Key points:

- Legacy planning is about looking ahead to leave wealth for your loved ones. The process starts with detailing your vision and intentions.

- It’s important to start while you are in control of your finances, of lucid mind and in good health.

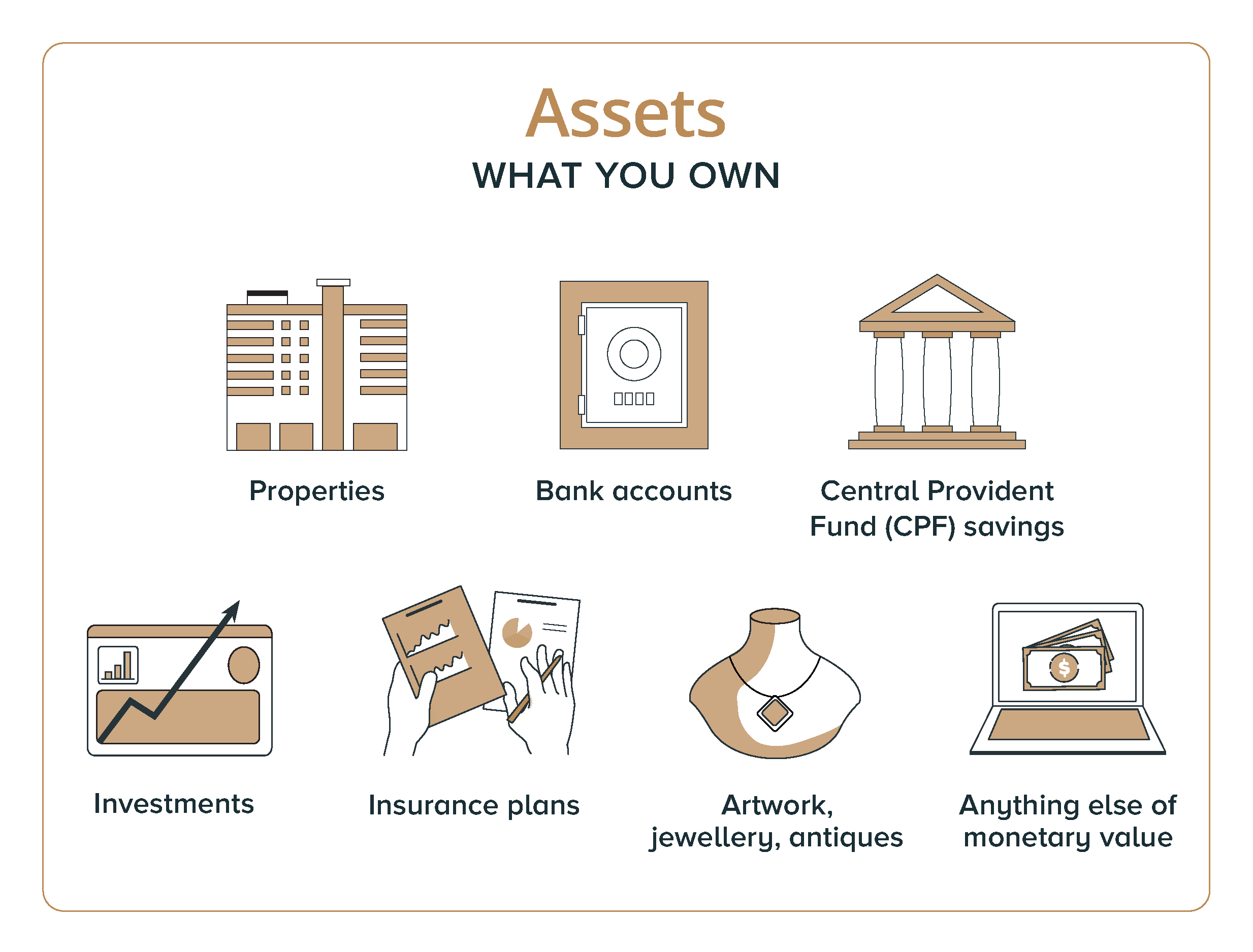

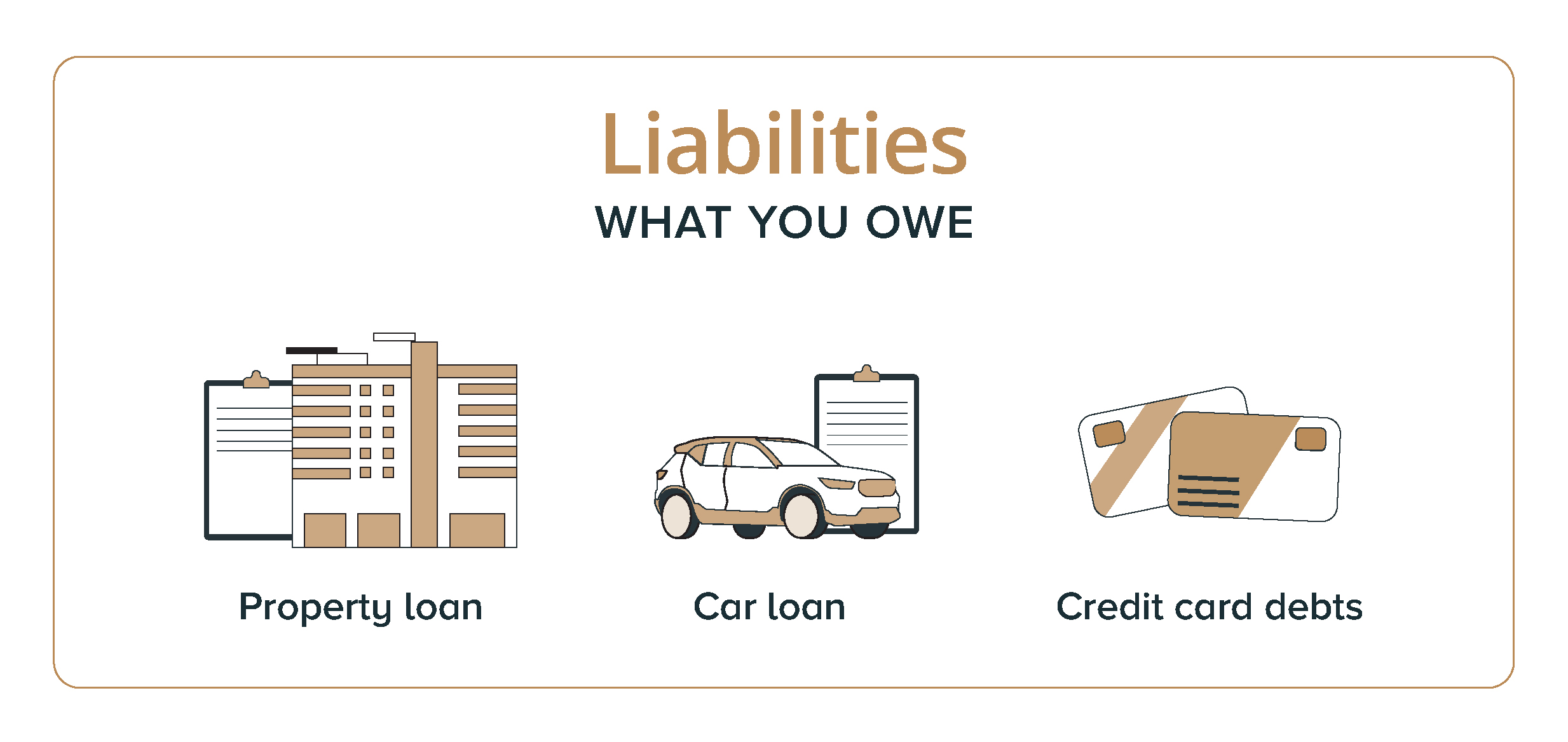

- Start by consolidating a list of all your assets and liabilities. Keeping this list up to date is as important as drawing it up.

