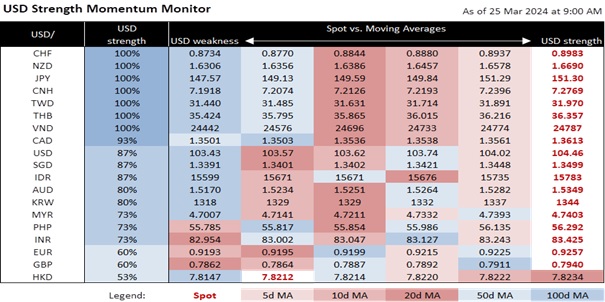

We are cautious about reading too much into last week’s developments that propelled the USD. The DXY Index appreciated 1% to 104.4 for the second week after the FOMC. However, the market and the Fed are aligned on their rate cut expectations. DXY has a resistance at 104.7 or its 100-week moving average.

Although the Fed maintained its forecast for three rate cuts in 2024, it projected two instead of three cuts for 2025 after upgrading its 2025 forecasts for GDP growth to 2% from 1.8% and PCE inflation to 2.2% from 2.1%. That said, the Fed maintained the call for three rate cuts despite upgrades to its 2024 forecasts to 2.1% from 1.4% for GDP growth, 2.6% from 2.4% for PCE core inflation, and 4% from 4.1% for the unemployment rate. On March 29, the consensus expects the PCE deflator to mirror the rise of CPI inflation by increasing to 0.4% MoM (2.5% YoY) in February from 0.3% MoM (2.4% YoY) in January. However, PCE core inflation is seen slowing to 0.3% MoM from 0.4% and staying unchanged in YoY terms at 2.8%. With the PCE deflators close to the Fed’s forecasts, the Fed officials speaking this week should affirm that the Fed is near to attaining the confidence to lower rates.

The Atlanta Fed GDPNow model sees US GDP growth slowing to an annualized 2.1% QoQ saar in 1Q24 from 3.2% in 4Q23. Last week, the National Retail Federation predicted slower US retail sales growth of 2.5-3.5% in 2024 vs. 3.6% in 2023. Tomorrow, the Consumer Confidence Index should show caution from receding Fed cut bets and the rise in the unemployment rate to a two-year high of 3.9% in February. Consensus sees nonfarm payrolls slowing towards 200k in March.

At the post-FOMC press conference, Fed Chair Jerome Powell hinted at tapering quantitative tightening at the coming FOMC meetings. Powell also told US lawmakers at his semi-annual congressional testimonies earlier this month that some banks would fail due to their commercial real estate sector exposure.

USD/JPY rose to 151.41 despite the historic end to the Bank of Japan’s negative interest rate policy and yield curve control framework on March 19. However, USD/JPY backed off whenever it neared 152 in the next three sessions. JPY bears backed off last Friday on Japan’s policymakers. Finance Minister Shunichi Suzuki warned against sharp JPY depreciation with a “high sense of urgency.” BOJ Governor Kazuo Ueda said the central bank would eventually scale back bond purchases, affirming that Japan was only at the start of normalizing its ultra-loose monetary policy. BOJ board member Naoki Tamura, a leading advocate of unwinding monetary stimulus in early 2024, speaks on March 27. Last Friday, Japan’s largest trade union confederation, Rengo, confirmed that wages would increase by 5.25% this year, near the preliminary 5.28% rise announced a week earlier. This Friday, consensus expects the Tokyo CPI inflation to stay at 2.5% in March, and excluding fresh food, to moderate to 2.4% from 2.5%.

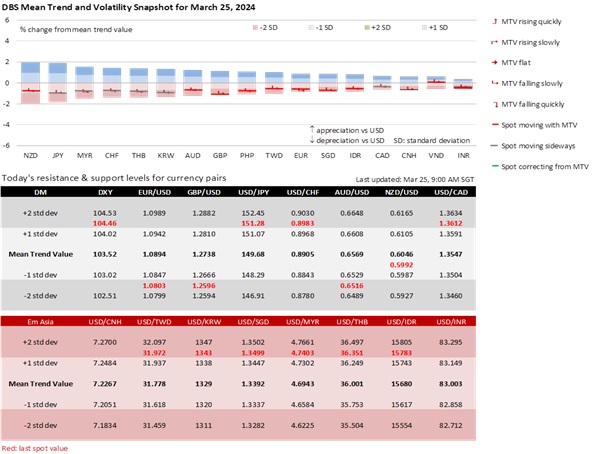

As the end of the first quarter approaches, markets need to assess if the recent sell-off to technical support levels can continue. For example, USD/CHF rose three months from 0.8330 to 0.90 into the Swiss National Bank’s rate cut last week. GBP/USD is back at 1.26 after its failed attempt to push above 1.28. Similarly, EUR/USD and AUD/USD are back at familiar support levels at 1.08 and 0.65, respectively. Markets will assess if they have overreacted to last week’s fixing in pushing USD/CNY above 7.20 to four-month highs.

Advisory

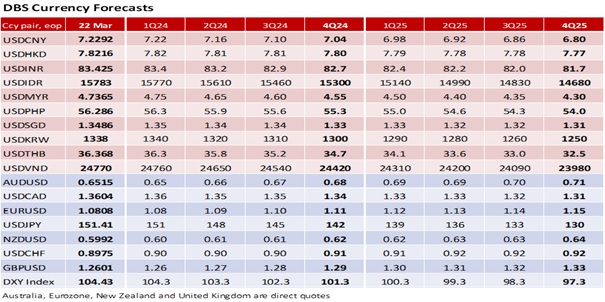

FX forecasts revisions keep bias for USD depreciation on eventual Fed cuts.

Quote of the day

"If I advocate cautious optimism it is not because I do not have faith in the future but because I do not want to encourage blind faith.”

Aung San Suu Kyi

25 March in history

The city of Venice was founded in 421 A.D.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.