Check Account Balance

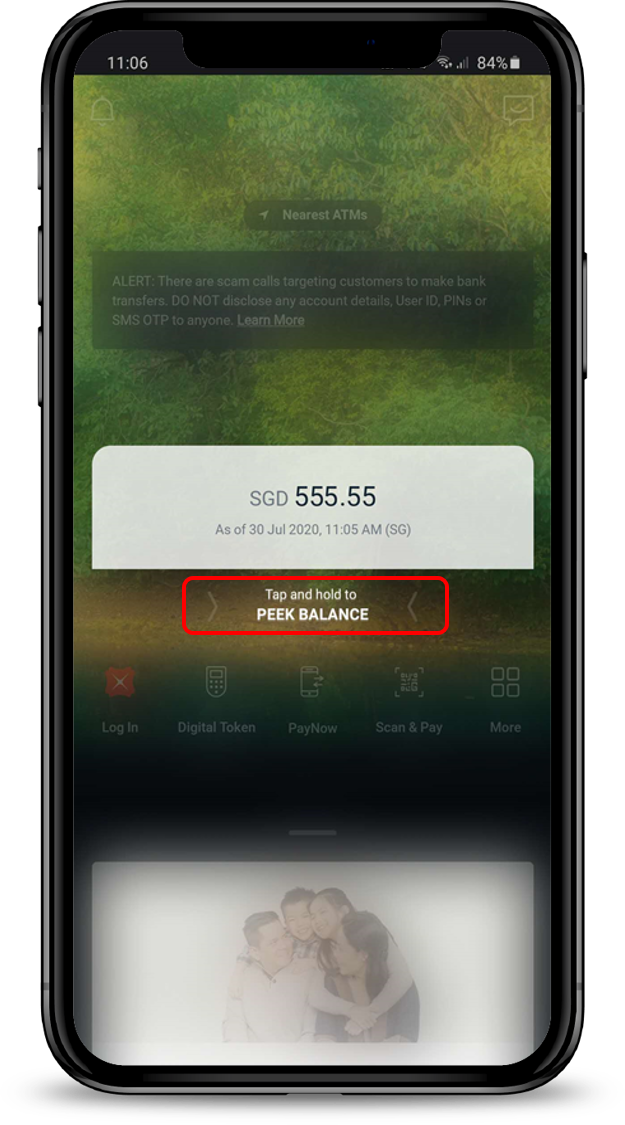

You can check your account balance using DBS Digibot, digibank (setup Peek Balance via digibank mobile to skip login), Phone banking or at DBS/POSB ATM.

Part of: Guides > Go Travel with DBS, Go Shopping with DBS

How to check account balance

There are various channels which you may check account balance with us. The most convenient method would be via digibank mobile.

