Check and Share Account Transaction Details

You can check your transactions using digibank, DBS digibot and Phone Banking.

Part of: Guides > Your Guide to digibank online

Important information

- You can view your eStatements and eAdvices for transactions that are more than 6 months ago.

- For PayLah! transactions, log in via DBS PayLah! app. Learn more on how to check PayLah! transaction history.

How to check and share your account transaction details

There are various channels which you may check your account transactions with us. The most convenient method would be via digibank mobile.

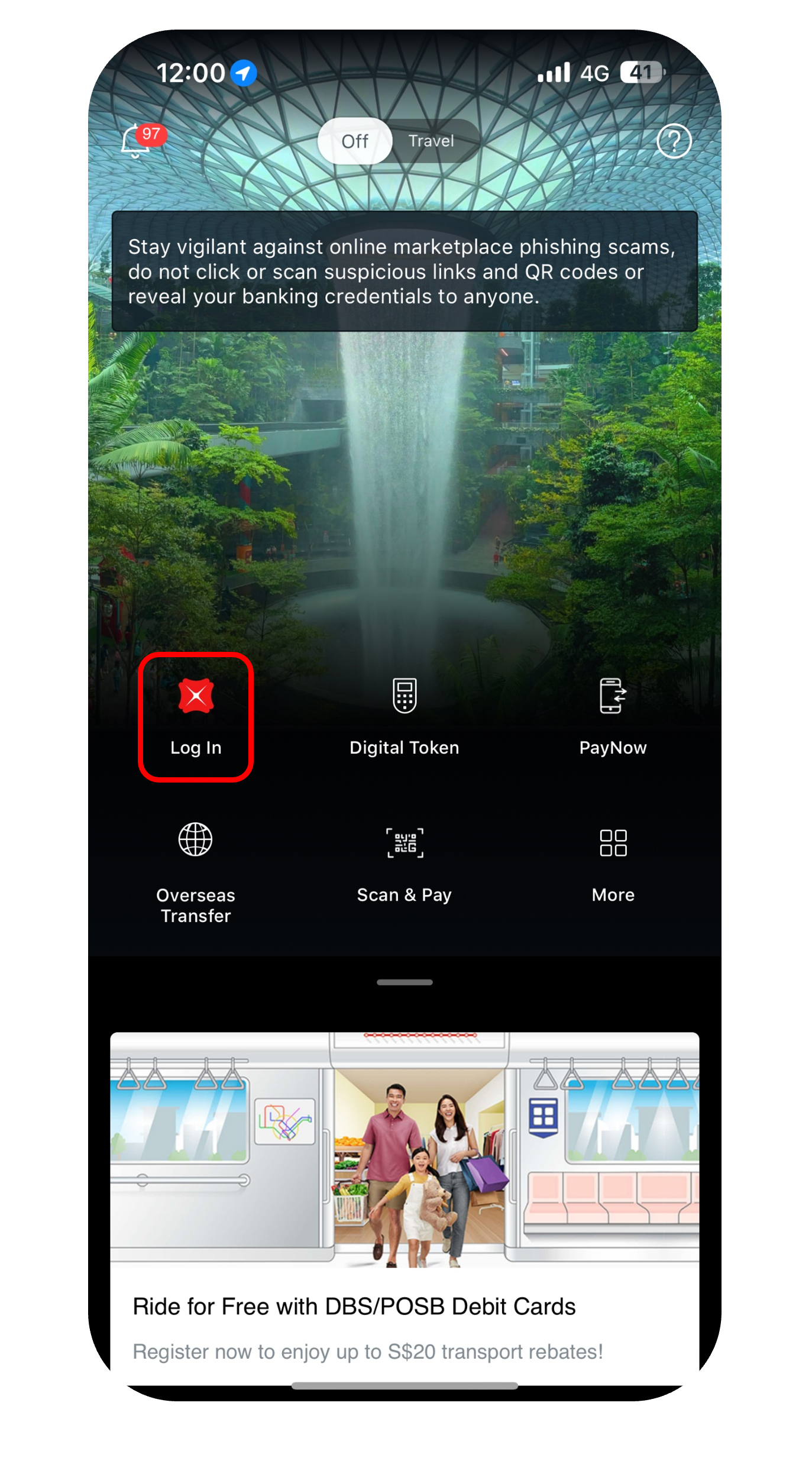

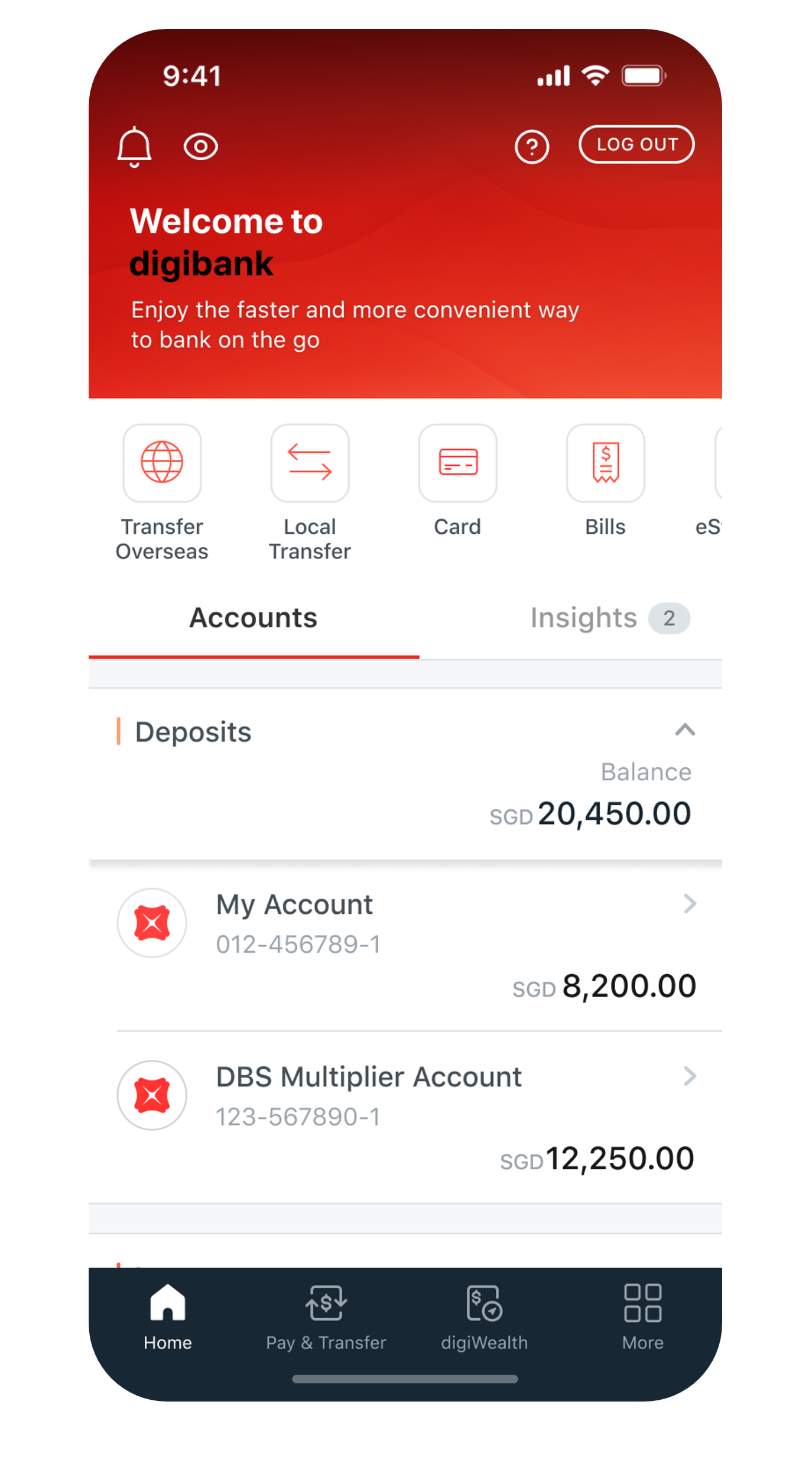

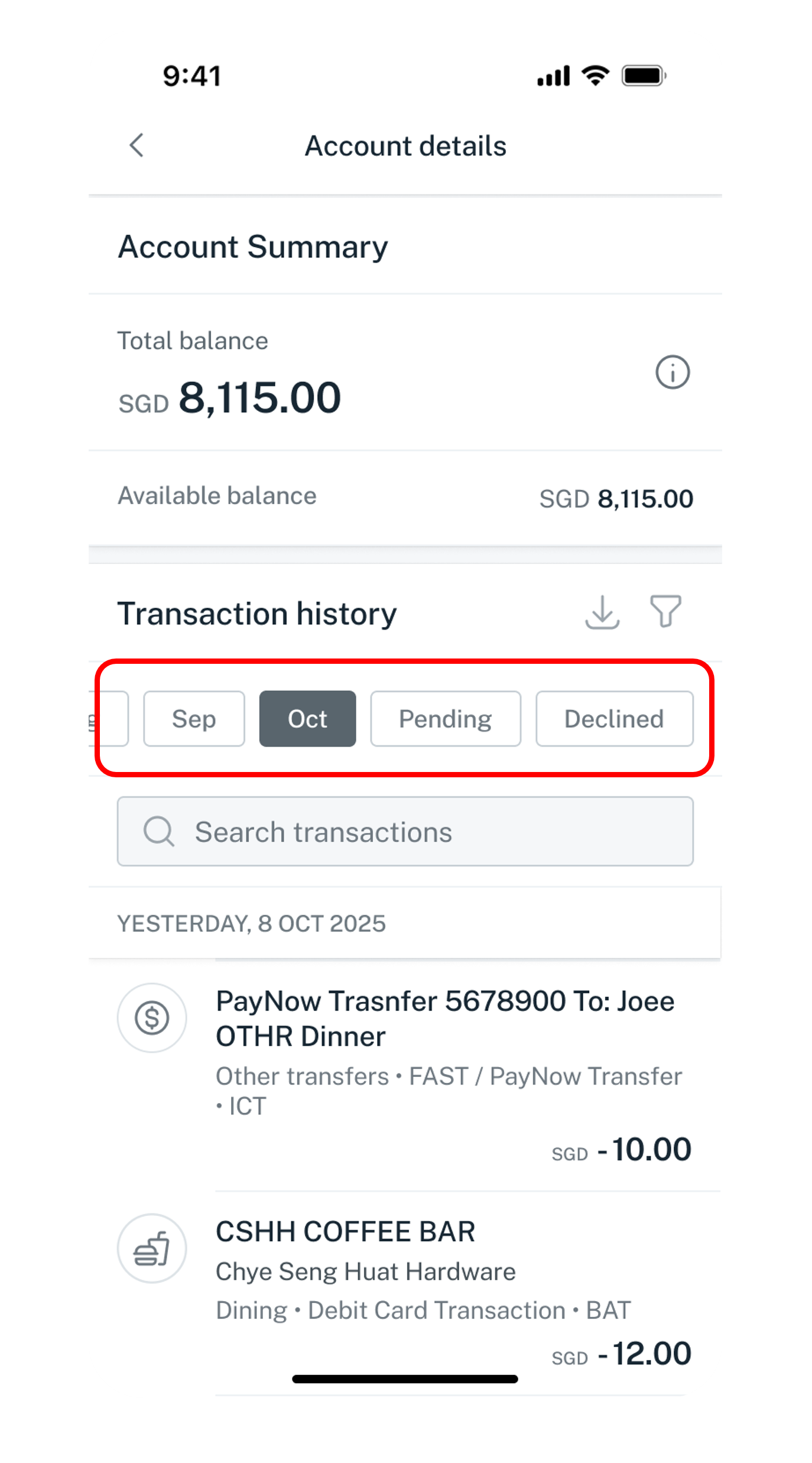

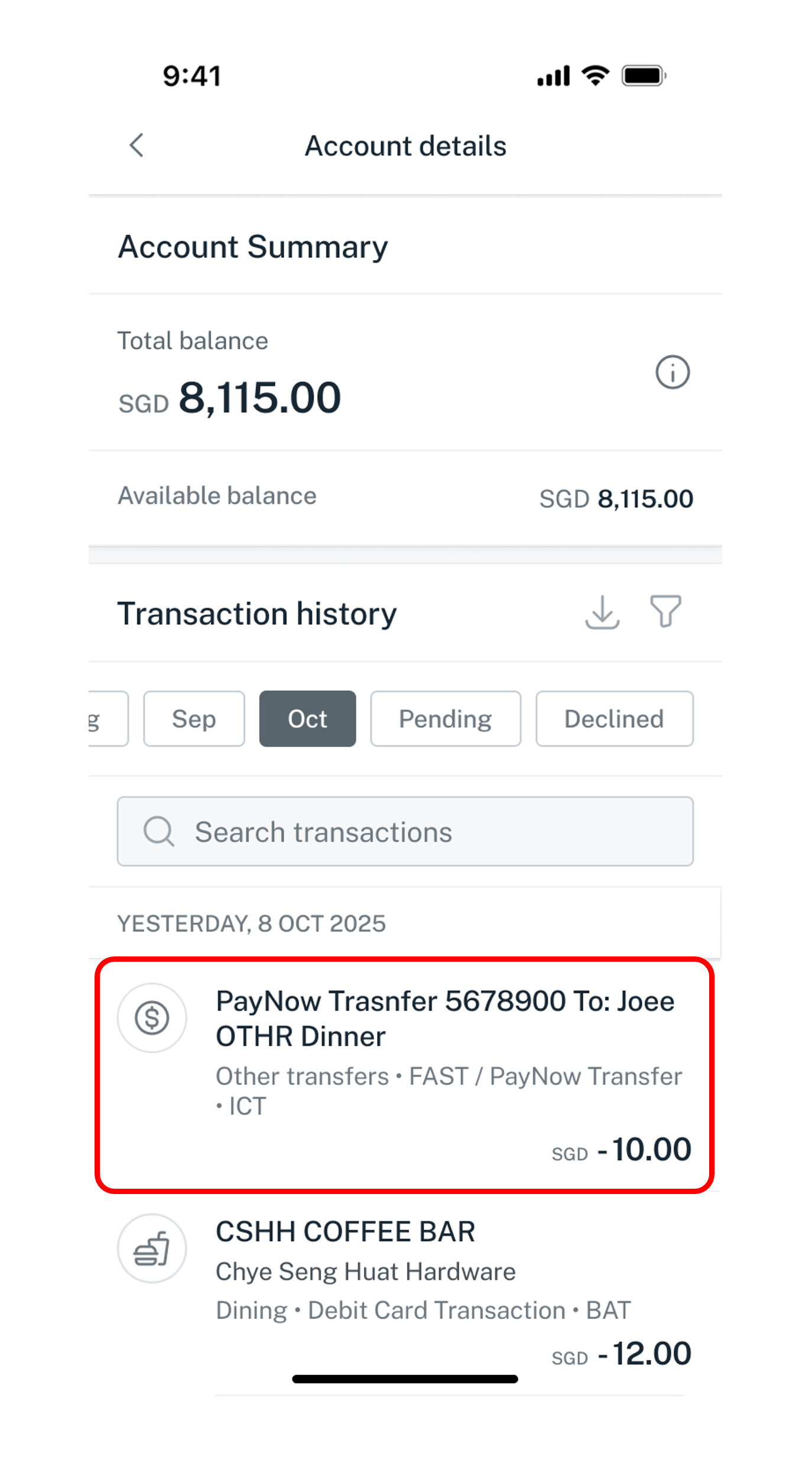

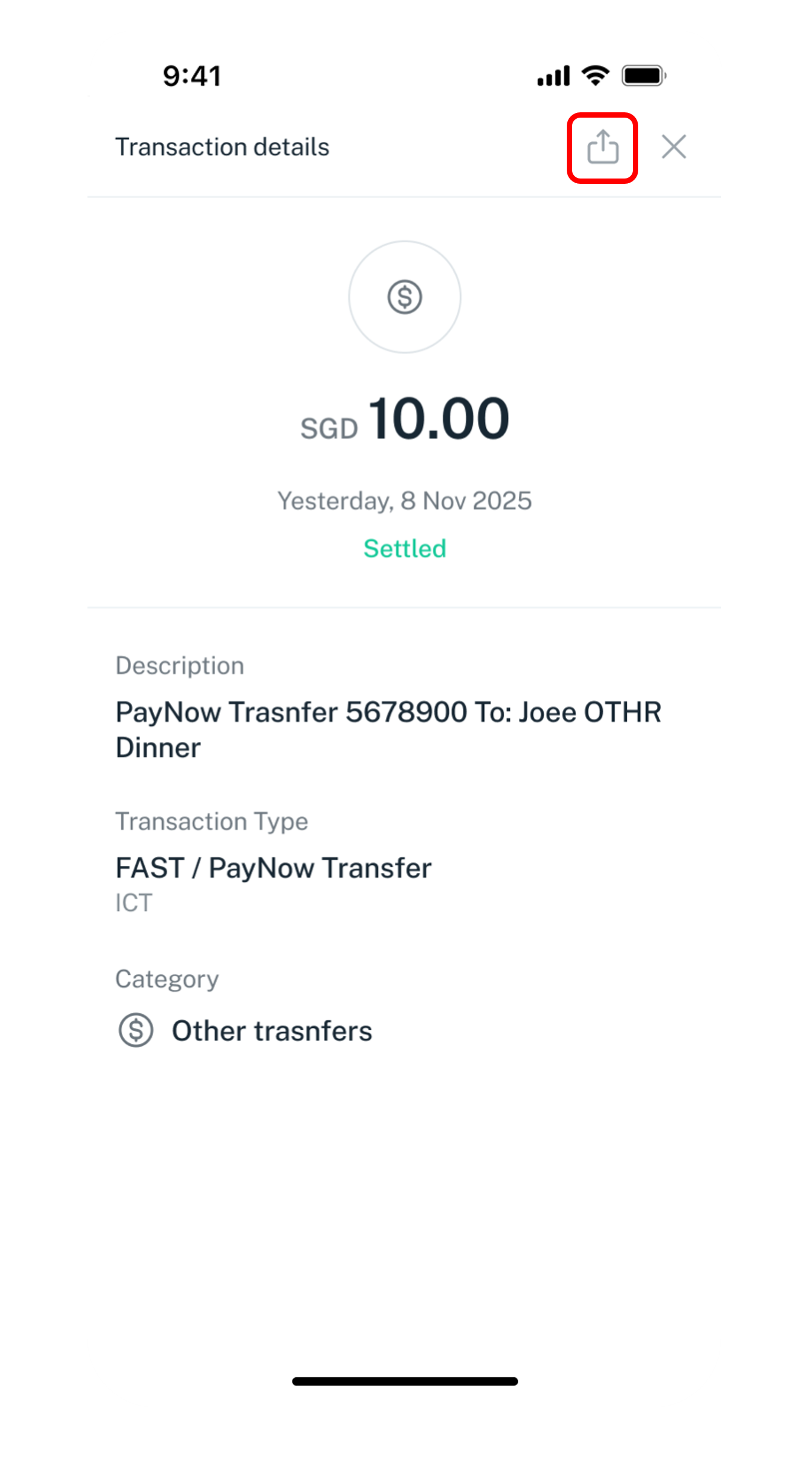

digibank mobile

