![]()

If you’ve only got a minute:

- “Loss aversion” is normal but can cost you dearly. The loss of spending power through inflation may happen if you hold too much cash over the long term.

- Rein in your fear of investing—understand that time is your friend. Studies have found that the longer your holding period for stocks, the lower your probability of incurring a loss.

- Get to know yourself, understand the investments you want to make, and be comfortable that you can stomach whatever risks you are taking on.

![]()

If you are afraid of investing, take heart that this is quite normal behaviour. In particular, the fear of making losses due to wrong decisions tends to dissuade many from even starting!

By nature, humans feel the need to protect what’s theirs in order to survive and when it comes to our savings, this can mean keeping them locked up and unutilised in our bank accounts.

Granted that this is a safe option, loss aversion is not a helpful attribute if you want to have a larger retirement nest egg. Furthermore, this can result in us investing less than we should and investing too conservatively, among others.

A study by American economists including the Godfather of behavioural economics, Richard Thaler found that humans weigh losses twice as strongly as gains. This means that the loss of satisfaction of losing $100 is “roughly twice” the gain in satisfaction of gaining $100.

In simpler terms: You probably feel happy to receive a $100 hongbao, but you’ll feel twice as sad if you dropped $100 on the floor and are unable to recover it.

Loss aversion can cost you over the long-term

When it comes to investing, there are some benefits to having a healthy fear of losses. It makes you more scrutinous, which allows you to make more well-informed investment decisions.

You should not equate this to fearing losses to the extent that you entirely avoid investing or overly conservative investing. But rather, it’s more about taking calculated risks and managing the risks involved with investing.

While there is the possibility of near-term loss through investment, you are likely to face a certain loss of spending power through inflation eroding the value of your cash over the long-term.

Did you know that US$1 million from 1923, held literally in cash - the metaphorical “money under the mattress”- will today have lost around 94% of its spending power.

Put simply, the US$1 million will be able to buy only around 5.7% of what it would have been able to buy 100 years ago. Similarly, the savings you have now will most likely be worth a lot less in real spending power in 20 years, in the light of today’s persistent inflationary environment.

Stocks perform best over the long run

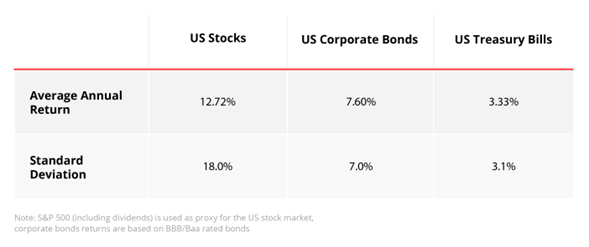

The long-term history of US stocks, bonds, and cash tells us that stocks perform best, bonds next, and cash in a bank account barely keeps up with inflation. Although the Singapore market has a much shorter history than the US market, the same applies.

When investing across different asset classes (e.g. stocks, bonds), you should expect that they have different levels of risk.

Based on data on US stocks, corporate bonds and treasury bills over a 90-year period from 1932 to 2021, we are able to see the general relationship between risk and returns (measured using standard deviation and average returns).

While US Treasury Bills (US government bonds) are the lowest risk investments of the trio, it had the lowest returns. Meanwhile, stocks are the highest risk of the 3 asset classes, but it is also accompanied by the highest returns.

This is why we often hear that stocks are riskier investments than government bonds. At the same time, stocks often have higher upside potential, meaning it generates higher returns in the long run.

What to do to cover your grounds before starting

Before you jump right in, ensure that the money you are putting into investment is your surplus cash.

Regardless of whether there are recessionary concerns or not, it is prudent to have at least 3 to 6 months of emergency cash, or more if you have dependants, to tide you over during a crisis, and at least 12 months for those who are self-employed.

It is also advisable that you address your protection/insurance needs before investing excess savings. For starters, consider getting health insurance that cover hospitalisation, like an Integrated Shield plan, and critical illnesses, as well as a term plan if you have a home loan.

Investing tip 1: Time is your friend

One of the ways to manage your fear of investing is to understand that time is your friend. This means being patient with yourself as the investment journey is a lifelong one. It requires discipline and time too!

Many new investors tend to get impatient or discouraged when they focus on short-term stock performance, especially if they are incurring negative returns. Do remember that stock prices tend to ebb and flow, and this is amplified when you focus only on short-term returns.

Given that you are investing for the long-term, you should judge investment performance over longer time periods.

