![]()

If you’ve only got a minute:

- Home prices in Singapore are rising slowly, with mortgage rates staying elevated.

- Start planning your finances early and use tools on DBS Home Marketplace for better budgeting and cashflow management.

- Get advice from homeowners, secure an In-Principal Approval (IPA), and find deals on renovations and furnishings to save money.

![]()

For generations, purchasing a home has been an important milestone for many Singaporeans, marking major life events like moving out on your own, getting married and having your own family.

While it may be a big step financially, home ownership is a goal that many still aspire to achieve.

However, the current property situation in Singapore isn’t exactly reassuring. Home prices and mortgage rates continue to stay elevated, albeit at a slower pace.

As the United States Federal Reserve is cutting interest rates more slowly than expected amidst persistent high inflation1, this prolonged period of high mortgage rates makes borrowing more expensive. The impact is higher cost of living, from higher utility bills to more expensive loan rates.

Given these complex market conditions, planning your finances before buying a home is more crucial than ever. Here are some tips to help you navigate the challenges of buying a home in this current macroeconomic environment.

1. Plan your finances right from the beginning

Planning your finances begins well before you buy a home.

For starters, here are some things you need to do:

- Look at your bank and CPF balances to determine how much you can pay in cash and CPF savings (include your partner in the conversation if you’re buying a home together).

- Work out the maximum amount you can afford, including downpayment, monthly instalments and additional costs like legal fees and stamp duty.

- If you’re going for a bank loan, apply for an In-Principal Approval (IPA) to ensure your affordability before setting your heart on a home.

- For each property you have shortlisted, work out how much your downpayment will be as well as the cash portion, and calculate your potential monthly instalments.

- Research and compare home loans to find one with terms and rates that meet your needs.

You can plan your finances on DBS Home Marketplace using a variety of tools such as the MyHome planner, which lets you work out the affordability of a property you’re interested in.

