Open a New Bank Account with DBS/POSB

Open a new account with us anytime, anywhere with digibank using these easy steps.

Part of: Guides > Your Guide to digibank

Are you new to the bank or an existing customer?

New Customers

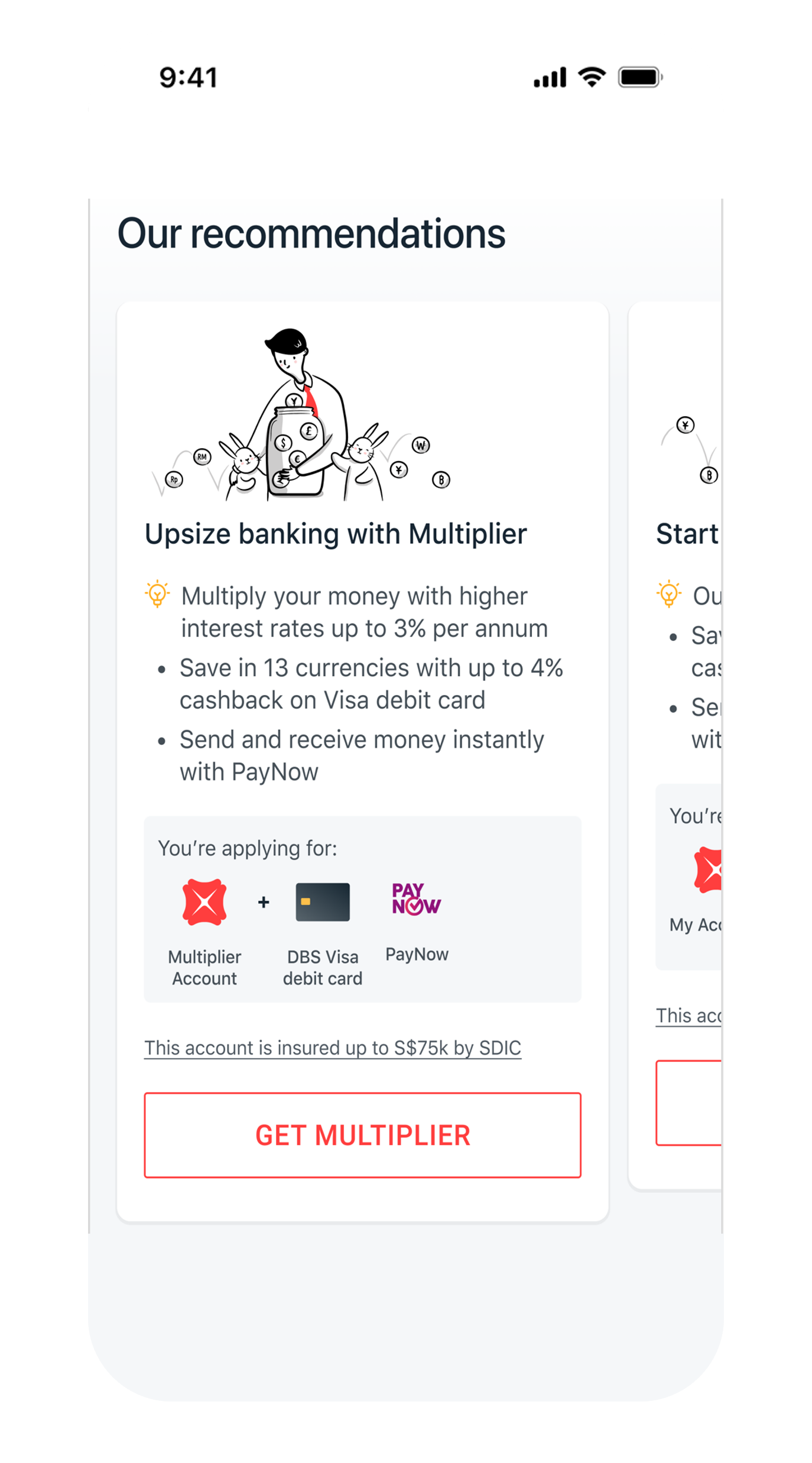

You can open your personal My Account and Multiplier Account directly on DBS or POSB digibank mobile.

Before you apply, do prepare the required documents using our checklist.

Note: If additional document or information is required after you submit your application, we will send you a follow up email with the necessary details and instructions.

For additional assistance on account opening, simply drop us a note here and our service team will contact you at your preferred date and time.

