Apply for SGS Bonds/T-Bills

Learn more about Singapore Government Securities (SGS) Bonds and Treasury Bills (T-Bills) and how to apply using digibank easily.

For Singapore Savings Bonds (SSB), learn more on how to Apply for SSB.

Important information

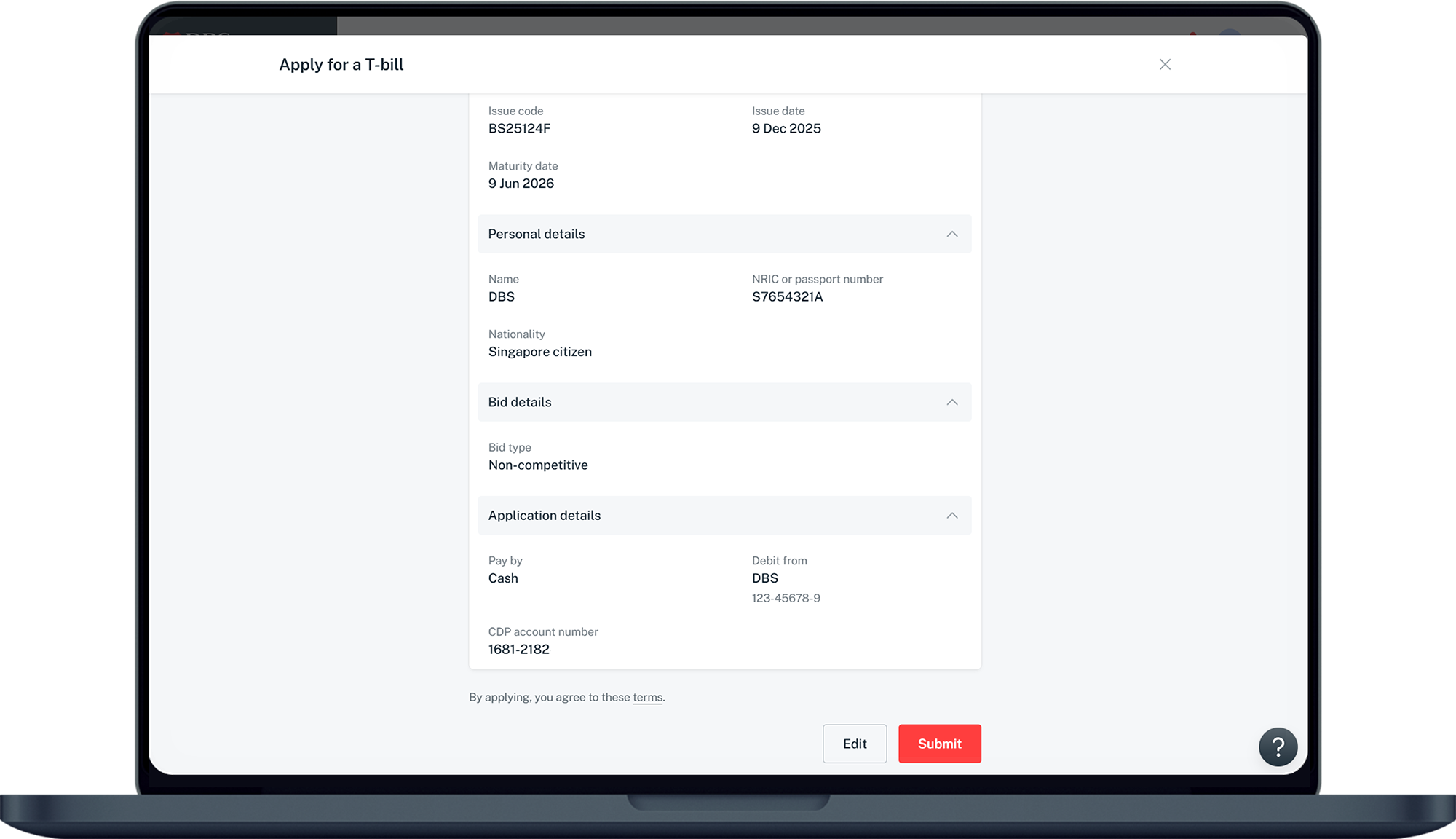

- Ensure you have selected the correct issuance code during your SGS Bonds/T-Bills application. Applications are strictly not revocable/amendable after submission.

- The closing date is 1 business day before auction. This applies to all transactions except CPFIS-SA transactions. Refer to MAS website for the Auctions and Issuance Calendar.

- Multiple submissions are allowed; they will be treated as an additional application and will not overwrite the previous submission.

- For SGS Bonds/T-Bills application in cash, you must have an individual CDP account with Direct Crediting Service activated; joint CDP accounts are not allowed. Apply for an individual CDP account.

- For Singapore Permanent Residents or Foreigners, ensure that your NRIC/Passport details matches CDP records.

- For CPFIS-OA / CPFIS-SA applications, ensure that you have sufficient balance from the time of application till issue date. Any proceeds credited to your CPFIA (e.g., SGS bond or T-bill maturity) will take one working day to reflect in your investible balance for CPFIS-OA investments.

- You can check your balance under My CPF Online Services > Investment > Amount available from Ordinary Account for professionally managed products / Amount available from Special Account for professionally managed products.

- From January 2025, we will no longer accept CPFSA applications for SGS Bonds/T-bills forms (Primary & Secondary market) from customer aged 55 and above, as the Special Account (SA) will be closed by Singapore’s Central Provident Fund (CPF).

Application deadlines, channels and fees

| SGS Bonds & T-Bills New Issue | ||||

|---|---|---|---|---|

| Investment Mode | Cash | SRS (DBS SRS Account Holders Only) |

CPF - Ordinary Account (DBS CPFIA Holders Only) |

CPF - Special Account |

| Application Start | Announcement Date from 6 pm | Announcement Date | ||

| Application End | Online: 1 business day before the Auction Date at 9 pm | 2 business days before the Auction Date at 10 am | ||

| Fees | No Charges, all application fees are waived | $2.50 + GST each for purchase and maturity. There is an additional fee of $2.00 + GST per counter per quarter. |

No Charges | |

| Minimum Application | S$1,000 | |||

| Maximum Application | Up to S$1m per applicant | |||

| How to Apply | ATM, digibank online and mobile | digibank online and mobile only | Branch Only | |

