- The CDS and T-bill markets are pricing in heightened risks of US default, albeit a technical one

- Potential consequences include higher costs of borrowing, falling asset prices, tightening liquidity

- It is not our base case that US congress would stand idly by, but markets may still be impacted

- Investors should keep a posture of prudence; focus on high quality equities and fixed income

- Focus on gold as risk diversifier and short-term credit to avoid excessive duration risk

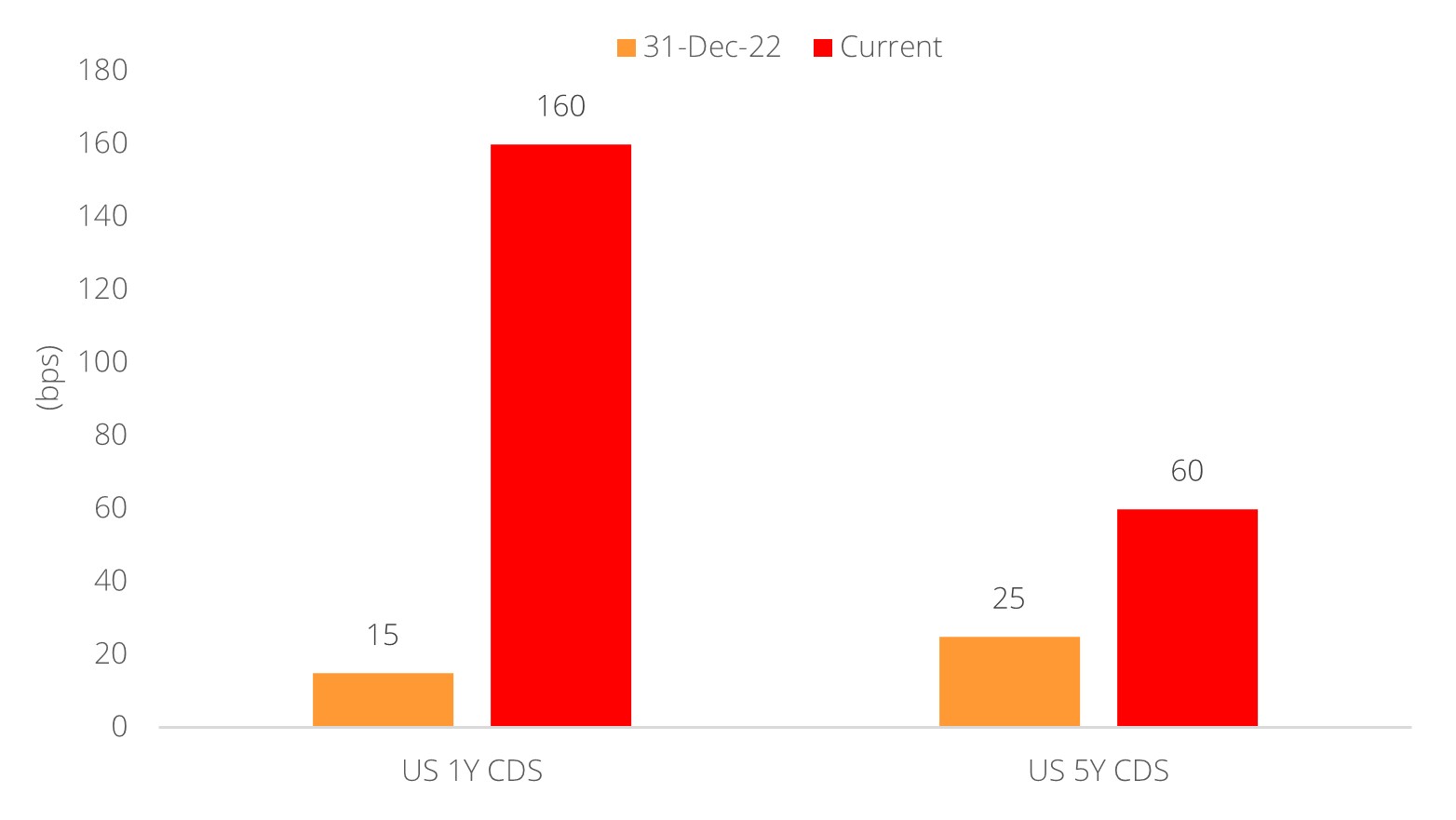

Early sightings of black swans. Conventionally, US lawmakers have never failed to pass a suspension/increase in the debt ceiling before the Treasury ran out of cash to pay its obligations. However, close observation of the bills and derivatives markets reveal that the markets are willing to wager that “past performance is no guarantee of future results”; that the unthinkable scenario of a US default – albeit perhaps a technical one – is not as remote as what history might suggest.

Figure 1: Default expectations for the short term have soared above the long term

Source: Bloomberg, DBS

What are the consequences of a US default? Given that the market is pricing a non-zero risk of US default, investors need to be aware of the non-zero possibilities of its consequences, including:

- Higher borrowing costs. US default pushes up the sovereign curve, which elevates all other borrowing costs that take reference from these rates, including mortgages, credit card debt, auto-loans, and company borrowings, raising risks of defaults.

- Risk-asset price fragility. Similarly, higher risk-free rates would result in valuation contraction across all asset classes due to higher discount rates, which filters to lower consumer confidence through a negative wealth effect.

- Delayed payments. There would be indefinite payment delays to the millions of federal employees, contractors, military servicemen, social security beneficiaries etc, causing a de facto tightening of liquidity conditions.

- Broad financial instability. Treasuries are integral to the global economy, serving as collateral for trillions of dollars of short-term money-market loans and derivatives, while forming the bulk of the high-quality liquid asset bases of major banks. Investor perceptions of higher Treasury risks can also result in failed auctions, and the Fed may be forced to monetise debt to support the financial system.

Armageddon is not our base case. Noting the above repercussions, we believe that it is not in the interest of either side of congress to allow a disorderly default. Additionally, even with US 1Y CDS at c.160 bps, the market implied probability of a credit event is still around 4% – hardly a certainty. Nonetheless, market risk pricing suggests that investors need to remain prudent in their portfolio positioning in the near term.

Stay with quality assets. The debate around the debt ceiling is likely to result in much market volatility over the next few months. The conceivable upshot is that applying fiscal prudence to manage the ballooning US debt would (a) ease inflationary pressure and (b) tighten consumer confidence in the medium term, judging by the contents of the Republican’s "Limit, Save, Grow Act". This implies that the Fed need not hike much further as credit conditions would already tighten in response to such spending cuts. Nonetheless, we believe investors would be better off

- Staying with high quality equities (consistent cash flow, strong balance sheets) and fixed income (A/BBB rated), given that these companies/issuers are better positioned to weather a slowdown,

- Holding gold as a risk diversifier, noting that it stands to gain either way under opposing outcomes of recession and inflation, and

- Remaining with short duration (3-5Y) credit, noting that persistent US debt sustainability concerns would not bode well for long-term obligations.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.