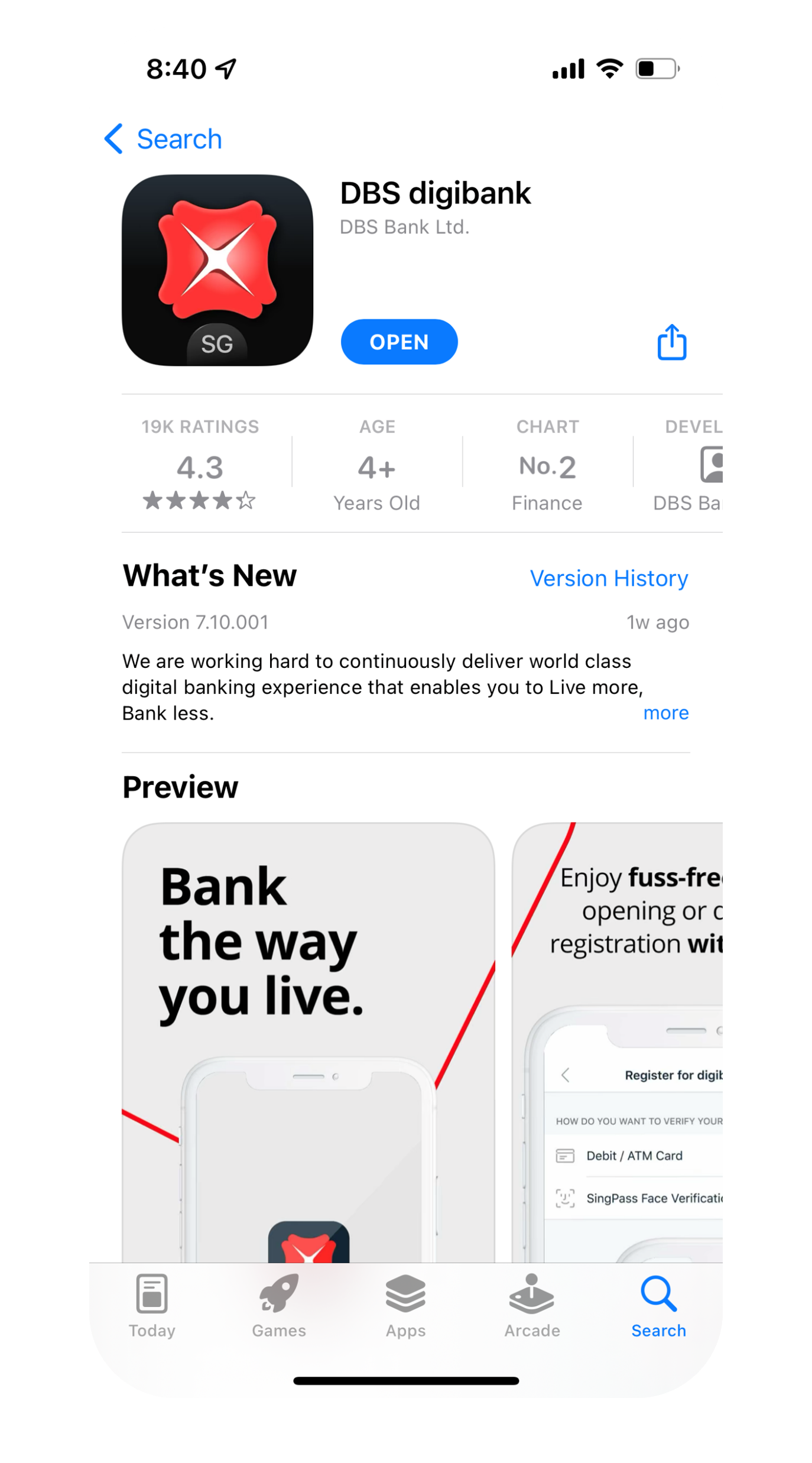

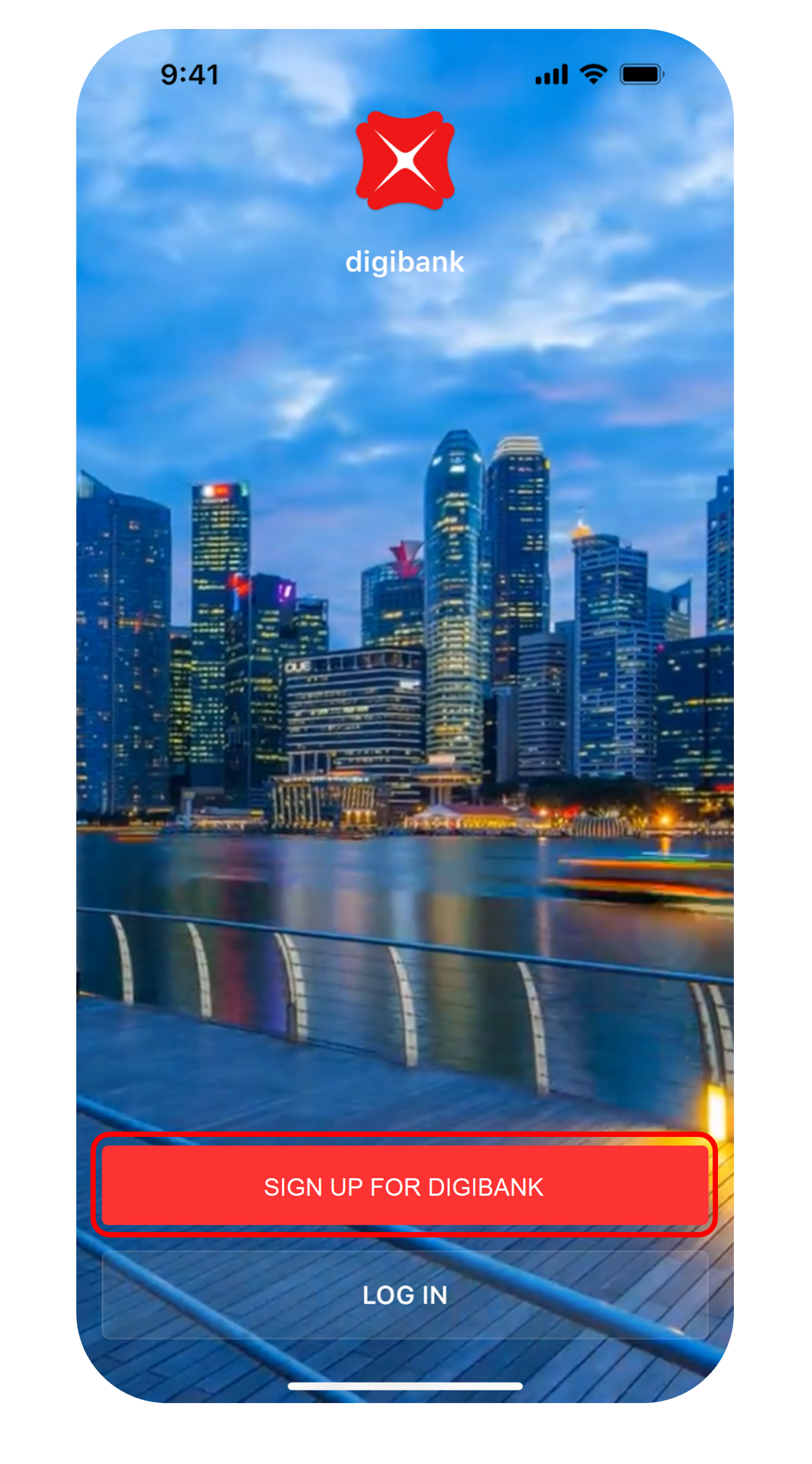

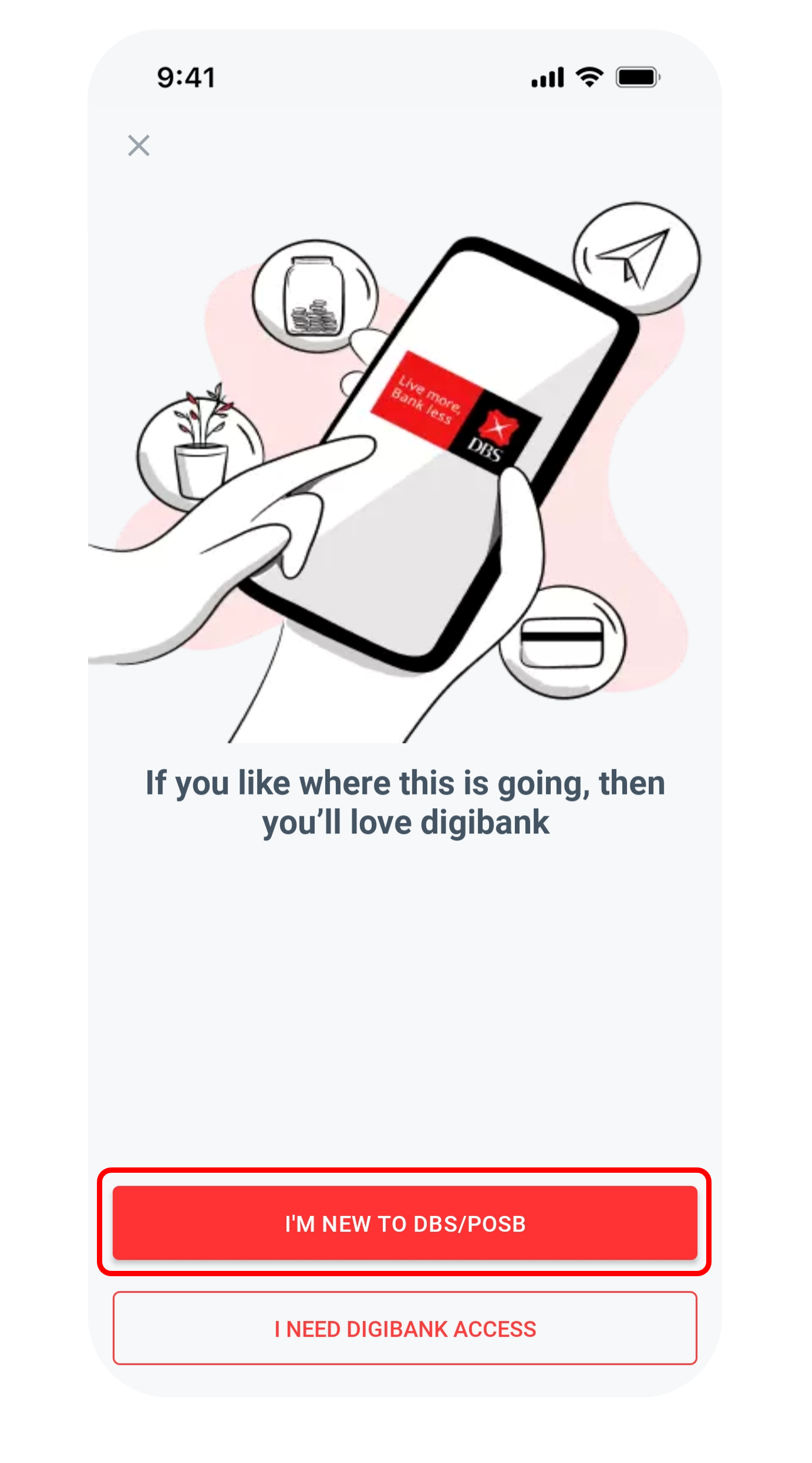

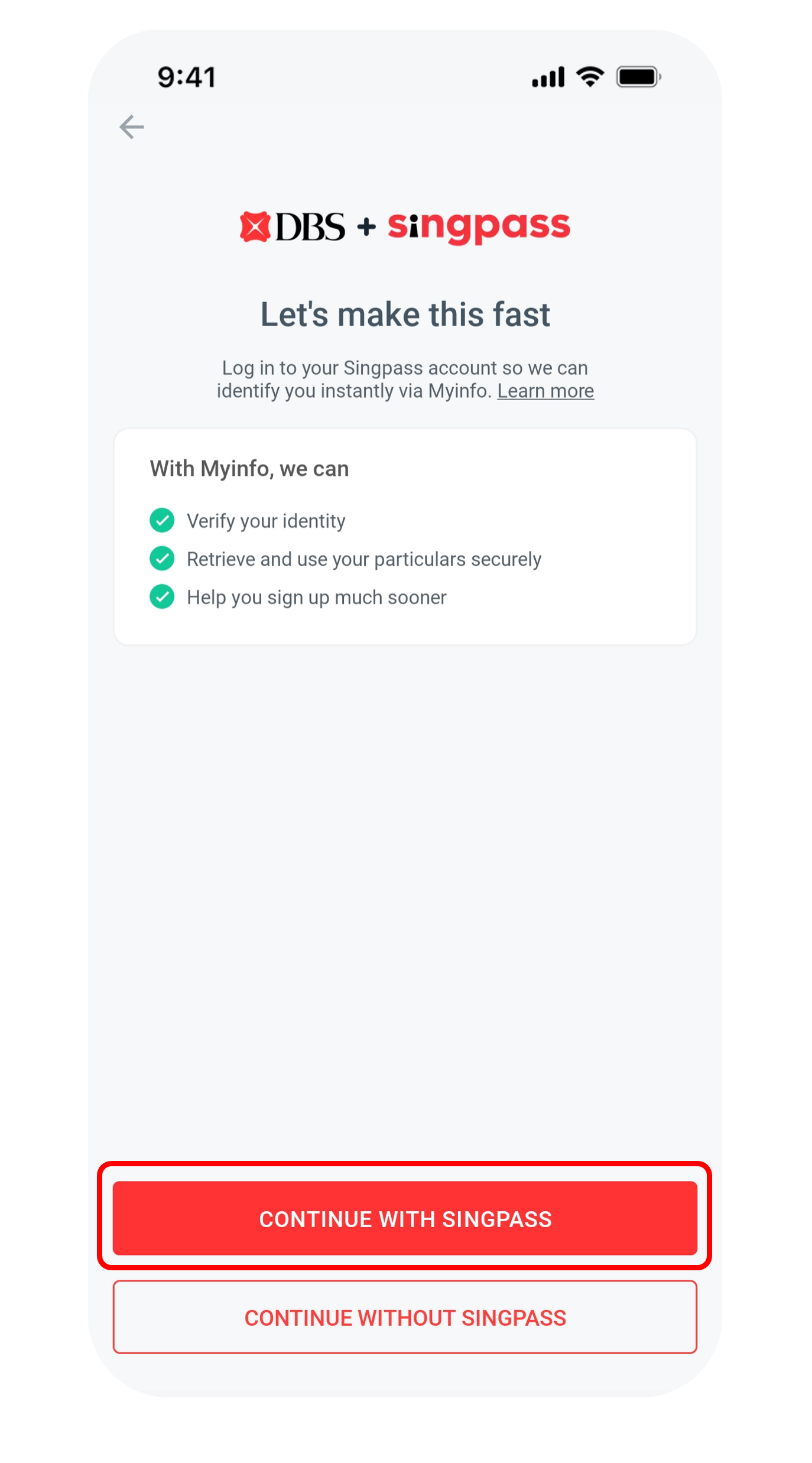

