Understand your Home Loan Transaction History

Learn how to obtain and understand your mortgage loan transaction history via digibank.

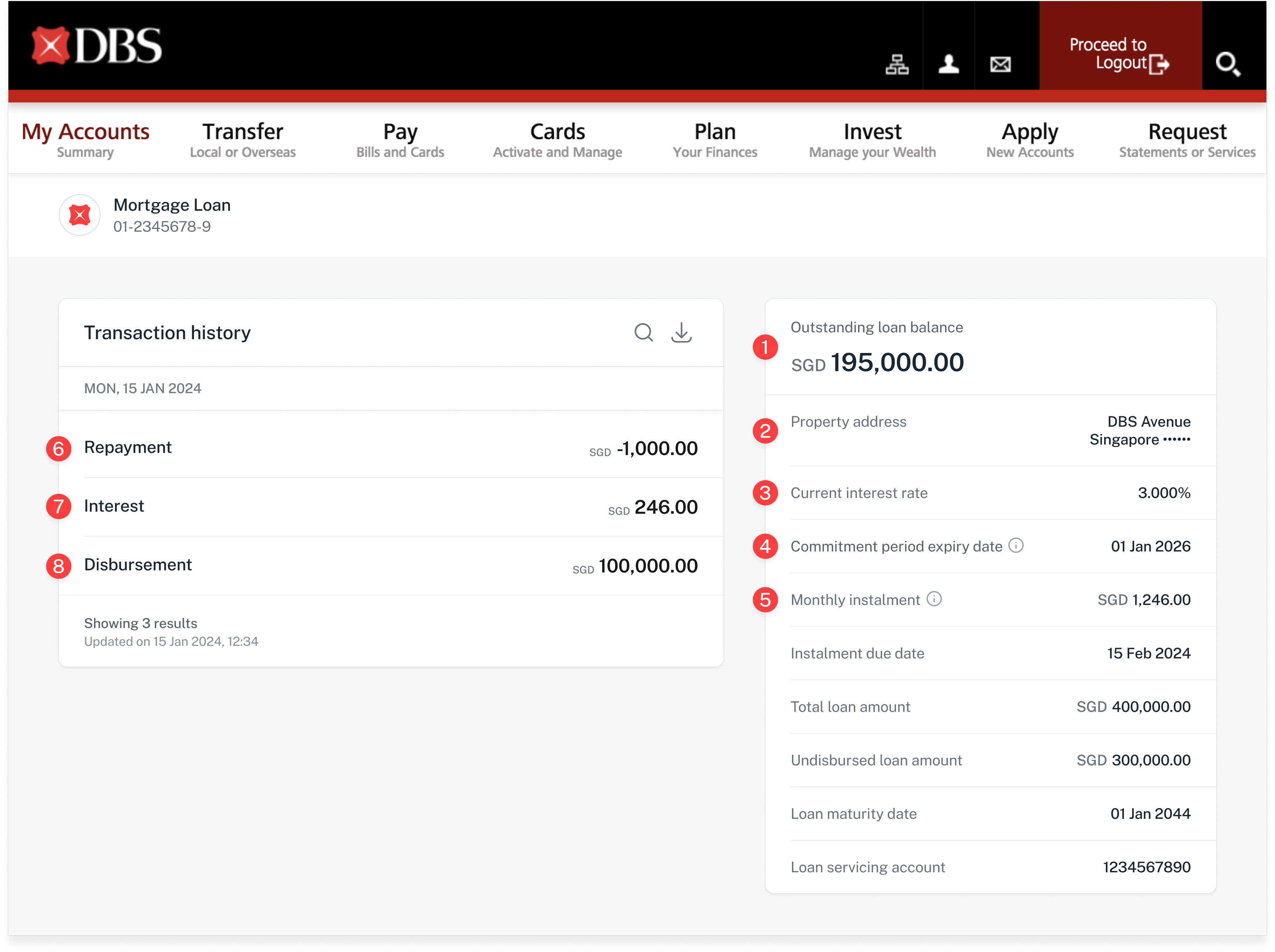

Click here to enlarge image below.

Key Features

- Total outstanding mortgage loan balance.

- Property address of your mortgage loan.

- Current interest rate your loan.

- Expiry date for your current mortgage loan commitment period.

- Your next monthly instalment amount and due date.

-

Repayment transactions posting

- Repayment: Cash repayment collected from your loan servicing account.

- Repayment (CPF): CPF repayment received from your CPF Account. Each borrower's repayments will be shown individually.

