Consolidated Statements

This is a monthly statement that consolidates details of your deposit accounts, investments and loan products based on the mailing address linked to these accounts.

Fixed Deposit (FD) Transactions Added to Your Consolidated Statement

Your Personal and Joint FD account transactions (i.e. new placement, renewal, interest payment, maturity withdrawal, premature withdrawal or interest adjustment) will be displayed in your July 2025 month end consolidated statement.

With the cessation of FD standalone statements, you will be able to view your accounts conveniently at a glance instead of relying on different statement updates.

Important information

- Do note that Credit Card transactions will be reflected in a separate statement.

- For Passbook accounts included in the consolidated statements, you will only be able to view the overall balance in the account summary. Should you wish to view your transactional details, please update your passbook.

- If you only have passbook accounts with the bank, there will be no consolidated statement generated

Who receives a Consolidated Statement?

You will enjoy this statement consolidation service automatically if you hold more than one of the accounts/products listed below. If you are already receiving eStatements for one of your existing accounts, you will start to receive a consolidated eStatement that incorporates the rest of the accounts.

What is included in the Consolidated Statement ?

Deposit Accounts

- DBS / POSB Current Accounts

- DBS / POSB Savings Accounts

- DBS Autosave / SAYE Accounts

- POSB Passbook

- Multi-Currency Accounts

- SGD and Foreign Currency Fixed Deposits

- Foreign Currency Current Accounts

Investments

- Structured Deposits

- Unit Trusts

- CPF Investment Scheme Investments

- Supplementary Retirement Scheme (SRS) Investments

Loans

- Mortgage Loan

- Renovation Loan

- Auto Loan

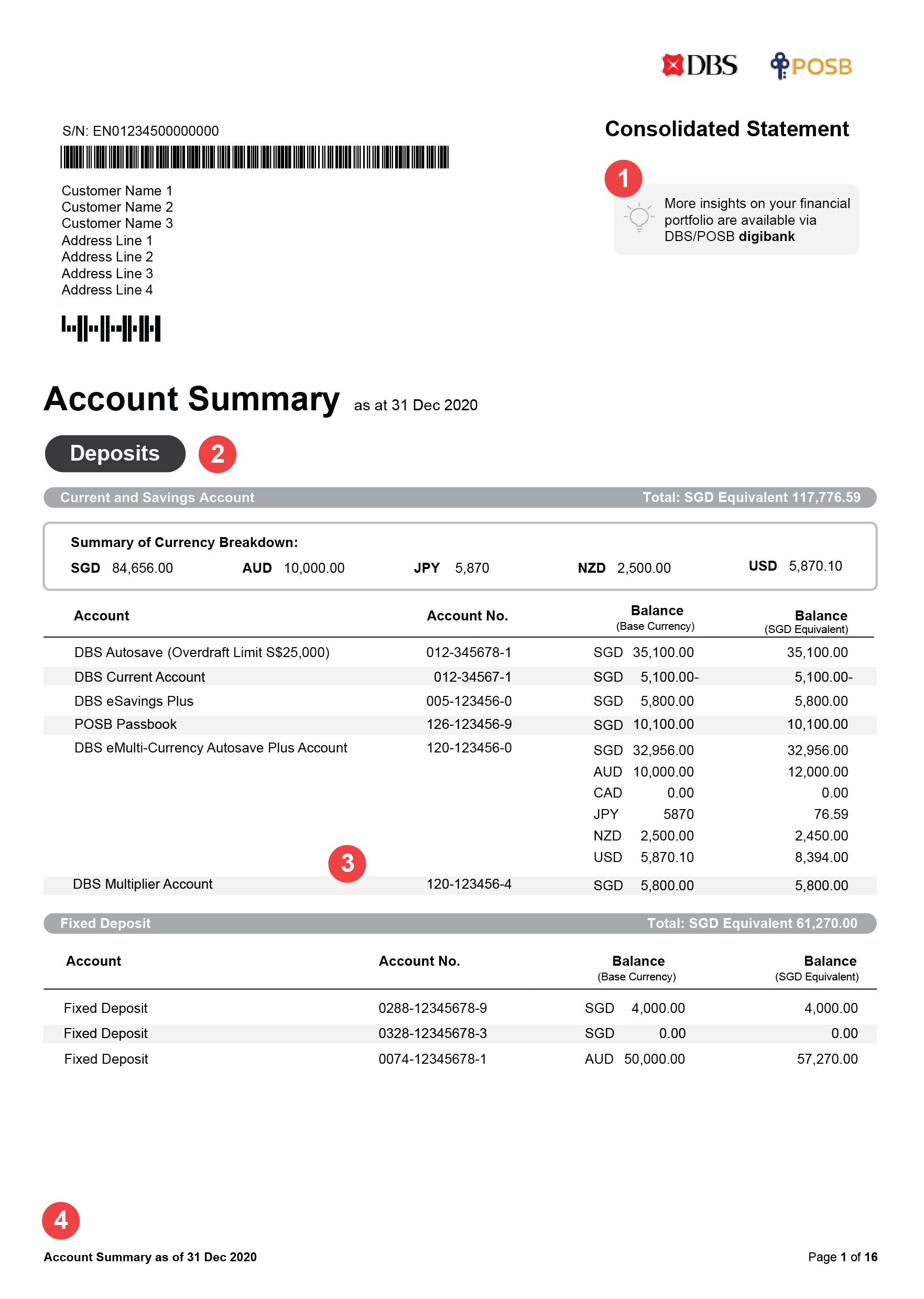

Overall Layout

Key Features

- New message board to highlight key announcements.

- Newly designed sections to create clearer segments.

- Addition of alternate grey shaded rows as a visual guide.

- Indication of statement segment at every page for easy reference.