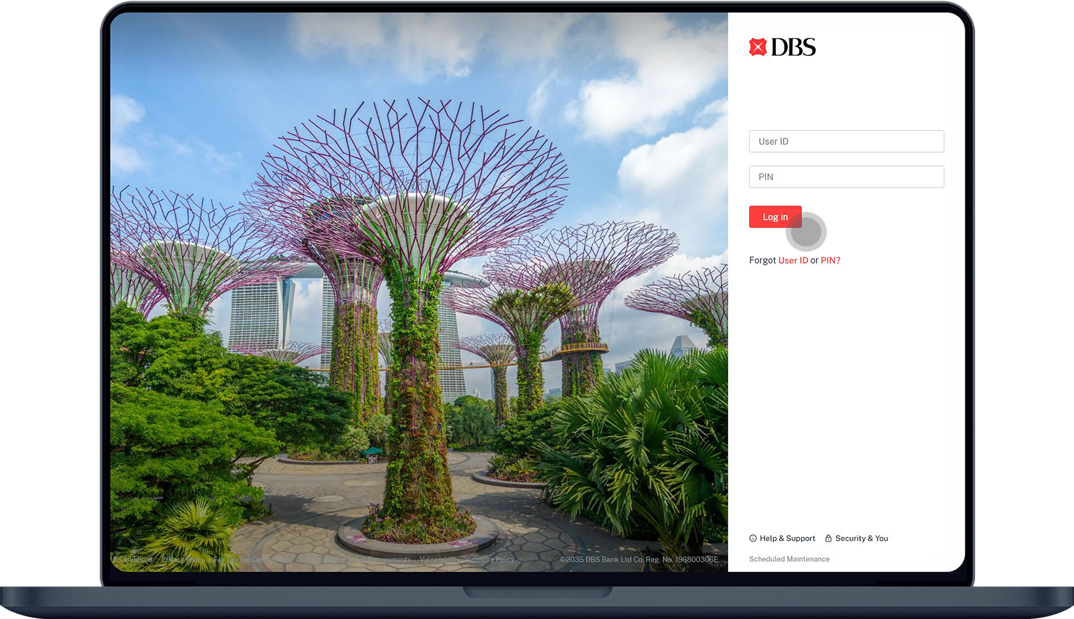

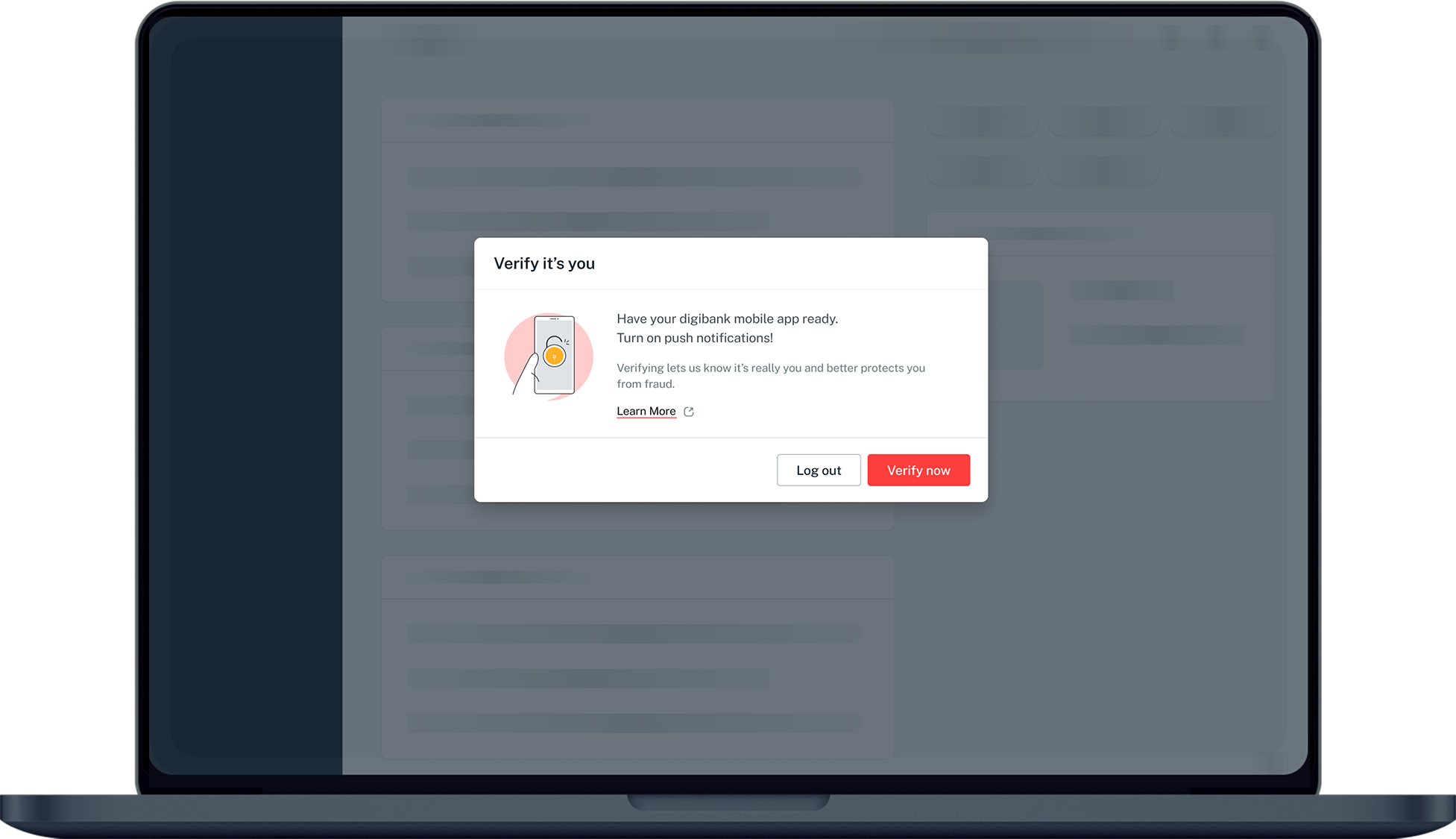

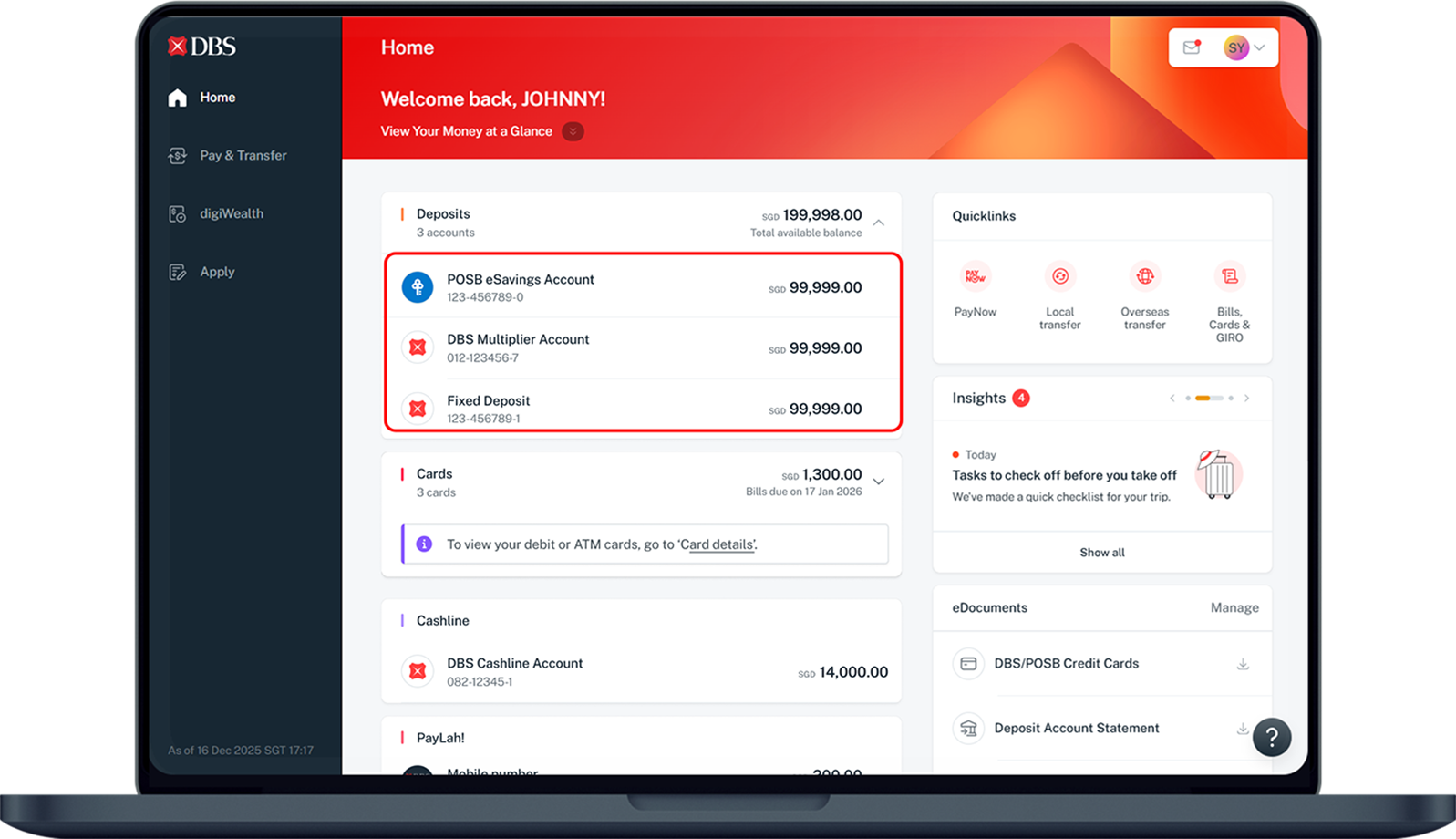

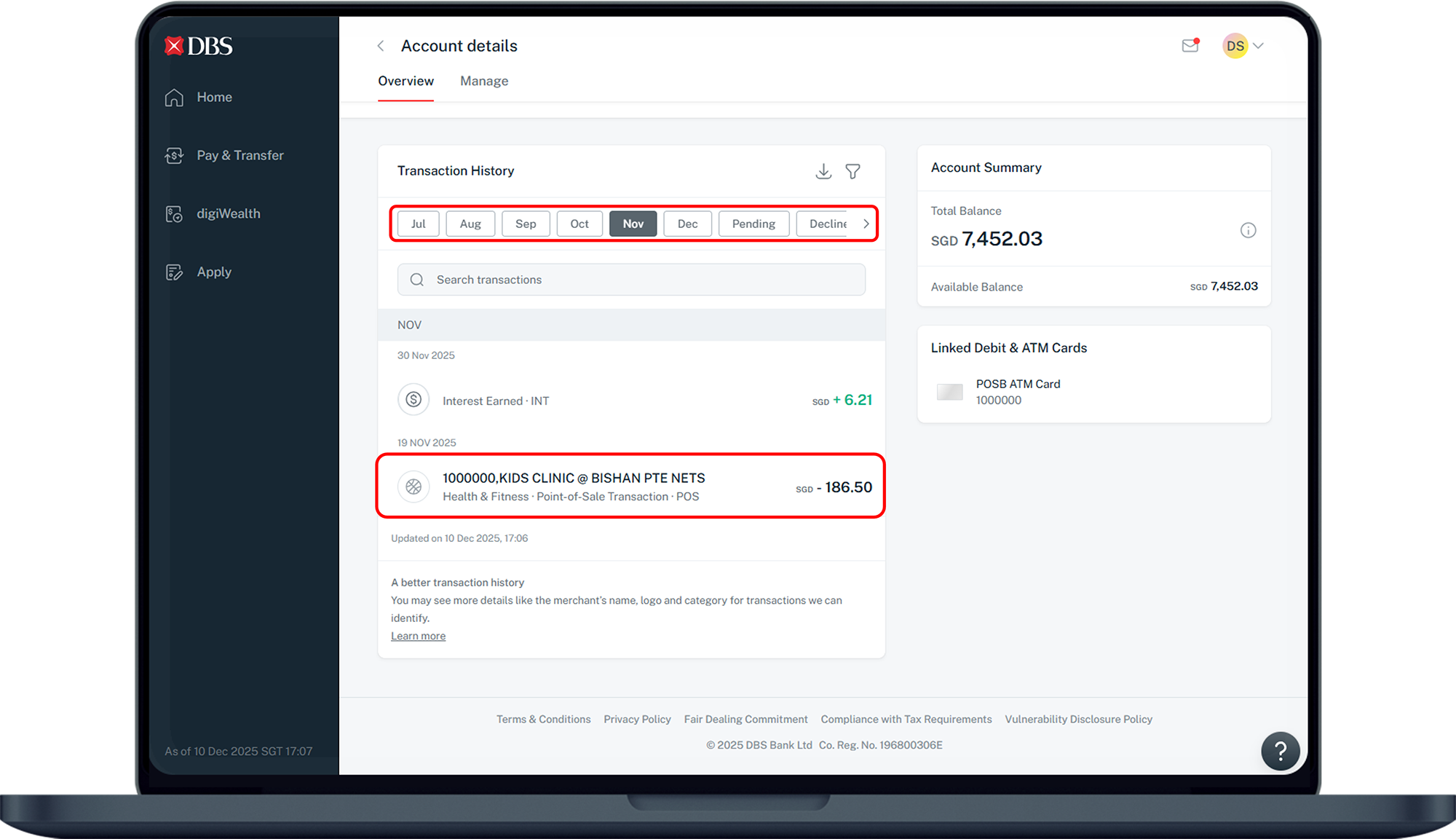

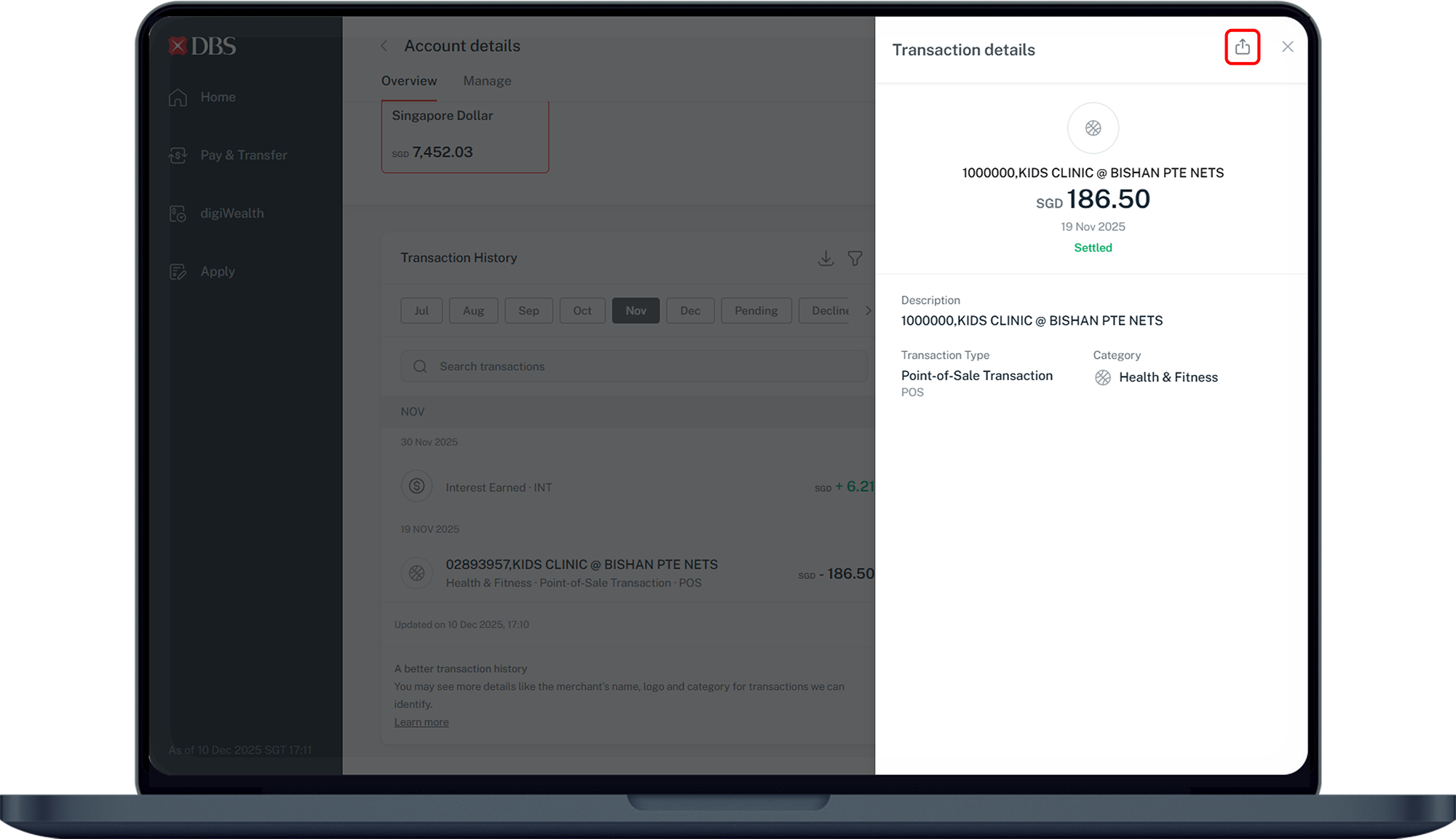

digibank online

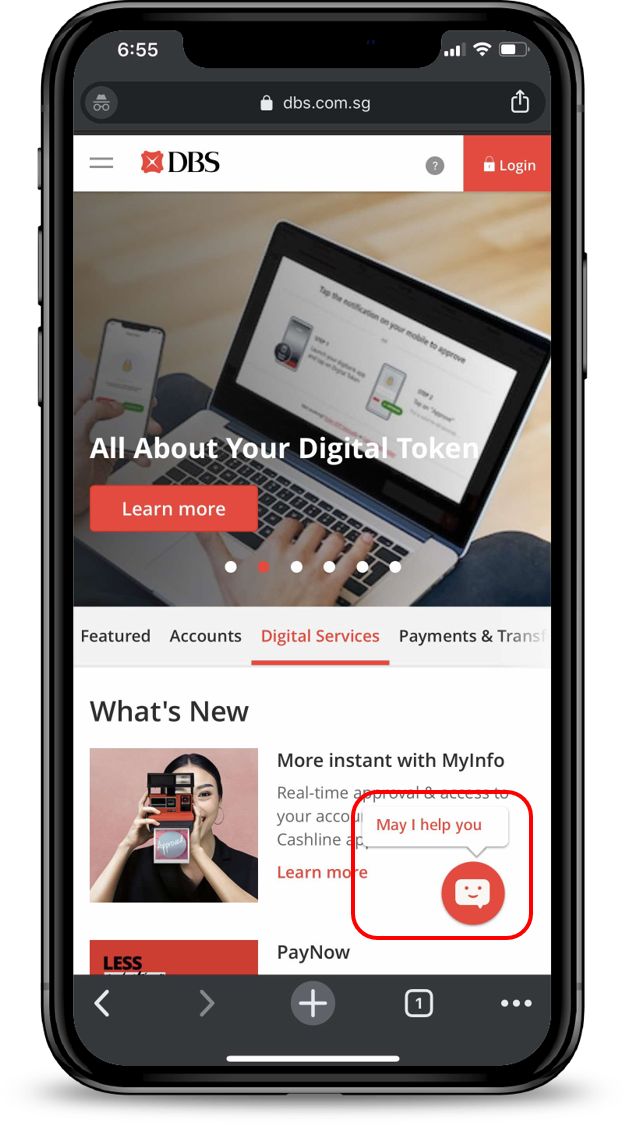

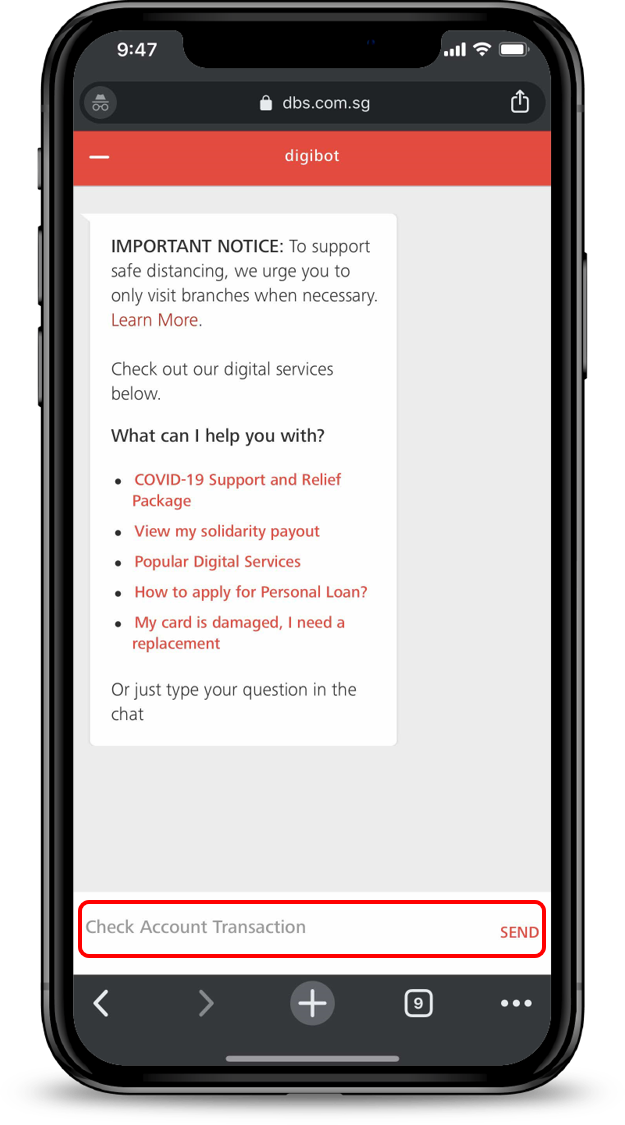

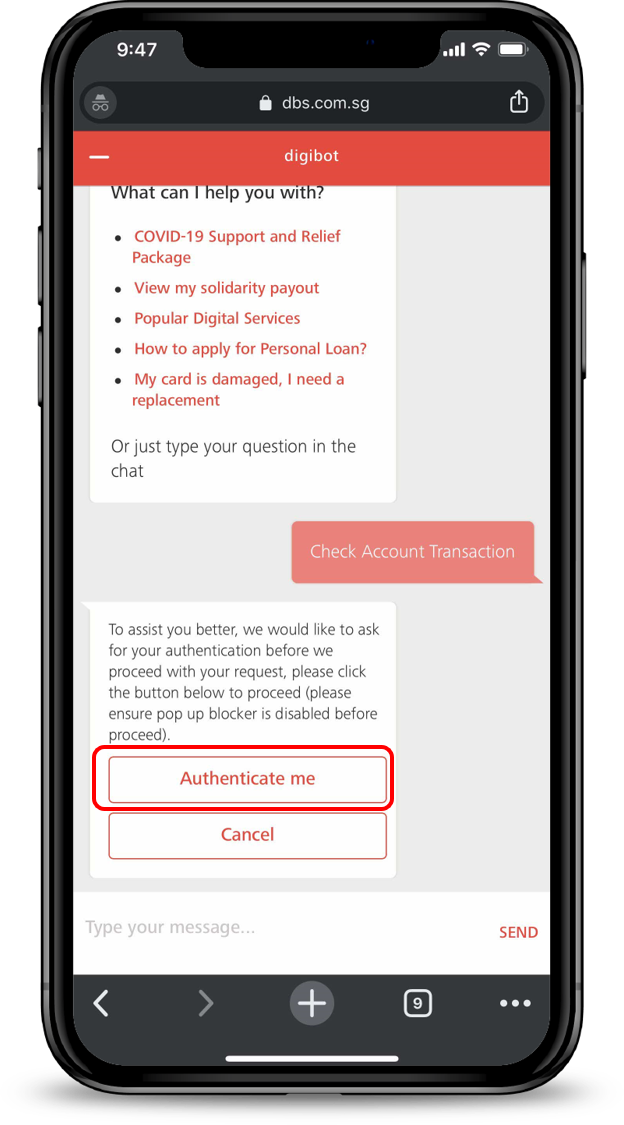

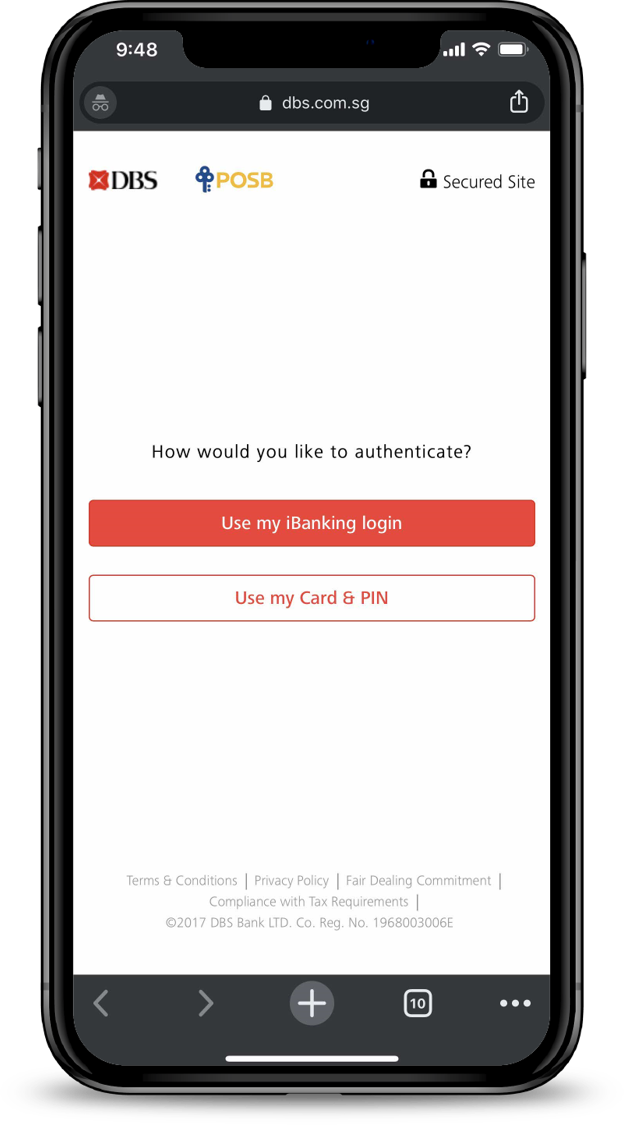

