5 tips to set better money goals this year

It's the season for year-end gatherings, Instagram top nines, and… reflecting. As you look back on the past year, you might wonder: What did I learn? How did I conquer that challenge? And… where did my money go?

As you set your new year's resolutions, here are five common ones that may not give the kind of results (read: more savings) you are looking for - and five goals you should be setting instead.

![]()

1. Just planning to save more this year

You have some sort of savings goal in mind and have every intention to get there. Perhaps it’s a big purchase like wedding expenses, a parent’s 60th birthday bash, or new furniture for your home. But after you make a few unexpected purchases… you find yourself giving up.

If this sounds familiar, try this instead: “I want to save [Insert a specific sum] this year.”

That’s because goals need to be SMART: Specific, Measurable, Attainable, Relevant and Time-bound. We’ll focus on Specific, Relevant, and Attainable in this article.

Save better by: Working out a Specific amount to save in 2023

By identifying a Specific figure, you train your brain to commit to it and set aside an amount as close to this number as possible every month.

These questions are a good starting point to work out the number:

- What are you saving for? (That makes it Relevant)

- How much have you already saved for the goal?

- What is the shortfall?

- What is the Specific amount you need to set aside every month to reach your savings goal?

Then commit to paying yourself first, by saving that Specific amount every month once you receive your pay. Make this more Attainable by:

Looking for things that you can already cut back onTake a deep breath, and look over your bank statements. You are looking specifically for items you pay for and hardly use, and anything that could save you money in the long-term. Perhaps you've been paying for a music streaming service but hardly use it. Or you realise you could save on your electricity bill by moving to another service provider.

Ensuring you have at sufficient emergency fundsYour emergency funds give you the flexibility to make choices without having to dip into the savings goal. For instance, when you need to look for a new job but the hunt takes longer than expected. Or perhaps, you are thinking of taking a sabbatical.

The general rule of thumb is to set aside about three to six months of expenses as your rainy day fund. So, if you spend S$2,000 a month on bills, home repayments, and everyday necessities, you would need to set aside between S$6,000 to S$12,000.

If you are self-employed, it will be prudent to have at least 12 months of emergency cash set aside. That works out to at least S$24,000, using the example above.

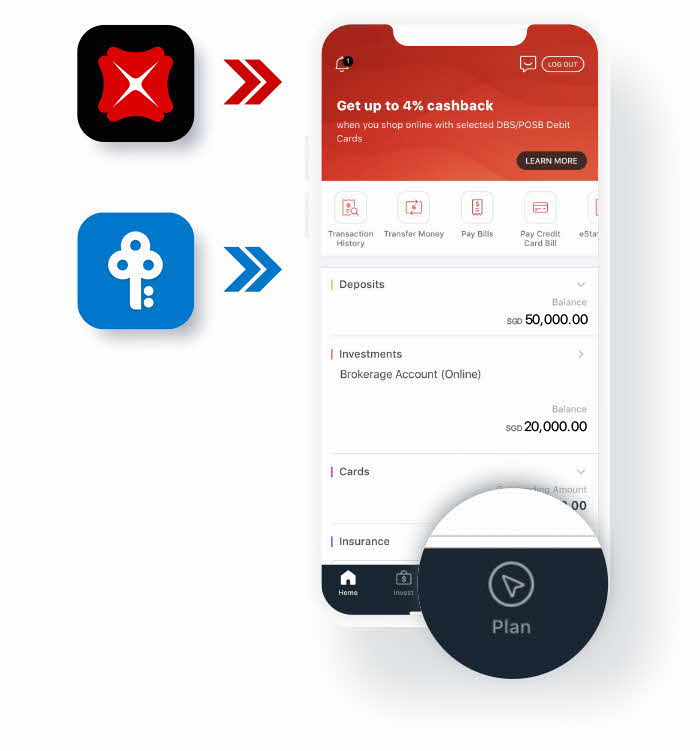

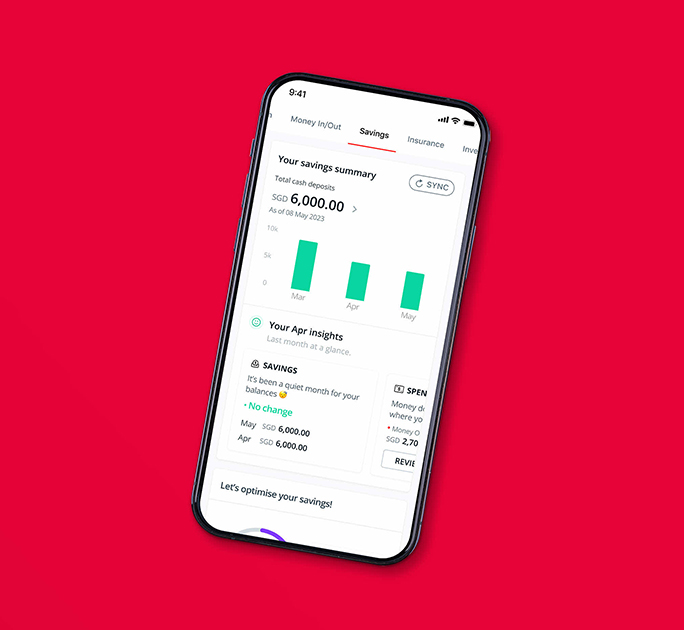

If are a DBS or POSB customer, this is made even easier with the Map Your Money function. Simply log in to digiBank, and tap on the “Plan & Invest” tab, and there – you can simulate your goals and track check if you’re on track or need to make adjustments.