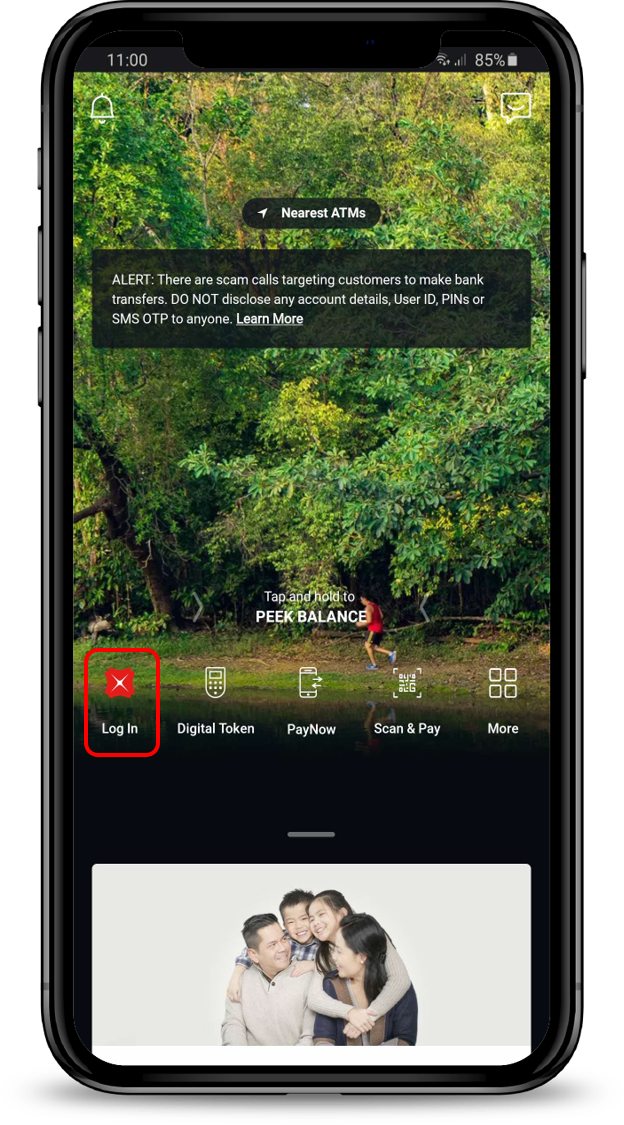

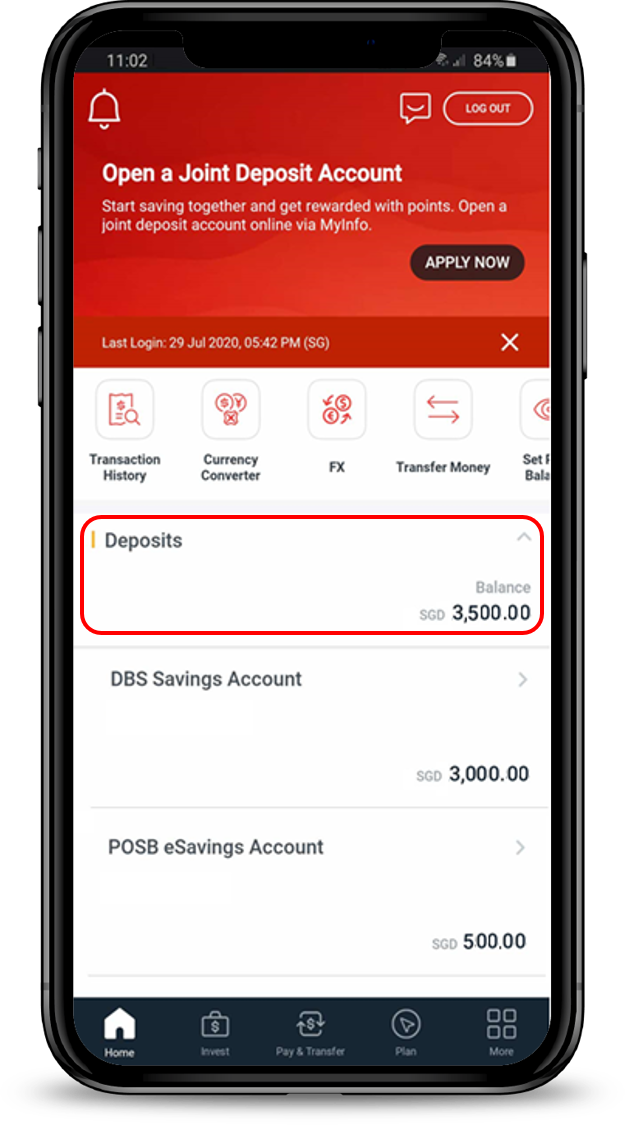

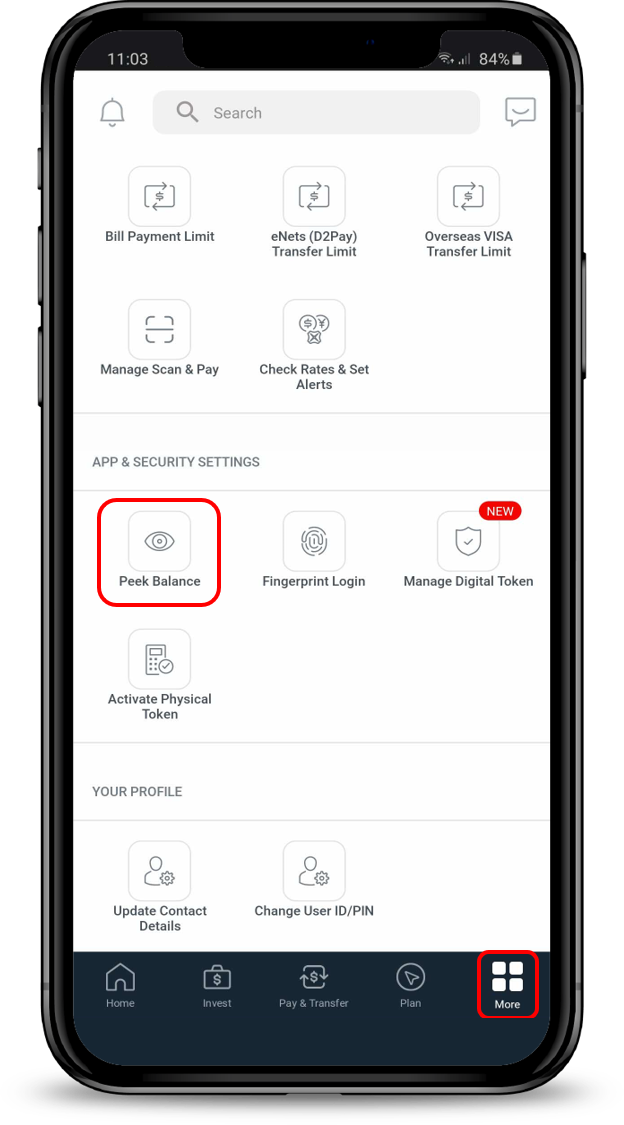

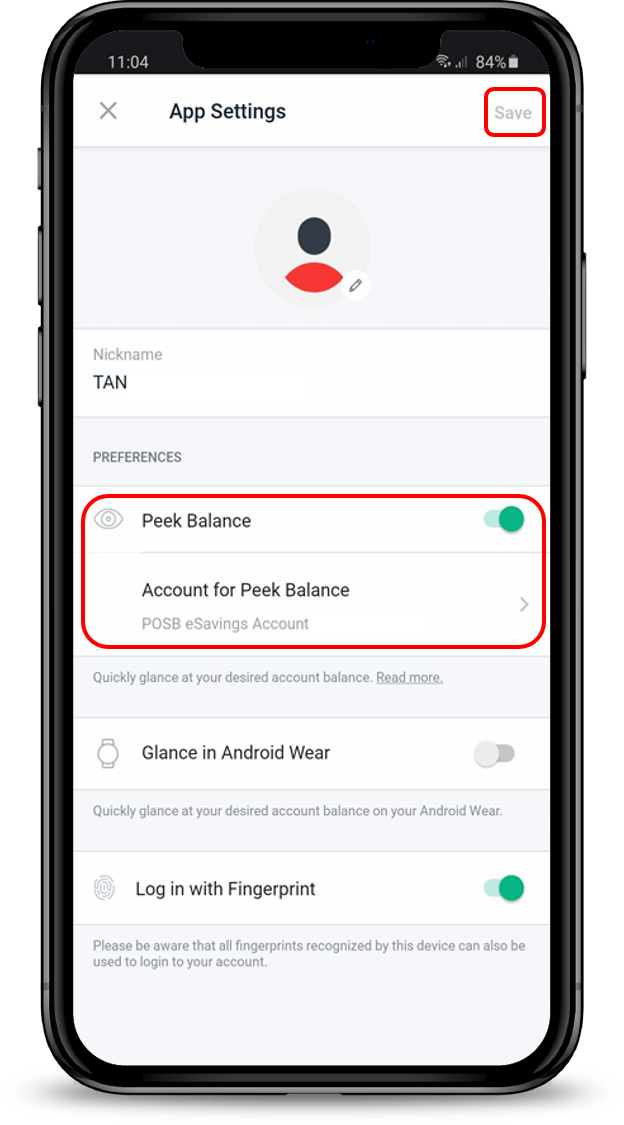

digibank mobile

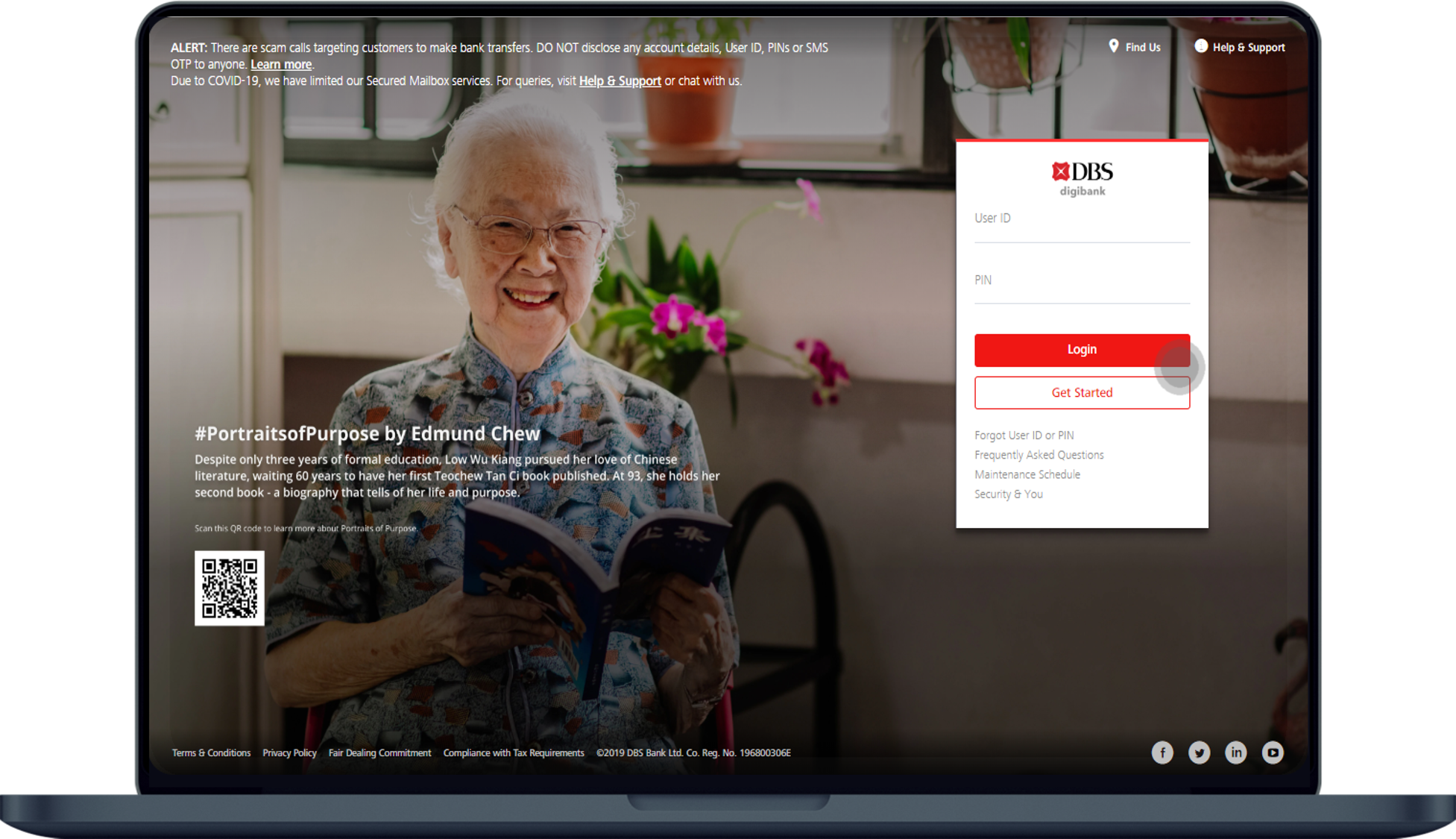

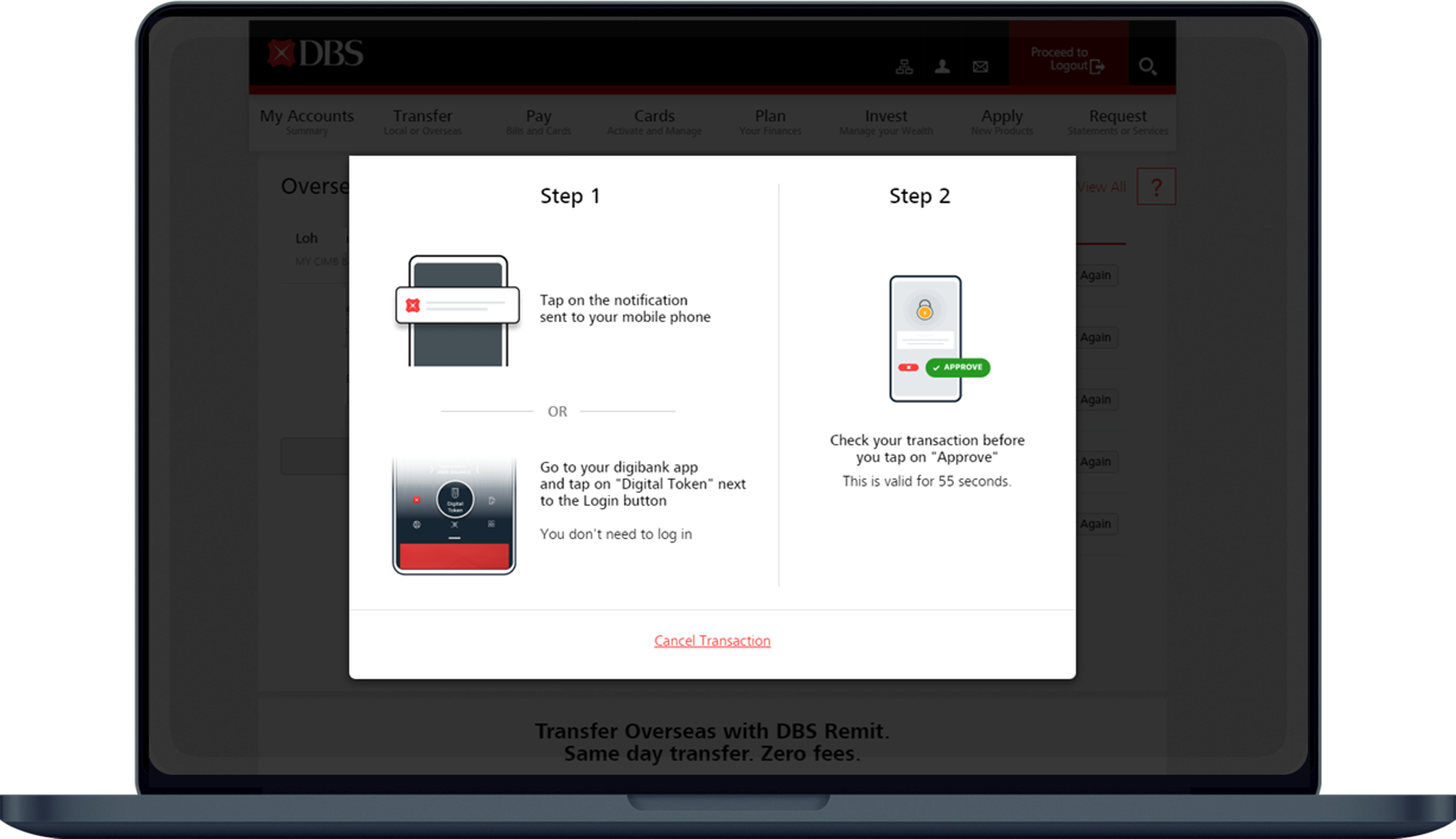

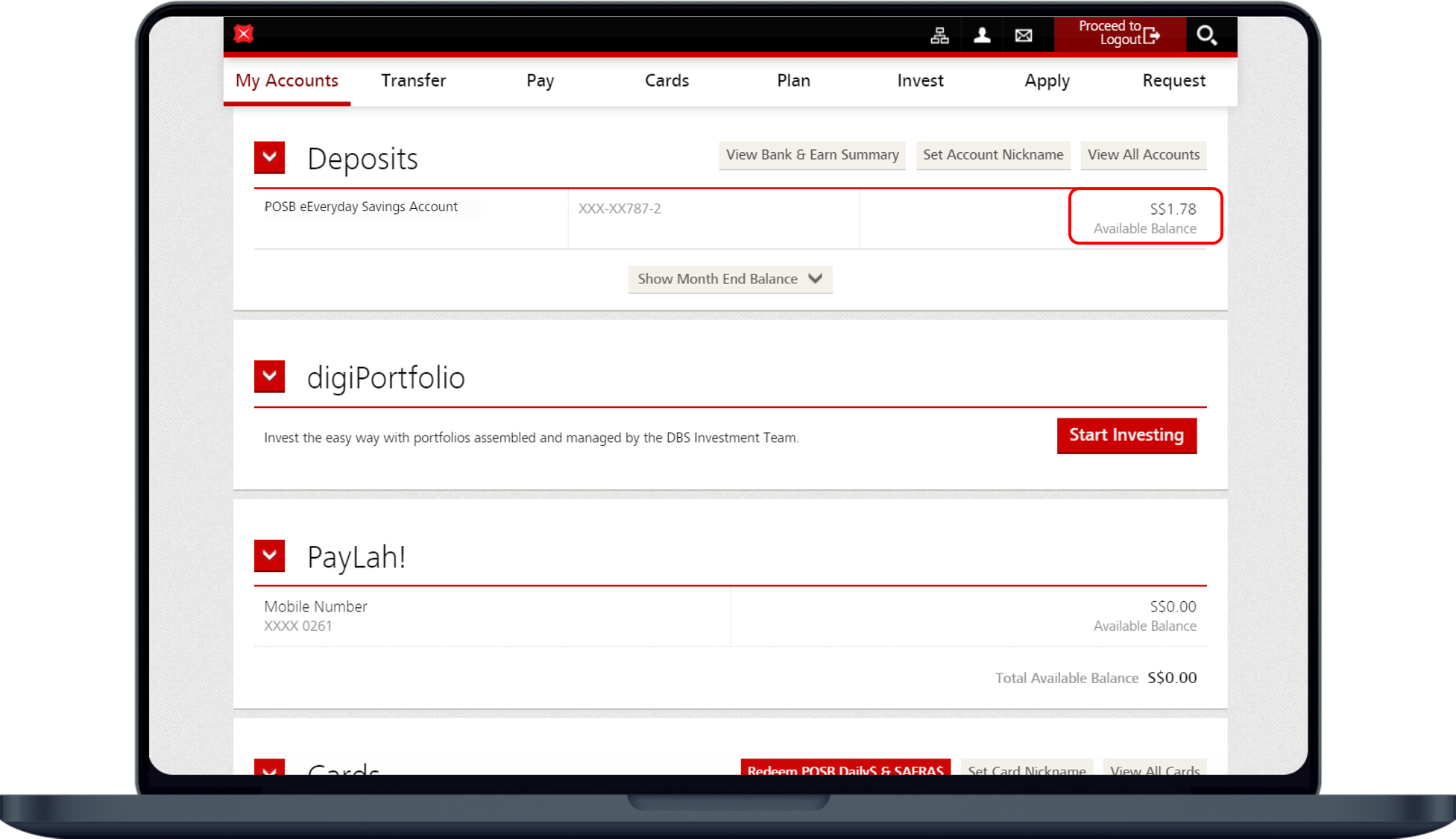

