What is a Trust and why consider setting up one?

By Lorna Tan

![]()

If you’ve only got a minute:

- Trusts are commonly used to protect the interests of young or vulnerable children who may not be able to handle their own financial affairs.

- Trusts can also be used as an avenue to pass wealth through generations and help protect your assets from creditors or in the event of divorce proceedings.

- Understanding the differences of revocable and irrevocable trusts, fixed and discretionary trusts, and associated costs is crucial for legacy planning.

![]()

Trusts were traditionally offered to the wealthy or super-wealthy as a form of legacy planning. With increasing mass affluence, some people are realising that a trust can be relevant to the man in the street too.

So, what exactly is a trust and how can you go about setting it up?

Here are the 5 most common questions people have.

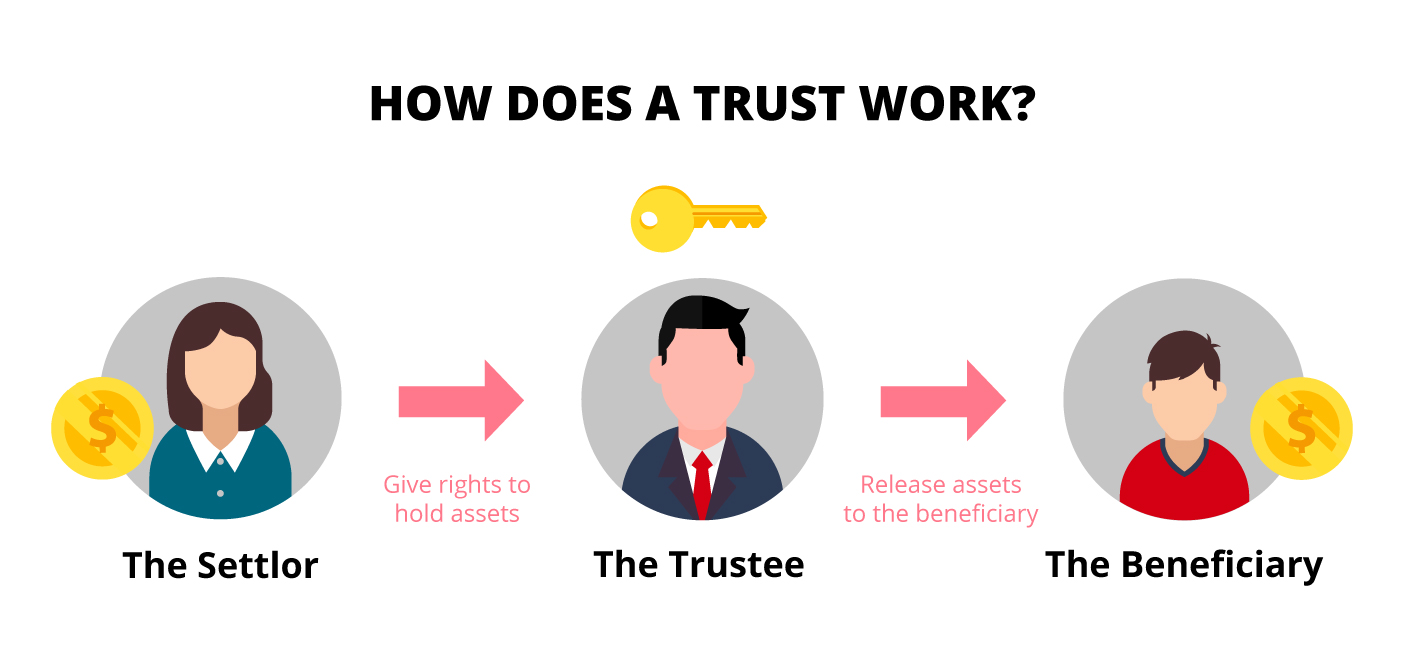

Q1: What exactly is a trust?

A trust is a legal arrangement that allows an individual like you (known as the settlor) to place your assets such that an appointed trustee can administer and manage them for the benefit of others (your beneficiaries).

Your assets may include cash, stocks, property, and family businesses, and your beneficiaries may include family members, friends, or charitable organisations.

There are different types of trusts. For example, you can specify how much and how your assets should be distributed to your beneficiaries. You can also determine the specific instruments for your trustee to manage and distribute your assets and income (such as investment gains).

Your trustee has a statutory obligation to act in your beneficiaries’ best interests. You may also appoint a “protector” to safeguard the trust and prevent the trustee from abusing his/her powers.

Q2: Why should I consider a Trust?

Whether you need a trust depends on your personal circumstances. The following are some reasons people use trusts for legacy planning purposes:

Protecting the interests of young or vulnerable beneficiaries

Most commonly, trusts are used to protect the interests of young or vulnerable children. And that may be children who are minors, or beneficiaries who, for whatever reason, are not capable of handling their own financial affairs. These include special needs children, children too young to get substantial inheritances, or beneficiaries who are spendthrifts.

In addition, trusts also avoid the legal delays that beneficiaries face in gaining access to assets bequeathed under a will. Before assets can be distributed to the beneficiaries stated in your will, the Executor has to apply to the Court for a Grant of Probate.