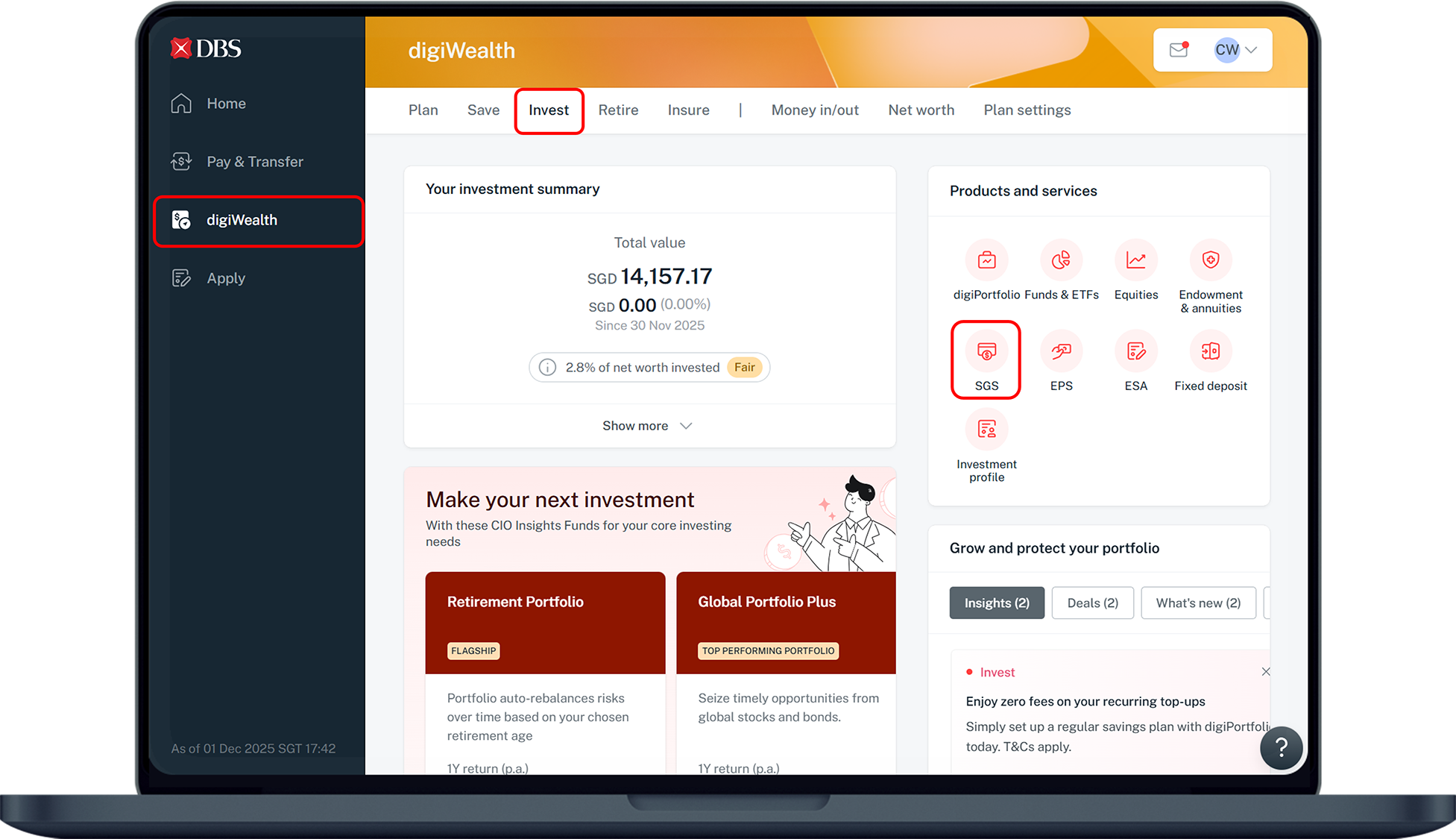

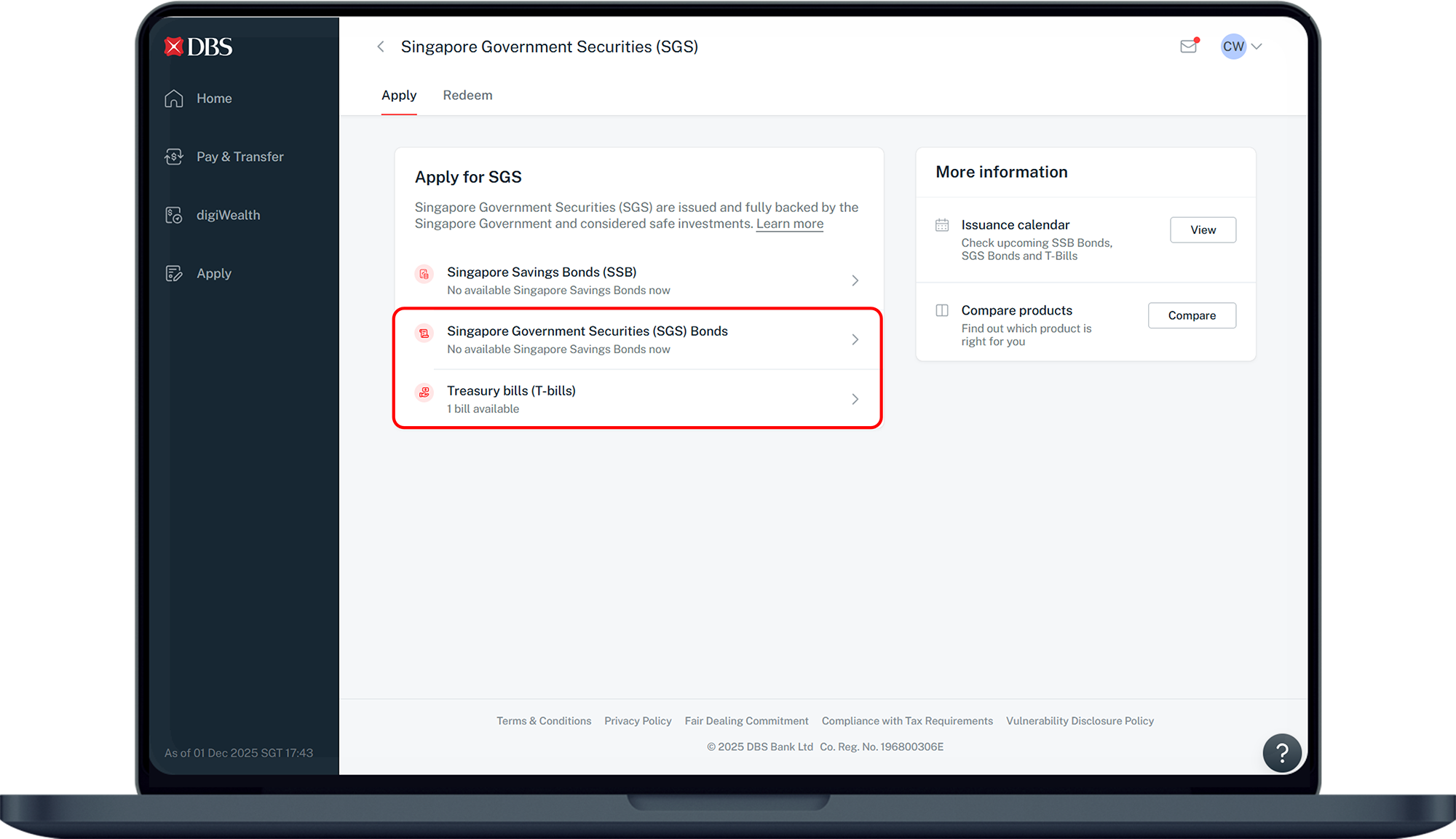

