Meet Jack. He’s a first jobber who credits monthly salary of S$3,500 to his DBS/POSB savings account and transacts in two categories.

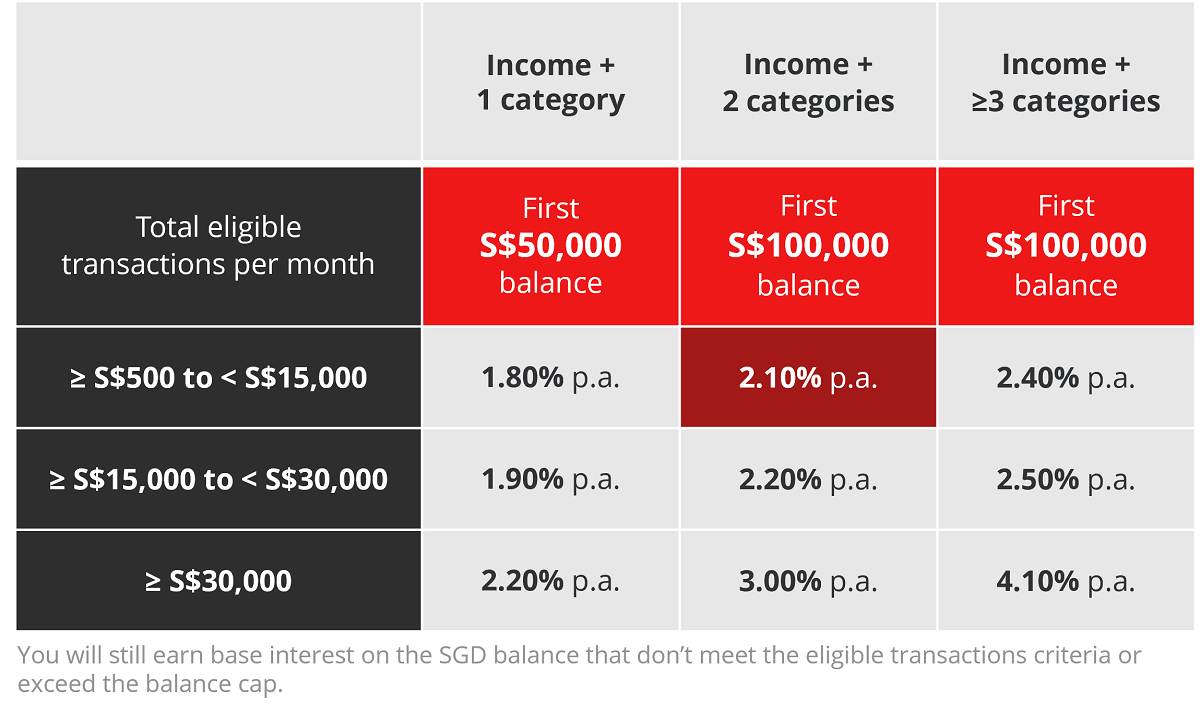

Jack has a total eligible transaction of S$3,800 and gets a bonus interest of:

- 2.10% p.a. for the first S$100,000 and

- Base interest rate for balance above S$100,000

To unlock higher interest rates, Jack can transact in one more category. By purchasing an insurance, Jack transacts in 3 categories and his interest rate increases from 2.10% p.a. to 2.40% p.a.

Meet Rachel and Bryan. They are married with two children and have a personal Multiplier Account each. Rachel and Bryan credit their salaries of S$6,000 and S$5,000 respectively into a joint account to qualify for higher eligible transaction tiers on their individual Multiplier Account.

They are also joint borrowers of DBS/POSB Home Loan and spilt the S$3,000 monthly instalment equally. Both are accorded the full monthly instalment amount of S$3,000 as an eligible transaction for their individual Multiplier Account.