-

Interest: Interest charged for the previous month will be posted on the 1st of each month for private properties and 15th of each month for for HDB flats (or the next business day if the 1st or 15th is a non-working day).

Mortgage loan interest is computed on a daily rest basis. This means that if there is any repayment (including partial repayment), disbursement or change in interest rate during the month, the interest computation will be adjusted accordingly.

For example: If there is a disbursement on 8 Mar 2023, the interest reflected on 1 Apr 2023 in your transaction history will include:- Interest calculated from 1 Mar 2023 to 7 Mar 2023, based on the initial outstanding principal before the disbursement on 8 Mar 2023.

- Interest calculated from 8 Mar 2023 to 31 Mar 2023, based on the resulting outstanding principal after the disbursement on 8 Mar 2023.

- Amount disbursed by the bank.

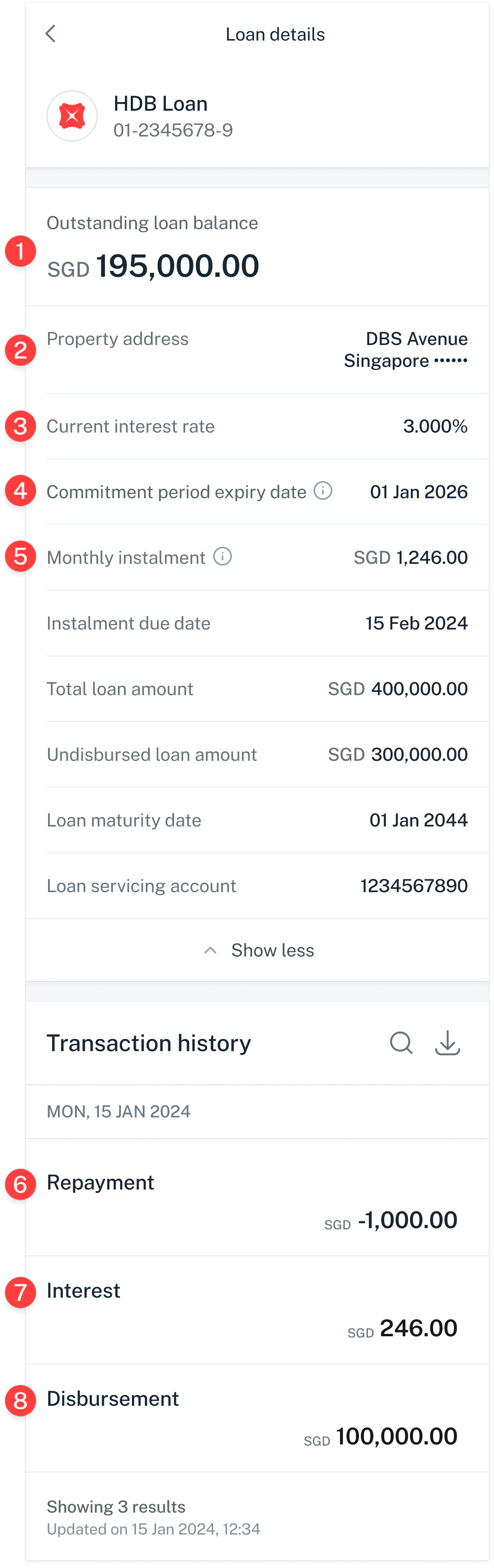

Click here to enlarge image below.

Key Features

- Total outstanding mortgage loan balance.

- Property address of your mortgage loan.

- Current interest rate your loan.

- Expiry date for your current mortgage loan commitment period.

- Your next monthly instalment amount and due date.

-

Repayment transactions posting

- Repayment: Cash repayment collected from your loan servicing account.

- Repayment (CPF): CPF repayment received from your CPF Account. Each borrower's repayments will be shown individually.

-

Interest: Interest charged for the previous month will be posted on the 1st of each month for private properties and 15th of each month for for HDB flats (or the next business day if the 1st or 15th is a non-working day).

Mortgage loan interest is computed on a daily rest basis. This means that if there is any repayment (including partial repayment), disbursement or change in interest rate during the month, the interest computation will be adjusted accordingly.

For example: If there is a disbursement on 8 Mar 2023, the interest reflected on 1 Apr 2023 in your transaction history will include:- Interest calculated from 1 Mar 2023 to 7 Mar 2023, based on the initial outstanding principal before the disbursement on 8 Mar 2023.

- Interest calculated from 8 Mar 2023 to 31 Mar 2023, based on the resulting outstanding principal after the disbursement on 8 Mar 2023.

- Amount disbursed by the bank.

Was this information useful?