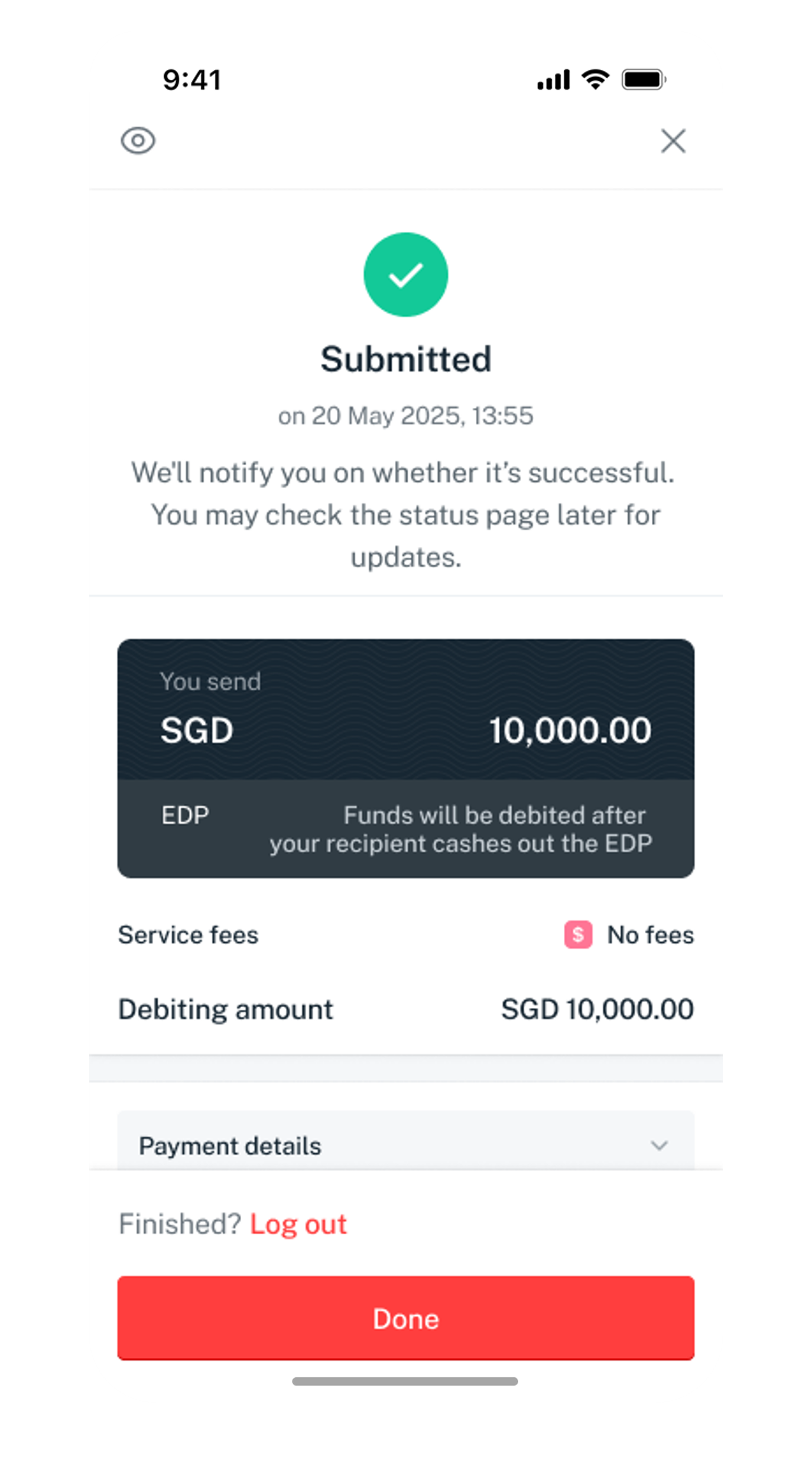

Issue an EDP/EDP+

Learn how to issue an EDP/EDP+ via digibank mobile easily.

Important information

- Your recipient must have online banking with a participating bank to receive an EDP/EDP+. Otherwise, the payment won’t be possible.