- Rachel

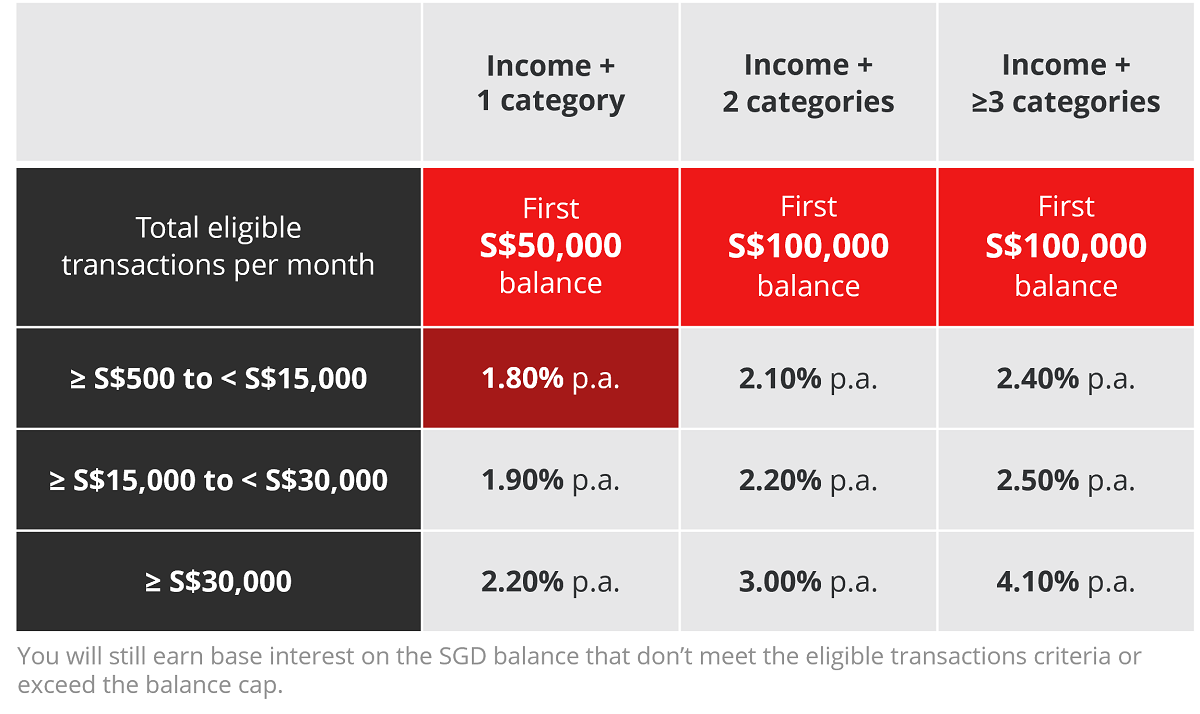

Rachel has a total eligible transaction of S$19,000 and gets a bonus interest of:

- 2.20% p.a. for the first S$100,000 and

- Base interest for balances above S$100,000

- Bryan

Like Rachel, Bryan benefits from the combined credited salaries. He is accorded the full monthly instalment amount of S$3,000 as a joint borrower of DBS/POSB Home Loan and bought an insurance policy recently.

Bryan has a total eligible transaction of S$18,000 and gets a bonus interest of:

- 2.50% p.a. for the first S$100,000 and

- Base interest for balances above S$100,000

William receives S$755 monthly allowance credited to his DBS/POSB savings account and has DBS PayLah! Retail Spend of S$100.