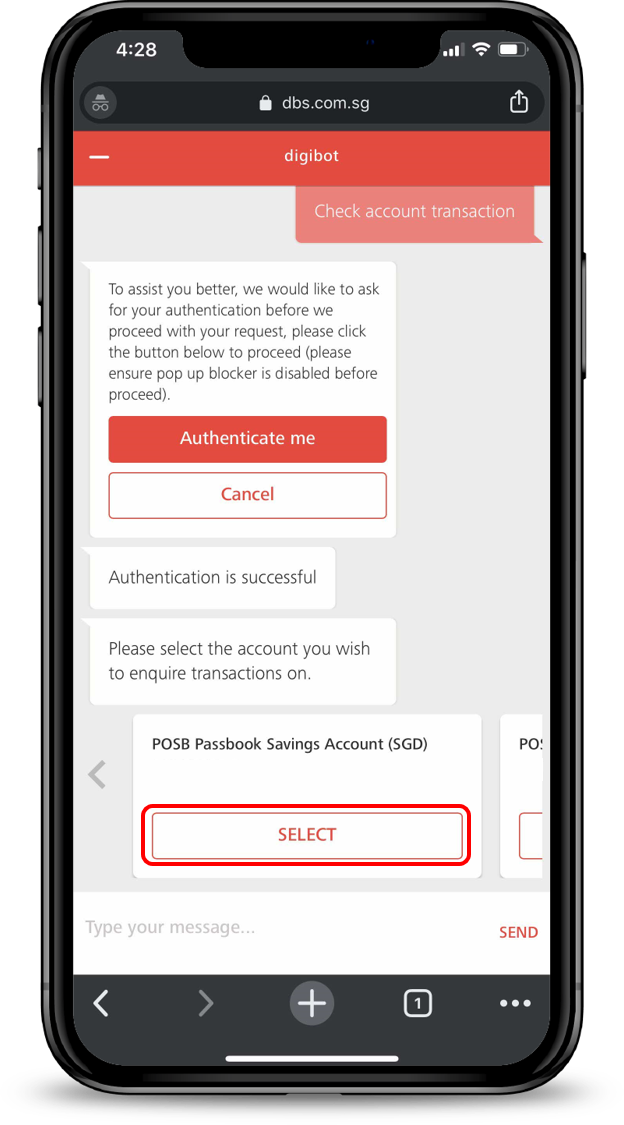

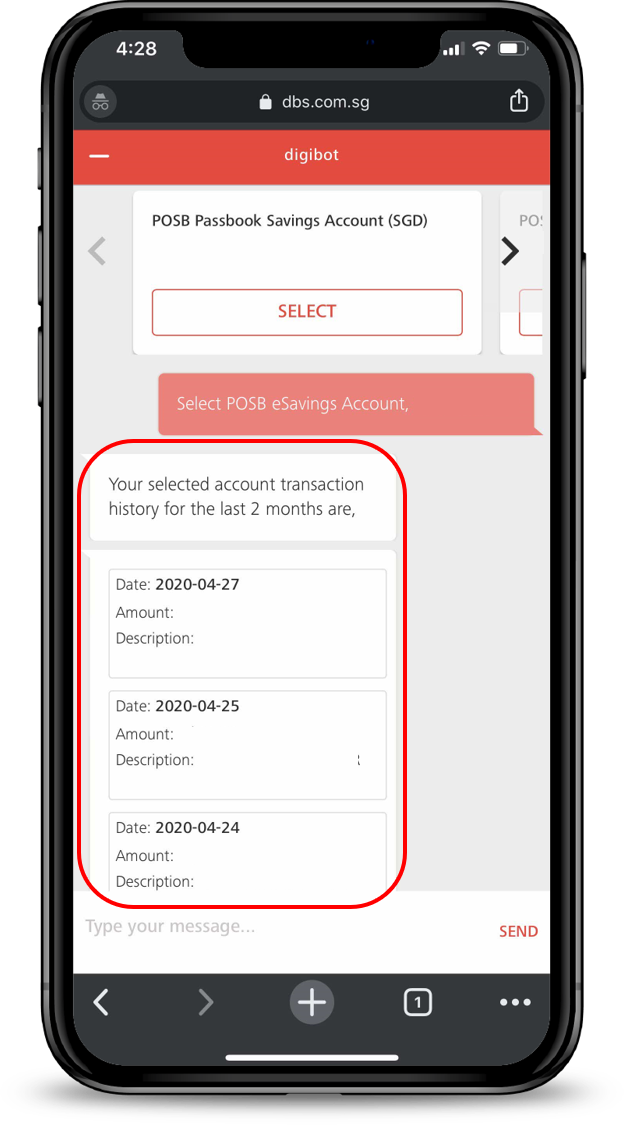

DBS digibot

Phone Banking

- Dial 1800 111 1111 (from Singapore) or (65) 6327 2265 (from Overseas) for DBS Personal Banking Hotline (24/7).

- For a menu in English Press 1, for Mandarin Press 2.

- Enter your NRIC, Debit or Credit Card Number followed by # to proceed.

- Follow the steps for SMS OTP to proceed.

- Select Deposit Account Related Services.

