- Insufficient to only allocate capital based on environmental responsibility scoring systems

- Innovations into technologies that reduce energy & carbon intensity are needed

- As many innovations are nascent, private capital providers are well-placed to support

- Exposure to emerging decarbonisation tech via private asset funds offers investment opportunities

- Investors can make meaningful impact while generating attractive returns

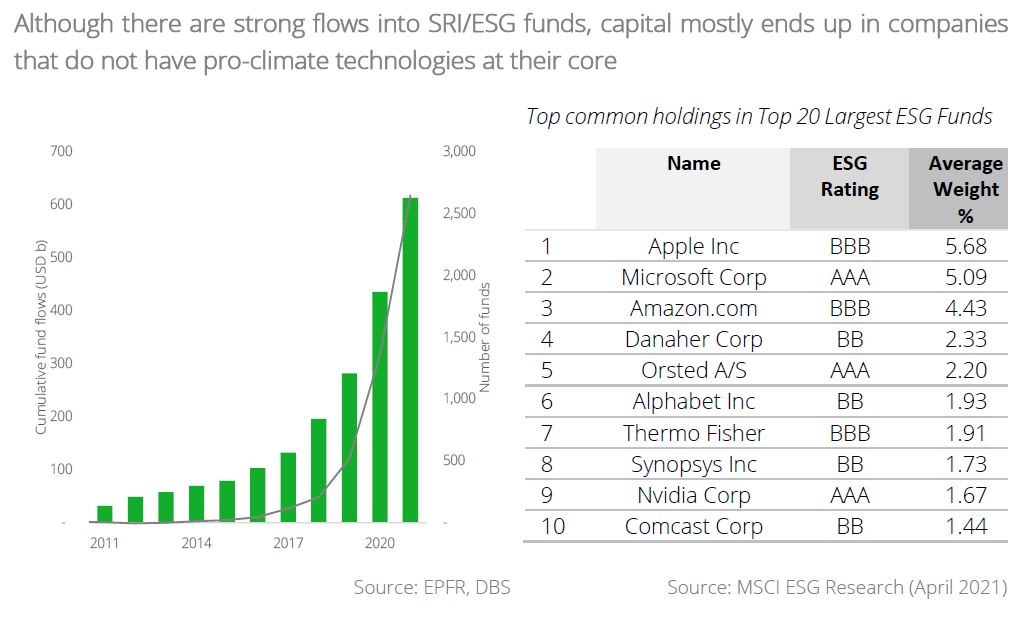

Green investing needs an overhaul. With the promulgation of green narratives, the investing world today boasts no shortage of channels to facilitate deploying capital in an environmentally friendly manner. Scores that appraise environmental responsibility are now recognised as a mainstay of investing, and the number of equity funds classified as social responsible investing/environmental, social, and governance (SRI/ESG) has ballooned tenfold since a decade ago.

Although investors may be eager to jump onto the green investing bandwagon, it is difficult to rid oneself of the nagging scepticism about whether capital allocation based on such scoring systems alone can bring about the impact needed to achieve our climate goals. The truth is that while stellar ratings suggest that a company may have been relatively responsible in mitigating its negative externalities, simply being “less bad” does not necessarily imply a path of progress.

As with all forms of human progress, innovation is indispensable. Decades of a “growth at all costs” mentality without considering the environmental ramifications have brought us to where we are today – faced with a looming climate catastrophe threatening the very existence of our species. Yet reversing this millennia-old positive correlation between gross domestic product (GDP) growth and carbon emissions cannot be achieved just through a simple revision of capital allocation practices within existing corporations alone. This formidable task requires a thorough overhaul of our economic modus operandi, achievable only through disruptive, avant-garde solutions. Fortunately, many such solutions are already under development, and are ripe for the picking of far-sighted investors who wish to be early adopters in the foundations of a more climate-friendly world.

The private market edge – Invest in the foundations of a low-carbon world. The opportunity to supercharge these solutions gives investors the chance to build the carbon-neutral world of our future. Given the nascence of many such disruptive technologies, private capital providers are best suited to partner in their development. From an investor’s perspective, gaining exposure to emerging decarbonisation technologies via private asset funds delivers the best of both worlds – the opportunity to make meaningful impact, while generating attractive returns from doing so.

Download the PDF to read the report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.