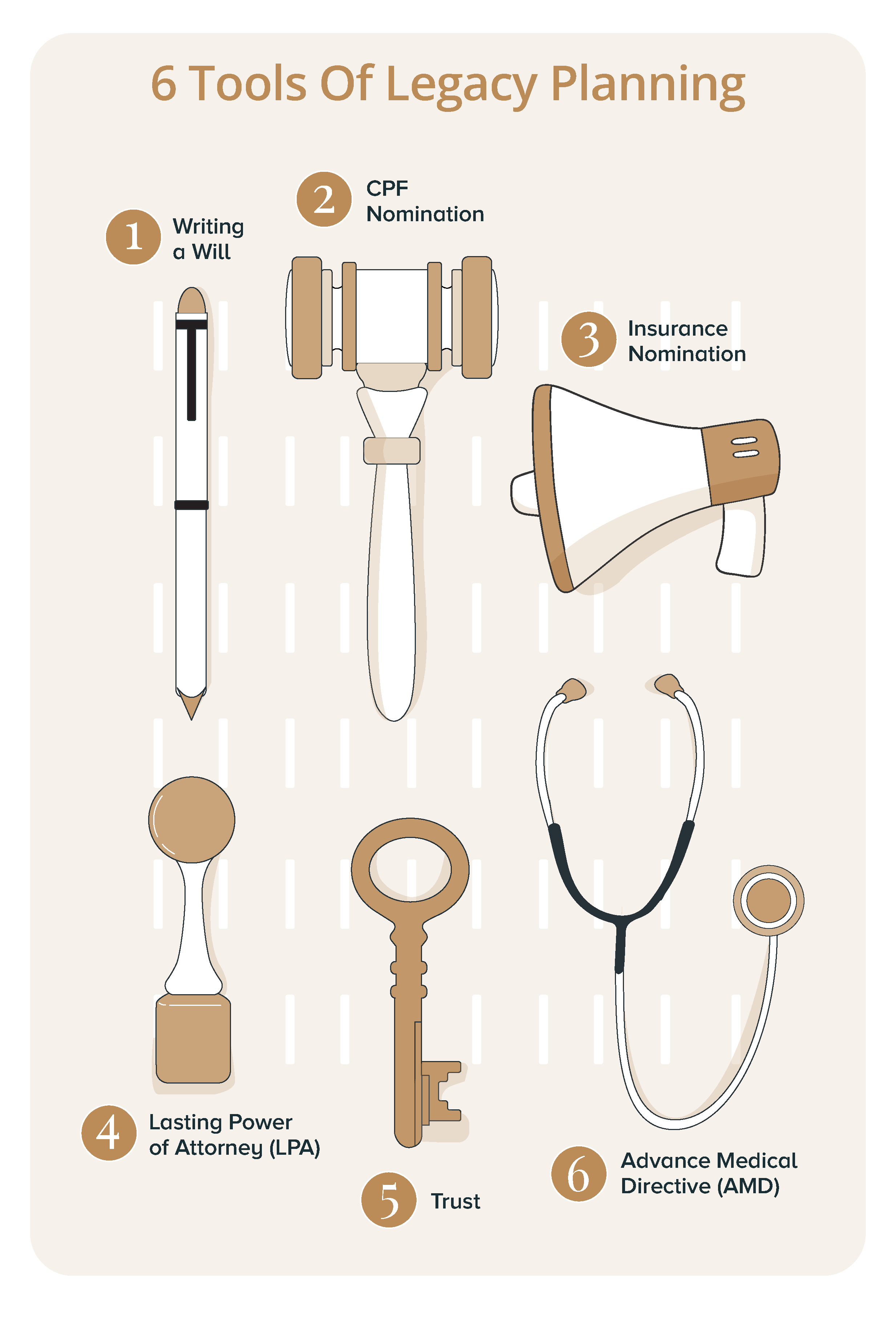

- Make use of the tools of: Writing a Will, CPF nomination, Insurance nomination, Lasting Power of Attorney, Trust, Advance Medical Directive.