Wealth Management and Transfers

Trusts can also be used to pass wealth from one generation to the next. Rules can be written for the trust to determine how the assets are passed on, not just your children, but also your grandchildren and great-grandchildren.

You may also set out rules on how the assets in your trust are to be invested.

Protection from creditors and during divorce proceedings

Some types of trusts can protect assets intended for beneficiaries from creditors – and hence, can be used by people in high-risk businesses or professions (where they may be sued for negligence) to protect family assets.

Similarly, it can protect assets intended for beneficiaries in the event of divorce legal proceedings.

But typically, this only applies to trust structures under which the settlor no longer has any rights over the assets transferred into the trust.

For instance, a standby trust can be useful if you want to give assets to your child, while ensuring that the assets will not become a divisible matrimonial asset if he/she eventually marries and divorces. This means that your ex-son- or daughter-in-law will not be able to claim those assets.

Tax Planning

Trusts may also be useful for legitimate tax planning purposes. For instance, you may channel income or profits from your assets to family members in lower income tax brackets, so that the income/profits are subjected to lower tax rates. A trust can also be used to protect assets from capital gains or death taxes that may apply in other jurisdictions.

Q3: What are some features of Trusts?

Revocable versus Irrevocable

If a trust is revocable, the settlor can terminate or change the terms of the trust. As such, the settlor still has some control over the future of the trust. However, this means it may not provide protection against creditors or from claims from a former spouse in a divorce. Because the trust arrangement can be unwound by the settlor, a court may deem that the settlor still has control over the assets and may demand that the settlor terminates the trust to repay creditors.

On the other hand, an irrevocable trust, as the name suggests, cannot be terminated or altered once the settlor has signed off on the arrangement and transferred the assets into the trust. And since the settlor has no legal rights over the assets, creditors cannot take the assets in settlement of claims against the settlor. Simply put, the assets do not belong to the settlor anymore.

In Singapore, to protect the assets from creditors, an irrevocable trust must have been set up for more than five years before a bankruptcy.

Fixed versus Discretionary

A fixed trust is an arrangement under which the settlor determines at the beginning how much and under what terms each of the trust’s beneficiaries shall receive from the trust. The trustee in this case has no discretion and merely administers the assets according to the terms of the trust.

On the contrary, the trustee of a discretionary trust has full discretion over how much, when and how financial distributions are made from the trust to each beneficiary.

It is sometimes preferred over a fixed trust because the discretion the trustee has may be used to protect family assets in certain legal situations.

Setting a trust is a complex legal area and that right of discretion may be challenged in certain situations. Do consult a lawyer on the circumstances under which there may or may not be protection from creditors and other claims.

Q4: What are the costs of setting up a Trust?

The costs vary widely depending on the complexity of the arrangements and the choice of law firms. The costs of establishing a trust can range from a few thousand dollars to S$20,000 or more. In addition, there may be annual maintenance fees.

Special Needs Trust Company (SNTC)

Besides professional trust firms and banks, the government has set up the non-profit Special Needs Trust Company to provide affordable trust services to special needs people with mental and/or physical conditions. Its fees are 90% to 100% subsidised by the Ministry of Social and Family Development.

Q5: What are some common types of Trusts?

Testamentary Trust (Will Trust)

This is a trust that is formed in a Will to take e¬ffect only after the settlor’s death. The trust is not an entity in his lifetime.

When the settlor passes away, assets flow into the testamentary trust through the Will and is subject to the terms as well as duration of the Grant of Probate process.

Do note that in the event the settlor loses his or her mental capacity (due to medical conditions including dementia or a coma), the distribution instructions of the trust cannot be carried out.

Compared to other types of trusts, the testamentary trust requires the lowest set-up fee. There is an annual fee only after the trust is activated after the probate process.

Intervivos Trust (Living Trust)

This type of trust is created in a person’s lifetime and is a legal entity at the start. Assets are placed in the trust during his or her lifetime, and it also allows Central Provident Fund (CPF) nominations and assignment of insurance plans.

An intervivos trust allows the trustee to look after the settlor’s dependants during the settlor’s mental incapacity and upon death. Distribution of assets and/or income to the beneficiaries can be stated in the Letter of Wishes, a document that can be revised anytime by the settlor.

Such trusts are usually used for tax e¬ffectiveness and to protect assets from creditors.

Besides annual trust administration fees immediately payable after the trust is created, such trusts generally require higher set-up costs, stamp duties and charges.

Standby Trust

This is a hybrid of the testamentary and intervivos trusts. A standby trust is popular as it offers the advantages of the testamentary and intervivos trusts.

Like the testamentary trust, no or little assets are placed in the standby trust during the settlor’s lifetime. The trust also has the advantage of including the provision for mental incapacity and allowing for CPF nominations and assignment of insurance policies. This is done without the fees associated with assets transfer and ongoing administration.

The set-up fee of standby trusts is lower than that of intervivos trusts. Annual fees are nominal as long as the trust is dormant.

This article is Part 2 of 4 in a series about Estate Planning. For more in this series:

Part 1: The Importance of Estate Planning

Part 3: Why Lasting Power of Attorney is not just for the elderly

Part 4: Considering Trusts as part of Legacy Planning

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)