Help Topic

Bank

-

Account EnquiriesThere are various channels which you may open and check your account with us. The most convenient method would be via digibank online or digibank mobile.

Account EnquiriesThere are various channels which you may open and check your account with us. The most convenient method would be via digibank online or digibank mobile.- Open an Account with DBS/POSB

- Documents Required for Account Opening

- Check Account Opening Application Status

- Enhanced Due Diligence Form

- Activate Account (New to Bank Customers)

- Change MySavings/SAYE Account Instruction

- Check and Share Account Transaction Details

- DBS/POSB Transaction Codes & Descriptions

- Find your Account Number

- Peek Balance

- Check Account Balance

- Deposit Account Minimum Balance Service Charge

- View Joint Account Information

- Convert POSB Passbook Savings Account

- Request for DBS Account Conversion

- Close a DBS/POSB Deposit Account

-

Applications & FacilitiesRefer to our articles below for help on the various self-service banking channels made available for you.

Applications & FacilitiesRefer to our articles below for help on the various self-service banking channels made available for you. -

Card EnquiriesIf you are having issues or enquiries related to your card, articles below may help you solve them.

Card EnquiriesIf you are having issues or enquiries related to your card, articles below may help you solve them.- Apply for a Debit Card

- Activate New Card

- Enable/Disable Card For Overseas Use

- Check Debit Card Transaction Details

- Transact & Withdraw in Foreign Currency Overseas

- Replace ATM/Debit or Credit Card

- Lost or Stolen Card

- Your Guide to Submit Card Transaction Dispute

- Unable to Withdraw and Transact

- Reset Card PIN

- Update ATM/Debit Card Limits

- Manage Accounts Linked to your Card

- Overseas Card Transaction Fees

- Overseas Withdrawal Charges

- Cancel Card

-

ChequesHave a cheque related query? Information below may help you clear all your doubts.

ChequesHave a cheque related query? Information below may help you clear all your doubts.- Deposit/Issue a Cheque

- Cheque Clearing

- Enquire Cheque Status

- Returned/Bounced Cheque

- Purchase Cashier's Order

- Purchase a Demand Draft

- Issue an Online Cheque

- Add Cheque or Demand Draft Recipient

- Remove Cheque or Demand Draft Recipient

- Deposit Cheque Wrongly

- Cancel Cheque

- Multiple Names in Cheque

- Request for New Cheque Book

- Foreign Currency Cheque Deposit

-

Child Development Account (POSB)Children are our future and we have prepared the right articles to aid your queries.

Child Development Account (POSB)Children are our future and we have prepared the right articles to aid your queries. -

DBS digibankAny problems related to our digibank platform can be solved with the articles we have prepared for you.

DBS digibankAny problems related to our digibank platform can be solved with the articles we have prepared for you.- Minimum Operating System (OS) Requirements

- Your Guide to Digital Token

- Your Guide to digibank

- Set up your Digital Token

- Apply for digibank

- Reset/Retrieve digibank User ID and/or PIN

- Using your DBS Physical Token

- Manage Transactional Alerts

- Switch your digibank mobile to Simple Mode

- DBS digiWealth

- SGFinDex

- Link insurance policies to DBS NAV Planner

- Unlink Financial Institution from SGFinDex

-

DBS Multiplier AccountLearn how you can earn higher interest with DBS Multiplier Account!

DBS Multiplier AccountLearn how you can earn higher interest with DBS Multiplier Account! -

Fixed DepositInformation regarding opening, placing and changing maturity instructions for your fixed deposit available here.

Fixed DepositInformation regarding opening, placing and changing maturity instructions for your fixed deposit available here. -

Local Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.

Local Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.- Transfer Funds to Other Bank Accounts in Singapore

- Add Fund Transfer Recipient

- Remove Fund Transfer Recipient

- Retrieve and Share your Transaction Details

- Your Guide to DBS PayLah!

- Set up Standing Instruction for Local Funds Transfer

- View Standing Instruction for Local Funds Transfer

- Terminate Standing Instruction for Local Funds Transfer

- Change Local Funds Transfer Limits

- Transfer Funds to Wrong Local Account

- Unsuccessful Fund Transfer to Another Bank Account

- Receive Funds from Others

-

Overseas Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.

Overseas Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.- Your Guide to Overseas Funds Transfer

- Transfer Funds to Overseas Account

- Add Overseas Funds Transfer Recipient

- Remove Overseas Funds Transfer Recipient

- DBS Remit

- Country Specific Information for DBS Remit

- Fees and Charges for Overseas Funds Transfer

- Timing and Limits for Overseas Funds Transfer

- Reasons for Delayed Overseas Funds Transfer

- Check Remit Status

- Amend or Cancel your Overseas Funds Transfer

- Change Overseas Funds Transfer Limits

- Retrieve and Share your Transaction Details

- Set up Recurring Funds Transfer to an Overseas Account

- View/Amend Recurring Funds Transfer to an Overseas Account

- Delete Recurring Funds Transfer to an Overseas Account

- Transfer to Overseas Visa Card

- Transfer via PromptPay (Thailand)

- Transfer via Paynow UPI (India)

- Transfer via Paynow DuitNow (Malaysia)

-

PayNowSend or receive money from anyone with just a mobile number.