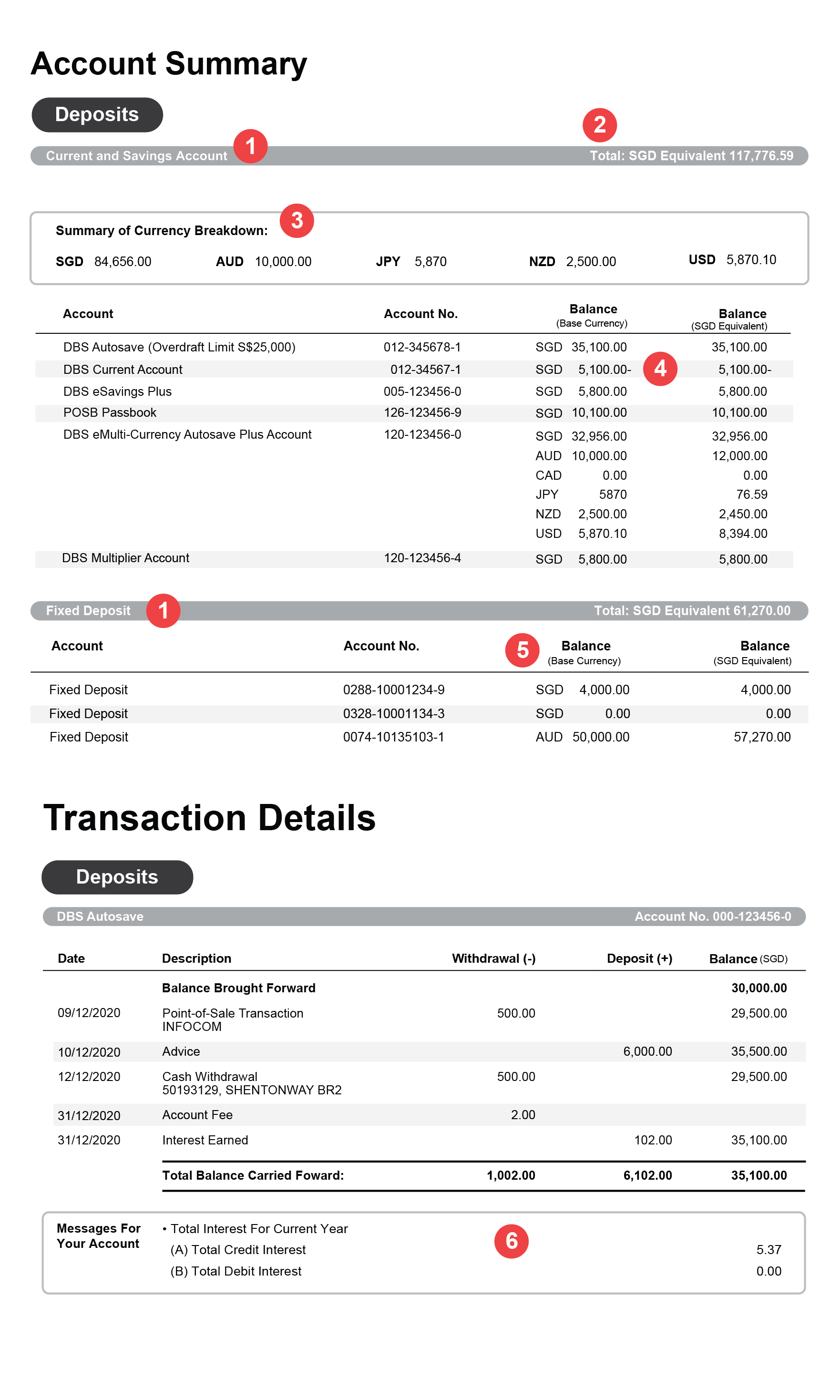

Deposits

Key Features

- Re-categorisation of Deposits to “Current and Savings Account” and “Fixed Deposit”.

- Clear summary of balances for each category under Deposits.

- At-one-glance summary of amounts in the respective currencies across Current and Savings Account.

- Account overdraft indicated by a negative sign after the amount.

- Additional base currency column to reflect the actual currency holdings in your account.

- Get updates about your accounts from the new message box.

