Plan your finances entirely online with digibank

![]()

If you’ve only got a minute:

- Enjoy personalised financial advisory at your fingertips with digibank - get curated investment picks, plan for your protection needs and make better, informed financial decisions as you go through life.

- Discover a compilation of online reads to help you better understand basic financial planning topics

![]()

Your personal finance journey begins with a single step, but it can be challenging to take your first. However, it gets easier with digibank.

Find everything you need, from learning the basics of money management to choosing a financial product that best suits your needs, online, anywhere, anytime.

1. Connect all your financial data with ease

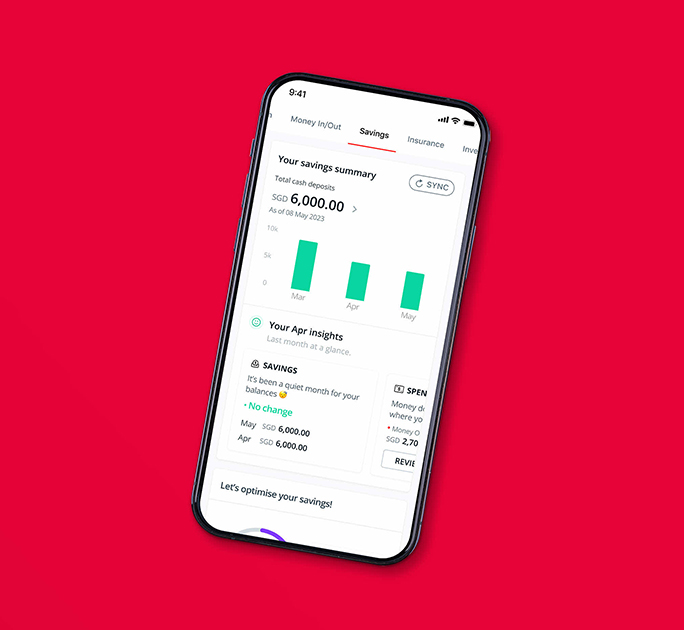

Forget about spreadsheets. The Plan & Invest tab on DBS digibank redefines financial planning by connecting all the pieces of your financial puzzle – from your income, cash, Central Depository (CDP) account under Singapore Exchange (SGX), CPF savings, property loan and investments to your expenses and loans. Get a complete overview of your financial wellness effortlessly.

With all your money in one place, the Plan & Invest tab in digibank gives you a holistic view of your financial wellness, even the parts that are not with DBS, and empowers you with personalised insights and tips so you can make better, informed financial decisions as you go through life.

2. Master budgeting with digibank

After knowing where you stand financially, aim to be in positive cashflow every month so that you can work on growing your wealth.

Budgeting is fundamental to managing your personal finances – this means keeping your expenses in check and starting to set aside some money for savings every month. It would be best to set aside at least 3 to 6 months of monthly expenses as a cushion for emergencies.

Start by setting up a realistic budget based on your income and monthly expenses and let digibank do its job. From automatically tracking your expenditure to sorting them out into categories like transportation, shopping, and so on, the app aims to remove the stress out of budgeting and provide an overview of your finances at a touch of a button. Over time, you will be able to better discern between your needs and wants and save better.

Online reads to help you understand budgeting and saving:

- Savings – Lifeline in emergencies, door to lifestyle choices

- Money matters for newly married couples

Additional digital tools and products to consider:

- Multiply your savings with DBS Multiplier

3. Build a financial safety net

With a clear view of your finances and budget, everything seems on track towards achieving your financial goals. Wouldn’t it be a shame if some unforeseen circumstances were to come along one day and take it all away?

Having a safety net in place is crucial for your personal finance. It helps to protect you and your loved ones against the downside of an unexpected event that can be financially damaging, such as the loss of income due to health issues.

Personalised based on your dependants, income and cashflow needs, the Plan & Invest tab on digibank helps you plan with certainty by taking into consideration what you currently have, prioritising and calculating the coverage you need to see if you have a protection gap to bridge.

If you prefer a more personalised human touch, go with our TeleAdvisory option and speak to our Wealth Planning Managers (WPM) to understand your coverage needs virtually.

Online reads to help you get the right protection for a peace of mind:

Additional digital tools and products to consider:

- Obtain instant personal accident protection for your entire family, from the young ones to the seniors. It covers you and your family if you’re hospitalised due to dengue fever, food poisoning, and hand, foot and mouth disease (HFMD).

4. Grow your wealth with digital investment options

The next thing to look at is growing your wealth so your money doesn’t sit idly in the bank and dwindle with inflation. Your goals are unique, so should your investment strategy.

The Plan & Invest tab on digibank can also find you the right investments to grow your wealth. Supported by DBS investment experts, simply answer a few questions and let the app do the rest by identifying investments aligned with your risk tolerance.

For example, with a Regular Savings Plan like DBS Invest-Saver, you can start investing with a fixed sum every month. The fixed sum doesn’t have to be large – it can be as little as $100 – but over time, and with the power of compounding, you can expect to see financial gains over the long term.

You can consider robo-investing on digiPortfolio as well. Enjoy personalised insights, tips, advice and options to grow your money that match your needs.

If you’re a seasoned investor, the app will offer you a bird’s eye view of all your existing investments at a glance (even if they’re not with DBS). With the market price feed feature, you will also be kept up to date on how your investments are performing and you can simply check in every month to track, review or adjust them over time.

Online reads to help you grow your wealth with various investment options:

- 6 affordable ways for the average Singaporean to invest

- Fear investing? It is normal - but can be managed

Additional digital tools and products to consider:

- Start investing from S$100 a month with DBS Invest-Saver

- Build your own portfolio with DBS Vickers

5. Chart your course to financial freedom with ease

Our bespoke digital advisory tool helps you work towards your aspirations and desired retirement lifestyle by visualising your future cashflow and identifying gaps you need to fill. It’s like a money forecast, but for the years ahead.

Our newly launched Your CPF feature can even help you project your CPF LIFE payout from age 65 onwards so you know how much retirement income you will have.

Learn how to get ready to retire from our online resources and tools, or speak to our Wealth Planning Managers WPMs through our TeleAdvisory service to understand your needs, from wherever you are.

Online reads to help you work towards your desired retirement lifestyle:

Additional digital tools and products to consider:

- See the big picture with digibank to find out how well you’re tracking towards your retirement plan

Regardless of where you are on your financial planning journey, it’s never too late to start. With this compilation of digital resources as a guide, you’ll be ready to take your first step and plan for your finances. The best part? You can do it entirely online!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)