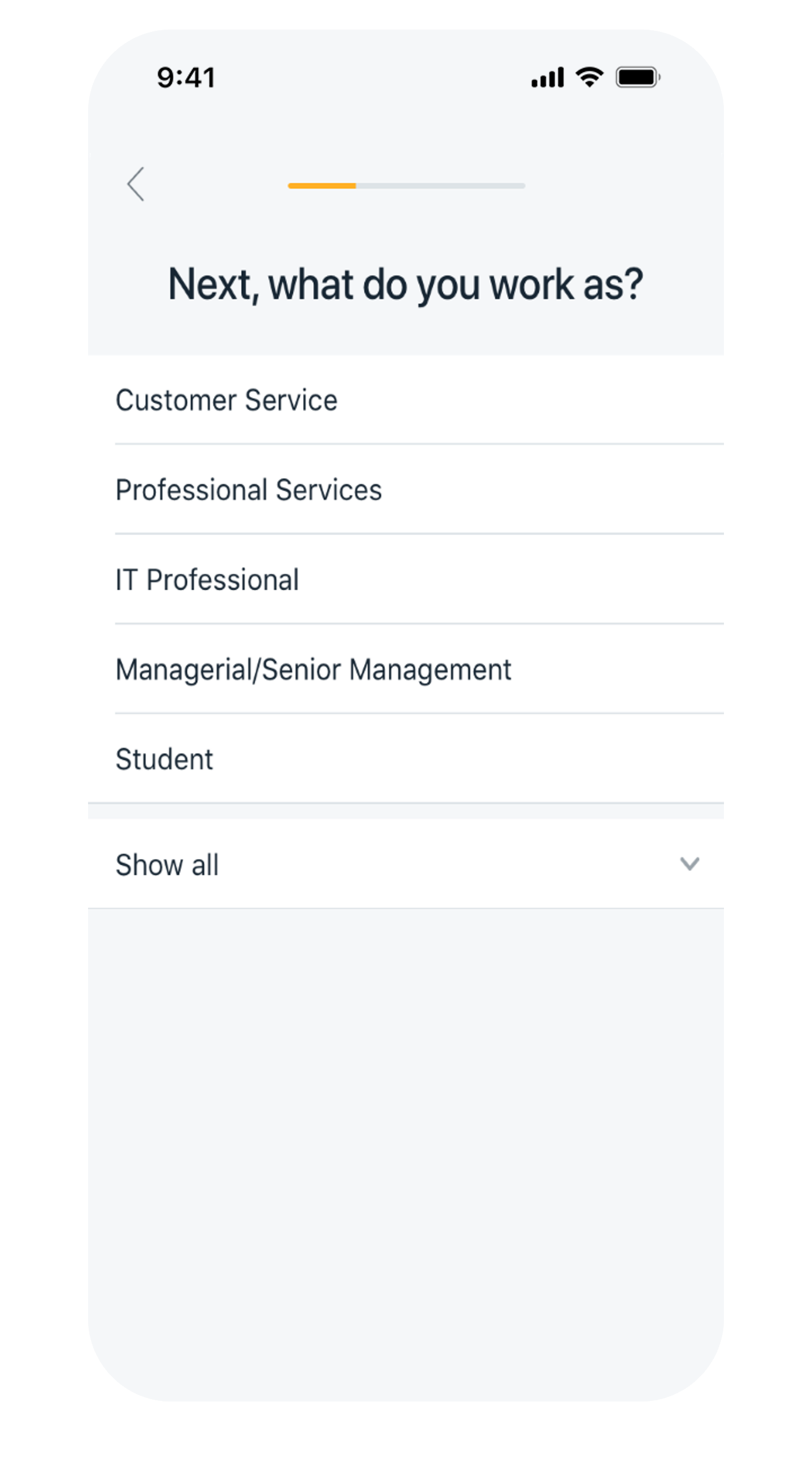

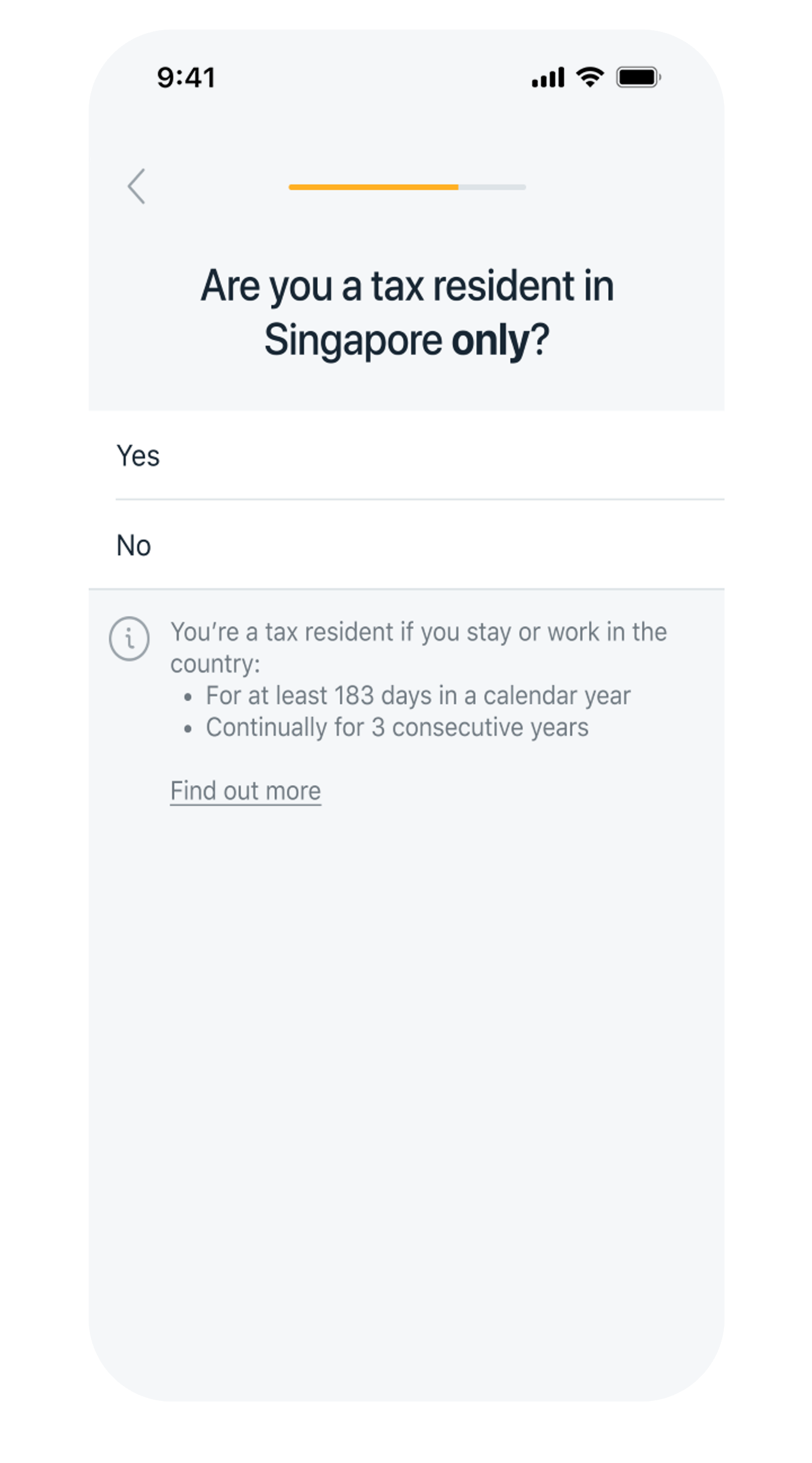

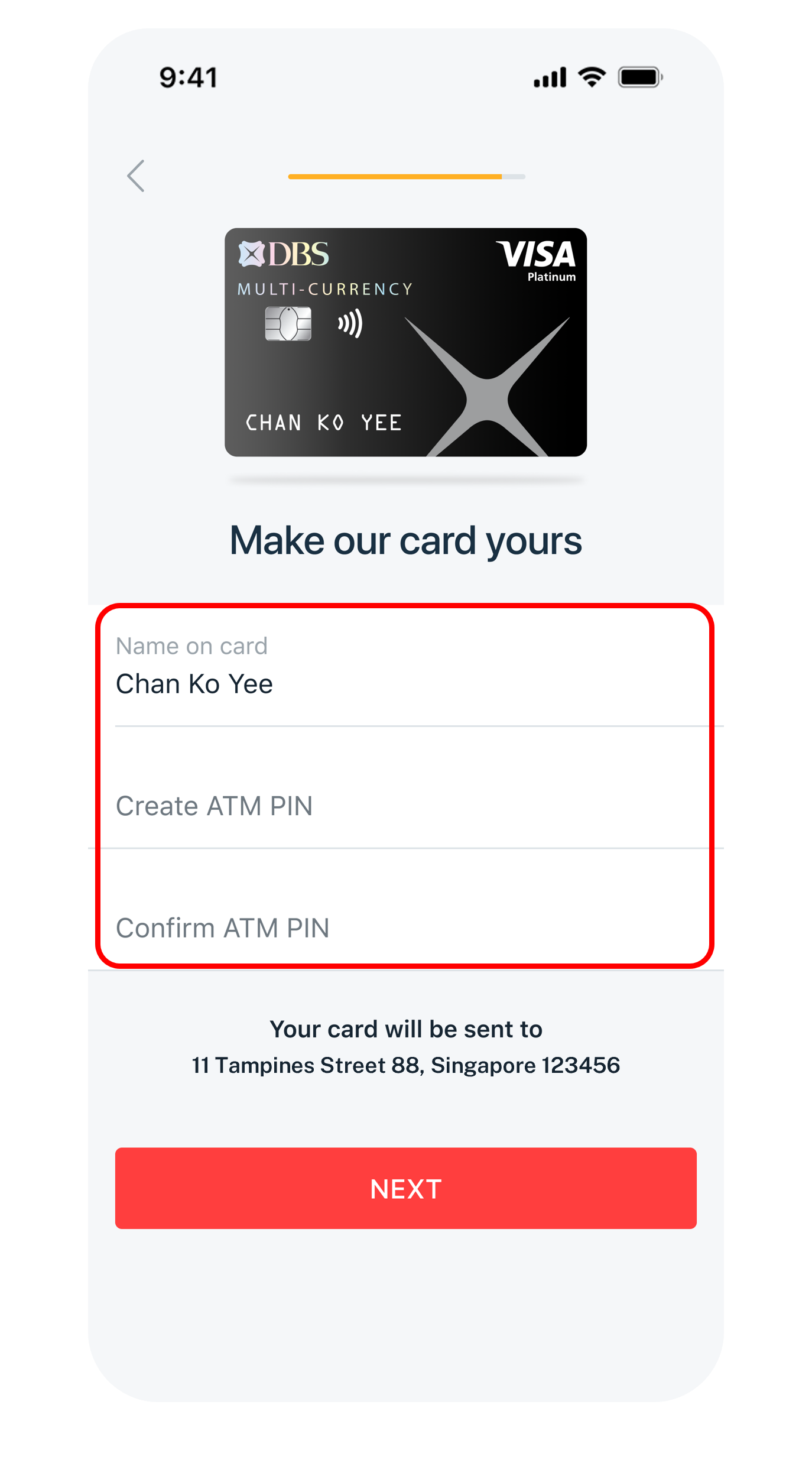