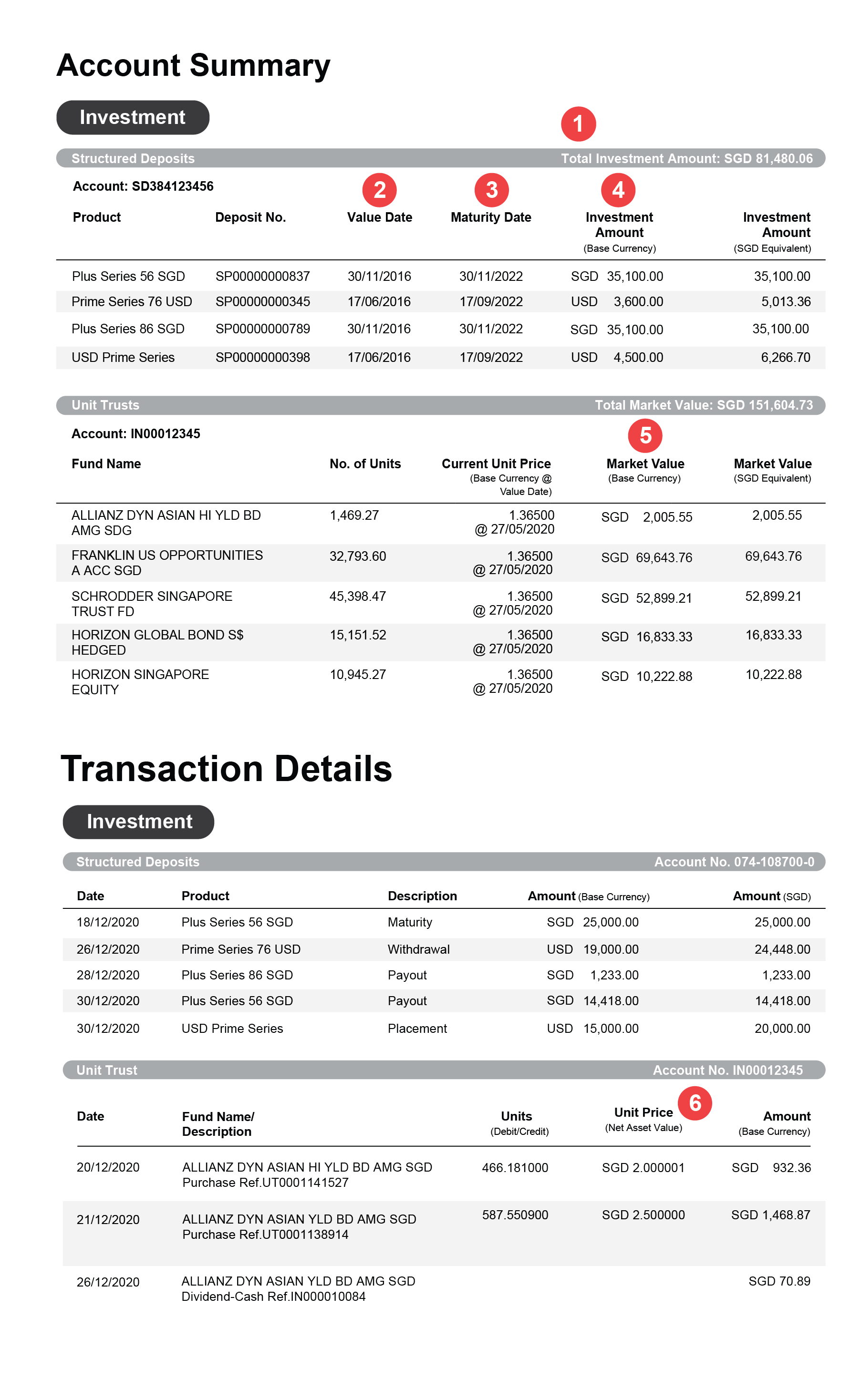

Investments

Key Features

- Clear summary of total investment amount for each Investment product.

- This refers to the start date of your investment, as stated in your contract.

- This refers to the end date of your investment, as listed in your contract.

