Ride the market steadily with Invest-Saver

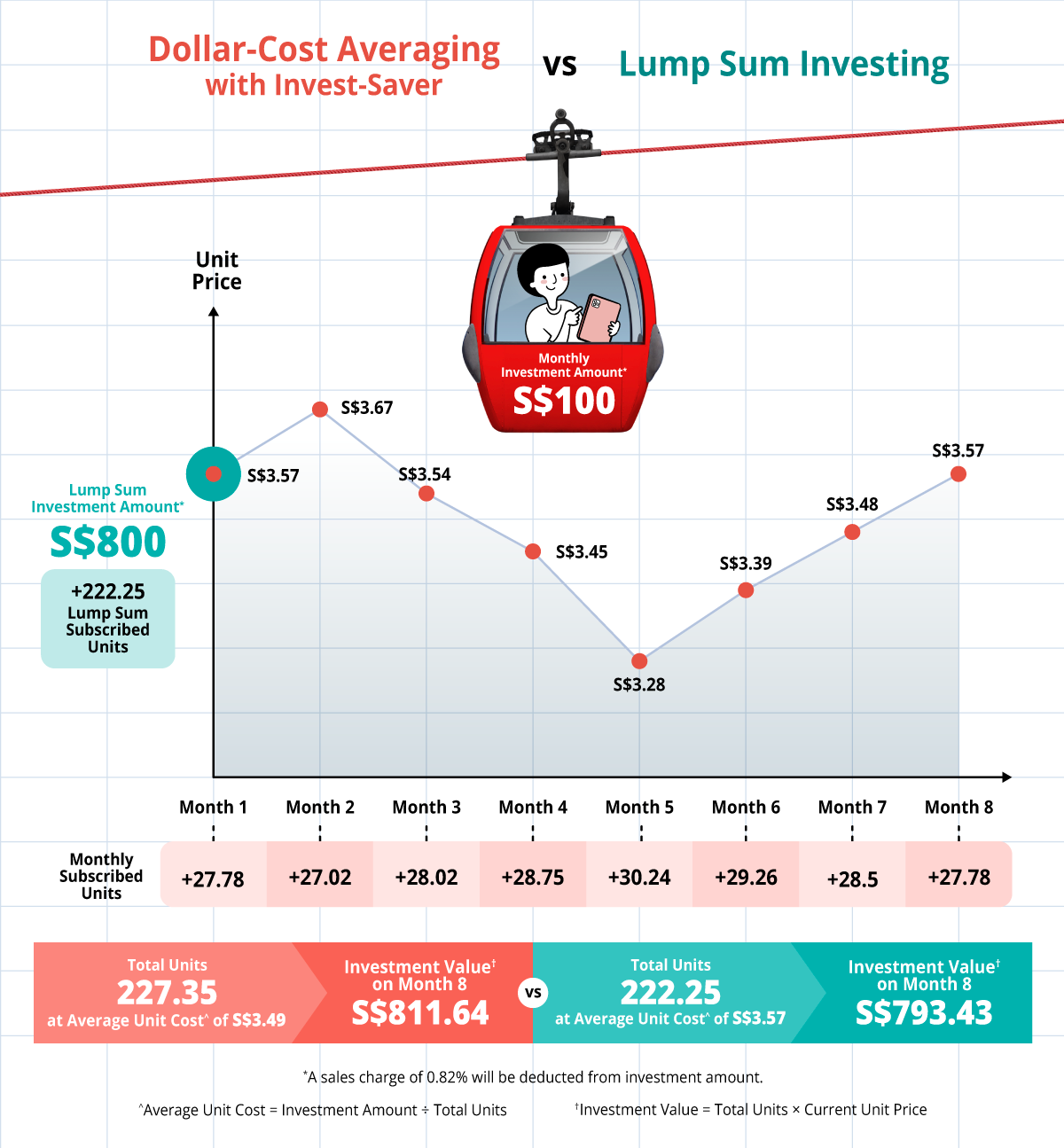

First-jobber Alan has been looking for a hassle-free way to invest. He decides to use Invest-Saver, and invest a fixed sum of S$100 a month. Let’s say the price of the fund fluctuates over the next 8 months as follows:

For the same investment amount, Alan may have gotten more units at a lower average cost with an Invest-Saver plan, than if he had invested a lump sum.