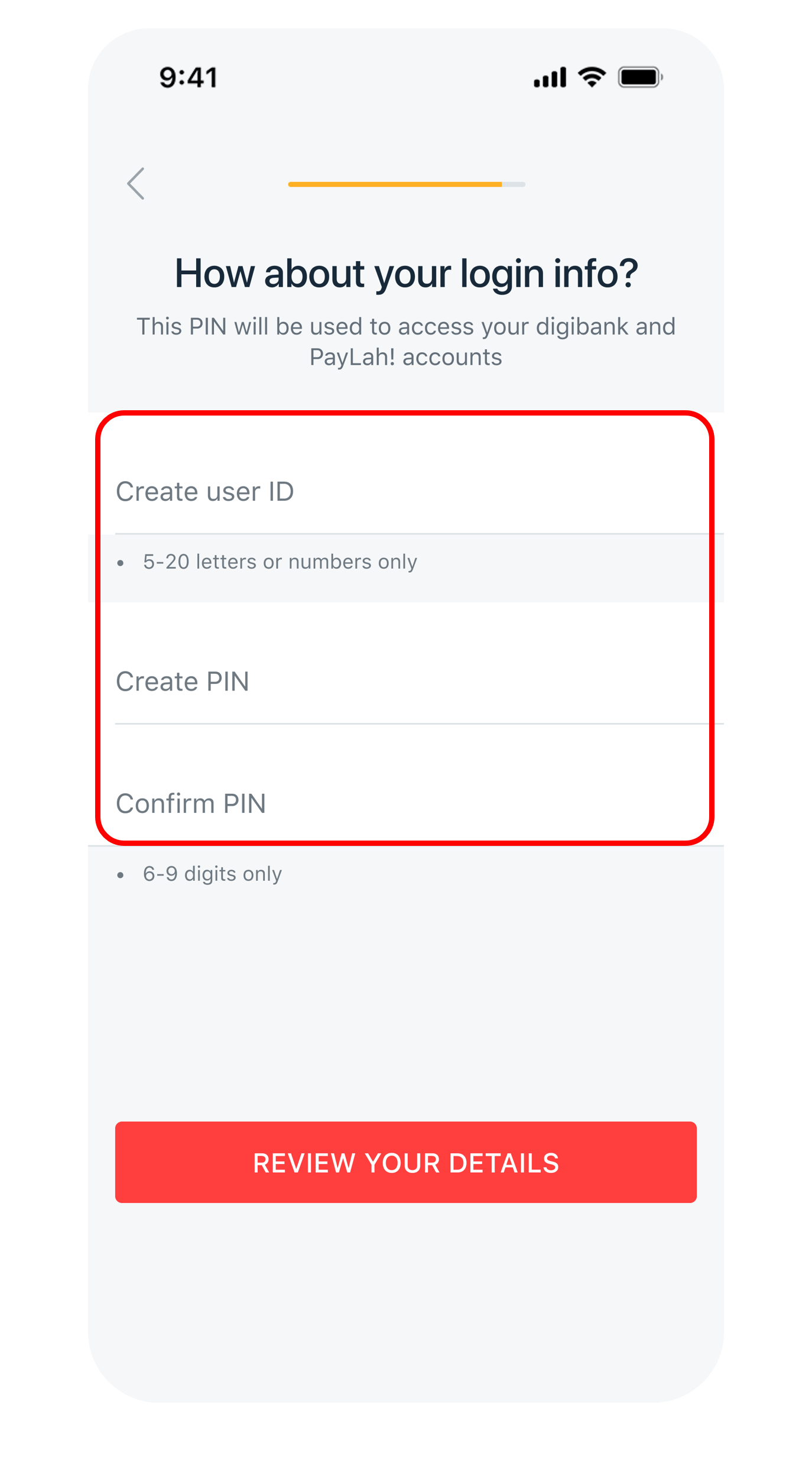

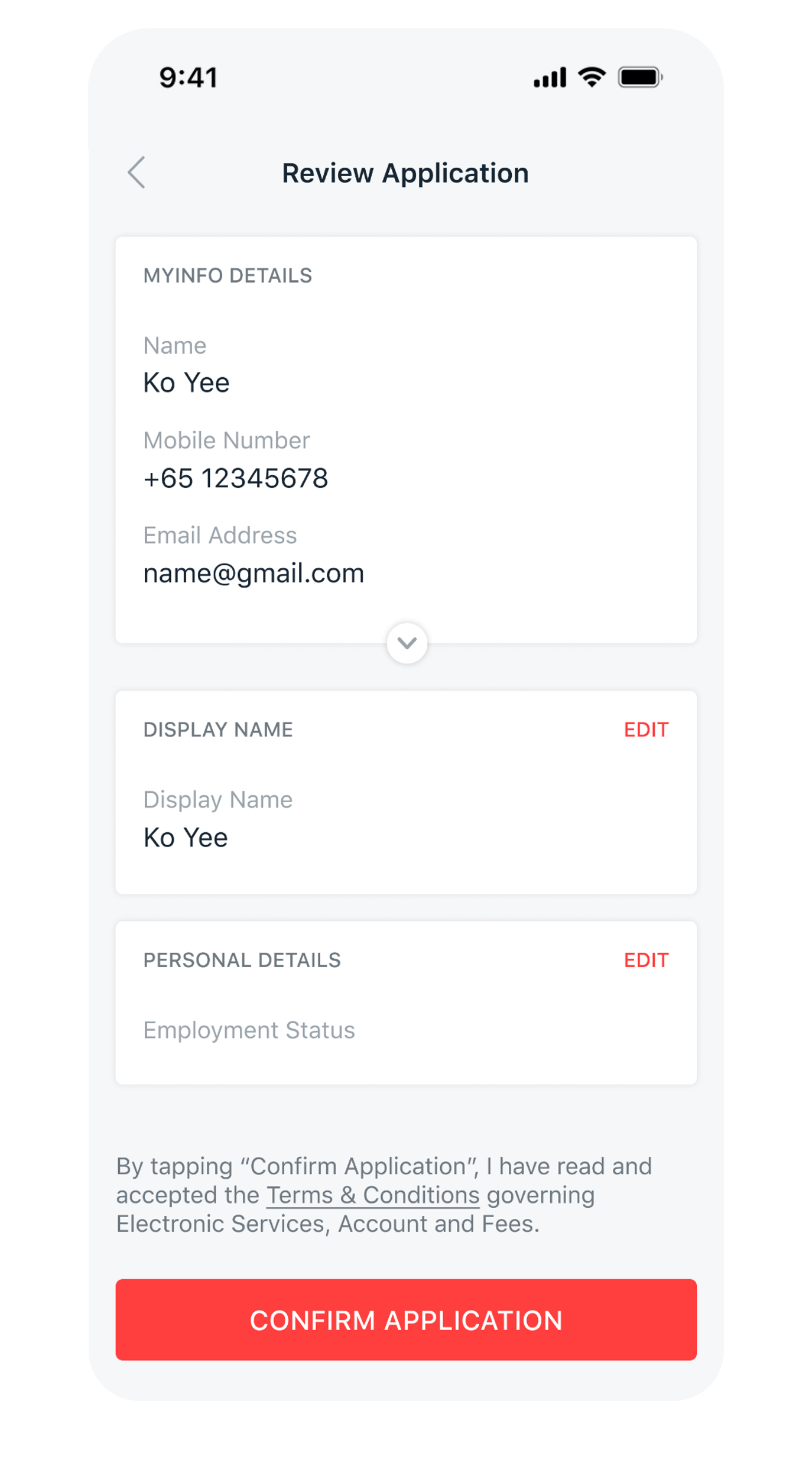

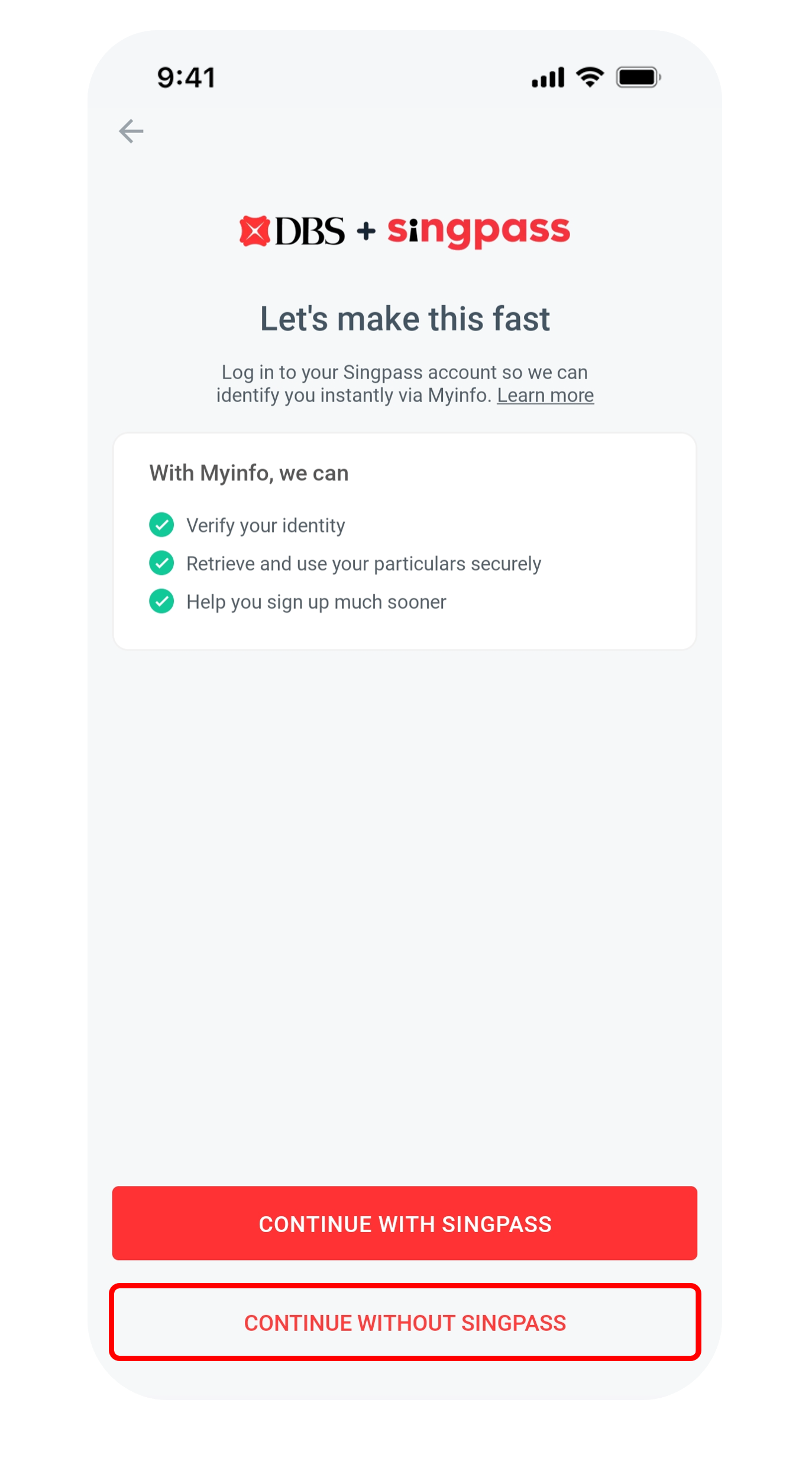

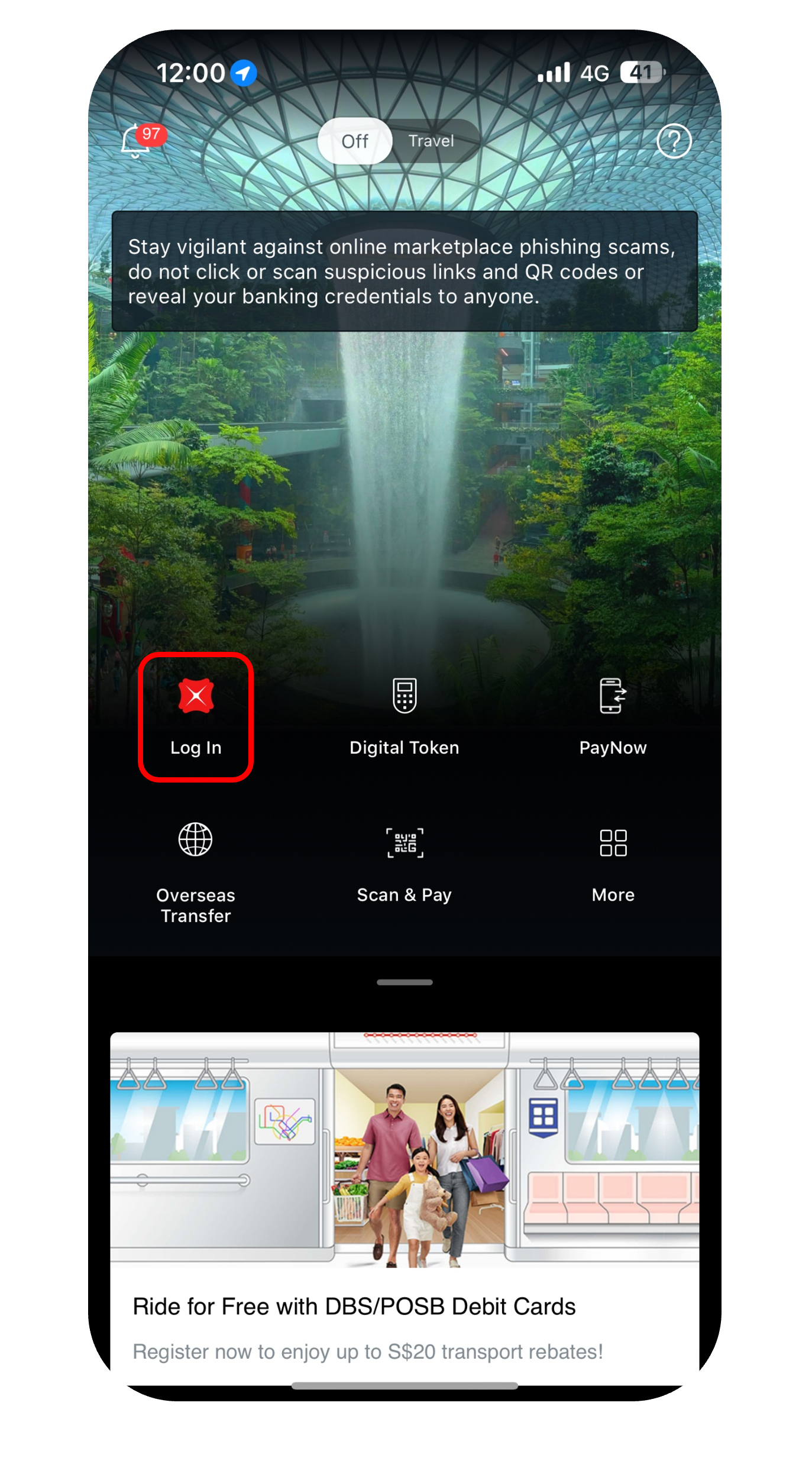

