Account Opening

The DBS Multiplier Account is a personal multi-currency deposit account that rewards bonus interest when you transact with DBS/POSB.

- Credit your income and transact in one or more of the following categories: credit card/PayLah! retail spend, home loan instalment, insurance, investments, adding up to S$500 or more.

- Transact with credit card or PayLah! for retail spend (29 years old and below)

It gives you access to Singapore dollar and 12 foreign currencies and comes with digibank and eStatement. The account does not come with a cheque facility.

Yes. Multiplier is a multi-currency account. You will have access to 12 foreign currencies and the Singapore dollar. The 12 foreign currencies are:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Chinese Renminbi (Offshore) (CNH)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Norwegian Kroner (NOK)

- Sterling Pound (GBP)

- Swedish Kroner (SEK)

- Thai Baht (THB)

- US Dollar (USD)

You can exchange these currencies conveniently at prevailing rates and earn interest on foreign currencies.

You can apply for DBS Multiplier Account via the digibank app.

For new DBS/POSB customers

Below are 3 simple steps on how you can open your account instantly

- Register for Singpass if you have not done so. Click here to register.

Download digibank app

- Apply for your account using Singpass, upload your passport (for Malaysian, upload front and back of your Malaysian IC) and your account will be opened instantly.

For existing DBS/POSB customers with digibank access

All you need to do is log in and refer to the following guided steps:

Digibank Online

To apply for a new DBS Multiplier Account:

- Select Apply > Deposit Accounts > DBS Multiplier Account > Instant Apply OR

- Request > Opt-in Bank & Earn Programme

Digibank App

To apply for a new DBS Multiplier Account:

- Login to your digibank app, tap on ‘More’ followed by ‘Deposit Account’ and tap on ‘DBS Multiplier Account’.

For account opening between Mondays to Sundays (including Public Holidays), 7am to 10.30pm, the account will be opened instantly. Should the account be opened on the last day of the month, applications made between 7am and 8pm will be opened instantly. Beyond these periods, account opening will take 2 working days.

OR

- To convert existing personal DBS Autosave or DBS Multi Currency Account (joint account not allowed) to DBS Multiplier Account:

- Select Request > More Requests > Request for DBS Autosave Account Conversion

You can check the status of your account opening application anytime via our Application Status Portal.

Simply log in using your NRIC/ Malaysian IC/ Passport number and Email address used in your application.

If you need further assistance, please refer to our Help & Support Page.

You can only hold 1 Multiplier Account. Also you can only take up a Multiplier Account or POSB Cashback Bonus, not both.

Upon successful switching, any interest not yet credited will be forfeited. Any existing insurance or Invest-Saver will also cease to be recognised as eligible transactions under DBS Multiplier Account.

Bonus Interest

The interest is credited into your DBS Multiplier Account in 2 parts:

- Base interest: Credited on the last calendar day of the month

- Bonus interest (if any): Credited by the 7th working day of the following month

Here's how we work out your interest:

- We add up all the eligible transactions for the full month. This total helps us figure out your bonus interest rate.

- The bonus interest rate applies only to your end-of-day SGD balance. The balance cap is the maximum amount of money that can earn bonus interest.

- We calculate the interest earned for each balance level. Then we round this off to the nearest four decimal places.

- We add up each day's interest earned and round this off to the nearest two decimal places.

- Finally, we add up the entire month's interest.

Check out Multiplier Account for the interest rate table and examples

Eligible Transactions

- Income: Credit your salary/ dividend/ annuities to any personal or joint DBS/POSB deposit account.

- Credit Card Spend/ PayLah! Retail Spend: Retail and cash advance transactions with any DBS/POSB personal credit cards or with DBS PayLah!

- Home Loan Instalments: Monthly instalments due on disbursed DBS/POSB residential loans.

- Insurance: policies purchased via DBS/POSB, after you have successfully opened DBS Multiplier Account. Existing insurance policies you have before account opening will not be recognised.

- Investments: New investments purchased via DBS/POSB after opening your DBS Multiplier Account. Existing investments you have before account opening will not be recognised.

- Unit Trust lump-sum

- DBS Invest-Saver

- digiPortfolio (min S$1,000 per transaction)

- Online equity trades made via DBS Vickers or DBS Online Equity Trading

- Bonds & Structured Products

No. Total monthly eligible transactions is derived by summing up the amounts across Income, Credit Card/ PayLah! Retail Spend, Home Loan Instalments, Insurance and Investments.

No. Eligible transactions are automatically detected across the DBS/POSB products held by you. You only need to deposit funds in your DBS Multiplier Account, while transacting with your usual DBS/POSB products to enjoy the bonus interest rates.

