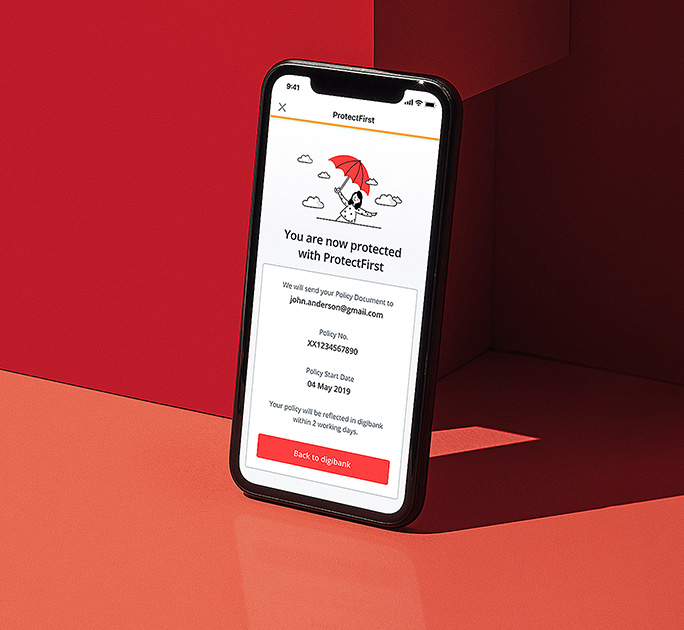

ProtectFirst

Promotions

Frequently Asked Questions

Yes, ProtectFirst provides coverage against early stage CI. Upon diagnosis of any of the covered early stage CIs, 25% of the CI sum insured will be paid.

This benefit will only be paid once and upon such claim, the CI sum insured (and premium) will be reduced accordingly and subsequently payable upon advanced stage CI.

CI covered by ProtectFirst are Cancer, Heart Attack, Stroke, Liver Failure and Major Organ/Bone Marrow Transplantation.

ProtectFirst is a regular premium, non-participating plan which will protect you for 5 years, coverage can be renewed to cover you up to age 65.

Whenever a claim is made, premium will reduce.

This is because the respective benefits will either (1) cease or (2) reduce in the case of an early stage CI claim whereby remaining (reduced) sum insured is payable on advanced stage CI.

Each of the coverage for ProtectFirst are independent benefits. After receiving the maximum payout for one benefit, you can continue to enjoy coverage on the rest of the benefits.