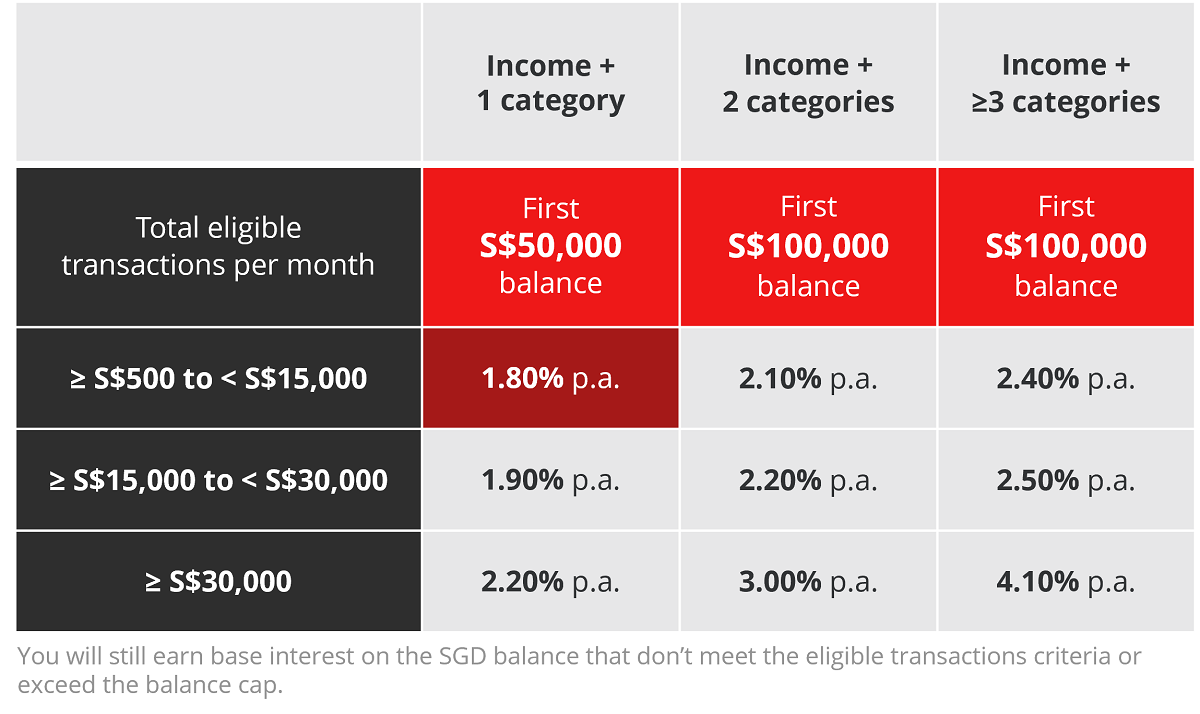

With a total eligible transaction of S$855, he qualifies for interest of

- 1.80% p.a. for the first S$50,000 and

- Base interest rate for balance above S$50,000

To earn higher bonus interest, William can choose to take up an investment product which means he will fulfil 2 categories. His bonus interest will then increase from 1.80% p.a. to 2.10% p.a. His balance cap also increases from S$50,000 to S$100,000, allowing him to earn bonus interest on a higher amount.

This is Andrea. She’s 21 years old, full-time student and spends S$100 through DBS PayLah!.

With a total eligible transaction of S$100, she qualifies for interest of

- 1.50% p.a. for the first S$50,000 and

- Base interest rate for balance above S$50,000.

Andrea can increase her interest rate from 1.50% p.a. to 1.80% p.a. when she credits her income through internships, part-time work, adding up to S$500 or more a month.

Philip is retired and receives his CPF LIFE monthly payouts through DBS. He also transacts his monthly expenses using PayLah!.

With a total eligible transaction of S$900, he qualifies for interest of

- 1.80% p.a. for the first S$50,000 in his Multiplier Account and

- Base interest rate for balance above S$50,000.

To unlock higher interest rates, Philip can transact in one more category. Using Vickers, he invests S$1,000. Philip now transacts in 2 categories and his interest rate increases from 1.80% p.a. to 2.10% p.a. His balance cap also increases from S$50,000 to S$100,000.

FAQ & Eligible Transactions

How do I apply for DBS Multiplier Account online?

You can apply for DBS Multiplier Account via the digibank app.

For new DBS/POSB customers

Below are 3 simple steps on how you can open your account instantly

- Register for Singpass if you have not done so. Click here to register.

Download digibank app

- Apply for your account using Singpass, upload your passport (for Malaysian, upload front and back of your Malaysian IC) and your account will be opened instantly.

For existing customers with digibank access

All you need to do is log in and refer to the following guided steps:

Digibank Online

To apply for a new DBS Multiplier Account:

- Select Apply > Deposit Accounts > DBS Multiplier Account > Instant Apply OR

- Request > Opt-in Bank & Earn Programme

Digibank App

To apply for a new DBS Multiplier Account:

- Login to your digibank app, tap on ‘More’ followed by ‘Deposit Account’ and tap on ‘DBS Multiplier Account’.

For account opening between Mondays to Sundays (including Public Holidays), 7am to 10.30pm or on the last day of the month between 7am to 8pm, the account will be opened instantly. Beyond these periods, account opening will take 2 working days.

Can I convert my existing DBS/POSB account to Multiplier Account?

You can convert your existing personal DBS Autosave or DBS Multi Currency Account (joint account not allowed) to DBS Multiplier Account:

- Select Request > More Requests > Request for DBS Autosave Account Conversion

When do I get my interest?

Your DBS Multiplier Account pays you interest in two parts:

- Base interest: This gets added to your account on the last day of each month.

- Bonus interest: If you've earned any bonus interest, this gets added to your account by the 7th working day of the next month.

How is interest calculated?

Here's how we work out your interest:

- We add up all the eligible transactions for the full month. This total helps us figure out your bonus interest rate.

- The bonus interest rate applies only to your end-of-day SGD balance. The balance cap is the maximum amount of money that can earn bonus interest.

- We calculate the interest earned for each balance level. Then we round this off to the nearest four decimal places.

- We add up each day's interest earned and round this off to the nearest two decimal places.

- Finally, we add up the entire month's interest.

You can qualify with any of the following:

Salary Credit to any DBS/POSB Deposit Account

- Credit your salary into your DBS/POSB SGD-denominated account via GIRO/FAST/PayNow with transaction code “SAL”/“PAY” or transaction description “SALARY”/“PAYROLL”/“COMMISSION”/“BONUS”.