Ready-made portfolios designed and managed by experts.

Ready-made portfolios designed and managed by experts.

Passively managed funds, designed to match the performance of a market index.

Passively managed funds, designed to match the performance of a market index.

Passively managed funds, designed to match the performance of a market index.

Professionally managed funds, with the aim to beat the performance of a market index.

Professionally managed funds, with the aim to beat the performance of a market index.

You can set up a DBS Invest-Saver plan if you are:

- At least 18 years of age on the date of application

- Not a US Person (as defined in the Terms and Conditions Governing Investment in Funds)

digiPortfolio

Currently, we only accept individual Multi-Currency accounts and offer only individual digiPortfolios.

ETF & Unit Trust

You can set up a Invest-Saver plan using your joint-alternate Current or Savings account. However, the Invest-Saver plan will be in the sole name of the applicant.

Follow these steps to set up a recurring top up instruction for your digiPortfolio easily.

For new digiPortfolio customers

For existing digiPortfolio customers

You can set up recurring top up instructions for these digiPortfolios on the DBS digibank app.

- If you are accessing DBS digibank via mobile application, follow the steps under Invest in a few taps ETFs and Unit Trusts.

- If you are accessing DBS digibank via internet browsers

Simply log into DBS digibank and follow these 5 steps:

Step 1: Upon login, go to Invest > select More Investment Services

Step 2: Go to Make an Investment > Set Up Exchange Traded Fund RSP > Purchase Funds > go to Invest Using, choose Cash > Search for the full list of ETFs available

Step 3: Click on Info to view fund information.

Step 4: Click on Buy to purchase fund > select the Debiting Account, enter Monthly Investment Amount, Tax Status and Country of Birth > verify your inputs and Submit.

You are advised to click on the hyperlinks to carefully read the Prospectus and Product Highlights Sheet which contain details of your selected Fund

Step 5: Review Terms & Conditions and click on I Agree to confirm your Invest-Saver plan set up.

- If you are accessing DBS digibank via mobile application, follow the steps under Invest in a few taps ETFs and Unit Trusts.

- If you are accessing DBS digibank via internet browsers

Simply log into DBS digibank and follow these 5 steps:

Step 1: Upon login, go to Invest > select More Investment Services

Step 2: Go to Make an Investment > Set Up or Update Unit Trust Regular Savings Plan (RSP) > Purchase Funds > go to Invest Using, choose Cash > key in Fund Name or search using Fund House, Currency, Asset Class, Risk Profile, Geography/Theme > Search for the list of UTs available

Step 3: Click on Info to view fund information > Click on Buy to purchase fund

You will need to complete the Customer Knowledge Assessment (CKA) to ascertain your knowledge in the risks and features of Unit Trust – an unlisted Specified Investment Product, before any online purchase.

Step 4: Click on Buy to purchase fund > select the Debiting Account, enter Monthly Investment Amount, Tax Status and Country of Birth > verify your inputs and Submit.

You are advised to click on the hyperlinks to carefully read the Prospectus and Product Highlights Sheet which contain details of your selected Fund

Step 5: Review Terms & Conditions and click on I Agree to confirm your Invest-Saver plan set up.

digiPortfolio & ETF

For digiPortfolio & ETFs, there is no free look/cancellation period.

Unit Trust

For Unit Trusts, the free look/cancellation period is 7 calendar days from when the RSP is set up (only if it is in a scheme eligible for the free look).

digiPortfolio

Yes, you can modify your recurring top up instruction via DBS digibank mobile application by following these steps. However, take note that the changes would take 1 day to take effect.