digibank online

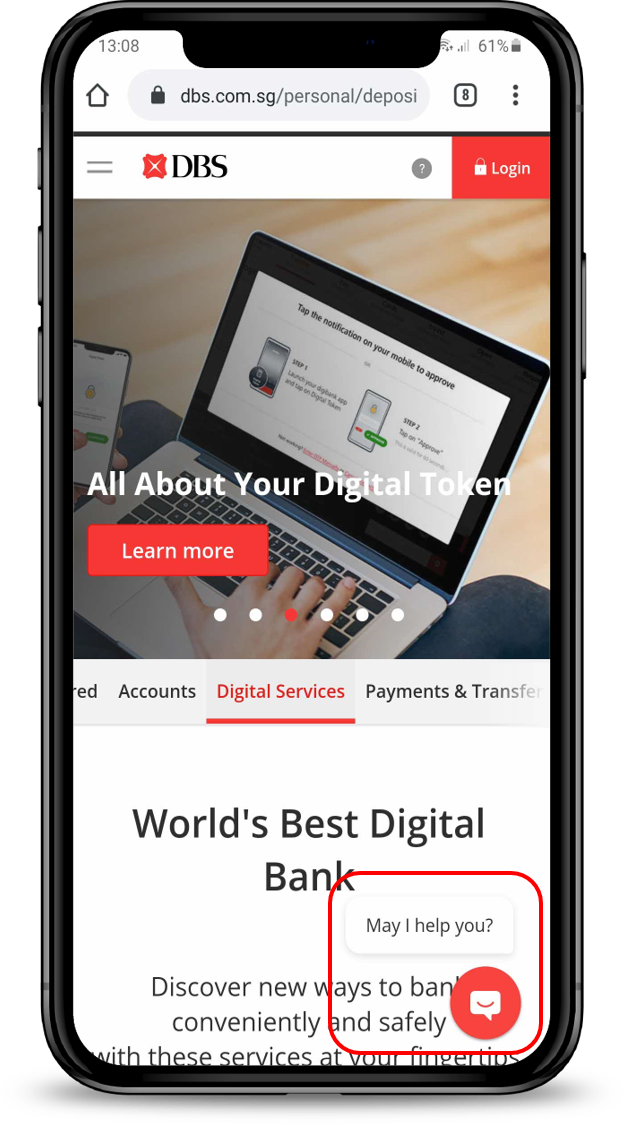

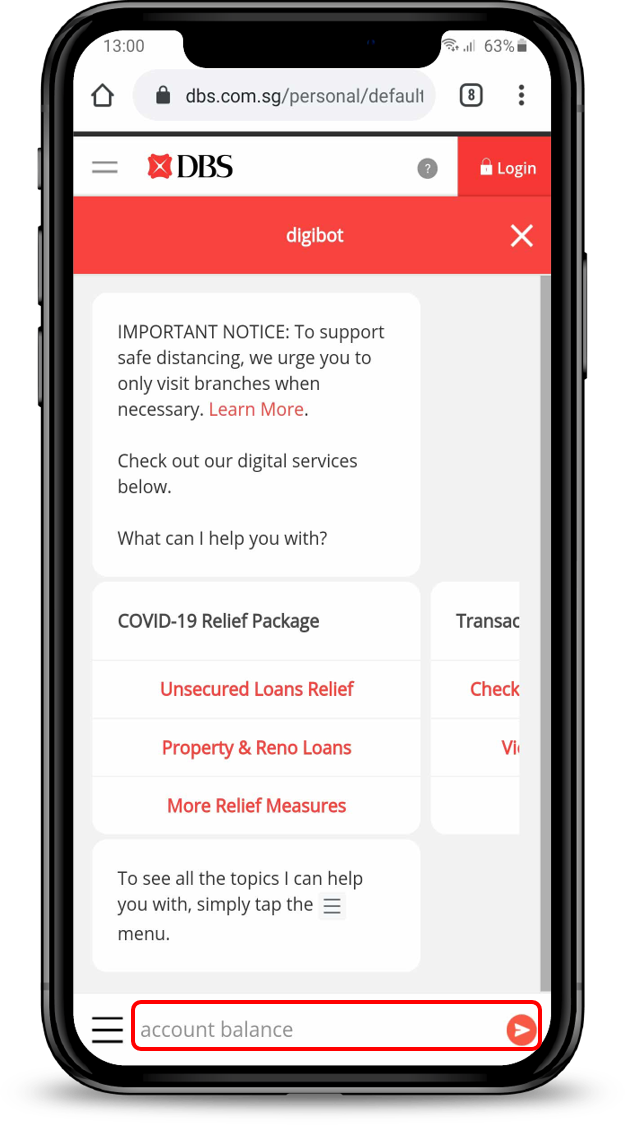

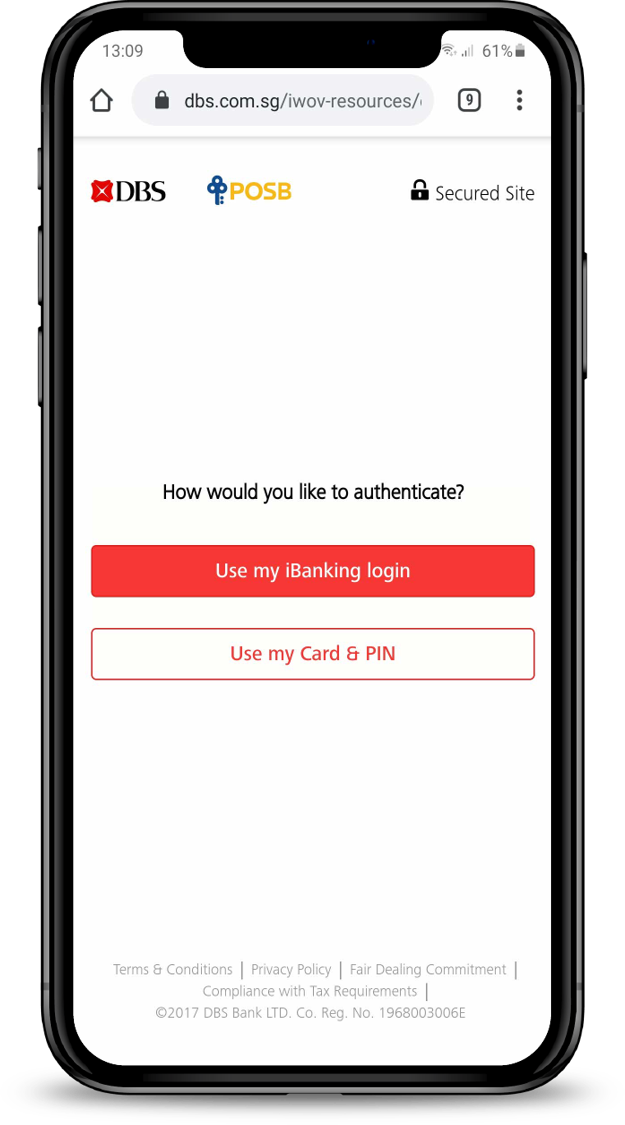

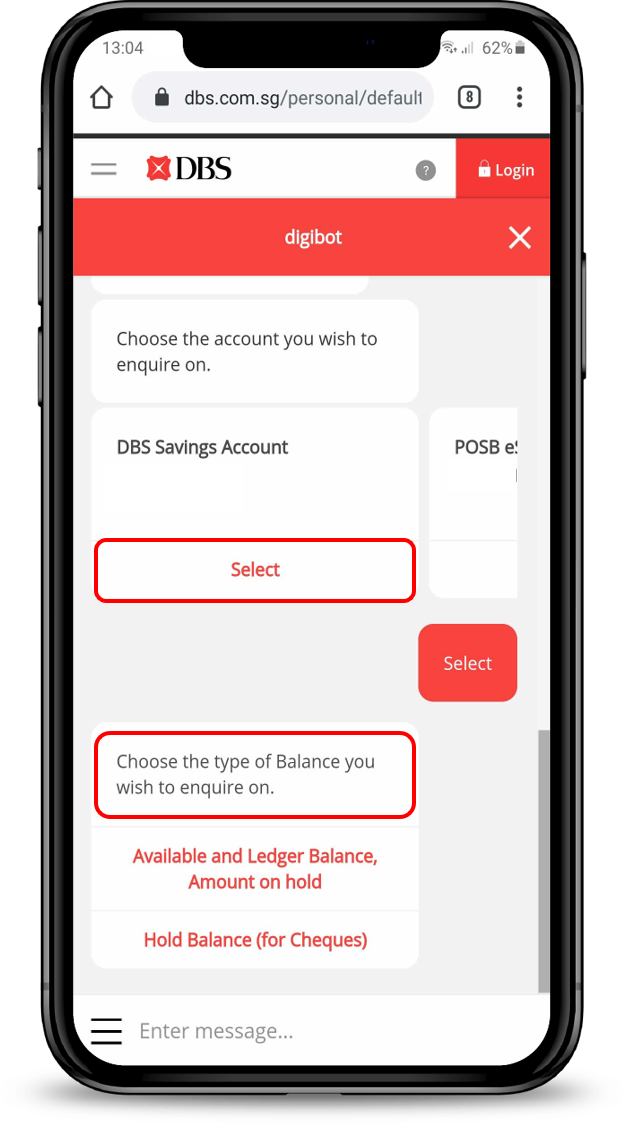

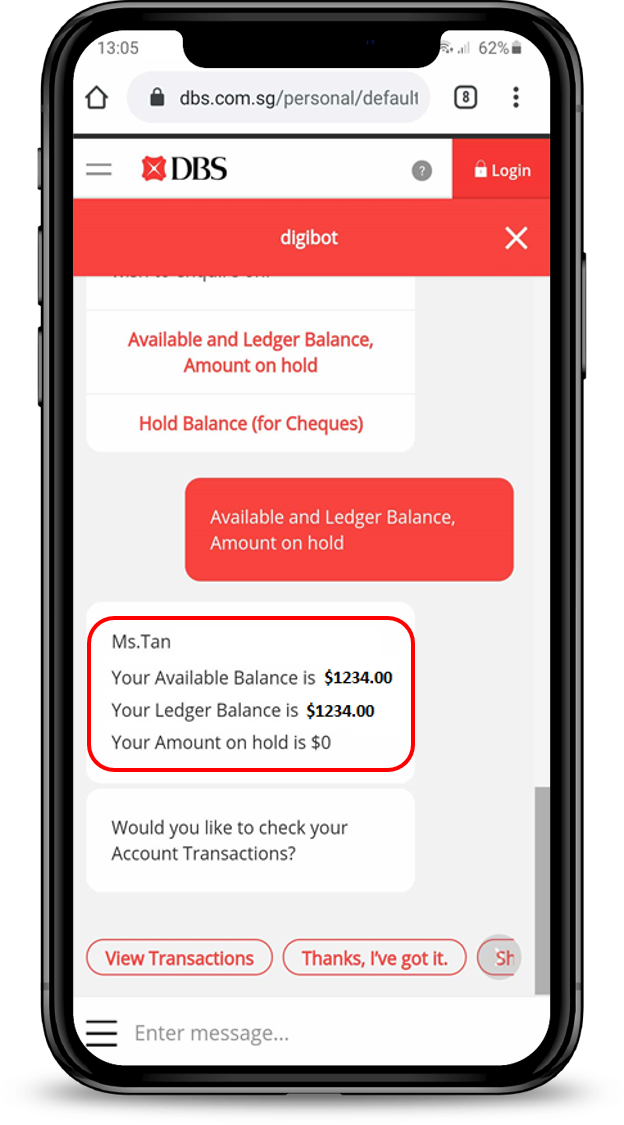

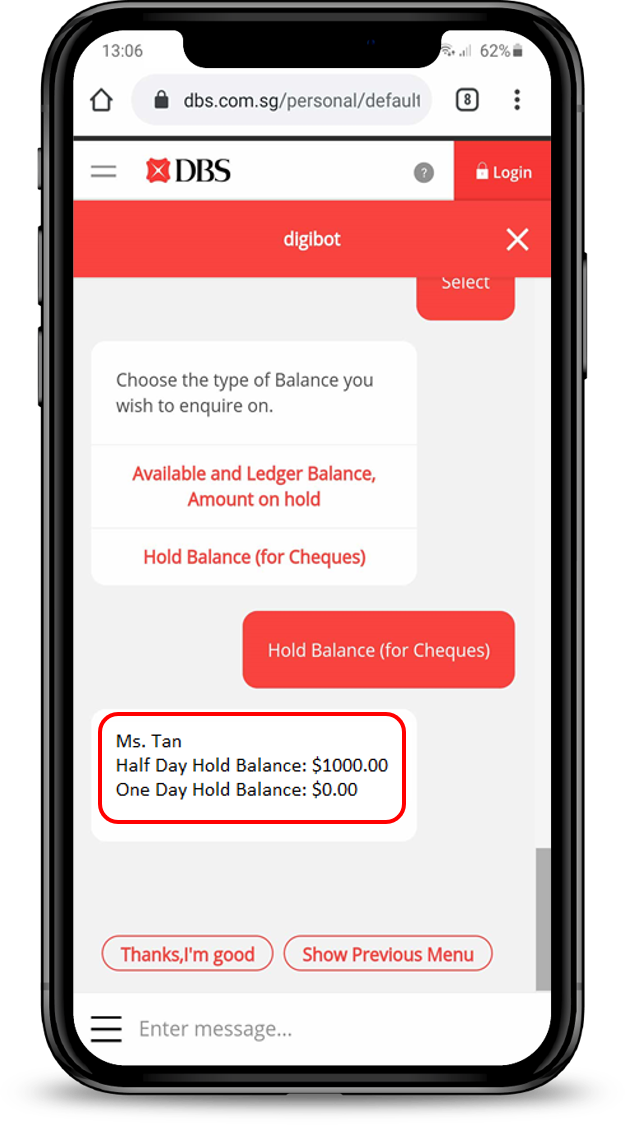

DBS Digibot

Phone Banking

