- Hong Kong’s mortgage rates and Prime lending rates are set to climb as liquidity tightens

- Property prices could ease, but risks of a severe correction are very low

- Demand has proven to be vigorous of late, while household balance sheets are also strong

- The rise in developers’ interest rate expenses is cushioned by recovering commercial rentals

- Wider HK real estate USD credit spreads look to be an opportunity given domestic conditions

Hong Kong faces higher lending rates

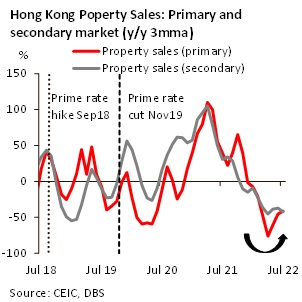

Leading Hong Kong banks have hiked their mortgage rates for the first time since September 2018 by 25bps to “Prime Rate -2.25%”. In our view, this is possibly a prelude to a Prime lending rate hike. We expect 25bps hikes in both 3Q and 4Q, which should bring the Prime rate to 5.50% by the end of this year and 5.75% by 1Q23.

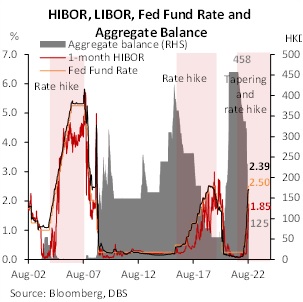

Similar to the last rate hike cycle, abundant liquidity forestalled major banks from taking immediate action after the Fed’s rate hikes in the past two quarters. However, liquidity is likely to reverse to tight levels in September. The Aggregate Balance (AB) has already shrunk from HKD458bn before tapering to HKD125bn of late. Back in 2019, it once dropped to around HKD50bn when the Fed Fund Rate (FFR) attained 2.50% in 2019. While we expect the FFR will reach 3.50% by end-22, AB will likely plummet to the same level amid aggressive HKMA intervention to defend the peg. 1M HIBOR already reached 1.85% as of last Friday, while there is further upside as 1M HIBOR-LIBOR spreads stayed elevated at around 50bps. Accordingly, we expect 1M-HIBOR will reach 2.28% by 4Q.

Impact on property prices

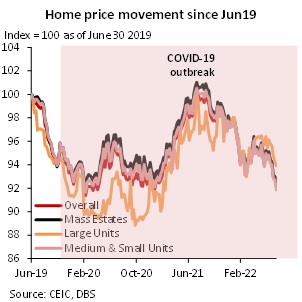

Rising Prime rates alongside mortgage rates will exert downward pressure on property prices. According to the GDP data, private sector real estate investment has dropped by 10.1% YoY YTD. This reflects increasing pessimism over the sector due to faster-than-expected rate hikes. Given the current rate trajectory, the effective mortgage rate will rise from 2.75% to 3.50%. This level of rates is much higher than the rental yield of 2.1-2.8% across all residential / commercial property classes, and hence is likely to suppress investment demand.

In fact, headline prices on the secondary market fell by 4.8% YTD and is projected to drop by around 5.0% in 2022. No. of transactions in secondary market also fell by 27.6% (m/m) to 2,494 in July. Weekend flat-hunting activities was at 20 weeks low of 400 last week. Valuation Index from major banks stayed weak at 34.5 in recent weeks. This compared to the post-5th wave of COVID outbreak high of 69.6 in April.

Still, a severe downturn in property prices is not likely. Primary market sales in August have been red-hot. The second batch launch of Novo Land, a large-scale development in Tuen Mun, saw 180 apartments oversubscribed by 70 times. This was higher than the 55 times of its first batch launch. The third batch has also almost completely sold out on last Sunday. While demand could have been stoked by the fact that pricing was around 15% lower against secondary market prices of neighbouring units, it is also clear that underlying demand is quite resilient. Primary market sales should see a rebound in August given these developments.

Implications for Hong Kong credit

While markets are unlikely to be surprised by eventual hikes in banks’ Prime lending rates, they still pose an impact for Hong Kong borrowers given the large amount of loans and mortgages amounting to HKD 7.3trn, (or around 250% of GDP). Close to half of these loans are linked to the property sector, with around 25% of loans being mortgages and another 23% of loans being for construction and property development and investment. Naturally, Hong Kong’s real estate sector could face a degree of headwinds via higher financing costs. Credit investors could fret about rising risks stemming from the growing interest expense on Hong Kong developers’ balance sheets, as well as possible second order impact on revenues from a slowdown in property sales amid rising mortgage rates.