- Additional base currency column to reflect amounts in the respective currencies.

- Clear indication of invested amounts in the respective currencies.

- Easy reference to the transaction prices of your investments.

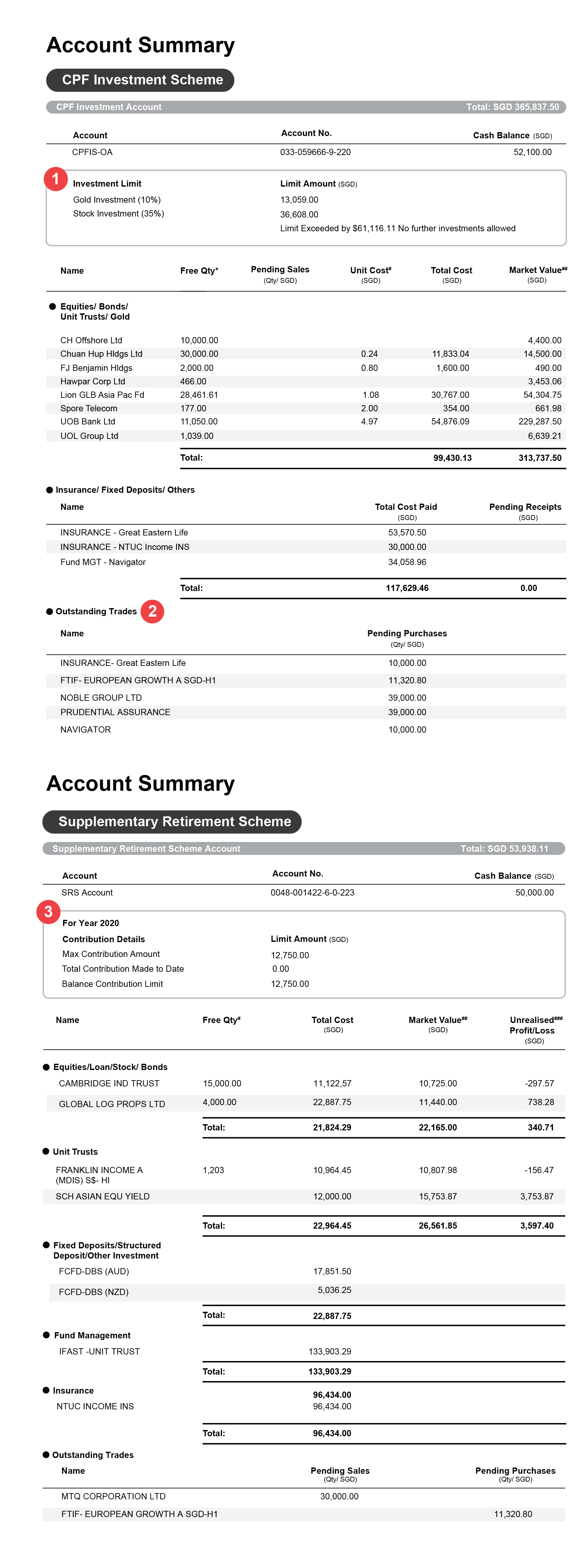

CPF / SRS

Key Features

- Get updates about Investment Limit details for your CPF account from the new message box.