Computation begins from the date of DBS Multiplier Account opening to the last day of the month. If your DBS Multiplier Account is opened on the last day of the month, computation will only begin on the first day of the following calendar month. For subsequent months, it will be computed from the first to last day of the month.

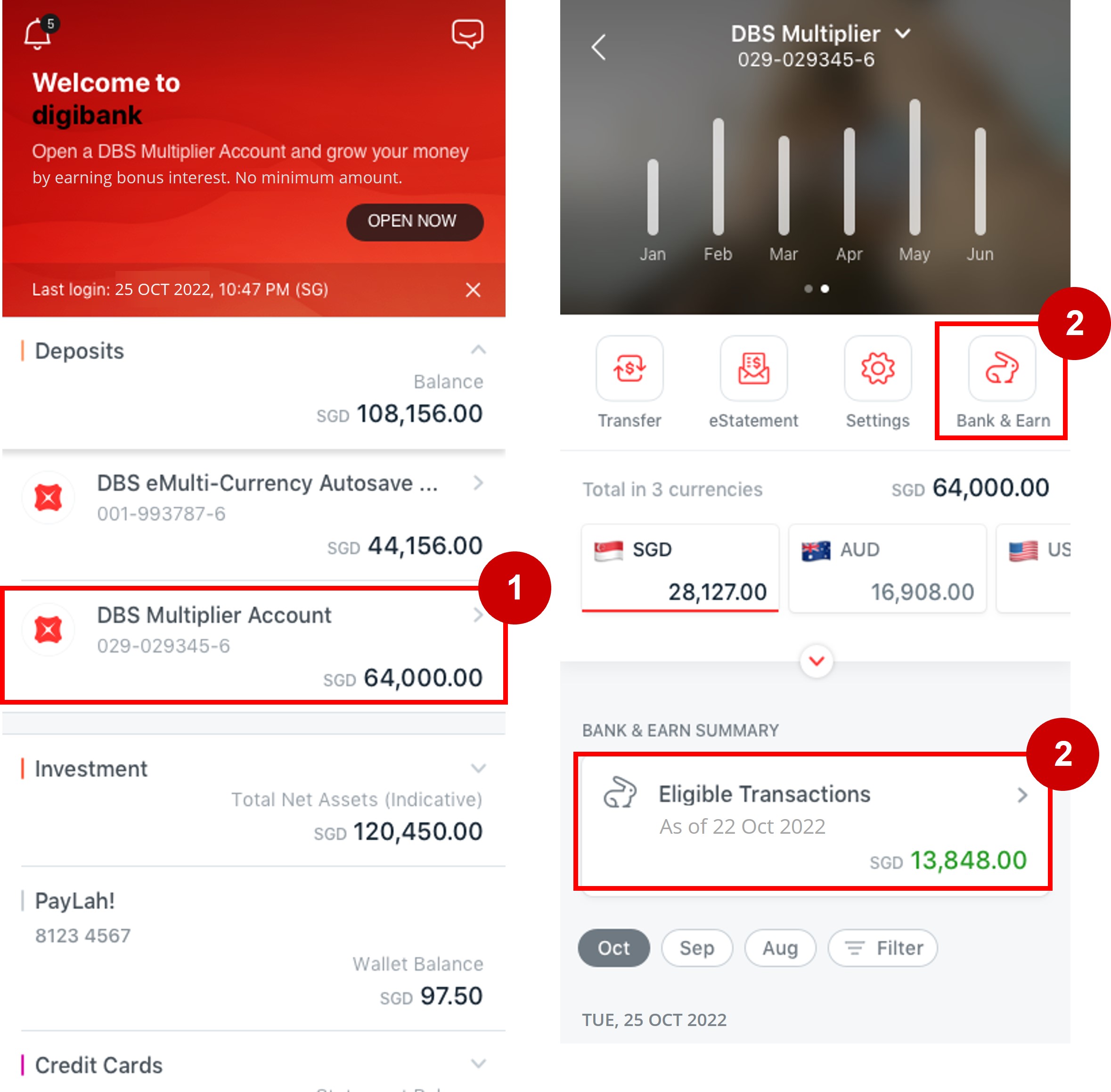

You can track your eligible transactions through digibank in the Bank & Earn Summary where you can view current month and the past month.

How to navigate to Bank and Earn Summary in digibank mobile:

Income

Salary Credit to any DBS/POSB Deposit Account

- Credit your salary into your DBS/POSB account via GIRO/FAST/PayNow with transaction code “SAL”/“PAY” or transaction description “SALARY”/“PAYROLL”/“COMMISSION”/“BONUS”.