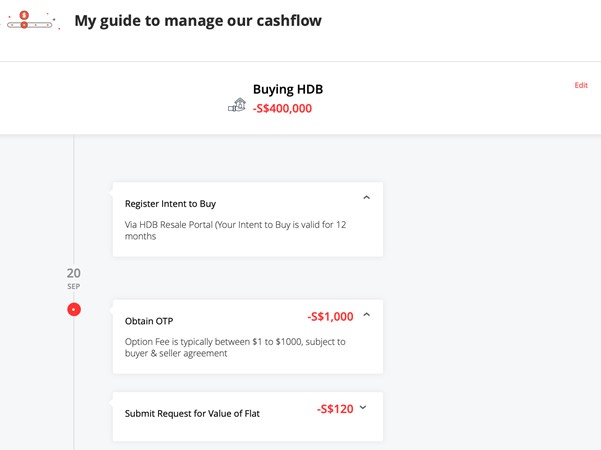

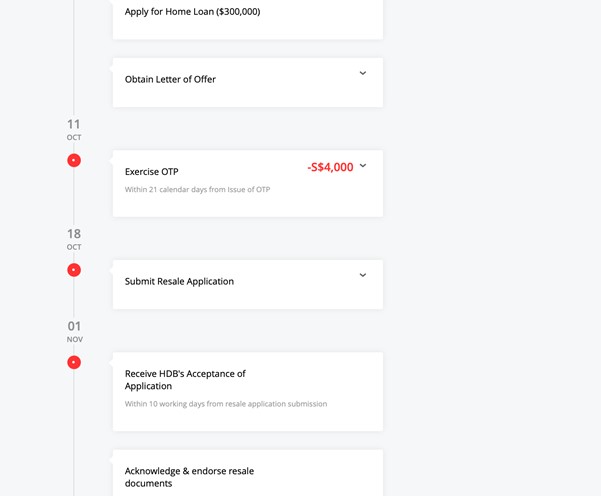

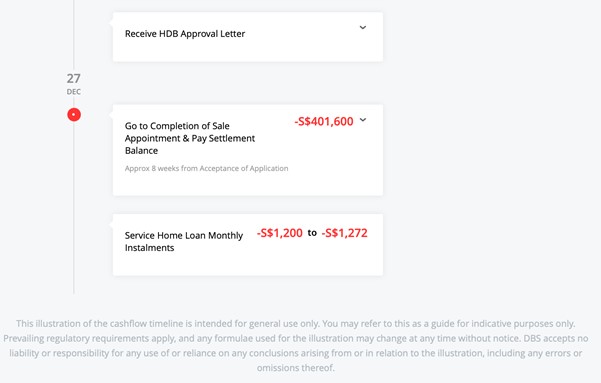

These tools include a Property Budget function, which helps you plan your finances; a Cashflow Timeline, which lets you manage your cashflow and payments; and a Repayment Calculator, which helps you calculate your home loan repayments.

2. Speak to fellow home owners & get an IPA

If you’re a first-time home owner, it can be helpful to speak to others about their home ownership journey.

For example, check in with friends who’ve already taken the plunge and bought their own homes. Take time to observe their space or neighbourhood, find out more about the renovation process and get them to recommend some of their favourite products and service providers.

3. Prioritise affordability when looking for your dream home

When searching for your dream home, remember that expectations and reality may differ.

It is important you remain flexible simply by having backup budgets and plan for various scenarios as you might find a place you love at a different price point than you had originally anticipated.

Consider hunting for your ideal home on based on your budget.

Unlike other property sites, it provides a more organised search process. Rather than endlessly sifting through listings, you can methodically go through home options tailored to your finances and bookmark those you like.

You also get to enjoy competitive loan options with the DBS HDB Loan and Two-In-One Home Loan. What’s more, if you have a DBS Multiplier Account, signing up for a DBS home loan lets you unlock higher interest rates.

4. Go deal-hunting to save money

Home renovation, furnishing and other services can get costly, especially if you’re hacking a resale HDB flat, doing major works or have an elaborate design in mind.

It is important to make sure that the interior designer you choose is professional, reliable and approved by HDB.

Besides relying on word of mouth and manual checks, you can also use the DBS Home marketplace to find approved interior designers and get a free quote from firms with no strings attached. This platform also makes it easy to search for sustainable items, such as bathroom products.

When furnishing your home, it’s a good idea to scout for deals in physical shops that let you store the furniture or appliances for a few months until your home is ready.

Common sale periods or annual fairs/expos held by big chains can offer such opportunities.

It is likely to knock a few bucks off your total purchase if you buy more than one item from the same shop.

If possible, you can also join forces with new neighbours to look for group-buy deals.

For additional savings, consider going for display pieces or second-hand stores — just make sure you carefully check the condition of the items before buying.

You can also check with friends or family to see if anyone can get you direct discounts or staff prices at shops or service providers.

Finally, don’t forget to use credit cards to pay and reap rebates, rewards and points!

Read more: How to build your dream home: Interior design trends 2024

5. Don’t forget the running costs of home ownership!

Buying a home and renovating it are just the first steps on your journey as a homeowner. You’ll also have to deal with the running costs of home ownership, including the cost of electricity, water/gas/utilities, food, internet/broadband, TV subscription, maintenance (if needed), cleaning supplies, hygiene supplies and other consumables in the home.

How much you spend will depend on the size of your home and your usage patterns.

DBS Home Marketplaceoffers a wide range of electricity and broadband deals that can help you survive inflation and the recent electricity price hike.

To save even more money as you grapple with the costs of adulting, consider cooking at home or eating at hawker centres more often and shopping for household products when there are deals — for instance, you can look for vouchers or new-user deals online, buy in bulk to save money or share bulk purchases with neighbours.

You can also apply for comprehensive home insurance to protect your home through DBS, with plans such as myHome Protect II. Home insurance is different from compulsory HDB fire insurance and is meant to protect your home, renovations and belongings.

6. Last but not least, remember to chill

Home ownership is a big project and can be stressful.

The good news is that with proper planning, you can make the journey a lot less scary.

In the end, regardless of the current market conditions, whether you decide on buying a home boils down to practical considerations, such as the urgent need for more space to start your family. Just remember to make savvy decisions that won’t burn a hole in your pocket!