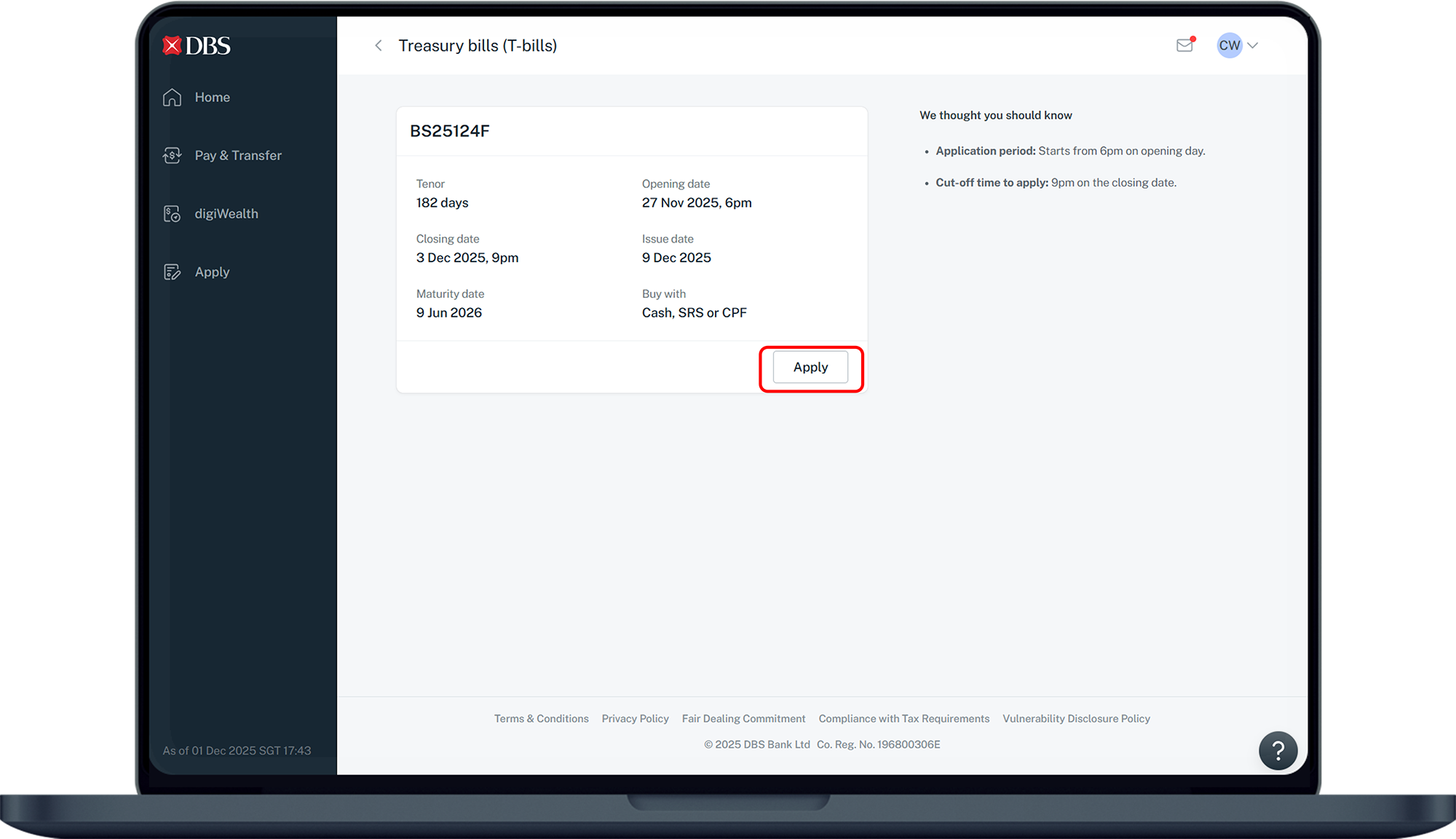

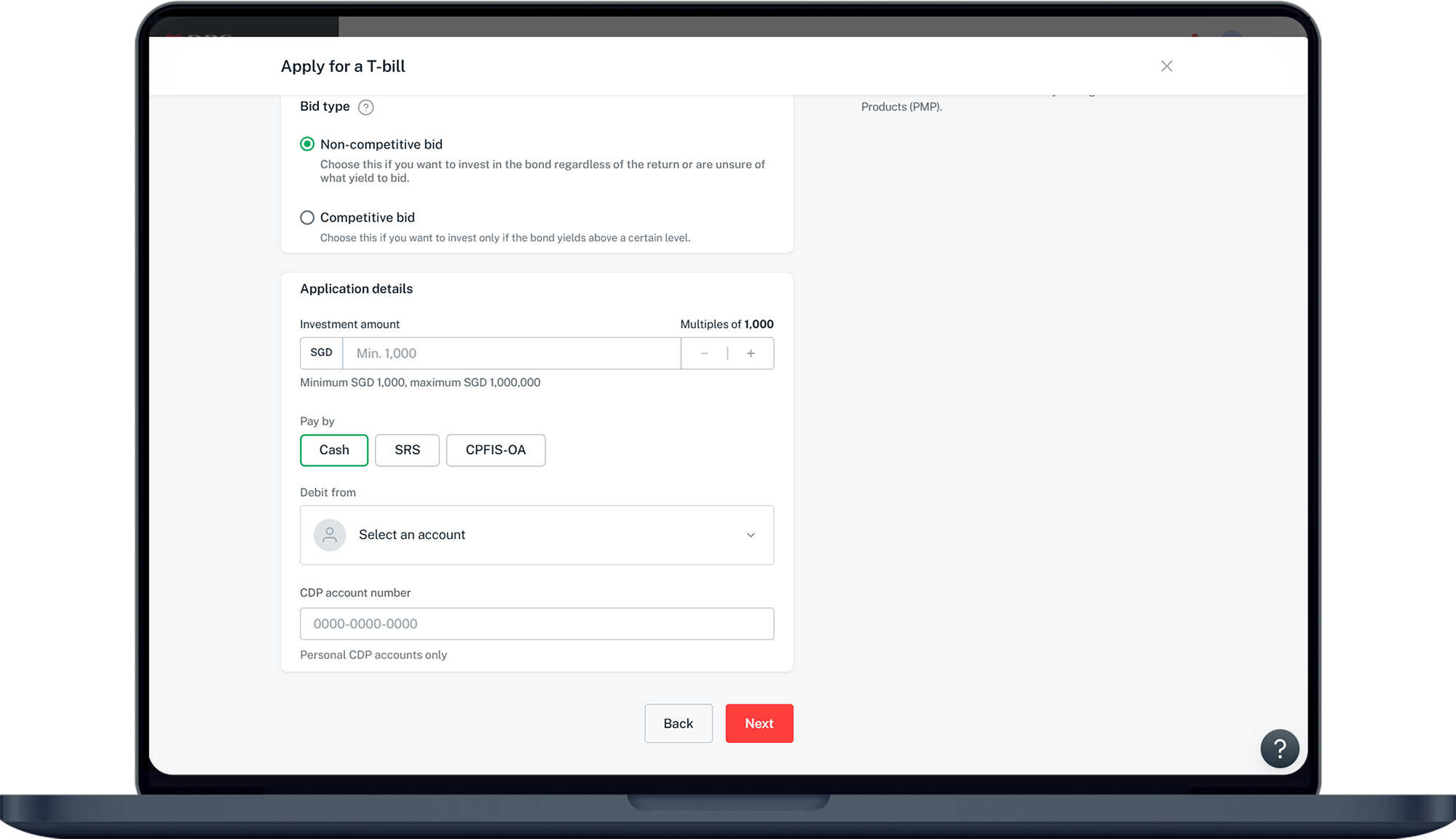

How to apply?