Email your HR to credit your salary with DBS today.

Dividends Credit

- Credit your dividends via GIRO/FAST/PayNow with transaction code “CDP”/“NDIV” or transaction description “DIVIDEND” into your DBS/POSB account, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) Account or CPF Investment Account (CPFIA)

- Eligible dividends include Central Depository Pte Ltd (CDP), DBS Vickers Securities, DBS Online Equity Trading (OET), DBS Unit Trusts, DBS Online Funds Investing, DBS Invest-Saver.

Switch your dividend credit to DBS today. Log in to your CDP account to change your bank account details for Direct Crediting Service.

Annuities

- Credit your CPF payouts or SRS withdrawals via GIRO/FAST/PayNow with transaction code “CPF”/“SRS” or transaction description “CPF”/“SRS” into your DBS/POSB account.

Switch your CPF payouts or visit any of our branches to do an SRS Account transfer to DBS today.

You can qualify with any of the following:

Spend with any DBS/POSB personal credit card(s)

- Eligible credit card spend consists of retail and cash advance transactions posted within the calendar month. Reversals/credits/refunds posted will offset eligible credit card spend.

- Eligible credit card spend across main cards & supplementary cards are accorded to the main cardholder.

Find out more about DBS Credit Cards here.

Spend with PayLah!

Eligible PayLah! transactions include:

- Payments to merchants through PayLah! in-app checkout, web checkout, express checkout

- Scan & Pay transactions

- Payments to billing organisations

- Donations to charitable organisations

- Valid for new and existing DBS/POSB home loan, for new home purchase or refinancing from another bank/HDB.

- The monthly instalment due (both cash and CPF included) on your DBS/POSB home loan(s) are included in the eligible transaction.

- The first 3 joint borrowers will be accorded the full monthly instalment amount due as eligible transaction.

Find out more about DBS Home Loans here.

Multiplier recognises all Manulife Regular, Flexible and Single Premium insurance policies distributed by DBS/POSB. No minimum premium amount required.

Regular and Flexible Premium Policy

- Valid for new regular or flexible premium policy purchased after Multiplier Account is opened.

- The recognition of the monthly premium (i.e. Annualised premium/12) starts on the 23rd of the following month after policy inception. It will continue on every 23rd of the month for 12 consecutive months as long as policy is in force.

Single Premium Policy

- Valid for new single premium policy purchased with cash or SRS after Multiplier Account is opened. The purchase date is based on policy sign date.

- The monthly premium amount will be calculated by dividing the single premium amount by 120 (based on 10% of the single premium amount to divide across 12 months). Recognition starts on the 23rd of the following month after policy inception and continues every 23rd of the month for 12 consecutive months as long as policy is in force.

Want to know more?

Chat with our friendly Wealth Planning Managers now. (This chat service is available from 9am to 6pm on Mon to Fri, excluding Public Holidays.)

Alternatively, you may leave your contact details and we will get in touch soon.

Unit Trust Lump-sum Investment

- Valid for new Unit Trust lump-sum or Online Funds Investment purchased with cash, CPFIA or SRS after Multiplier Account is opened.

- The investment amount will be recognised post settlement date.

Find out more about Unit trust lump-sum investments here.

DBS Invest-Saver

- Valid for new DBS Invest-Saver plan for Exchange Traded Funds or Unit Trusts purchased after Multiplier Account is opened

- The monthly investment amount will be recognised for the first 12 consecutive months per fund

Find out more about DBS Invest-Saver here.

digiPortfolio

Valid for new digiPortfolio purchased after Multiplier Account is opened

- Minimum qualifying amount is S$1,000 per transaction for Lump Sum investments

- Recurring top ups (RSPs) from S$100 will be recognised for the first 12 consecutive months per portfolio as long as the RSP remains valid

- The investment amount will be recognised post settlement date

Find out more about digiPortfolio here.

Online Equities Trade

- Valid for "BUY" equity trades with cash, CPF or SRS via DBS Vickers Online Trading or DBS Online Equity Trading after Multiplier Account is opened.

- The investment amount will be recognised post settlement date.

Find out more about online equities trade here.

Bonds & Structured Products

- Valid for new Bonds & Structured Products purchased after Multiplier Account is opened

- Eligible products include Bonds (excludes Singapore Savings Bonds and Singapore Government Securities), Structured Deposit, Currency Linked Investments and Structured Notes.

- The investment amount will be recognised post settlement date.

Find out more about Bonds & Structured Products here.