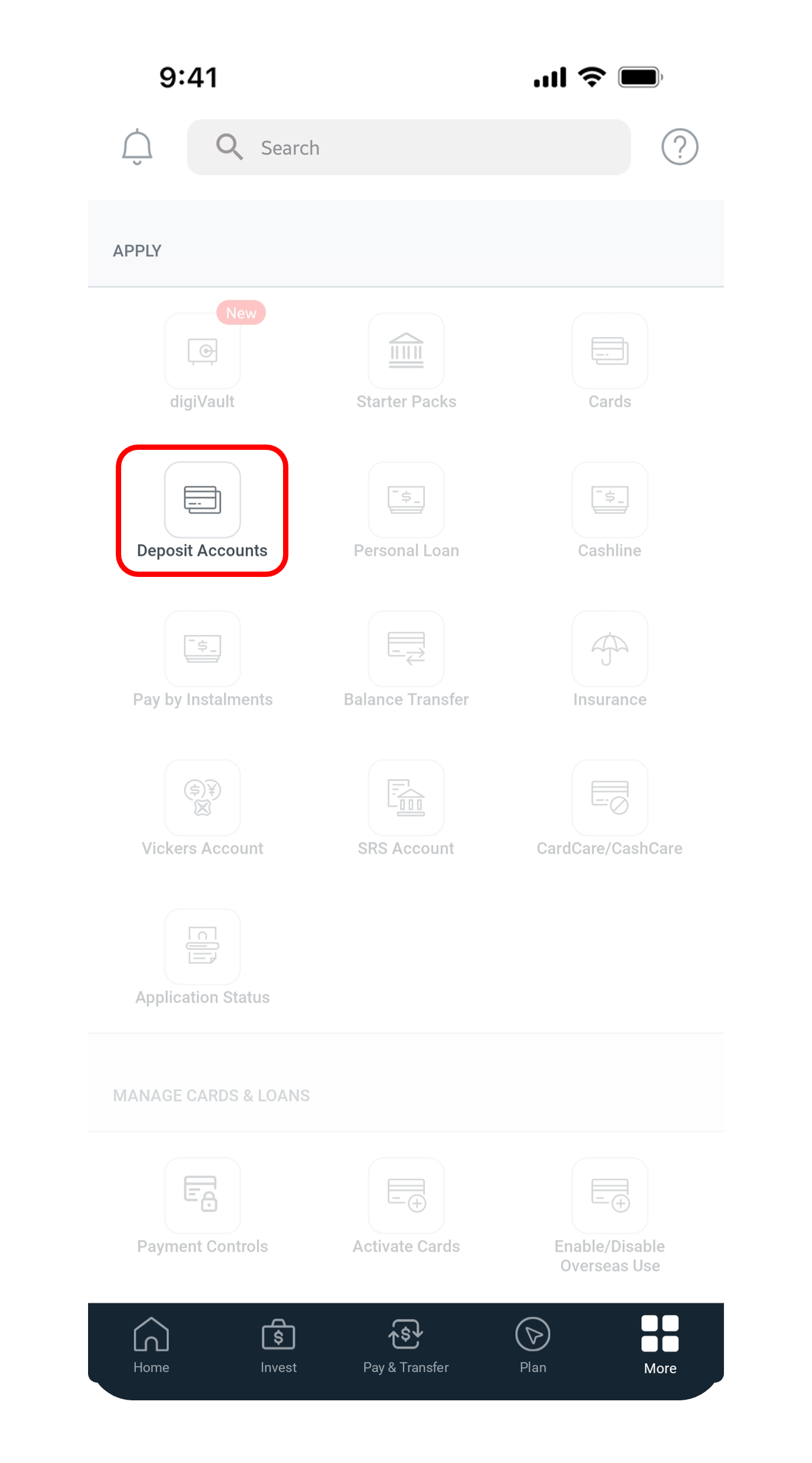

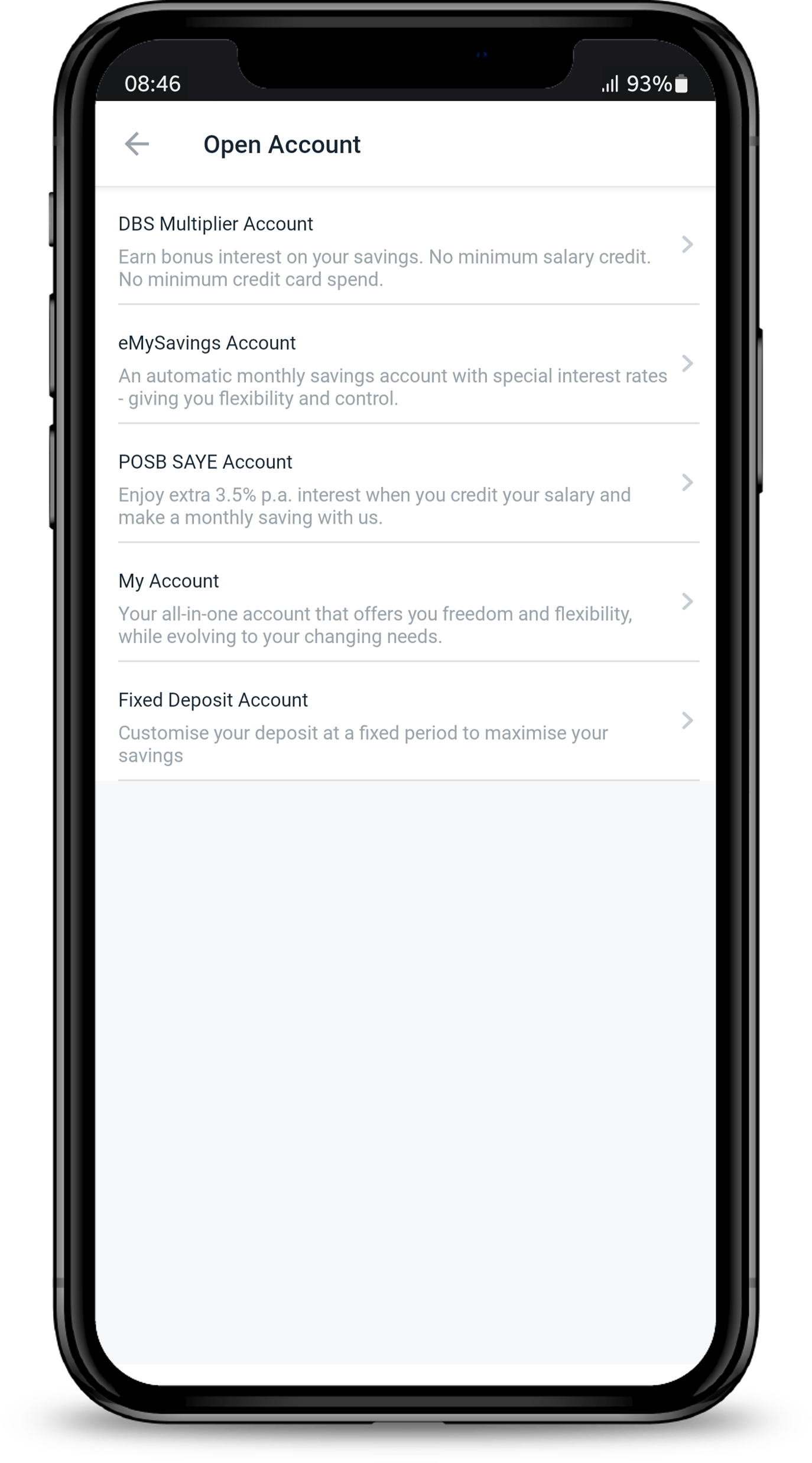

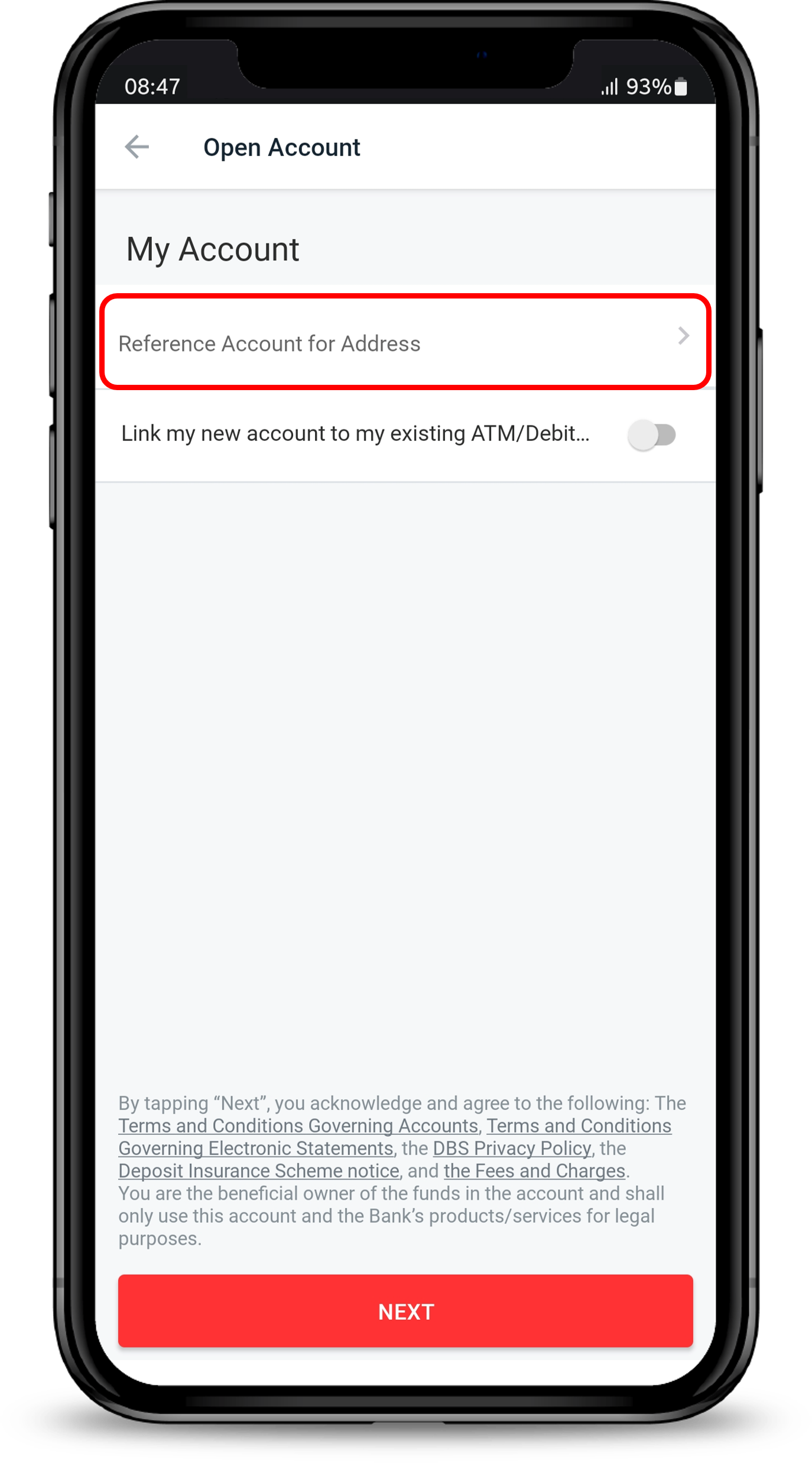