PayNowSend or receive money from anyone with just a mobile number. -

DBS PayLah!DBS PayLah!–Your ultimate everyday app

DBS PayLah!DBS PayLah!–Your ultimate everyday app- Apply for DBS PayLah!

- Request Funds using DBS PayLah!

- Transfer Funds using DBS PayLah!

- Responding to Fund Requests using DBS PayLah!

- Scan & Pay using DBS PayLah!

- Pay Bills Using DBS PayLah!

- Pay Merchants using DBS PayLah!

- Check DBS PayLah! Transaction History

- View your DBS PayLah! eStatements

- Change DBS PayLah! Profile and Nickname

- Manage DBS PayLah! Notifications

- Manage DBS PayLah! Account

- Update DBS PayLah! Linked Account

- Update DBS PayLah! Wallet Limit and Daily Transfer Limit

- Keeping your DBS PayLah! Mobile Number Updated

- Change DBS PayLah! Password

- Close DBS PayLah! Wallet

-

PaymentsRefer to the articles below if you need any details regarding bill payments.

PaymentsRefer to the articles below if you need any details regarding bill payments.- Make Bill Payment

- Add Bill Payment Organisation

- Remove Bill Payment Organisation

- Retrieve and Share your Transaction Details

- Pay Other Bank Credit Cards

- Add Other Bank's Credit Cards Recipient

- Remove Other Bank's Credit Cards Recipient

- Your Guide to DBS PayLah!

- eNets (D2Pay) Application

- Amend eNets (D2Pay) Payment Limit

- Change Account Designated for eNets (D2Pay)

- eNets (D2Pay) Deactivation

- Set up a GIRO Arrangement

- View Active GIRO Arrangements

- Update GIRO Payment Limit

- Terminate GIRO Arrangement

- Apply for a Recurring Bill Payment Arrangement

- Update Recurring Bill Payments with Billing Organizations

- Top Up Mobile Prepaid Number

- Change NETS QR Payment Limit

- Issue an EDP/EDP+

- Cash out EDP/EDP+

- Check Status of EDP/EDP+

- Cancel or Reject an EDP/EDP+

-

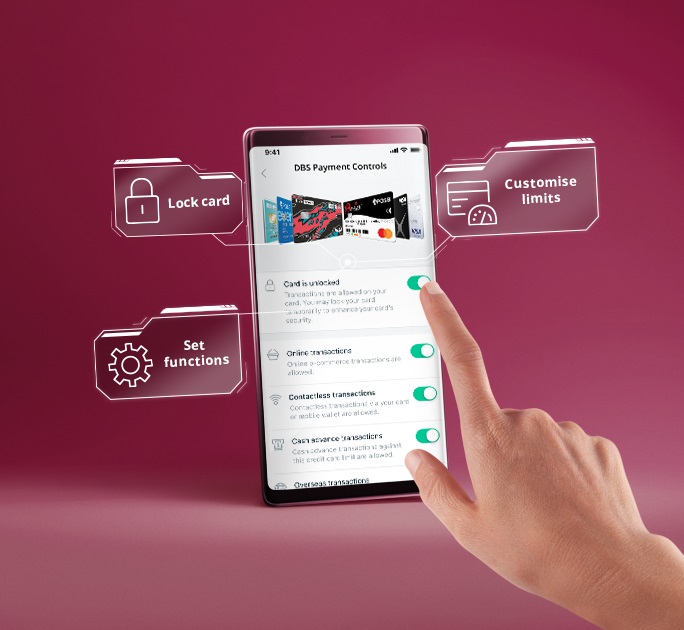

Payment ControlsControl and protect your cards with Payment Controls on digibank.

Payment ControlsControl and protect your cards with Payment Controls on digibank. -

StatementsStatements can be tough to understand but we have prepared some articles below for you.

StatementsStatements can be tough to understand but we have prepared some articles below for you.- DBS/POSB Transaction Codes & Descriptions

- Deposit Account Minimum Balance Service Charge

- Calculate Minimum Average Daily Balance (MADB)

- Consolidated Statements

- Retrieval of Printed Account Statements

- Apply for Financial Standing Statement

- Enrol to eStatement and eAdvices

- View your eStatements and eAdvices

- Manage your eStatement and eAdvices Notification

- De-enrol to eStatements and eAdvices