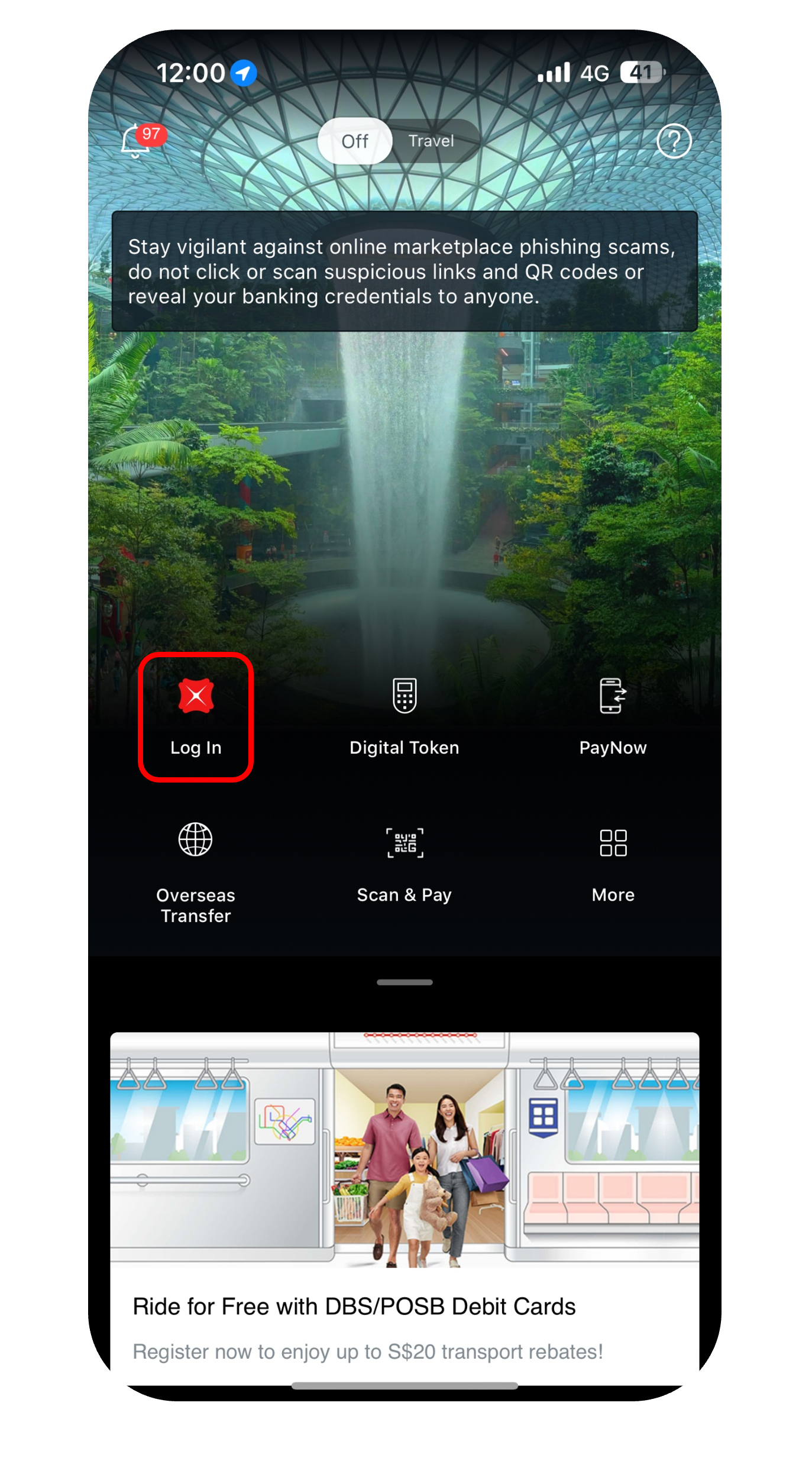

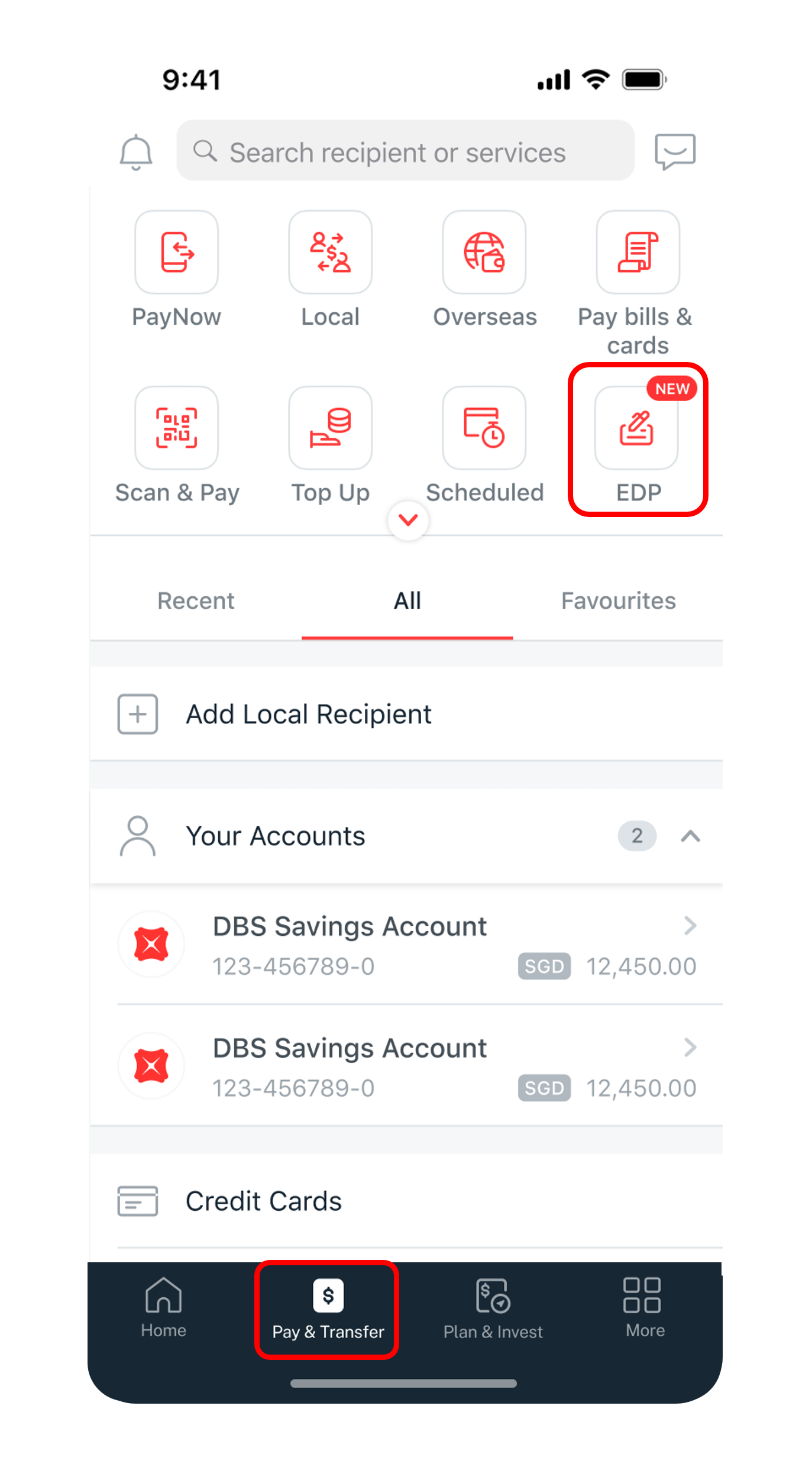

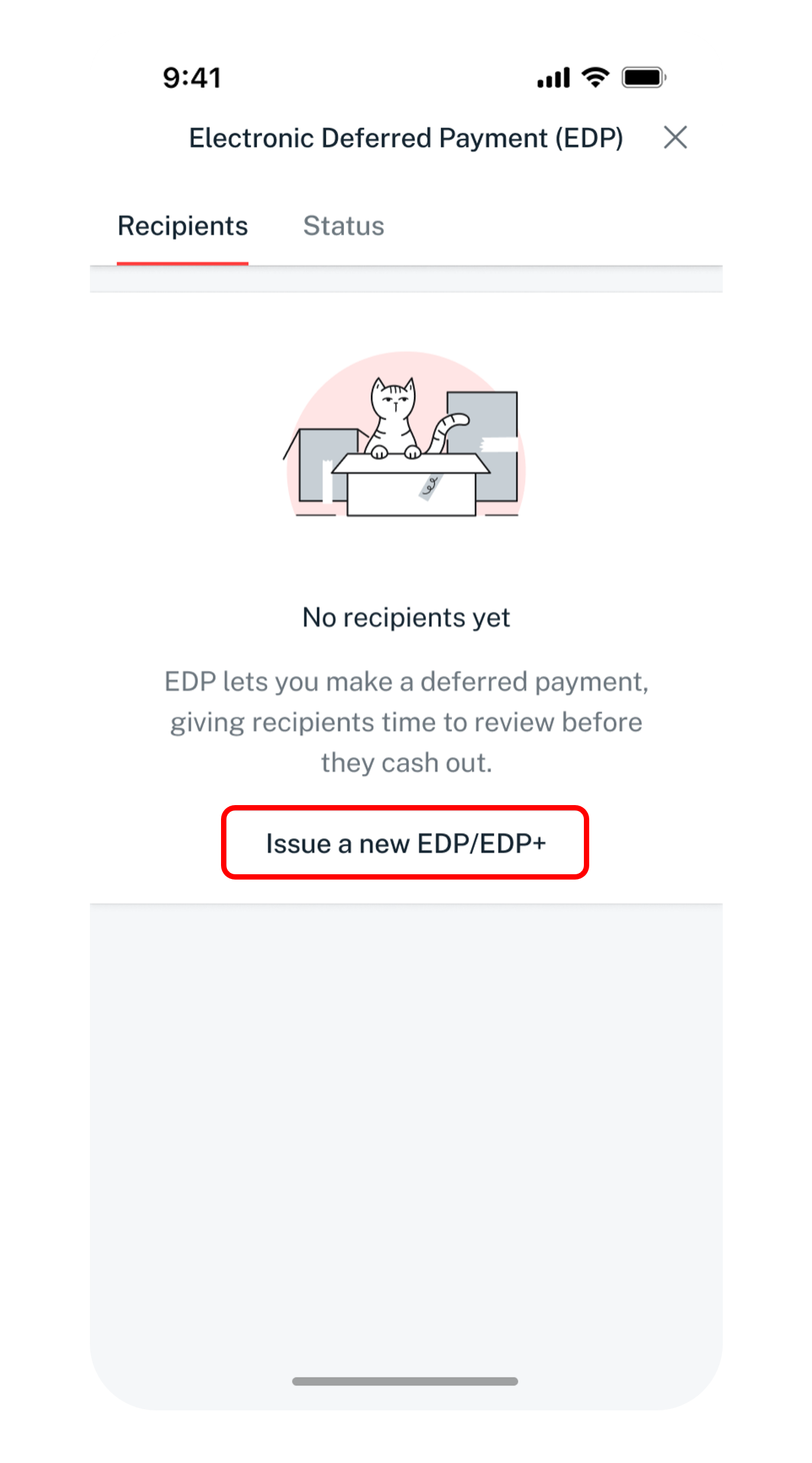

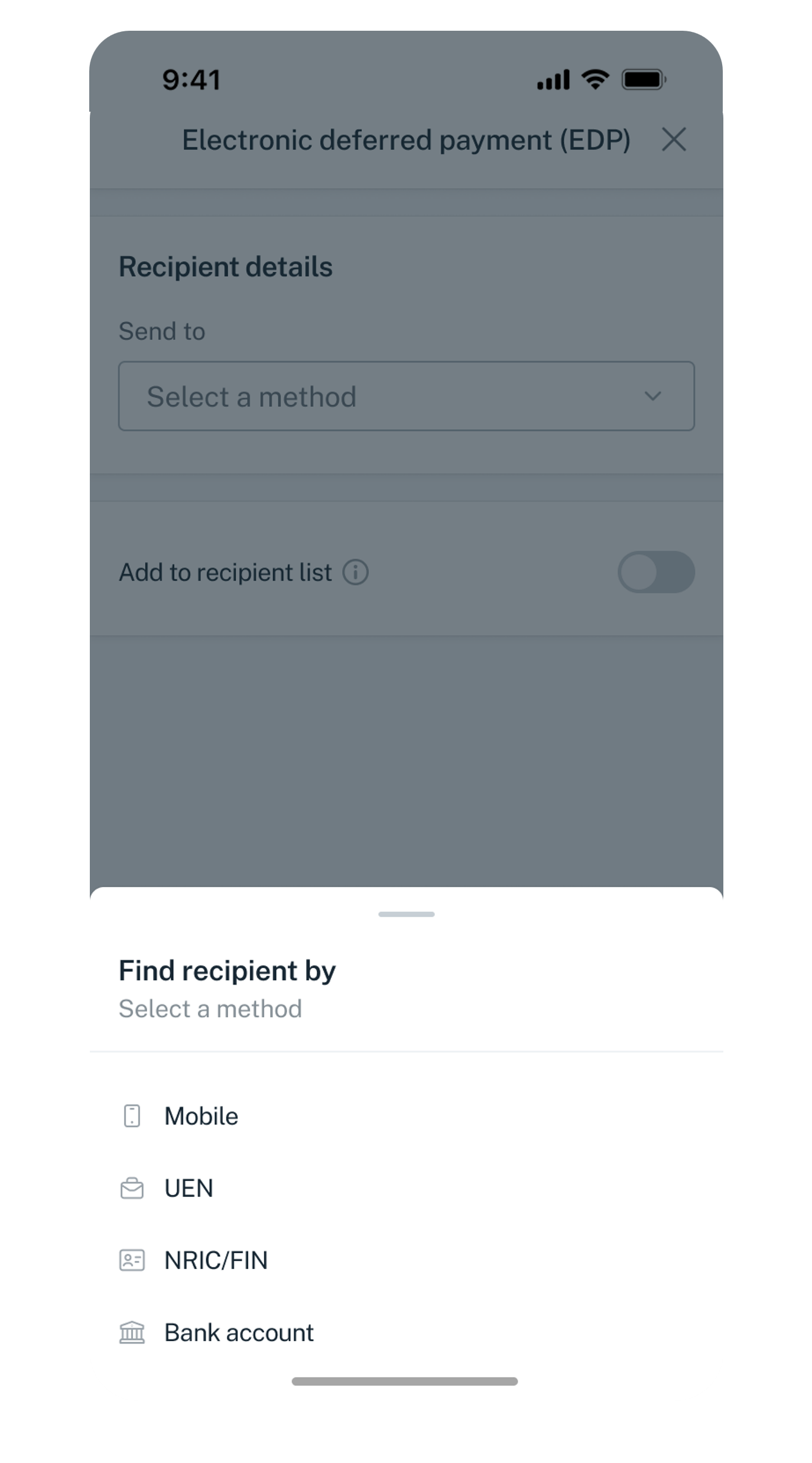

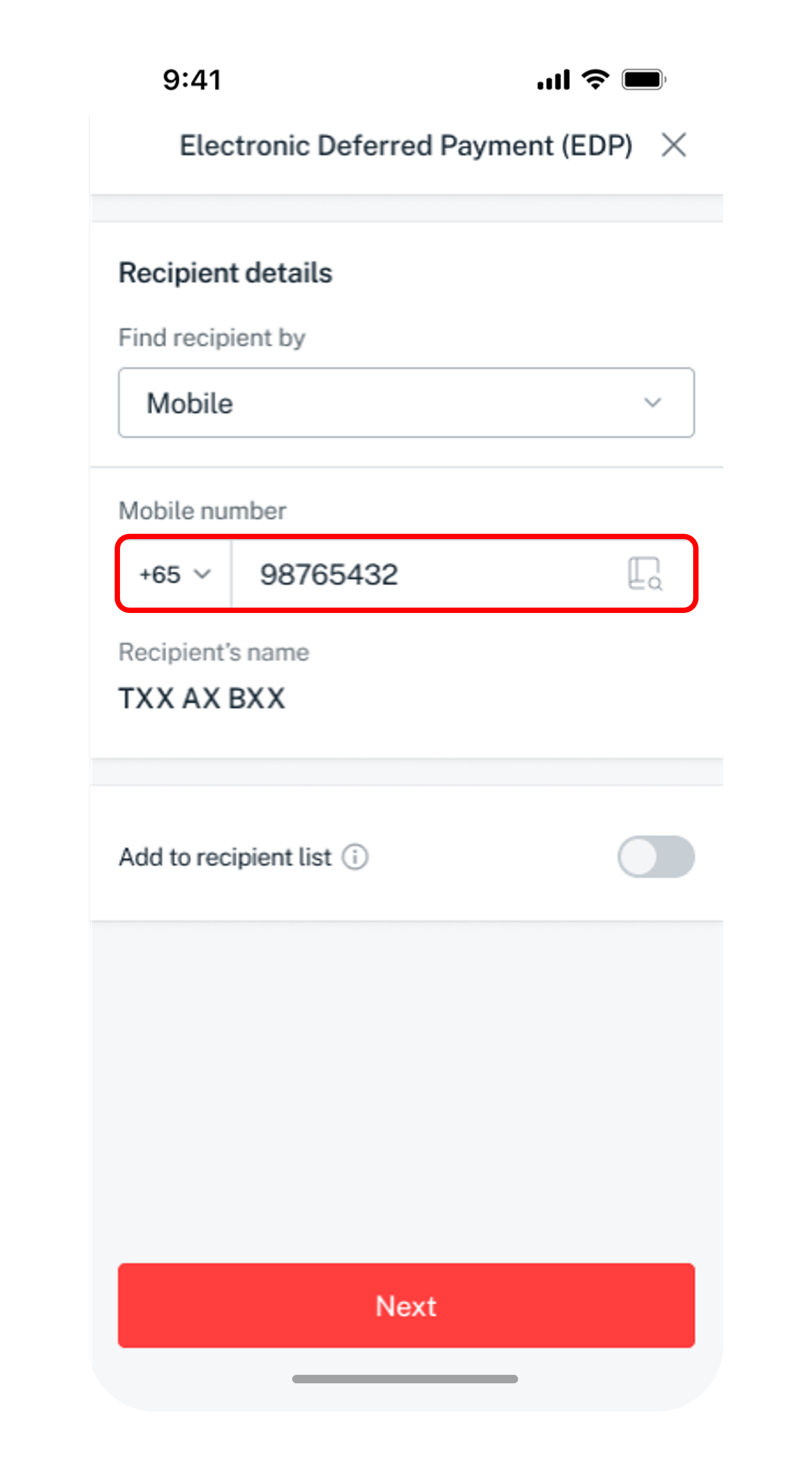

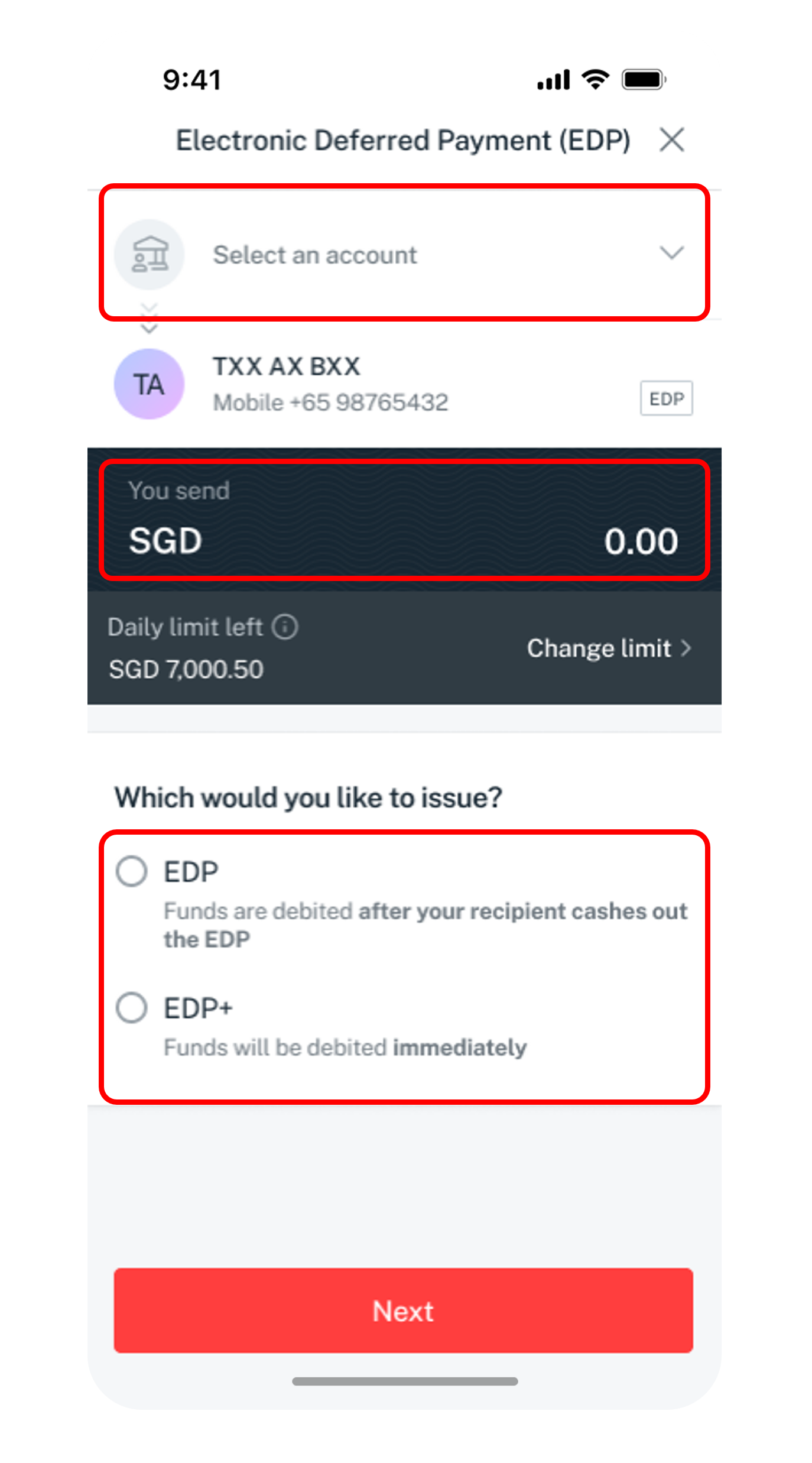