- Dial 1800 111 1111 (from Singapore) or (+65) 6327 2265 (from Overseas).

- For a menu in English Press 1, for Mandarin Press 2.

- Enter your NRIC, Debit or Credit Card Number followed by # to proceed.

- Follow the steps for SMS OTP to proceed.

- Select Deposit Account Related Services.

- Press 1 to listen to your Account Balance(s).

DBS/POSB ATM

- Insert your ATM/Debit/Credit Card and key in your PIN.

- Select Balance Inquiry.

- Select your Account Type.

- Your Account Balance will be reflected.

- Select End and remove ATM card.

Find the nearest ATM using our Locator.

Differences in Total and Available Balance

Total balance is the total amount of money in your account, comprising of available

balance (usable funds) & earmarked/holding balance (non-usable funds).

Usable funds

- Available Balance: Available balance refers to the balance in your account available for spending, withdrawal or transfers.

Non-usable funds

- Earmarked Amounts: Earmarked amounts are funds set aside, possibly due to Debit Card spending and/or promotional Fixed Deposits that you may have signed up for.

Holding Balance: Holding balance indicates that a cheque deposit have been made into your account and is currently being processed for clearance.

- One-Day Holding Balance: Cheque has been collected and is being processed. Funds will be available within 1 business day if cheque is successfully cleared.

- Half-Day Holding Balance: Cheque has been processed and funds will be available after 2:00 pm on a business day if cheque is successfully cleared.

Was this information useful?