Want to find out about legacy planning solutions suitable for you?

Legacy planning is about looking ahead to leave wealth for your loved ones. The process starts with detailing your vision and intentions. It’s important to start while you are in control of your finances, of lucid mind and in good health.

Start by consolidating a list of all your assets and liabilities. Keeping this list up to date is as important as drawing it up. The net value of your estate is based on your assets, liabilities, fees and expenses, and the nature of property ownership.

This list forms a strong foundation for successful legacy planning in Singapore.

1. Write a Will for clear distribution of your assets

You might wonder: Why write a Will when you can simply relay your wishes to your loved ones?

The main benefits are that it provides clarity and prevents unnecessary delays in the transfer of your estate. This is because a Will is a legally binding document that lets you specify how and to whom you wish to distribute your assets to.

This prevents misinterpretation and reduces stress for your family at a difficult time.

If you do not have a Will, Singapore’s intestacy laws (or for Muslims, Islamic inheritance law) will determine who gets what. The asset distribution may not be aligned to your wishes, and the settlement could be a long-drawn process.

Probate process in Singapore with a Will | |

|---|---|

| Executor applies to Court for a Grant of Probate (This legally recognises an individual as the executor of the deceased's estate.) |

| Executor distributes assets according to will. |

Probate process in Singapore without a Will | |

|---|---|

| The family or Court appoints an administrator of the estate. (This is usually the deceased's spouse and/or next-of-kin.) |

| An administration bond is filed by the administrator with two sureties vowing to distribute the estate following Singapore's intestacy laws or the Islamic inheritance law. |

| The administrator applies for the Letters of Administration, with these supporting documents:

|

| The Grant of Letters of Administration is issued and the administrator allocates the estate based on the Intestate Succession Act. This process could take months and cost more. |

What to include in a Will

- Who to distribute your assets to. Your beneficiaries can be people or charities.

- Who gets how much. You can allocate by proportion, or by assigning specific assets to specific beneficiaries.

- Who will ensure your wishes are carried out. These are your executors and trustees.

You can get a lawyer to help draft your Will, or use an online Will writing service.

Review your Will periodically, especially when your life status changes. For example, marriage revokes a Will that you made while you were single. However, having children and even having a divorce have no effect on the validity of the will.

Changes to your Will can be made any time, as long as you have the mental capacity to do so.

Let your intentions guide you

How would you wish your assets to be used?

You might, for instance, want to keep your home for your spouse’s use instead of selling it off. Or you might want to allocate some money for a child’s university education, and a separate amount for supporting an elderly parent.

Who will care for your dependants? And is there someone you trust to handle your assets on your behalf?

If you have a child under 21 years old, you should appoint a legal guardian for him/her in your Will to ensure your little one will be under good and responsible care. And if you’re single, you may wish to ensure that your parents, siblings and/or pets will be cared for.

Make a nomination to allocate your CPF savings; don’t lose sight of it

Even if you already have a Will, you will need to make a separate Central Provident Fund (CPF) nomination because CPF savings cannot be distributed via a Will.

