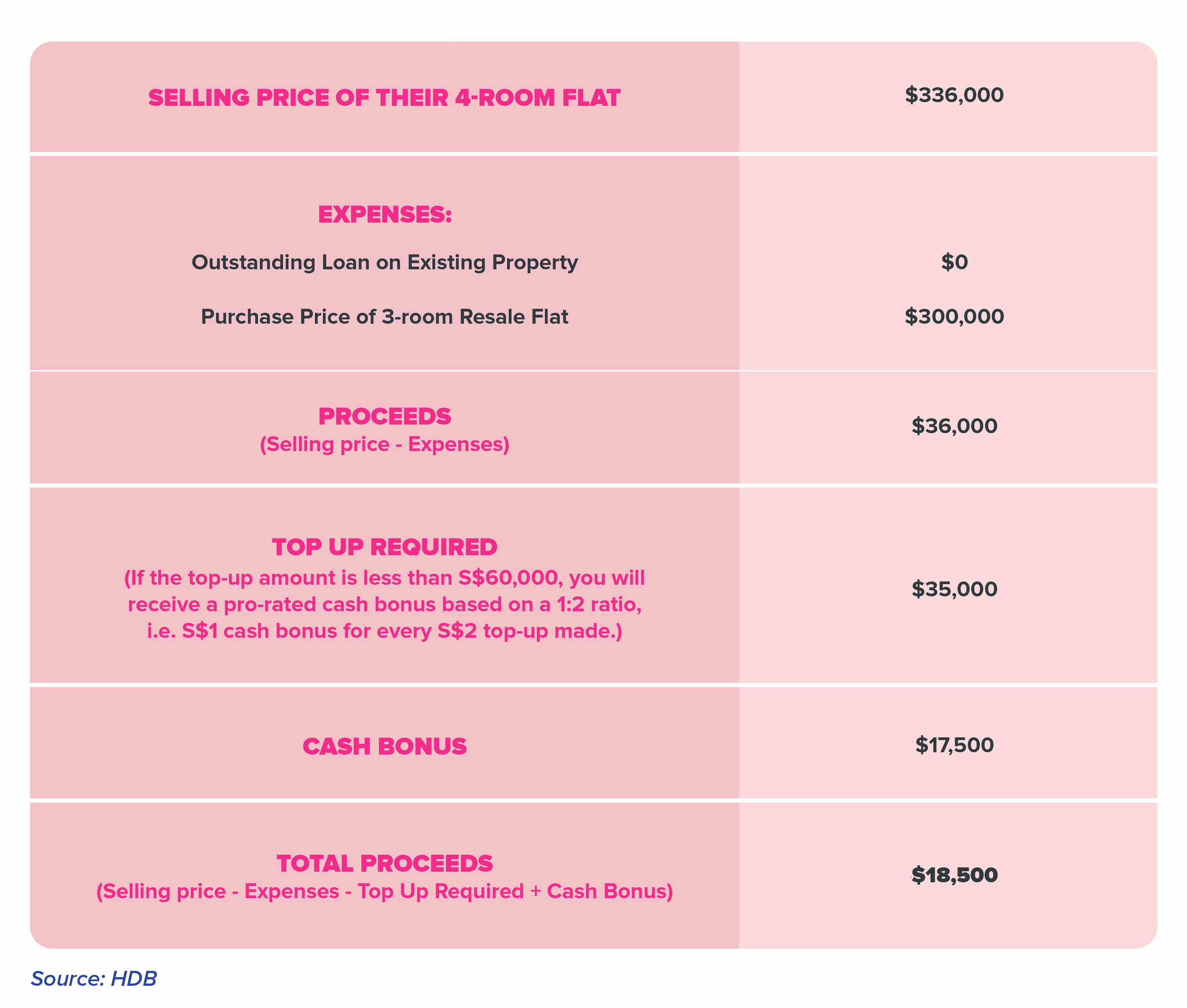

Scenario 2: Top up less than S$60,000 to your CPF RA (Partial Cash Bonus)

Mr and Mrs Neo are selling their 4-room flat in Bukit Batok and are planning to buy a 3-room resale flat in Simei. Based on their proceeds, they are required to top up S$35,000 to their CPF RA and join CPF LIFE.

As they topped up less than S$60,000 to their CPF RA, they get to enjoy a pro-rated SHB of S$17,500.

Pros

1. Higher price from selling your flat

You may get a better deal for your flat depending on the market condition at the point of sale.

2. Flat ownership is yours

Unlike the LBS, the ownership of the flat will still be yours

Cons

1. You must sell your current flat to downsize

This means you won’t be able to stay in your current flat.

2. Might face a negative sale of house

Depending on the market condition, selling your house at the wrong timing might lead to negative sale proceeds

How does the SHB support your retirement?

The SHB is suitable for SCs who own large HDB flats that they no longer need and for those who have insufficient retirement income.

Not only will SHB provide them with a flat with lower expenses, it can also serve as an additional income for them.

What is the difference between the LBS and the SHB?

The LBS allows flat owners aged 65 and above to stay in their homes and sell a portion of their remaining leases to HDB.

For the SHB, it allows flat owners aged 55 and above to receive a bonus for down-sizing to a smaller flat and contributing the proceeds towards their retirement.

In a nutshell, if you prefer to stay in your own flat, receive a monthly income for your retirement and have no plans to will your flat to your children, the LBS could be a better choice.

However, if you are looking to down-size to a smaller flat while receiving a monthly income and wish to will your flat to your children, the SHB might be a better option.