- US: Sticky inflation has pushed back rate cut hopes substantially

- China: 1Q GDP growth, driven by services sector growth and export demand, beat market expectations

- Singapore: MAS leaves SGD policy unchanged amid elevated inflation and uneven recovery

- India: Pre-election opinion polls continue to point towards win for incumbent coalition led by BJP

- Inflation and Growth Concerns Deepen26 Apr 2024

- Fed Cut Hopes Fade on Sticky Inflation12 Apr 2024

- Growth Recovery in Focus05 Apr 2024

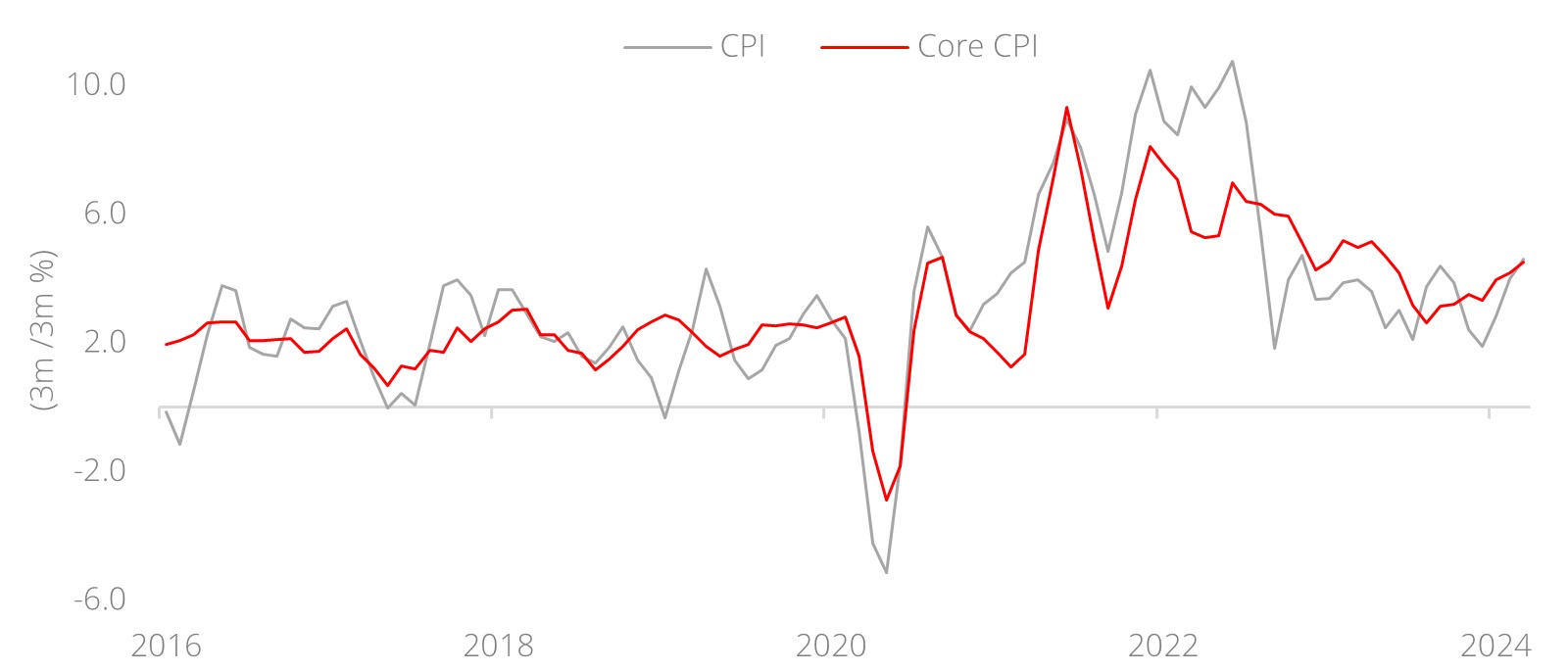

US: Inflation’s bumpy ride to 2% has pushed back rate cut hopes substantially. Driven by rebounding shelter and energy prices, US headline inflation moved up to 3.5% y/y in March, a tad higher than expected. While there has been substantial disinflation since the peak of mid-2022, strong demand has kept inflation, headline and core, well above the Federal Reserve’s 2% target. Barring supply side shocks, we see inflation stickiness to abate somewhat in 2H24, although even at the end of 2025, our forecasts remain above 2%. Rate cuts would be fewer than previously envisaged, consequently.

Various measures of inflation converging toward 2.5% would be sufficient for the Fed to ease. The first rate cut in this cycle will not happen before 2H24, something we have been flagging since June last year. However, Fed officials would not want to sacrifice the cycle by ignoring the disinflation so far and fixating only on the remaining work to be done. We think evidence of inflation settling around 2.5% will be good enough for the Fed to begin cutting. Furthermore, we believe the prudent risk management strategy for the central bank would be to cut modestly and gradually, as opposed to by a lot in a short period of time to deal with a recession when it is already too late. We estimate that in the 2020-25 period, core PCE will have risen by a cumulative 15%, which translates into an annualised rate of nearly 2.5%.

Higher for longer. We think that 50 bps of rate cuts in 2H24 are still on the cards, but no longer in the centre of the probability distribution. With growth and inflation both running above trend, it will become increasingly hard for the Fed to cut month after month. A signal that policy has room for normalisation with a 25 bps rate cut would likely be provided in July, in our view, but the next cut will have to wait till 4Q. After 50 bps of cuts in 2024, we think the Fed will continue with quarterly cuts in the following year, taking the policy rate down to 4% by the end of 2025. Stretching the definition of “higher for longer,” we believe communication would be provided that the terminal rate of the cycle, along with the so-called nominal neutral rate or r* is at least 3%, if not higher.

Figure 1: US inflation momentum

Source: LSEG Datastream, DBS

Download the PDF to read the full report which includes insights on China, Singapore, and India.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

- Inflation and Growth Concerns Deepen26 Apr 2024

- Fed Cut Hopes Fade on Sticky Inflation12 Apr 2024

- Growth Recovery in Focus05 Apr 2024

- Inflation and Growth Concerns Deepen26 Apr 2024

- Fed Cut Hopes Fade on Sticky Inflation12 Apr 2024

- Growth Recovery in Focus05 Apr 2024