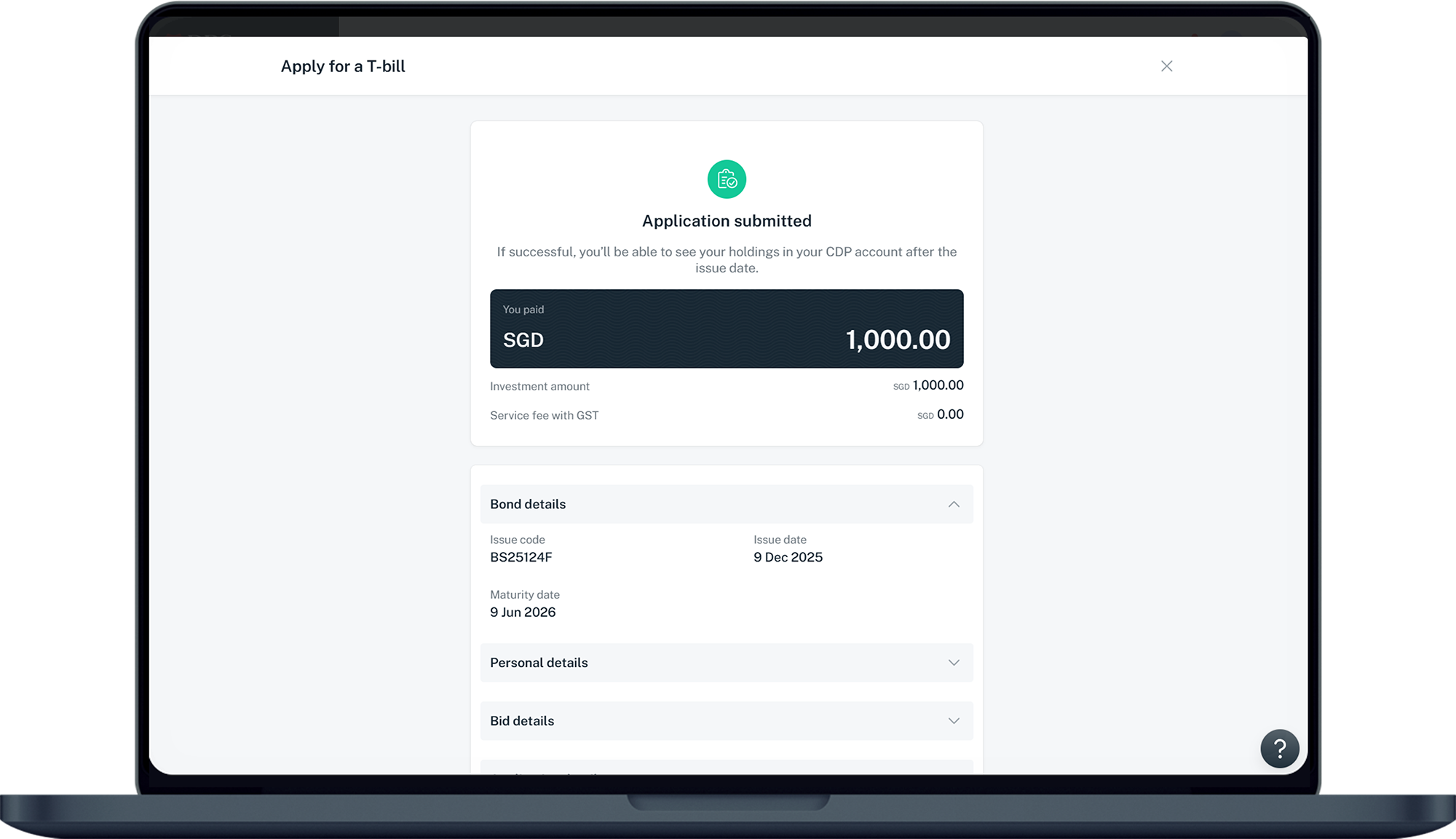

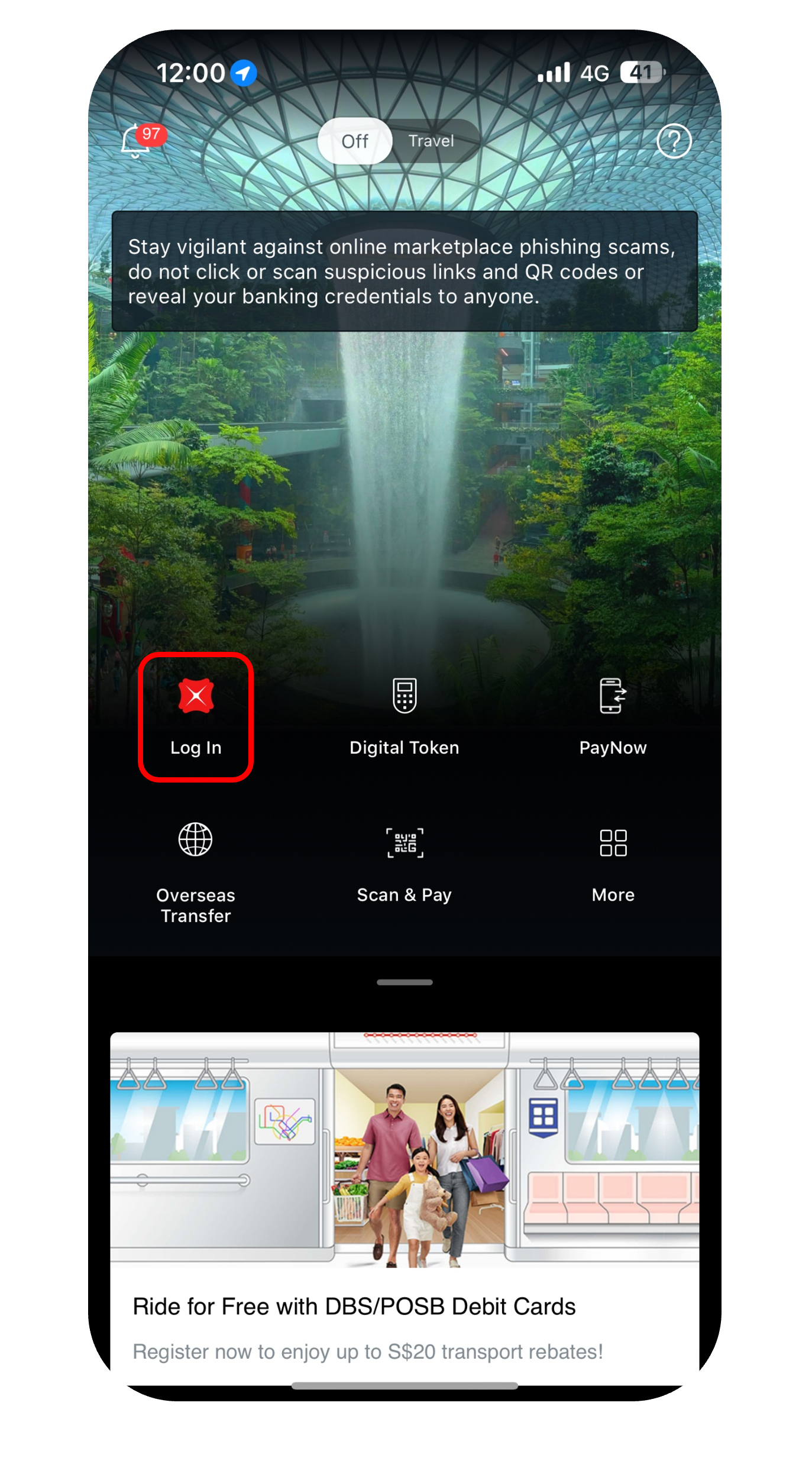

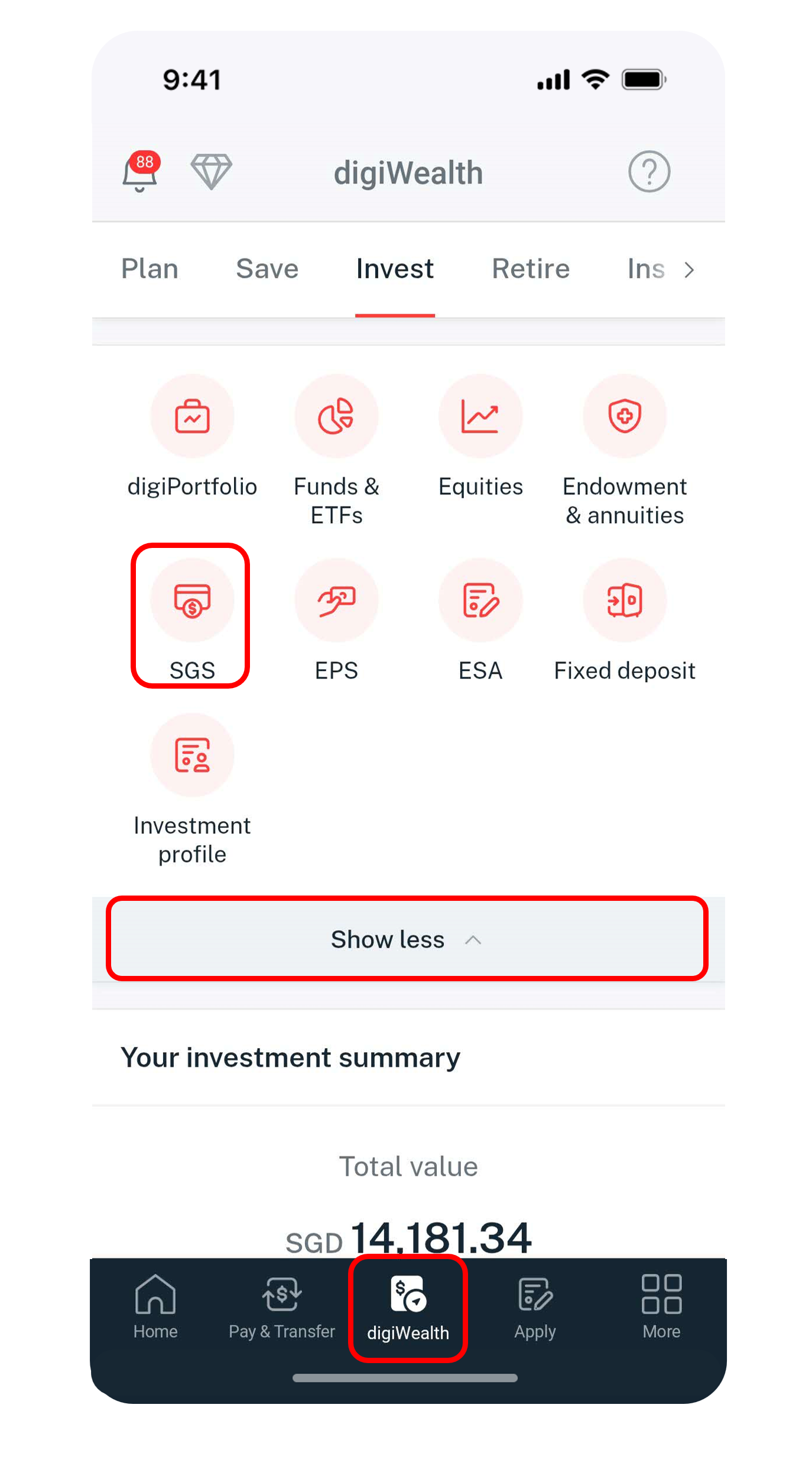