The idea behind this is that most stocks provide long-term returns to shareholders because the economy grows over the long-run and companies in the stock market, taken together, profit. Those growing profits accrue over to shareholders. When you focus on longer holding periods, it also minimises the effect of volatility.

Another thing to be aware of is that in the long run, “time in the market” beats “timing the market”. The reason behind this is quite simple: it’s not easy to pick the most opportune time to enter the market, which is why you shouldn’t be obsessed by it.

So, if you have never invested and have reservations on starting due to fear, consider starting small and building your investments over time. This will also help you build investing discipline by setting aside money regularly for investments while having some “skin in the game”.

Regular savings plans are useful in this regard. DBS Invest-Saver, for example, lets you buy exchange traded funds and unit trusts from as little as $100 a month.

Investing tip 2: Know yourself, understand your investments

Your personality and personal circumstances may not lend themselves to taking on too much risk. Hence, you have to know yourself, understand the investments you want to make, and be comfortable that you can stomach whatever risks you are taking on.

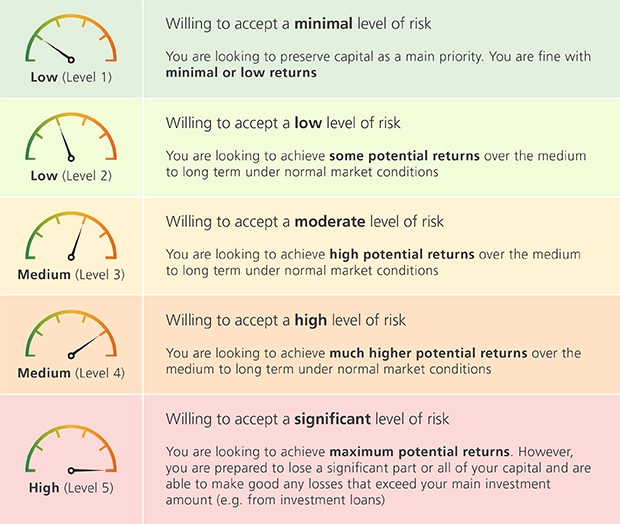

This leads us to our next tip, which is to understand your risk profile. This is the sum of your circumstances, personality, and preferences. It also comes down to how much loss you can tolerate on your investments.

This is crucial as knowing it well helps both your financial advisor and you to select investments for your portfolio which will correlate best to your needs.

All banks and other financial institutions will assess your risk profile before recommending or selling you an investment product. The questionnaires vary, but the key elements tend to be your investment time frame, experience, personal financial circumstances, and ability to accept losses.

They will rate you on a number of risk categories, all of which then determine the type of investments they will offer you.

Refer to the table below to identify your risk level and corresponding returns target.

Read more: 6 common mistakes in investing

Investing tip 3: Match your investments with your risk appetite

It is important to think through and answer your risk profile questionnaire carefully because a mismatch between your risk appetite and your investments may cause you emotional or financial discomfort. And that, in turn, may result in you selling a loss-making investment that may in time turn profitable if you had held on for longer.

If you are unsure of your risk profile but want to invest in ready-made solutions, robo-advisors like DBS digiPortfolio are an option to consider. A robo-advisor is a digital investment platform that provides automated, algorithm-driven financial planning services.

Robo-advisors usually collect some information about you through a questionnaire to find out more about your financial situation and risk appetite. It will use this data to provide and recommend a portfolio most suited to your profile.

Another feature you can consider is the “Make Your Money Work Harder” feature within DBS Plan & Invest tab in digibank on digibank. Through this digital advisory tool, you are able to receive advice that leverages artificial intelligence (AI) models to provide precise and right-sized investment recommendations. You only need to answer five key questions to assess their investment profile, all done in accordance with regulatory safeguards.

A digital advisory tool like this can be used to help remove guesswork along with investment biases, which in turn, widens the pool of investment solutions suited to you.

Read more: Diversify to help manage investment risks

In Summary

Even though it is normal to have a fear of making investment losses, entirely missing out on investing can put a serious dent in our aim of retiring comfortably.

When starting on your investment journey, do remember to think long-term and not be fixated with short-term returns from investing, always have a good understanding of your risk profile and align it to the investment products that are available.

Whatever option you choose, remember to only invest the amount that you can afford to do without in the short term as investing comes with risks and needs time to grow.

Do your due diligence and understand the investment products before going ahead and adopt a diversified approach.

Read more: Investment terms and metrics to learn

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products