2. Just tracking your daily expenses

It is super easy to shell out S$3 for coffee, S$4 for a cup bubble tea and S$10 for lunch. And it horrifies you at how it adds up. But… what are you tracking your expenses for?

Without a goal in mind, tracking your expenses simply means you have a lot of information about your spending habits. For it to be meaningful, what matters is what you do with the data.

Here's what could be more helpful: Identify one particular item / activity to spend less on in 2023.

Use the information to fill in the blanks for “I want to spend less on <one particular item or activity> in 2023”.

Save better by: Spending less on a Specific item or activity

Comparing your spending habits against how much you’re putting into your bank account gives you a better idea of your money-in-money-out. And when your dashboard’s a comprehensive one like the Plan & Invest tab in digibank, it helps you narrow down what to cut back on.

But don’t try to cut everything. Whether it is bubble tea, nights out, shopping or other indulgences, life is not meant to be miserable. Celebrate the small wins - once you've hit a savings goal, treat yourself! Now you'll know you budgeted for that, and can feel less guilty about the occasional treat.

3. Just wanting to manage your credit card debt

Wanting to manage credit card debt is a great start, but there are spends that we just must make.

So this could be more helpful: Make your credit card work smarter for you.

Save better by: Working your credit card smarter

"Debt" isn’t necessarily be a bad thing. Managed properly, debt allows you to furnish a new home, purchase a car, or collect reward points for little indulgences.

Credit cards are perfect for accruing rewards points and cashback rewards to offset your credit card bills. Just remember to spend within what you have budgeted (aka after putting aside the Specific amount we mentioned earlier, and remember to cut back on what we discussed in point two), and pay off your outstanding balances on time. On top of that, why not key a reminder into your Calendar app to do so?

Credit cards are a tool to help you get the most out of your spending. Master it, and don't let it master you.

4. Just planning to invest better this year

“Investing better” looks different for all of us. For some, it means understanding your existing investments better… or levelling up on your investment approaches and strategies. For others, it may mean getting started.

What’s helpful for you depends on your starting point.

Save better by: Understanding investments better

They say knowledge is power. So pick a few books, read a few chapters a week, and review what you have learned. You can even borrow audio books (for free!) using the National Library Board’s mobile app, and listen to them on the go. A better way to spend your commute? Now that’s a win in our books.

But if books are too long, jump into articles and videos on DBS Financial Planning to get up to speed with i) the basics, and ii) ways to level up your investment strategies. Financial jargon can be intimidating, but DBS Financial Planning distils it to what you need to know, and makes the entire process easier.

Save better by: Taking action on your first investment

Sometimes, goal-setting is really as simple as making time to sit down and taking action.

One easy way for beginner investors is through DBS digiPortfolio, a hybrid robo-advisory solution that requires just S$1,000 to get started. But if you prefer dollar-cost averaging, consider regular savings plans like DBS/POSB Invest-Saver, which starts you investing in Exchange Traded Funds (ETFs) and/or Unit Trusts from as little as S$100 a month, on repeat mode. You will not be locked in to a certain time period, and getting started just takes five steps.

And if you're ready for a more hands-on approach, consider doing any of these with digibank: buy unit trusts, trade in equities and ETFs, invest in a short-term endowment, or invest in Singapore Savings Bonds (SSBs). Then, you truly will be on your way to growing your savings.

5. Just wanting to have enough insurance

Insurance is very good to have - especially when you never know when life will throw you a curveball. It's also best to buy policies when you are young and relatively healthy as it's cheaper - policies typically get more expensive as one grows older.

Think of insurance like this – it is transferring risk from the individual to the community. In times of old, whole villages were obliged to help an unfortunate fellow member of the community if, say, his/her house was burnt down in a fire, or other ill fortune befell his/her family.

This can be seen as an ancient form of "insurance premiums" paid by members of the village, so they will receive a "pay-off" should misfortune strike them. Of course, insurance works on the basis that "bad stuff" does not happen to everybody at the same time.

But what is considered "enough insurance"?

Save better by: Reviewing your insurance needs and coverage

As you move into different stages of life, your insurance needs could change dramatically. For instance, outstanding home loan repayments, children’s education, and parents’ medical expenses. Prioritise what is important to you, as not everything needs to be covered at once.

These questions are a good starting point to review your coverage:

- Are your policies still in force?

- How much premiums have you paid so far?

- What kind of coverage do you have right now?

- What is the cash value of your policies?

- Is your family covered by any policies?

These steps are often tedious and are better dealt with by a professional. Before chatting with them, use the Plan & Invest tab in digibank to get a sense of what you need. And then, make an appointment with your Wealth Planning Manager to set your mind at ease, knowing your life insurance coverage is adequate for your needs right now.

In Conclusion

Making new year's resolutions may be daunting as there is always the risk of breaking them. But part of making goals is also giving yourself the grace to fall short - and then picking yourself back up to get back on track.

Which of these resolutions are you planning to make this year? If Jan 1 has passed and you feel like you have missed the boat, don't fret - the best time to start, as they say, is now.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Alternatively, check out Plan & Invest tab in digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)