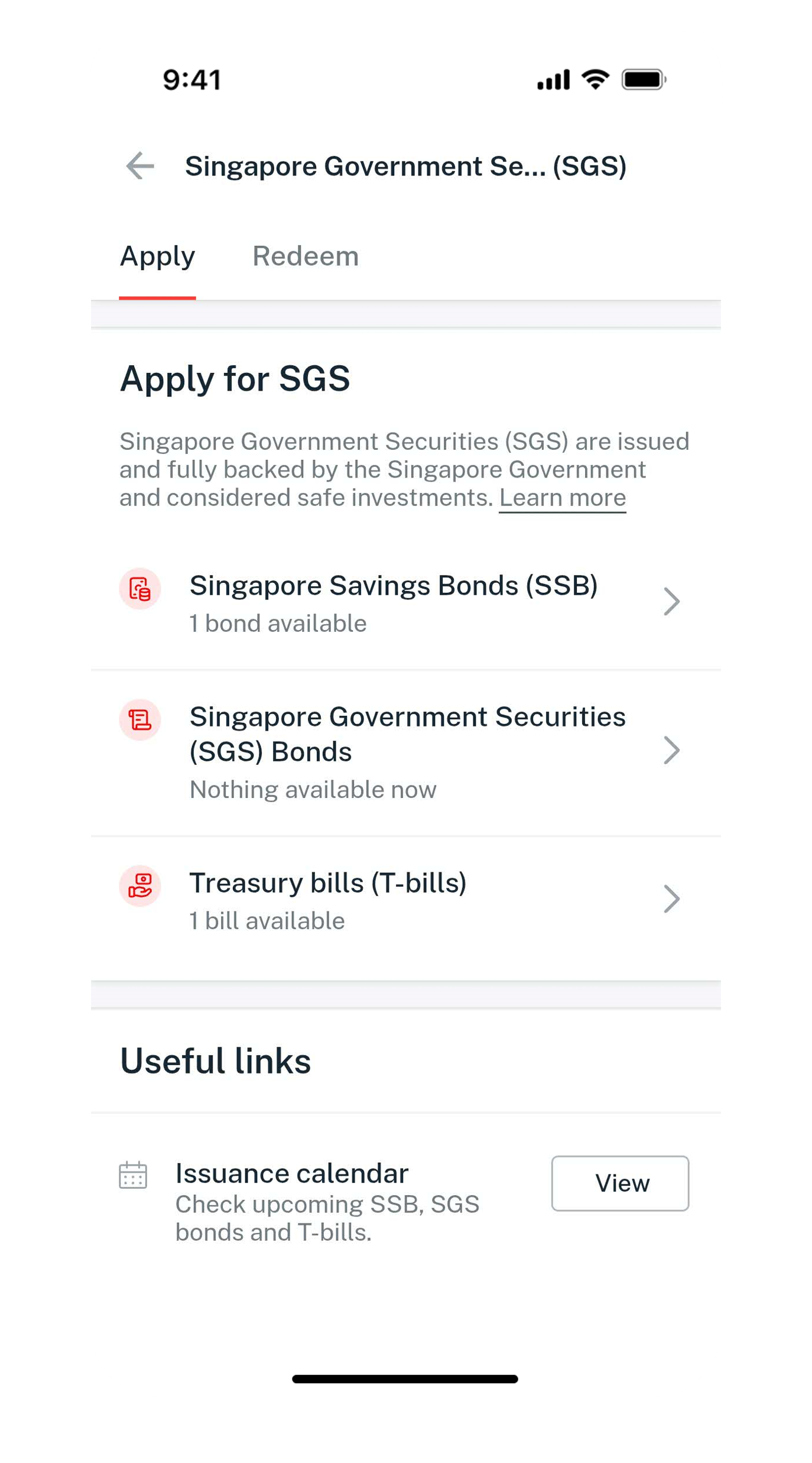

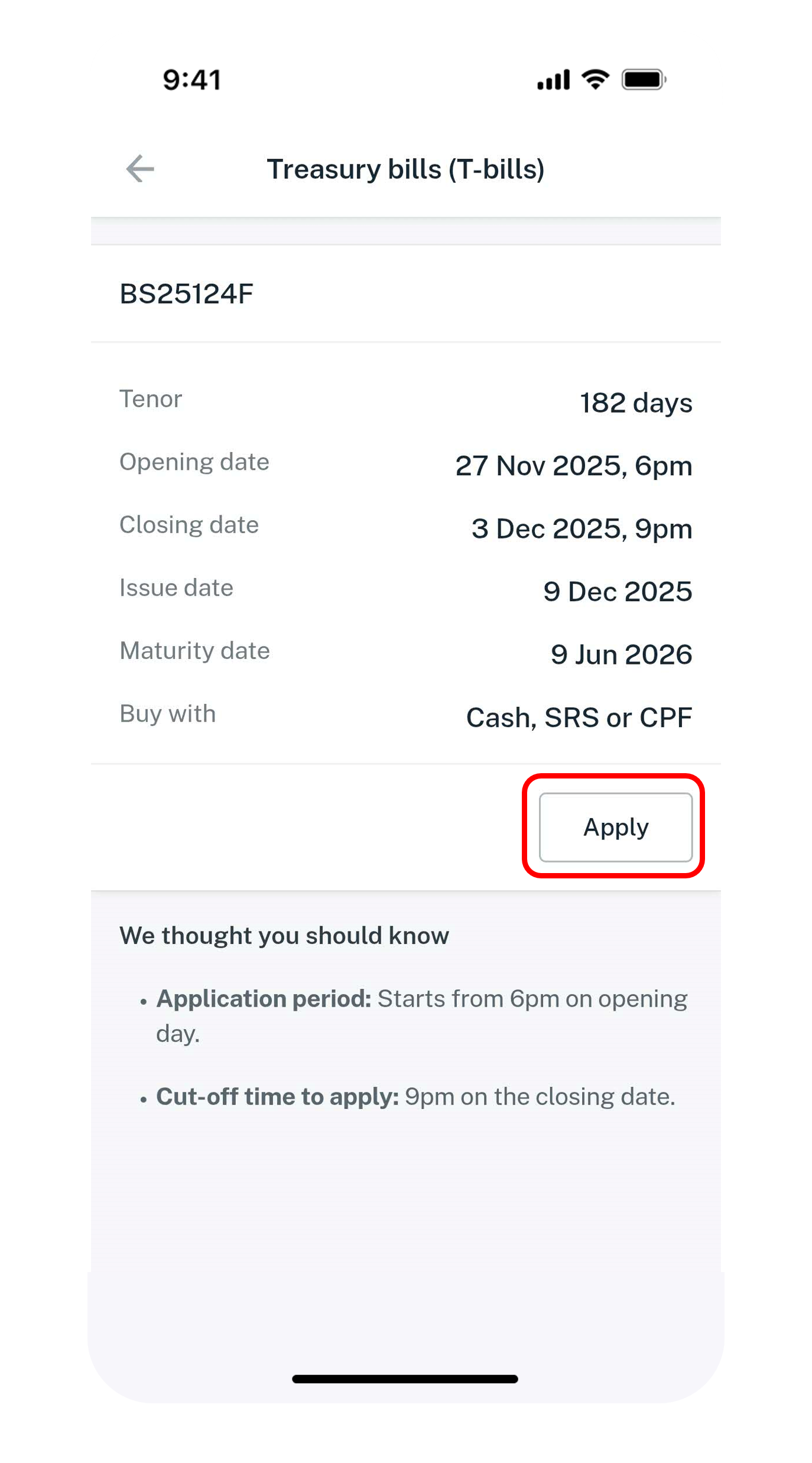

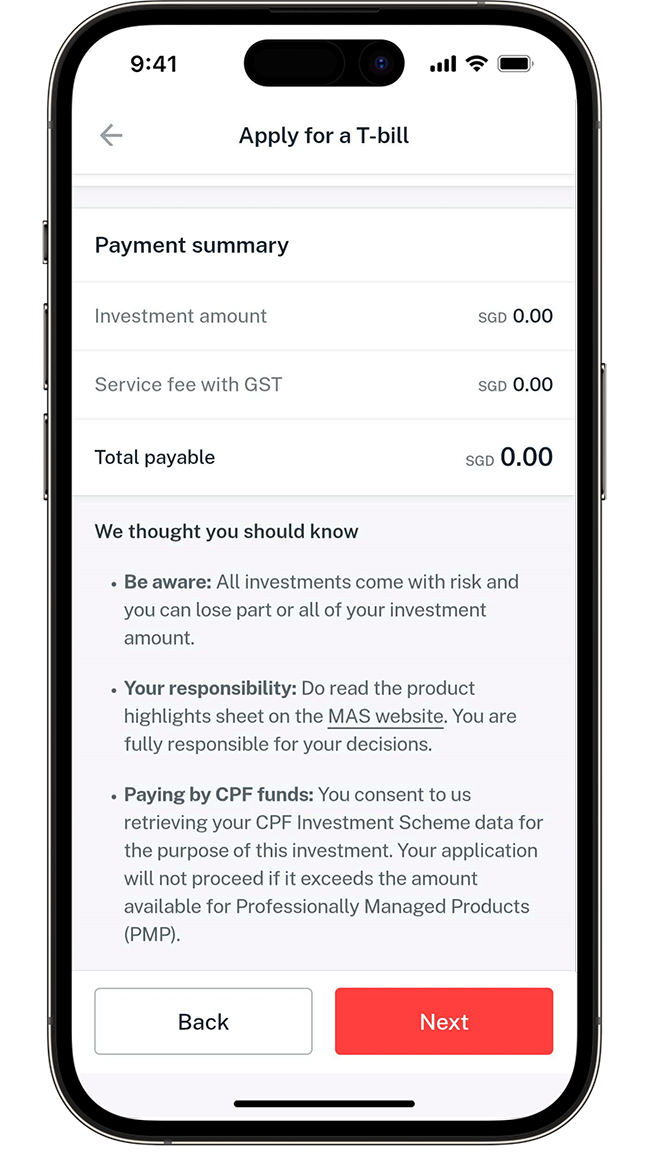