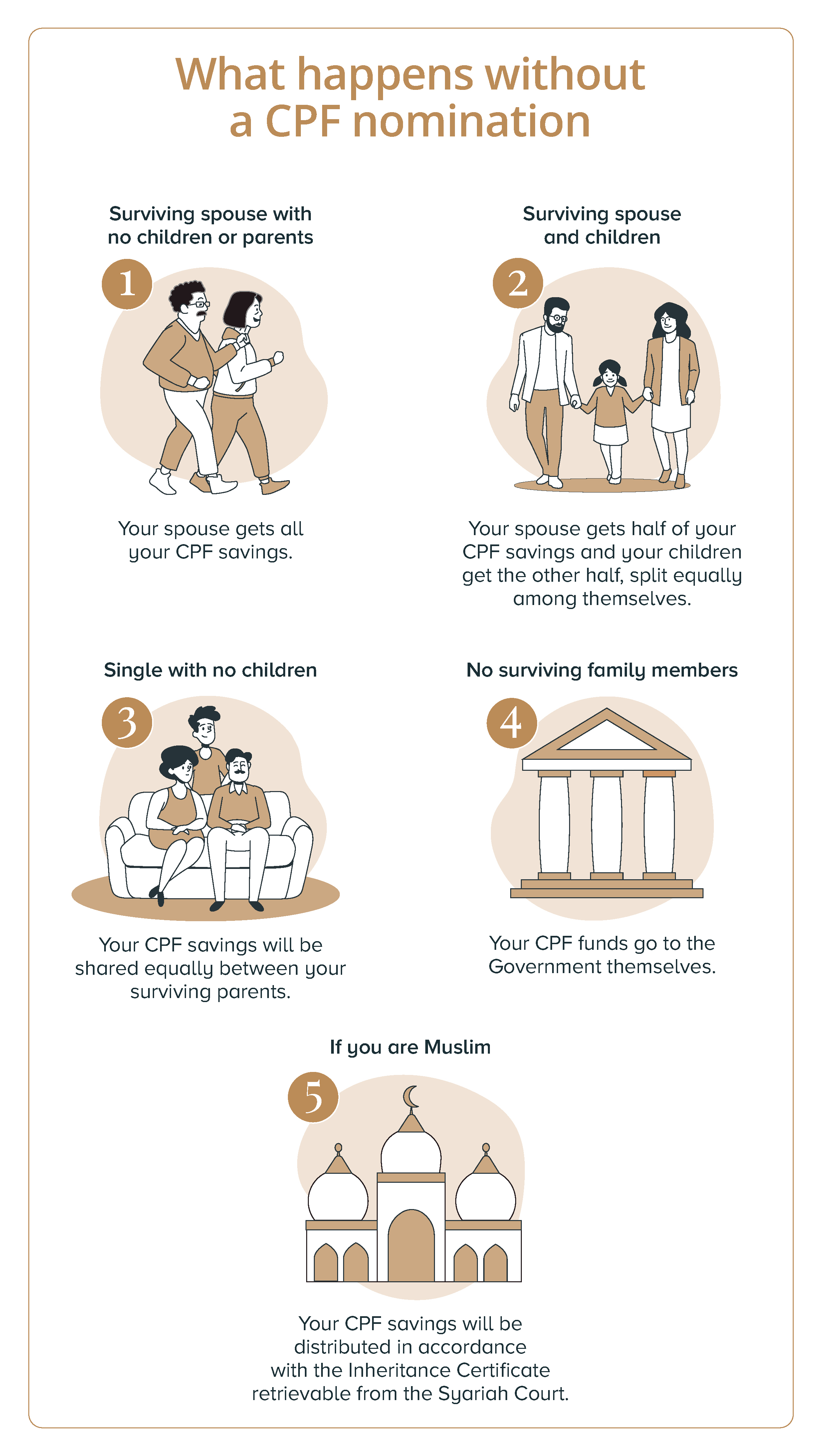

Without a CPF nomination, your CPF savings will be distributed according to Singapore’s intestacy Laws (or Islamic inheritance law).

With a CPF nomination, you can avoid paying a fee to the Public Trustee’s Office for administering un-nominated CPF money and prevent administrative delays.

You can make a nomination in person at any CPF Service Centre or fill in a CPF nomination form and submit it online.