Step 1: Login to DBS digibank.

Step 2: From the home dashboard, tap on your digiPortfolio account.

Step 3: Scroll down and tap on Your Recurring Top-Ups section.

Step 4: Tap on Modify to modify your recurring top up instruction.

ETF & Unit Trust

Yes, Invest-Saver portfolio is accessible 24/7 on DBS digibank.

Step 1: Upon login, go to Invest > select More Investment Services > Make an Investment > Set Up or Update Unit Trust Regular Savings Plan (RSP)

Step 2: Select Investment Account and click Search

Step 3: Select the Fund of your choice and edit the Monthly Investment Amount

You are advised to read the Prospectus and Product Highlights Sheet carefully for a full understanding of your selected fund. Read the Terms and Conditions governing investment in funds and tick the checkbox before you continue with your application.

Step 4: Confirm and submit your order

The Bank will send you a confirmation letter to confirm when the change to your investment amount will take effect

Please ensure your designated DBS account is sufficiently funded prior to RSP subscription top-up execution.

digiPortfolio

If your recurring top up fails for 3 consecutive cycles, the instruction will be terminated automatically. Should you wish to reinstate the instruction, please log in to digibank mobile and set up a new recurring top up instruction for your digiPortfolio.

ETF & Unit Trust

Please ensure your designated DBS account is sufficiently funded before the 15th of every month (or the next business day if the 15th is a Sunday or Public Holiday).

We reserve the right to terminate your DBS Invest-Saver plan(s) after 2 consecutive unsuccessful deductions.

digiPortfolio

You can redeem your holdings anytime by internet browsers or mobile application.

Step 1: Login to digibank

Step 2: Select Invest, then click on digiPortfolio

Step 3: Click on Withdraw

Step 4: Input transaction details, click Next

Step 5: Review your transaction details before clicking Submit

For withdrawals, the proceeds will be automatically credited back to your selected crediting account.

ETF & Unit Trust

Step 1: Upon login, go to Invest > select More Investment Services > Manage Investments > Redeem Unit Trust or Exchange Traded Fund (ETF)

Step 2: Select Investment Account and click Search

Step 3: Select the plan you wish to redeem and click Sell

Step 4: Input the number of units to redeem, select Crediting Account > Country of Birth > Next to proceed.

Step 5: Click on I Agree to submit your order.

You will receive a confirmation letter to confirm the amount of your redemption proceeds.

Only UT holdings can be redeemed in fractional units.

digiPortfolio

You can expect to receive the sales proceeds in about 5 business days for ETF-based digiPortfolios and about 10 business days for Income and SaveUp digiPortfolios based on regular market settlement timelines for ETFs/funds. Do note that the portfolio management fee will be deducted from the sale of your portfolio before the proceeds are credited to your Multi-Currency Account.

ETF & Unit Trust

Your account will be credited within T+7 business days from the date you submitted your redemption request.

No. Your RSP will still be active even after you have done a full redemption. To stop your RSP, you have to terminate the plan.

digiPortfolio

You may terminate your recurring top up instruction any time via digibank mobile application by following these steps. However, take note that it takes 1 day for the termination to take effect and any top ups scheduled for the same day will continue to occur.

Step 1: Log in to the digibank mobile application.

Step 2: From the home dashboard, tap on your digiPortfolio account.

Step 3: Scroll down and tap on Your Recurring Top-Ups section.

Step 4: Tap on Terminate to terminate your recurring top up instruction.

ETF & Unit Trust

Step 1: Upon login, go to Invest > select More Investment Services > Manage Investments > View or Delete Regular Savings Plan (RSP)

Step 2: Select Investment Account > Search

Step 3: Select the plan you wish to terminate and submit

We will send you a confirmation letter with details on your termination request.

digiPortfolio, ETF & Unit Trust

Yes, you can terminate and leave the holdings in your account and redeem them at a later date. Alternatively, you have the option to reactivate your Invest-Saver plan again.