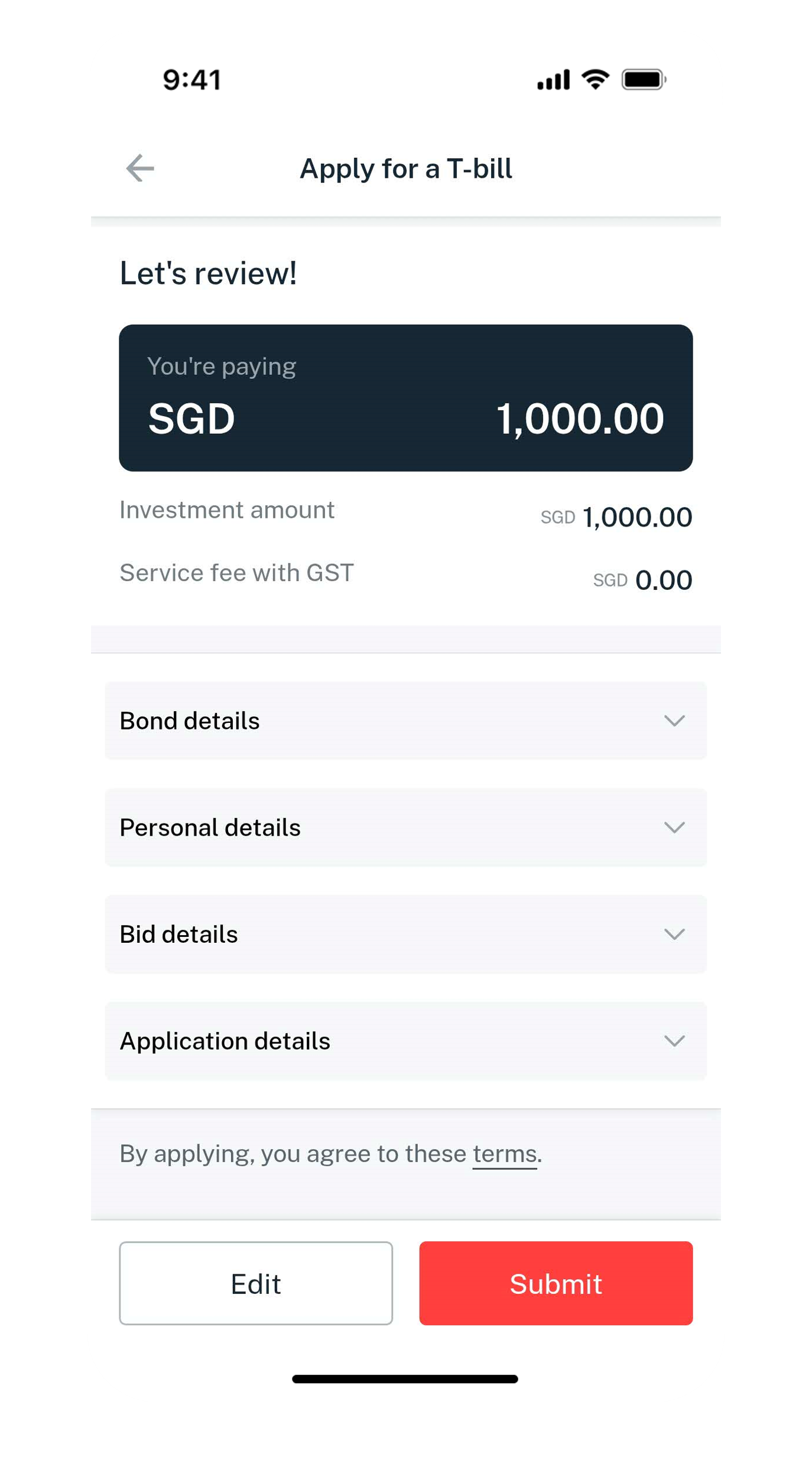

How to apply SGS Bonds/T-bills on digibank

Note

- You may check your bank-registered email for a confirmation on the successful status of your application submission. Learn more about how to Update Email Address.