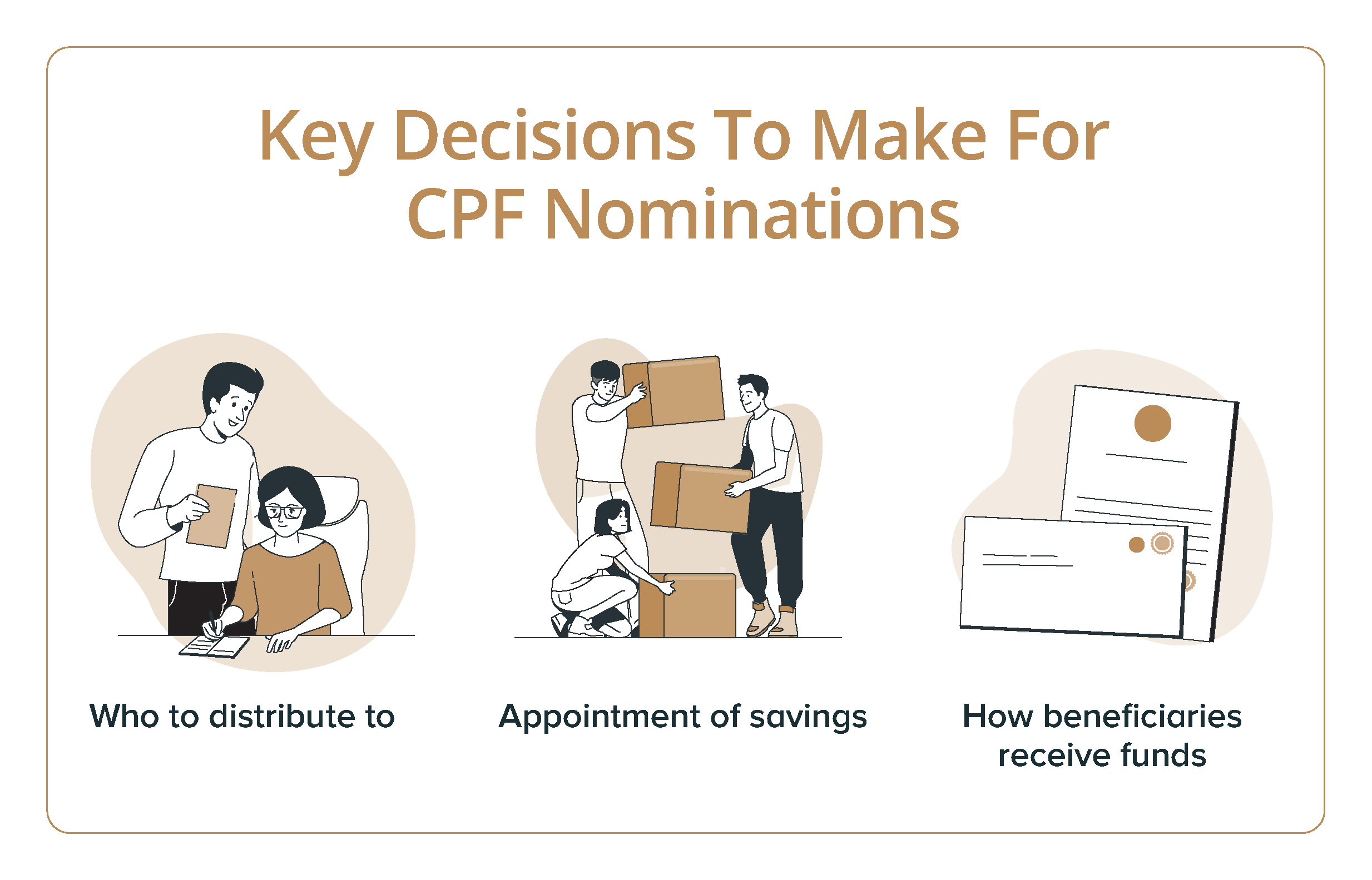

When making a CPF nomination, your key decisions may include:

- Who to distribute your CPF savings to;

- In what proportion; and

- How your beneficiaries should receive the funds (known as the Nomination Payment Options):

- Default setting: One-time cash payout.