The good news is that Hong Kong developers are entering the period of rising rates with strong balance sheets. Among major residential property developers in credit markets, short-term and long-term borrowings stand at around 32% of equity, with short-term debt only around 7%. Assuming a 50% interest rate hedge ratio for the long-term borrowings, a 100bps rise in interest rate has a small impact on ROE of 23 bps, which is quite marginal given average ROE of around 5%. As for major commercial real estate developers and investors in credit markets, their gearing ratios are even smaller. Their total borrowings stand at just 16% of total equity, while short-term debt also comprises a smaller proportion of the overall debt. Hence, there are very limited risks of outsized interest expense growth for Hong Kong’s real estate credit, even with banks’ prime lending rates poised to move upwards fairly sharply.

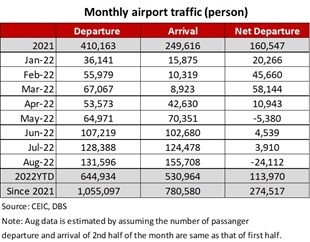

On the other hand, commercial property vacancies should continue to ease, as reopening momentum picks up while business travellers should also return in strength after Hong Kong shortened its mandatory hotel quarantine to three days. Commercial rental income could thus pick up, providing another offset against a rise in interest expenses. In fact, average daily passenger arrivals have risen sharply from 220 in March to 5,400 in mid-Aug. Total monthly arrivals is projected to increase to around 155,700 in August. This is a big boost compared to average monthly arrivals of just 41,800 in 1H22. Meanwhile, hotel occupancy rate rose from 55.0% in February to 75.0% in June (latest available data). This is only 12% below the pre-social unrest level back in June 2019. Overall room rate also rose from the year low of HKD747 in January to HKD868 in June.

As to the secondary impact on developers via residential property sales, the outlook should remain resilient. When the Prime rate was last hiked by 12.5bps in Sep 2018, systemwide loans growth eased to a 6.6% y/y pace from 3Q2018 to 3Q2019, down from 14.4% y/y from 1Q2017 to 2Q2018. But mortgages were a lot more resilient, barely easing by just 1% to an average 7.5% y/y growth pace from 3Q 2018 to 3Q 2019.

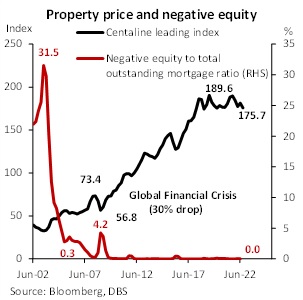

While household property affordability today looks worse compared to 2018 on both income-gearing and price-to-income metrics, risks of defaults for mortgages are actually very low. 55% of private residential properties are fully paid down (compared to 38% in the US), while only 1% of residential properties belong to buyers with multiple mortgages. Riskier mortgage borrowings, namely loans associated with private co-financing schemes, stayed low at 1.4%. Loan-to-value ratio for new loans fell from 60.7% in May to 57.1% amid tighter credit standards. This is also far below the peak of 68.9% in 2002. Mortgages with negative equity were below 0.05% of total outstanding mortgages in June (compared to 2.1% in the US). In fact, it has stayed below 0.5% since 2011. Even when property prices plunged by 30% during the 2008 Global Financial Crisis, the ratio was still quite small at 4.2%.

Given the strong household balance sheets, risks of a large price correction stemming from wider defaults are small. This should reinforce the confidence of home buyers and support primary market uptake, even as rates inevitably rise. Investment property demand could be dampened by the relatively low rental yield compared to mortgage rates, but such demand is already small given the low number of multiple-property mortgages. Robust demand from first-time homebuyers should be able to cushion investment slippage and support developer sales.

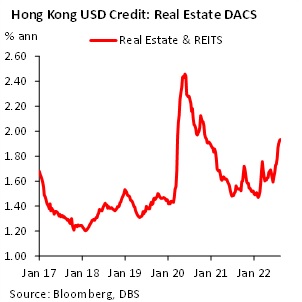

Despite modest sales and interest expense impact from higher rates, and new positivity from reopening momentum, Hong Kong real estate USD credit spreads have seen a significant widening since June. Our HK Real Estate DACS index has surged to 193bps, which is the highest since Nov 2020. This is significantly higher than the range of 120bps to 160bps seen in 2018 amid rate hikes. While developers’ net gearing ratios are a little higher today compared to 2018, risks still look quite modest based on our analysis. It is more likely that uncertainty in the China property market is spilling over to investor sentiment towards HK real estate, which we will discuss in a future publication. Overall, HK real estate credit does look more attractive given that local market conditions are still solid, and headwinds from rate increases are not that large.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FlashThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.