Dividends Credit

- Credit your dividends via GIRO/FAST/PayNow with transaction code “CDP”/“NDIV” or transaction description “DIVIDEND” into your DBS/POSB account, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) Account or CPF Investment Account (CPFIA).

- Eligible dividends include Central Depository Pte Ltd (CDP), DBS Vickers Securities, DBS Online Equity Trading (OET), DBS Unit Trusts, DBS Online Funds Investing, DBS Invest-Saver.

Annuities

- Credit your CPF payouts or SRS withdrawals via GIRO/FAST/PayNow with transaction code “CPF”/“SRS” or transaction description “CPF”/“SRS” into your DBS/POSB account.

No. Salary and dividend credit will be summed up and classified as income for the month.

You can contact us and provide latest computerised payslip for assessment.

The combined total salary and dividend credits in that joint account will be recognised under the individual DBS Multiplier Accounts.

Example 1: John and Mary credit their salaries (S$3,000 and S$3,100 respectively) and dividends (S$500 each) into their joint POSB savings account. They have their own DBS Multiplier Accounts and are accorded a total income amount of S$7,100 each.

Example 2: George credits his salary of S$4,000 into a joint POSB savings account shared with Emily. Emily does not have an income. They have their own DBS Multiplier Accounts and are accorded a total income amount of S$4,000 each.

No. They are summed up and classified as 1 category for the month.

Only posted retail and cash advance transactions will be recognised as eligible credit card spend. Balance transfers, instalment payment plans, preferred payment plans, and any fees/ charges imposed by the bank are not eligible.

Example:

30 Aug: Credit card spend is made at a merchant.

1 Sep: Transaction is posted to your credit card account.

This transaction is therefore recognised under September’s credit card spend (not August).

Yes. However, the supplementary card’s eligible transactions will be accorded to the principal credit card holder.

Yes. Any posted reversal/refund/credit will offset the eligible credit card spend. If the total amount of the reversals/refunds/credits exceeds the eligible credit card spend, there will not be any eligible transaction recognised under the Credit Card Spend category.

No. Eligible credit card transactions are automatically detected across all the personal DBS/POSB Credit Cards held by you. DBS Multiplier Account recognises credit card transactions made via American Express® / MasterCard® / Visa.

- Payments to merchants: through DBS PayLah! in-app checkout, merchant in-app checkout, web checkout, express checkout

- Scan & Pay transactions: Make payments to participating merchants by scanning the Fave, NETS, SG and/or PayNow QR codes using your DBS PayLah! Simply look out for these logos below.

- Pay bills: using DBS PayLah! App

- Donations to charitable organisations: using DBS PayLah! (Android App only)

Non-Eligible Transactions include Peer-to-Peer (P2P) fund transfers via PayLah! message, mobile number, QR Code & Payment Link, eGift, QR Gift.

Yes. Any posted reversals/refunds/credits transactions will offset the eligible PayLah! Retail Spend. If the total amount of the reversals/refunds/credits exceeds the eligible PayLah! Retail Spend, there will not be any eligible transaction recognised.

PayLah! Retail Spend transactions will be accorded only to the owner of the PayLah! wallet that the transaction is made from.

Home Loan Instalments

The amount accorded under the Home Loan Instalments category is based on the instalment due date.

- If your home loan is disbursed between 1st to 15th of the month, the instalment due and recognition as an eligible transaction will start next month.

- If your home loan is disbursed after 15th of the month, the instalment due and recognition as an eligible transaction will start 2 months later.

Any loan repayment received before the instalment due date will not be recognised.

The first 3 joint borrowers of the home loan will each be accorded the full amount of monthly instalment due. This amount is not divided among borrowers.

Yes. Both CPF and/or cash contributions for the home loan instalment will be included in the eligible transaction amount. The cash contribution can be deducted from any personal or joint DBS/POSB deposit account.

Yes. The monthly instalment due is accorded to the first 3 joint borrowers of the loan, regardless of whether the LSA is under their names.

The amount accorded under the Home Loan Instalments category is based on the instalment due date:

- For private properties, the instalment is payable on 1st of every month

- For HDB flats, the instalment is payable on 15th of every month

If your DBS Multiplier Account was opened after the instalment due date, the recognition will start next month instead.

Insurance

All Manulife regular/single premium insurance policies purchased through DBS/POSB in cash or with funds in Supplementary Retirement Scheme (SRS) account after the DBS Multiplier Account is opened qualify as eligible transactions. The policy sign date will be taken as the date of purchase.