By default, your beneficiaries will receive the CPF funds in cash, through cheque or GIRO. The funds will be disbursed in one payment. - Via CPF account

If you opt for the Enhanced Nomination Scheme (ENS), your beneficiaries receive your CPF funds via their own CPF accounts. - Monthly payouts

If you have children with special needs, consider opting for the Special Needs Savings Scheme (SNSS), which pays out your CPF savings monthly.

- Default setting: One-time cash payout.

Similar to a Will, your CPF nomination should be continually reviewed, especially when your life status changes. For instance, getting married invalidates the CPF nomination that you made while you were single. However, getting divorced has no effect on the validity of the CPF nomination as you may still wish to provide for your former spouse and children.

You can update your CPF nomination any time, so long as you have the mental capacity to do so. Here are some reasons to make a new CPF nomination:

- One of your nominees passes away

- You get married, divorced or remarried

- You have children after your nomination was made

- You wish to add a new nominee

Choose to make a revocable or irrevocable nomination for your insurance policies

Life is unpredictable and it’s prudent to think about safeguarding against life’s curveballs. Insurance is a financial safety net that prevents your loved ones from inheriting your bills and debts.

It is not compulsory to make separate insurance nominations, especially if you have already made a Will detailing how the distribution of your estate. Still, insurance nomination offers an avenue to distribute your policy proceeds to your loved ones according to your wishes, that is separate from your Will.

Under the Insurance Nomination law, policyowners of life, accident and health insurance plans with death benefits are given two options:

- Make a trust (irrevocable) nomination; or

- Make a revocable nomination.

With a trust nomination, the policyowner gives up all rights to the ownership of the policy, and it can only be revoked with the consent of all nominees. This can be a useful avenue to protect your estate from falling to creditors, as only your spouse and children can be the beneficiaries of a trust nomination.

In the case of a revocable nomination, the policyowner is free to change, add or remove nominees without their consent.

How an LPA fits in with your legacy plans

A Lasting Power of Attorney (LPA) is drawn up to appoint people (donees) entrusted to look after you (the donor) and make decisions on your behalf if and when you lose mental capacity. Caregiving has two aspects - personal welfare and property, and financial affairs.

There is no default "right" for families to manage their loved one's affairs. Without an LPA, some families may get caught up in unnecessary and lengthy court proceedings to gain control of accounts and assets, including insurance proceeds.

An LPA also helps protect your estate from being squandered away by irresponsible caregivers, if you suffer from mental incapacity. As such, it goes hand in hand with setting up a Will which takes effect upon death.

For a LPA to be valid, it must be registered with the Office of the Public Guardian (OPG). There is currently a fee waiver for the LPA Form 1 application for all Singapore citizens until 31 March 2023, to encourage more Singaporeans to plan ahead and apply for an LPA.

Do you need a trust as part of your plan

A trust serves to protect family assets that might otherwise go to beneficiaries who are too young to get substantial inheritance, or who are financially immature or vulnerable.

With a trust, the ultimate distributions to theses beneficiaries should be delayed for a certain time to ensure they get their inheritance when they reach a certain age or maturity.

What is an AMD and do you need one

An Advance Medical Directive (AMD) expresses your intention that no extraordinary life-sustaining treatment should be applied if you suffer from a terminal illness and become unconscious or incapable of exercising rational judgment.

By doing so, your family members will not have to make a decision that could cause immense guilt and avoid incurring financial burdens from life-preserving treatments.

Look ahead confidently with proper legacy planning

Ultimately, legacy planning is about ensuring that the people you love get what you wish to give them efficiently. From retirement to legacy planning, if you need help evaluating your assets, your DBS Treasures Relationship Manager is in an ideal position to help you as we:

- Have the same overview of your account, assets and liabilities as you do;

- Can easily access related documents, past activities and interactions, both online and offline;

- Have a team of product specialists to provide solutions for holistic wealth management portfolio, with the right investments and insurance.

Not yet a DBS Treasures client? Get started on your wealth management journey now.

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.