Difference between Competitive and Non-Competitive bid

| Non-Competitive | Competitive | |

|---|---|---|

| Overview | You only specify the amount you want to invest, not the yield. | You need to specify the amount and yield you want to invest. |

| Allotment | Non-competitive bids will be allotted first, up to 40% of the total issuance amount. | Note that you may not get the full amount that you applied for, depending on how your bid compares to the cut-off yield. |

| Reason to select | Choose this if you wish to invest in the bond regardless of the return or are unsure of what yield to bid. | Submit a competitive bid, if you wish to invest in the bond only if it yields above a certain level. |

Timeline of Events

Application using:

| Timeline | Application using Cash |

|---|---|

| Application |

Where to apply: digibank online/ digibank mobile /ATM When to apply: From 6pm on Announcement Date to 1 business day before Auction Date at 9pm. Funds will be debited from your bank account at the point of application. |

| Auction date | If you are unsuccessful in your application, the entire application amount will be refunded to the debiting account within 1-2 working days from the auction date. (For T-bills only) If you are successfully allotted a T-bill by MAS, a discount (based on the cut-off price) will be refunded to your debiting account within 1-2 working days from the auction date. |

| Issue date | If you are successful in your application, your holdings will be credited to your CDP account by 1 business day after the issue date. |

| Coupon payouts (SGS Bonds only) | (For SGS bonds only) You will receive the coupon payment for your SGS bonds on the first day of the month, every 6 months from the bond's issue date, into your Direct Crediting Service (DCS) bank account*. In the event the payment date falls on a public holiday, the coupon will be paid on the next business day. T-bills do not pay coupons; instead, they are issued at a discount to the face (par) value. The interest is paid at maturity and is the difference between the purchase price and the face value. |

| Maturity Date |

On maturity date, the following maturity proceeds will be automatically credited to your Direct Crediting Service (DCS) bank account by end of the day*:

|

| Timeline | Application using SRS |

|---|---|

| Application | Where to apply: digibank online/ digibank mobile When to apply: From 6pm on Announcement Date to 1 business day before Auction Date at 9pm. Funds will be earmarked from your SRS account balance at the point of application. |

| Auction date | If you are unsuccessful in your application, the full earmark amount will be released from your SRS account balance. (For T-bills only) If you are successfully allotted by MAS, the earmarked amount will be released & revised amount will be earmarked based on the allocation amount, less the discount (based on the cut-off price). |

| Issue date | If you are successful, the allocation amount (for T-bills, this will be less the discount, based on the cut-off price), will be deducted from your SRS account and displayed in your SRS Transactions. You may check your SRS Account via DBS digibank to view your holdings by the issue date (end of day). |

| Coupon payouts (SGS Bonds only) | (For SGS Bonds only) You will receive the coupon payment for your SGS bonds on the first day of the month, every 6 months from the bond's issue date, into your SRS Account. In the event the payment date falls on a public holiday, the coupon will be paid on the next business day. Note: T-bills do not pay coupons; instead, they are issued at a discount to the face (par) value. The interest is paid at maturity and is the difference between the purchase price and the face value. |

| Maturity Date |

On maturity date, the following will be automatically credited to your SRS bank account:

|

| Timeline | Application using CPFIA / CPF-SA |

|---|---|

| Application |

Where to apply:

|

| Auction date | If you applied using (a) CPF Investment Scheme - Ordinary Account or (b) CPF Special Account, you would only know the results on the Issue date. |

| Issue date | If you were successfully allotted by MAS & have sufficient CPF balance, the allocation amount* would have been debited from your CPF-OA/CPF-SA account at a date between the auction date and issue date. You will then be able to refer to digibank for your CPFIA holdings (for CPFIS-OA applications) or CPF Portal (for CPFIS-SA applications) by the issue date (end of day). *For T-bills only, the amount deducted would be less the discount (based on the cut-off price). |

| Coupon payouts (SGS Bonds only) | (For SGS Bonds only) You will receive the coupon payment for your SGS bonds on the first day of the month, every 6 months from the bond's issue date, into your CPF Investment Account (for CPFIS-OA) or CPF Special Account (for CPFIS-SA). In the event the payment date falls on a public holiday, the coupon will be paid on the next business day. Note: T-bills do not pay coupons; instead, they are issued at a discount to the face (par) value. The interest is paid at maturity and is the difference between the purchase price and the face value. |

| Maturity Date |

On maturity date, the following will be automatically credited to your CPF Investment Account or CPF Special Account:

|

Announcements and results

Auction Result

- For non-competitive final bid prices, refer to MAS Auctions and Issuance Calendar > View Details > Closing Yield (SGS Bonds) / Cut-off Yield (T-Bills).

- For Cash applications, please refer to your CDP account/statements.

- For SRS/CPF applications, please refer to your SRS/CPF accounts/statements.

Differences between SGS Bonds and T-Bills

| SGS Bonds | T-Bills | |

|---|---|---|

| Overview | Long-term, tradable government debt securities that pay a fixed coupon every 6 months. | Short-term, tradable government debt securities that investors buy at a discount. |

| Maturity Period | 2 to 50 years | 6 months to 1 year |

| How does it work? | Coupon payment; semi-annual coupon starting from the month of issue. | No coupon payment; discount is returned within 1-2 working days after the auction date. |

| Example | Invest $10k, with a 10 Year Maturity date and coupon rate of 1% p.a.

|

Invest $10k in 6-Mths T-Bill with a cut-off yield of 1% p.a.

|

More information

- There is no early redemption for SGS and T-Bills before the maturity date, but customers may sell the T-bill through our DBS/POSB branches via the secondary market.

- However, please note that the prices of bonds may rise or fall before maturity & customers may lose their principal amount.

Was this information useful?