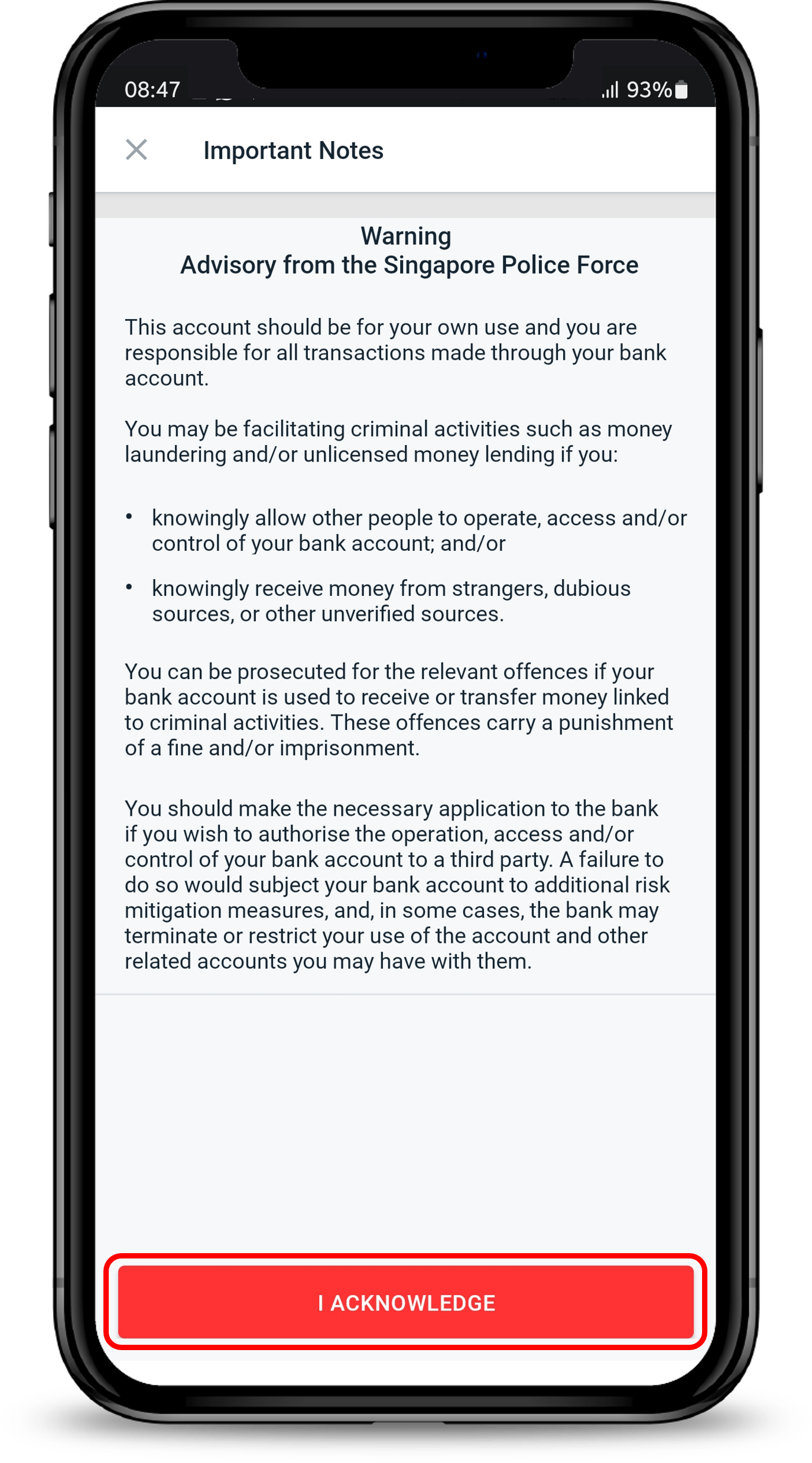

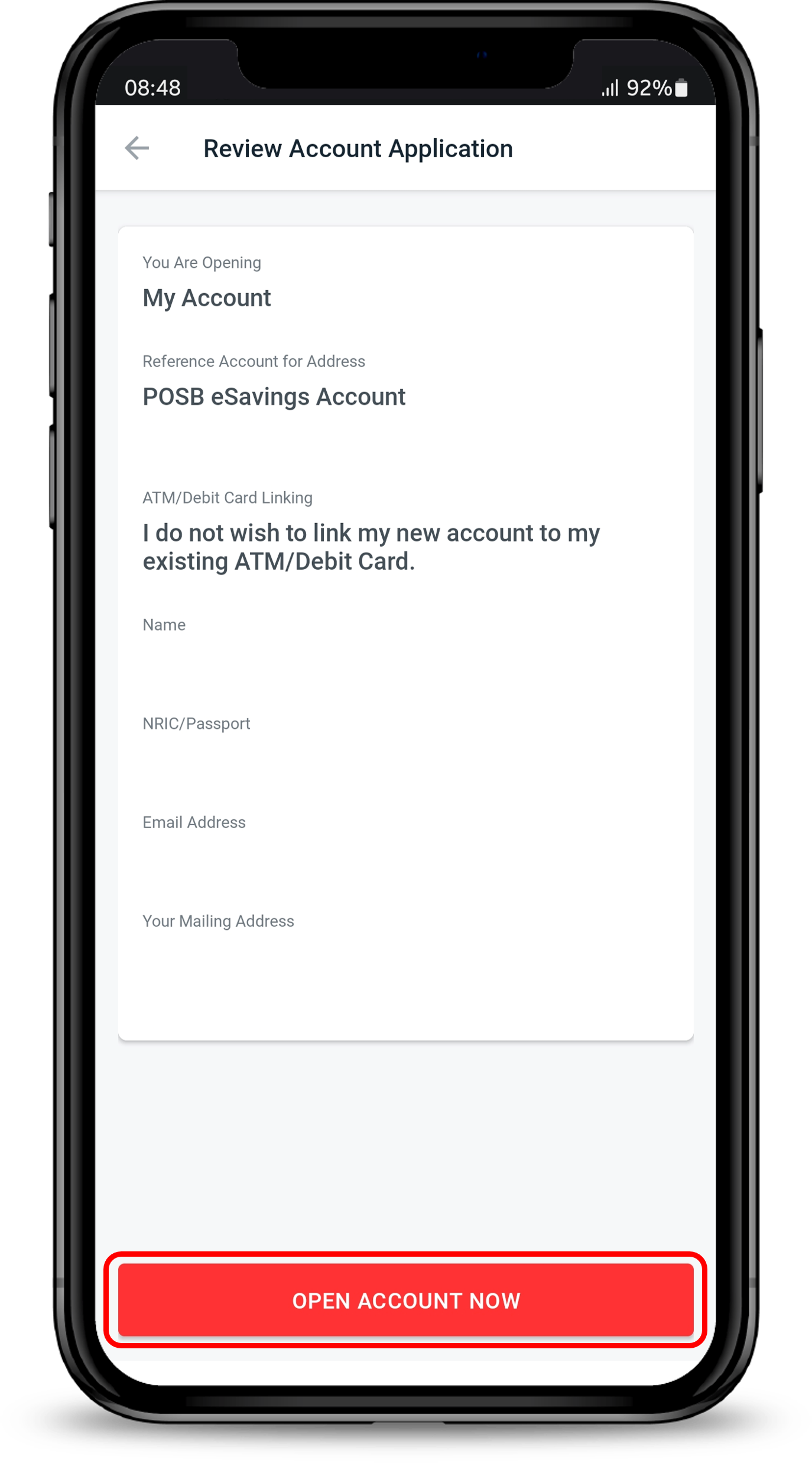

Follow the steps to open a new account with us using digibank mobile.