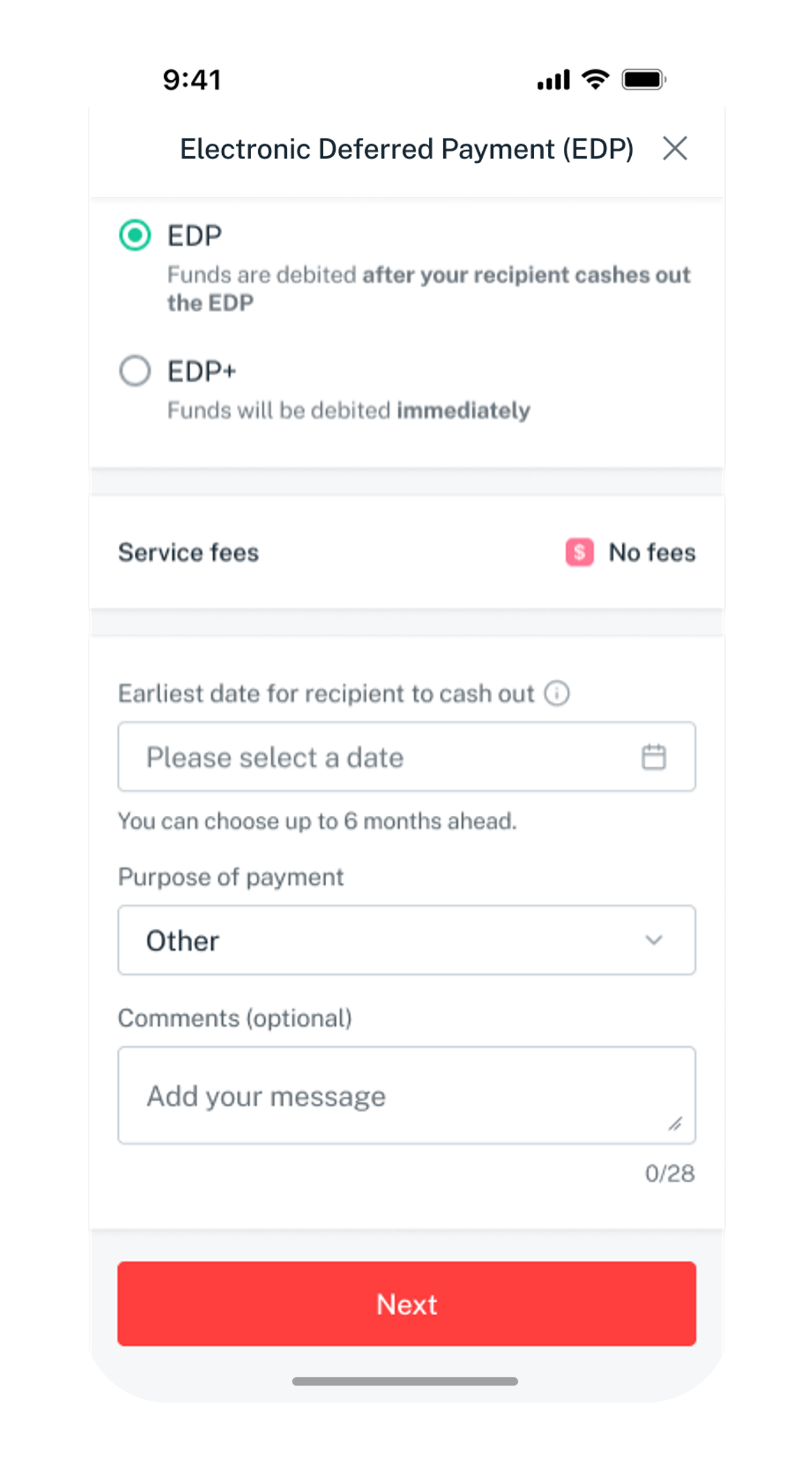

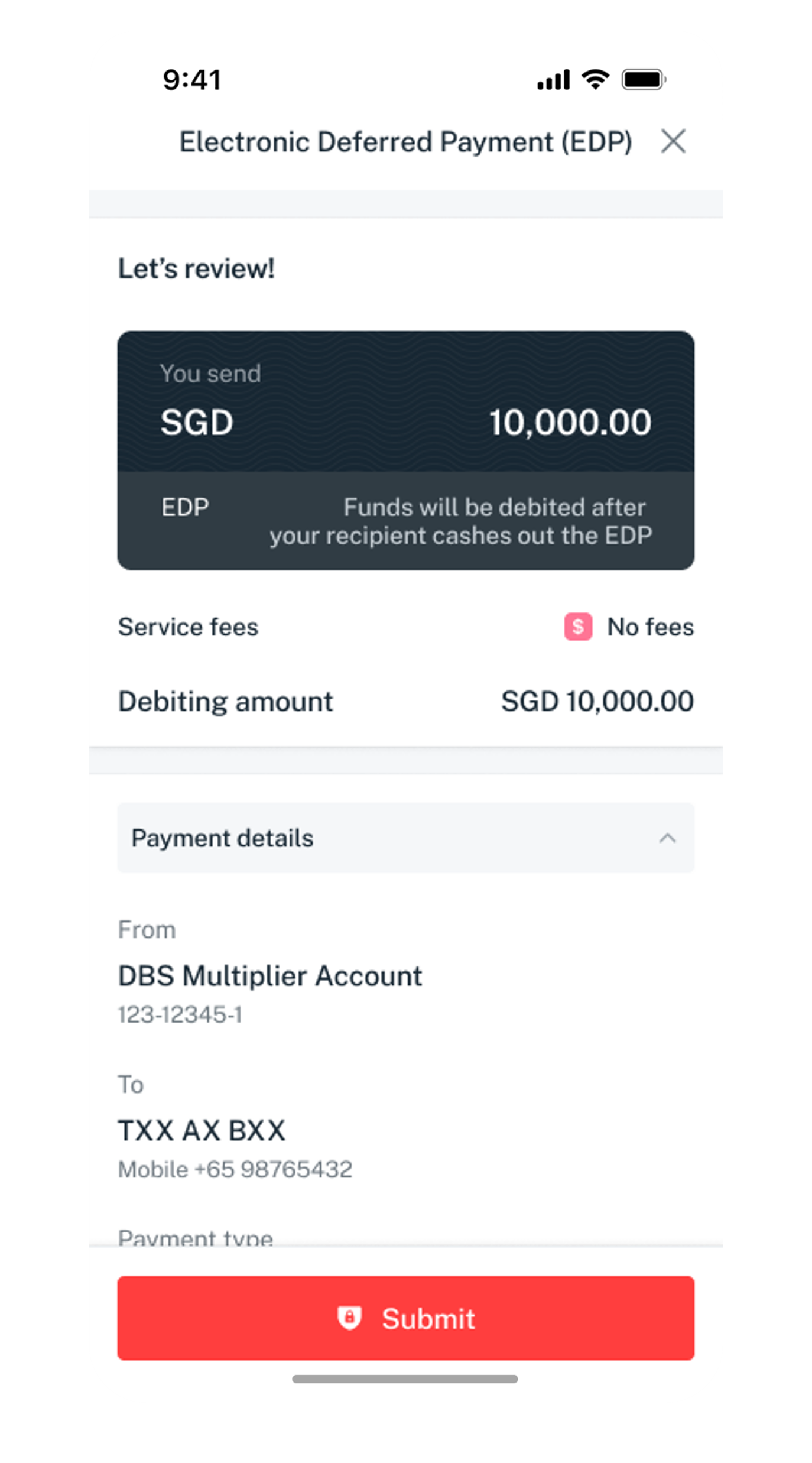

How to issue an EDP/EDP+

digibank mobile

Frequently Asked Questions

What are the banks participating in EDP?

The participating banks are Citibank, DBS Bank, HSBC, Maybank, OCBC Singapore, Standard Chartered Bank and UOB.

As the sender, can I choose a future date for EDP/EDP+ to be valid?

Yes, for EDP. As the sender, you may issue a post-dated EDP to your recipient as you can select an effective date up to 6 months ahead from the creation date.

For EDP+, the effective date is automatically set to one day (T+1) after the payment is created. For example, if you sent an EDP+ on 1 Jun 2025, your recipient will be able to cash it out from the next day, 2 Jun 2025 onwards. Unfortunately, you can't change this to a later date.

What is the validity of my EDP / EDP+?

EDP and EDP+ has a validity period of 6 months from the effective date (earliest date your recipient can cash out). Upon which, they will expire and become invalid. If your EDP/EDP+ has expired, here’s what you can do:

- For senders: Issue a new EDP or EDP+ to your recipient if needed.

- For recipients: Reach out to your sender directly to request a new EDP or EDP+.

I entered my recipient’s mobile number. Why is it showing me a different name / nickname?

When finding your recipient with their mobile number, your recipient’s PayNow nickname will be returned for your review before you proceed with the issuance of the EDP.

Was this information useful?