- At-one-glance view of any pending purchases and payments under the new segment “Outstanding Trades”.

- Get updates about Contribution details and limits for SRS Account from the new message box.

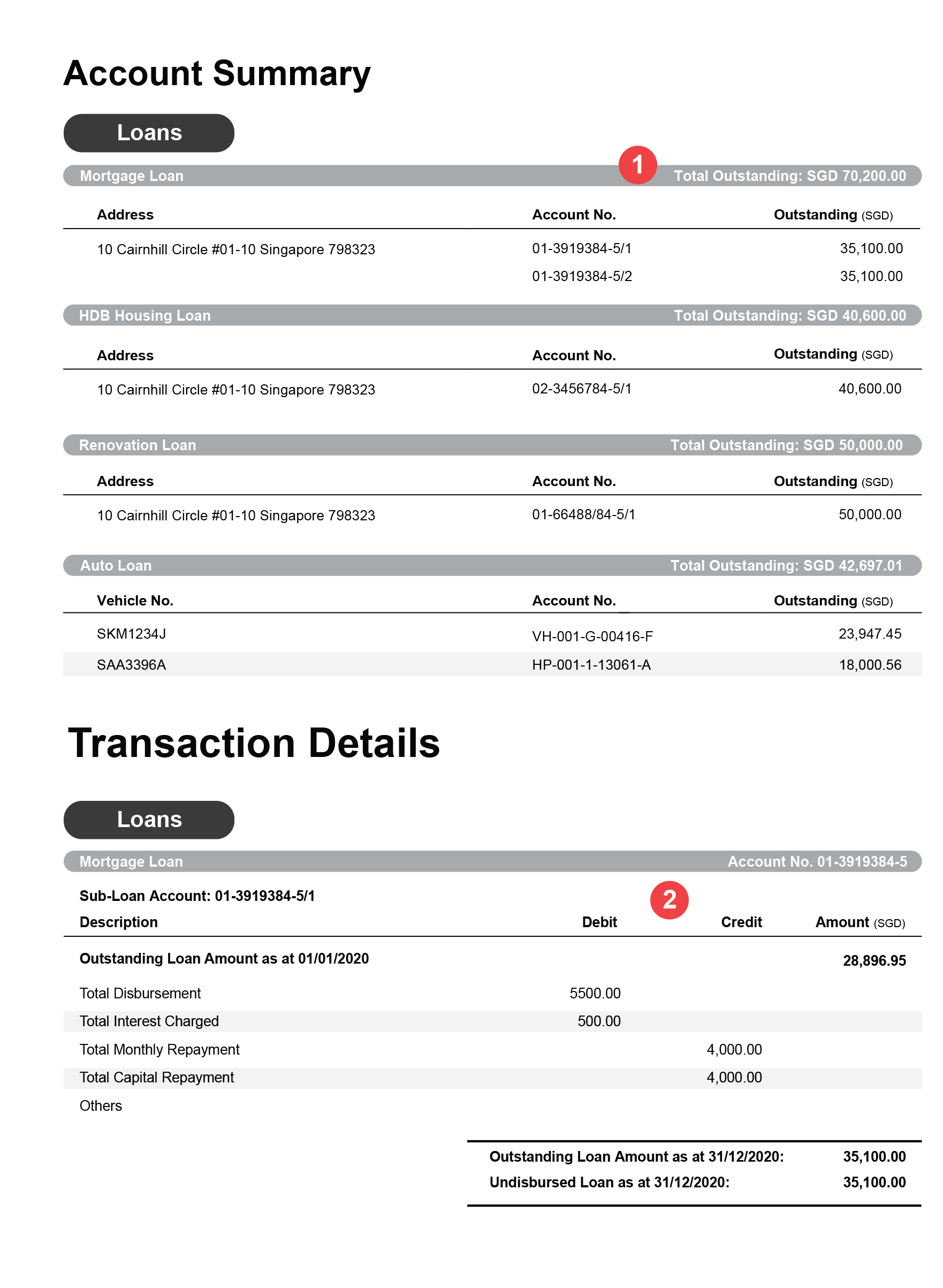

Loans

Key Features

- Clear summary of the total outstanding amounts under the respective loan categories.

- New headers “Debit” and “Credit” to reflect “Withdrawal” and “Deposit” respectively.

Was this information useful?