Existing DBS/POSB Customers

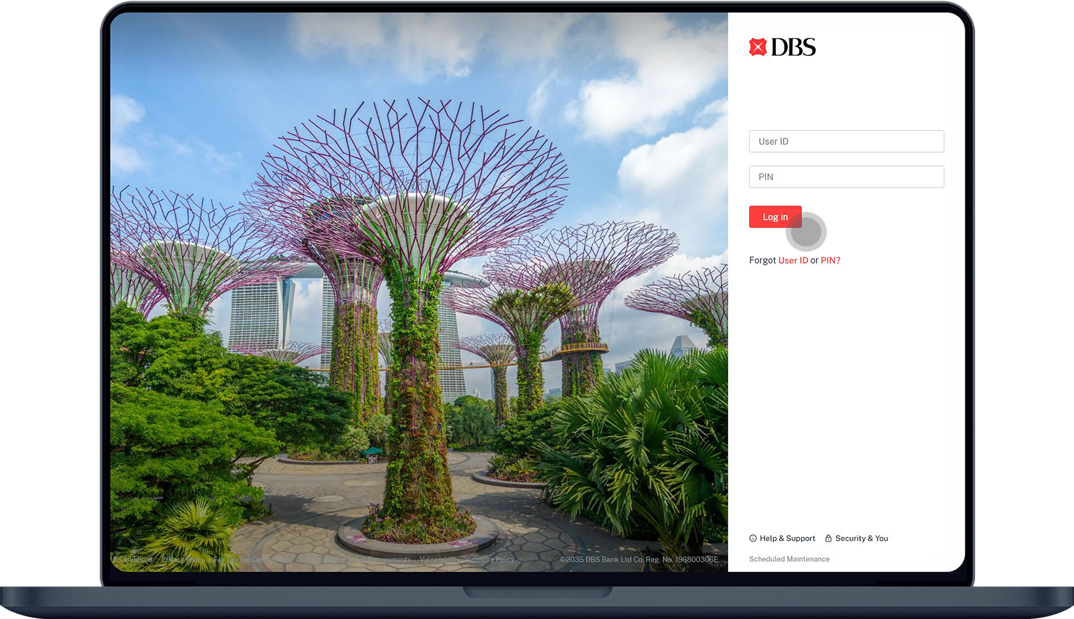

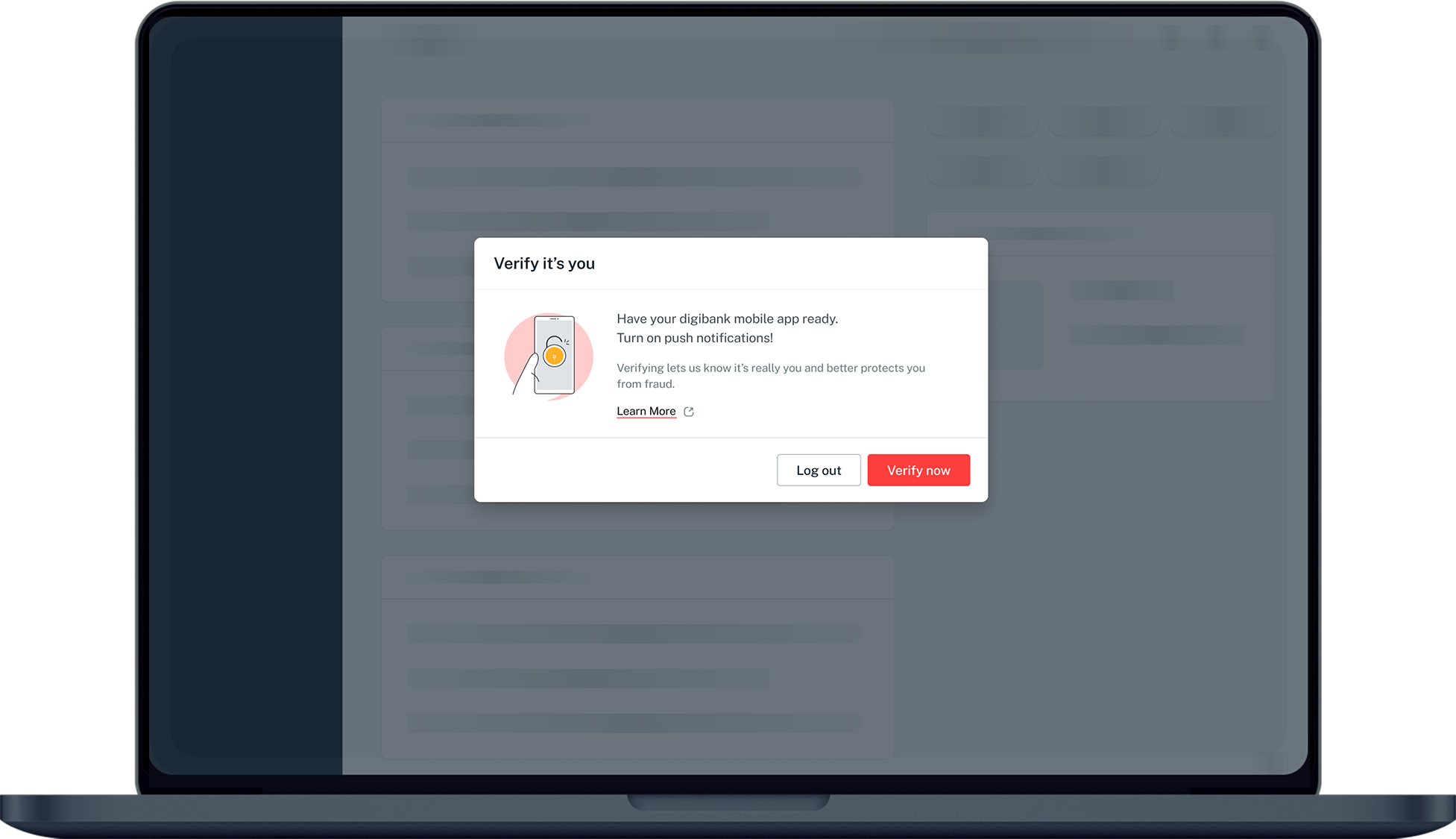

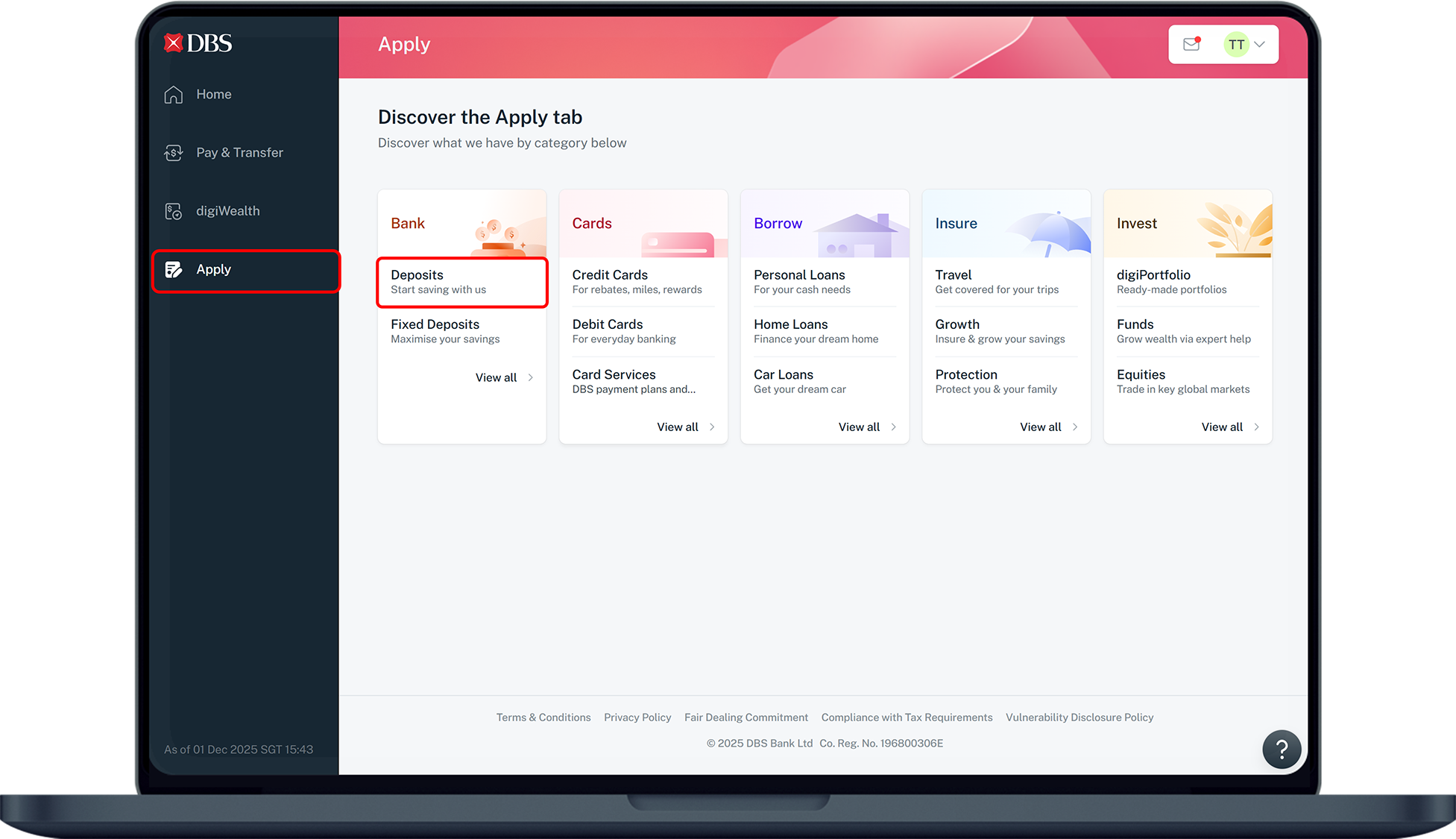

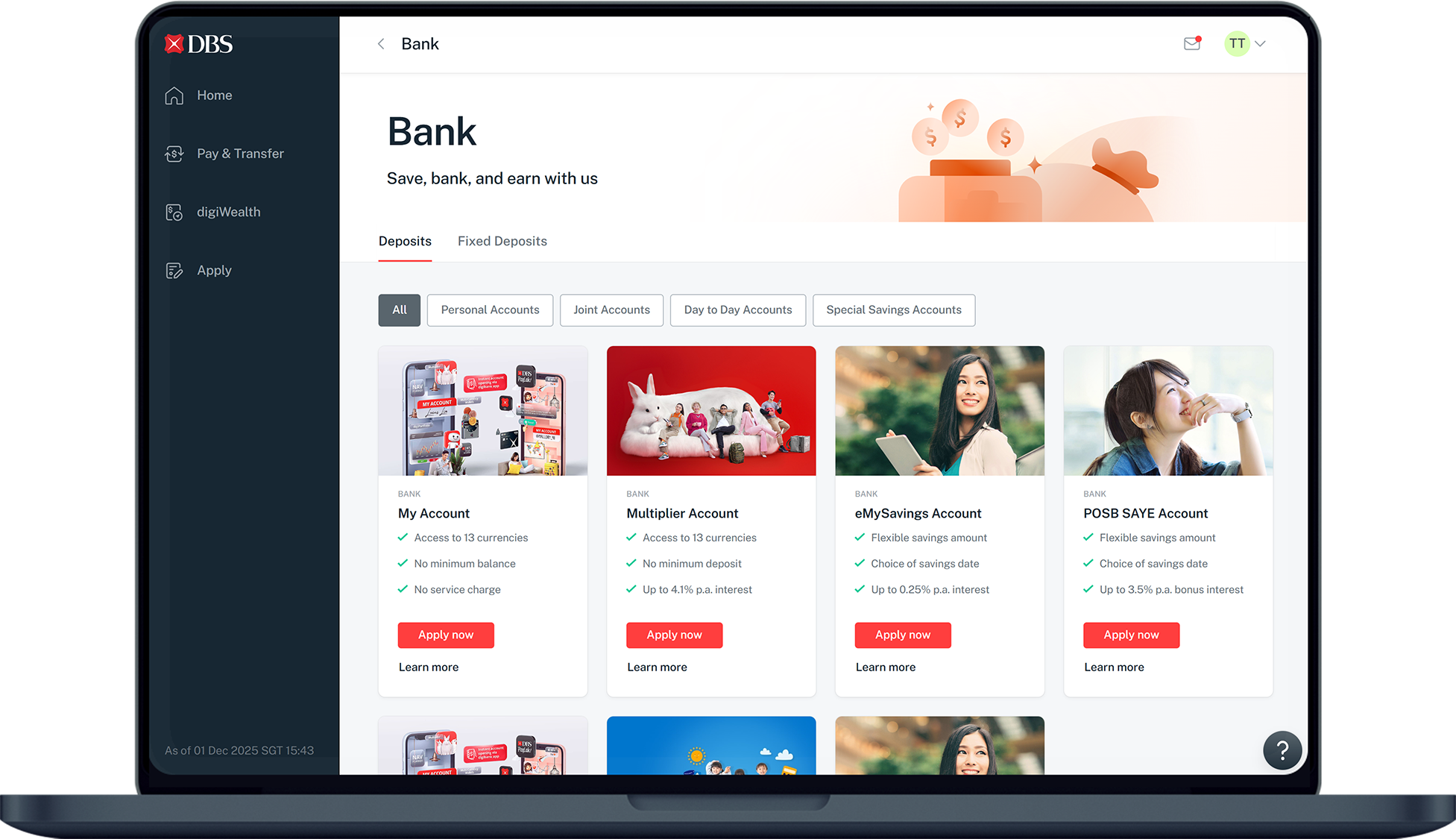

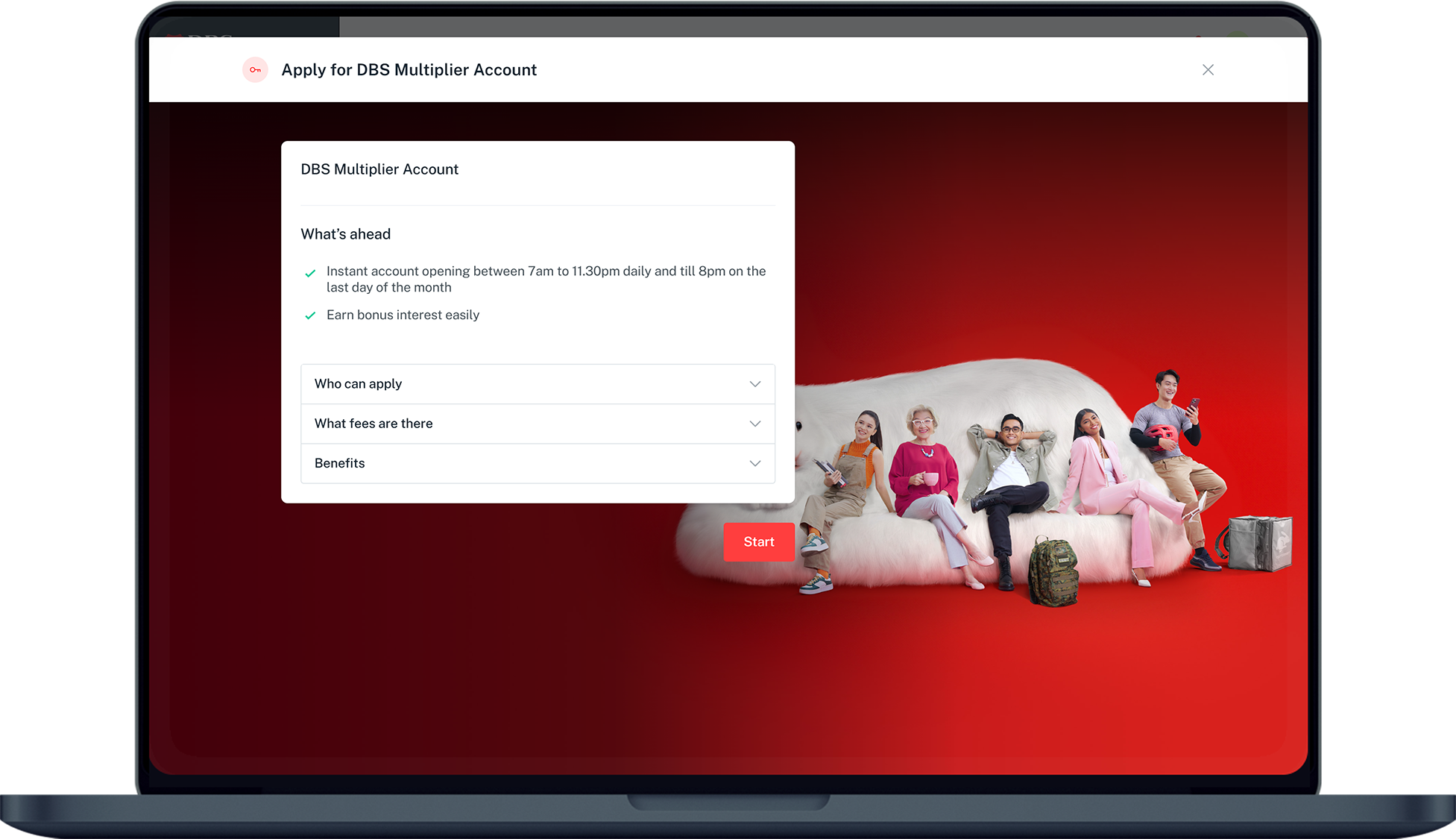

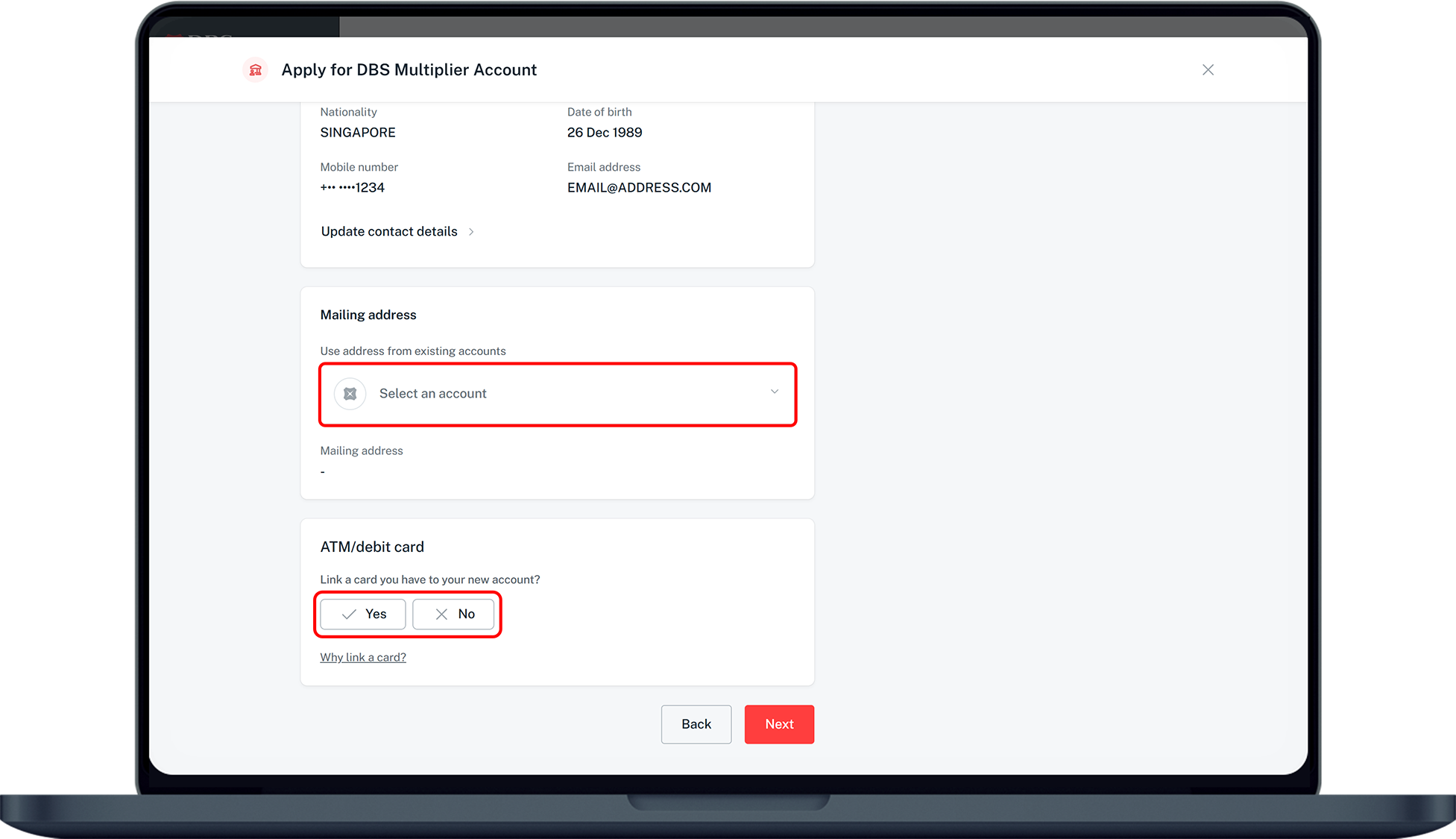

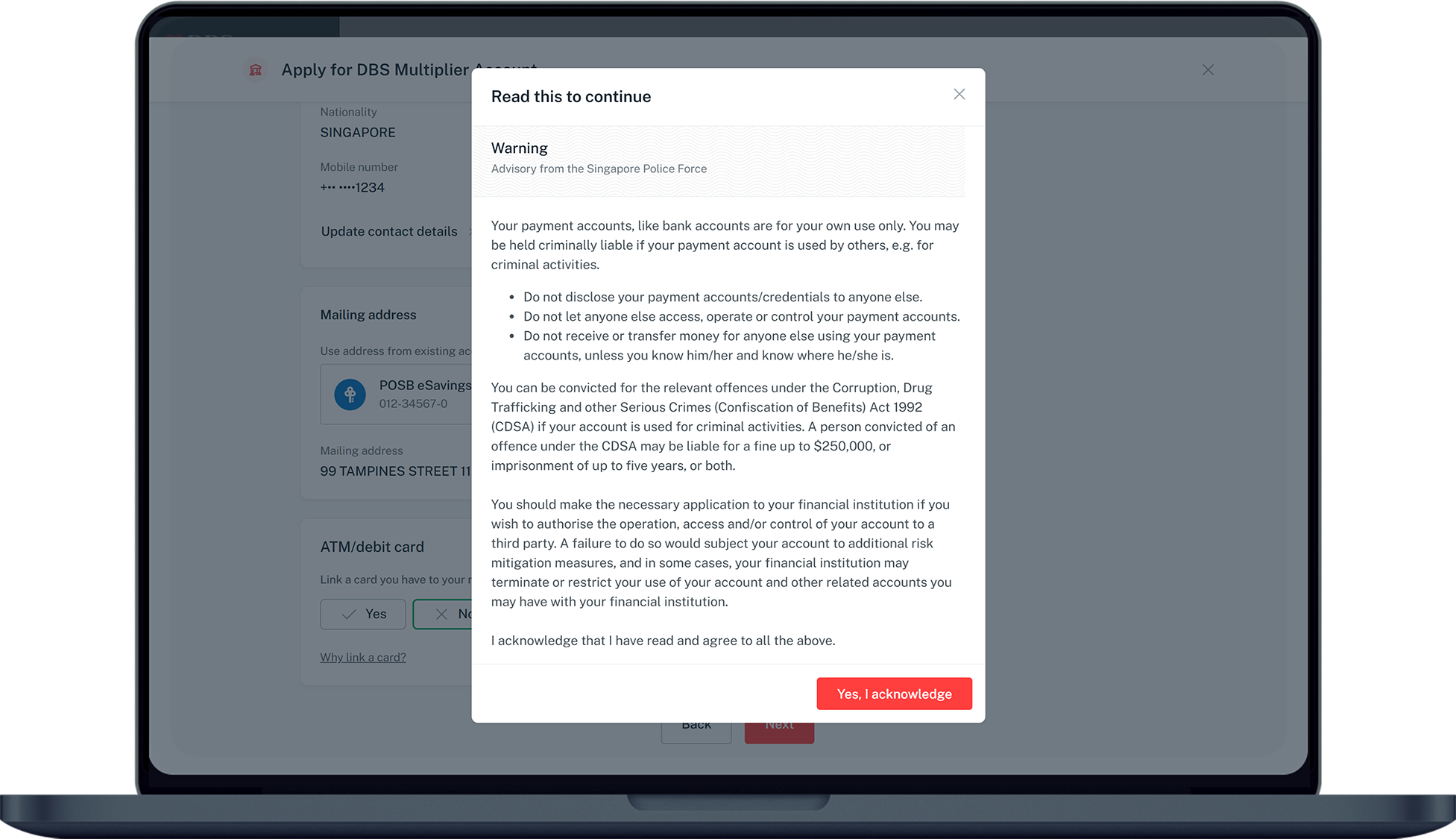

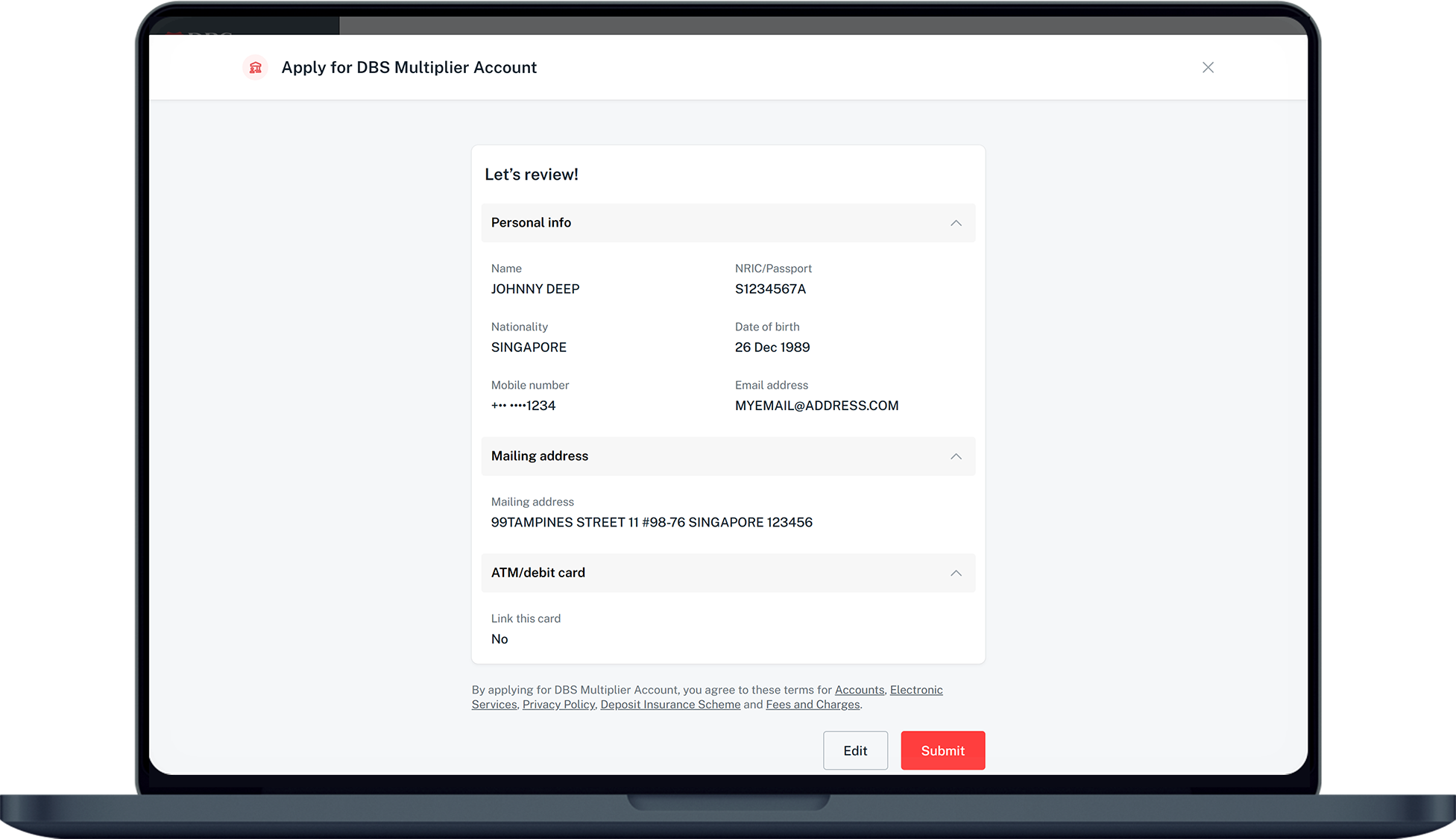

Follow the steps to open a new personal account with us using digibank.

To open Joint account, you may use our online form in My Account and eMySavings pages.

Frequently Asked Questions

New DBS or POSB Customers

Who are eligible to open their first account using digibank mobile?

- Customers who do not have any product or services with DBS or POSB; or

- Customers who only have Joint-Trust account with their parents; or

- Customer who only have Paylah account with DBS.

I have just registered for a Singpass account. When can I start using it to register for an account on digibank mobile?

What if my mobile number or Registered Address* in Singpass is incorrect or outdated?

Note: *Your new debit card will be mailed to your registered address.

I used Singpass to submit application however my account is not instantly opened, why?

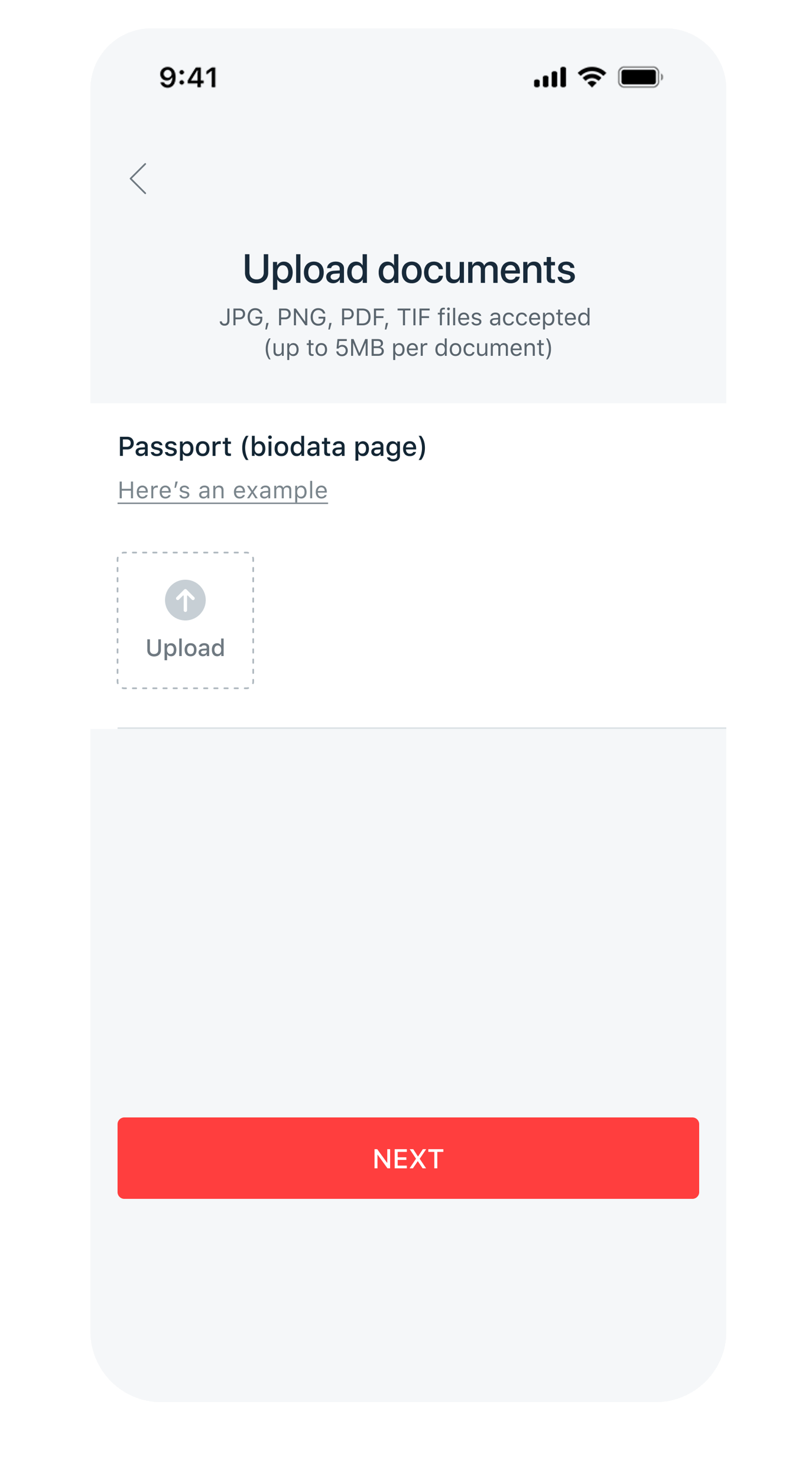

I do not have Singpass account, what are the requirements to open an account in digibank mobile?

- Valid mobile number, email address and residential address

- Supporting documents

I did not use Singpass to submit my application, what are my next steps?

- Activate your debit card. Learn more on how to Activate New Card.

- Once your card is activated, proceed to digibank mobile Registration.

- Once registered, login in digibank and set up your Digital Token when prompted.

Where can I check the status of my account opening application?

Existing DBS or POSB Customers

Why am I getting error when I try to open a new account using digibank?

- You have existing valid deposit account with DBS or POSB

- You have valid contact details and address in the bank’s record

You may also try to open account by tapping on Starter Pack menu under Apply in digibank mobile.

What is the minimum age to open a personal account?

How can my child own a personal account?

- If your child does not have any account with DBS or POSB or their only account is a Joint Trust account, they may apply for a personal My Account as a new DBS or POSB customer.

- If your child has other existing account with DBS or POSB and has digibank access, you may refer to the steps above to open a personal account

I have a Joint-Alternate My Account with my child. Can my child have digital access to the account

Your child must have:

- Valid contact details (mobile number and email address) and residential address in the bank’s record. Learn more on how to update mobile number and email address.

- Activated ATM, Debit, or Credit Card, or his own Singpass account (for Singaporean and Permanent Residents only)