- Press 1 for Account Balance(s).

- Press 2 for Last 5 Transactions.

- Enter your Account Number OR;

- Press # to list all the Accounts.

Frequently Asked Questions

Why is the amount debited from my account higher than the transaction amount I made through the merchant website / mobile app?

If your card transaction is converted to Singapore dollars via dynamic currency conversion (a service offered at certain overseas merchants or websites), you will be subject to an administrative fee on the converted Singapore dollar amount, which shall be payable by you and debited from your Card account. This includes but is not limited to any card transaction in Singapore dollars on overseas-based websites and mobile applications. Learn more about overseas card transaction fees.

I spotted an unauthorised transaction in my account. What should I do?

- Log in to digibank mobile to check the transaction.

- If the transaction is not made by you, go to Payment Controls on the digibank mobile app, and lock the card. Follow our step-by-step guide on how to lock your card temporarily.

- Call DBS Fraud Reporting hotline 1800 339 6963 or (65) 6339 6963 from overseas.

- DBS will investigate, and we will credit the disputed amount within 7 working days for successful cases. Should further verification be required, we will reach out to you within 7 working days.

Merchant charged me multiple times. What should I do?

- We advise you to contact the merchant to seek clarifications first. If you cannot resolve the matter, you can get in touch with us to raise a chargeback request with the merchant.

Was this information useful?