Eligible insurance policies will be recognised for bonus interest over 12 months. We will derive the monthly premium amount by:

- Single premium policies: dividing the single premium amount by 120 (based on 10% of the single premium amount divided across 12 months)

- Regular or flexible premium policies: dividing the annualised premium amount by 12

The inclusion of the monthly premium amount as an eligible transaction will start on the 23rd of the following month after the policy inception date and continues every 23rd of the month for 12 consecutive months as long as the policy is in force.

Example:

| Policy purchased date | 20 Jun |

Policy inception date | 20 Jul |

Multiplier recognition start date | 23 Aug (You will receive your bonus interest on the 7th working day of September, if any) |

In the event that there are modifications to the insurance policy, the monthly premium will cease to be included as an eligible transaction. This will take effect from the month where the modifications are made.

Modifications can include but are not limited to change in premium payment frequency, reassignment of policy ownership and change of servicing agent.

No. All are classified under the Insurance transaction category and so will be counted as 1 category. However, they will all be summed up under total monthly eligible transactions for the month.

For foreign residents, the identification number registered with Manulife and DBS/POSB must be identical in order for the Manulife insurance policy(ies) to be recognised. If your identification number (e.g. passport number) differs between Manulife and DBS/POSB, we are unable to recognise this policy.

Investments

No. All are classified under the Investments transaction category and so will be counted as 1 category. However, they will all be summed up under total monthly eligible transactions for the month.

Investment transactions will be recognised as the Singapore dollar equivalent at DBS’ prevailing exchange rate.

The transaction will be accorded to the investment applicant only.

Only investments made with your CPF-OA savings through a CPF Investment Account (CPFIA) opened with DBS/POSB will be recognised. Investments made with your CPF-SA savings will not be recognised as you do not need to open a CPFIA to invest your SA savings.

Only new Unit trust lump-sum purchase(s) made in cash, funds from your DBS CPFIA or DBS SRS account after you have successfully opened your DBS Multiplier Account will be recognised as eligible transactions.

The full amount is recognised for post settlement date of the selected fund as per the fund settlement cycle.

Only new DBS Invest-Saver purchase(s) made after you have successfully opened your DBS Multiplier Account will be recognised as eligible transactions.

DBS Invest-Saver will be recognised in the same month, if you sign up before the deduction date, 15th of the month (or the next business day if the 15th is a Sunday or Public Holiday). Else, it will be recognised the next month. It will be recognised for the first 12 consecutive months, per investment fund post settlement date of the selected fund as per the fund settlement cycle.

Example:

Deduction Date | 15 April (or next business day if 15th is a Sunday or Public Holiday) |

Settlement Date / Recognition Date | 21 April (3 to 4 working days, depending on fund house) |

Yes, you may update the amount and it will be recognised if deduction is successful.

Inclusion of the monthly contributions as eligible transactions will cease from the month where there is any failed deduction, or the DBS Invest-Saver is terminated.

No. For the re-purchase to be recognised, the fund has to be terminated and fully redeemed for at least 6 months from the date of termination or date of full redemption, whichever is later. Alternatively, you may consider purchasing a new fund to continue recognition.

Example:

Termination Date | 29 April |

Full Redemption Date | 30 April |

Re-purchase Set Up Date | Re-purchase after 30 October will be recognised |

Only new digiPortfolio purchase(s) or top ups made after you have successfully opened your DBS Multiplier Account will be recognised as eligible transactions.

Only ETF-based, Income, and SaveUp digiPortfolios will be recognised under the Investment category.

Lump sum: The lump sum invested (min S$1,000 per transaction) will be considered as an Eligible Transaction post settlement date.

Regular savings plan (RSP): Recurring top-ups in digiPortfolio will be considered as an Eligible Transaction post settlement date. It will be recognised for the first 12 consecutive months as long as the RSP is still valid.

USD-denominated digiPortfolio investment is recognised based on DBS' prevailing exchange rates to determine if it meets the minimum S$1,000 per transaction, which may differ from the time you converted SGD to USD. Therefore, we advise maintaining a buffer when investing in USD.

Only “BUY” equity trades purchased via DBS Vickers Online Account or DBS Treasures Online Equity Trading using cash, CPF or SRS qualify as eligible transactions for the month, after settlement date.

For joint DBS Wealth Management Account, the equity trades will be recognised in full for each joint account holder under their individual DBS Multiplier Accounts.

The following transactions are ineligible: Contra trades, sell trades, initial public offerings (IPOs) and trades executed via Trading Representatives and DBS Vickers Customer Service Line.

DBS Vickers Online Account, DBS Online Equity Trading

Only new purchase(s) made after you have successfully opened your DBS Multiplier Account will be recognised as eligible transactions.

Singapore Savings Bond, Singapore Government Securities and initial public offerings (IPOs)