ReNew bets on round-the-clock hybrid

By Manju Dalal, APAC Editior, IJGlobal

31 July 2023

ReNew – one of the largest green energy producers in the world – is on its way to create history by lighting up India’s first round-the-clock (RTC) project.

Consisting 3 wind farms, 1 solar park and a battery energy storage system (BESS), the RTC is spread across 3 Indian states – Rajasthan, Karnataka, and Maharashtra.

The 1.3GW project is expected to start commercial operations in phases, beginning next month (August 2023).

“This is a first of its kind project with around-the-clock feature that addresses intermittency issues in renewable energy projects,” says Anita Bharathidasan, executive director on the energy and infrastructure Asia group at Credit Agricole. “As the name indicates, this technological configuration is aimed at delivering power on a continuous basis.”

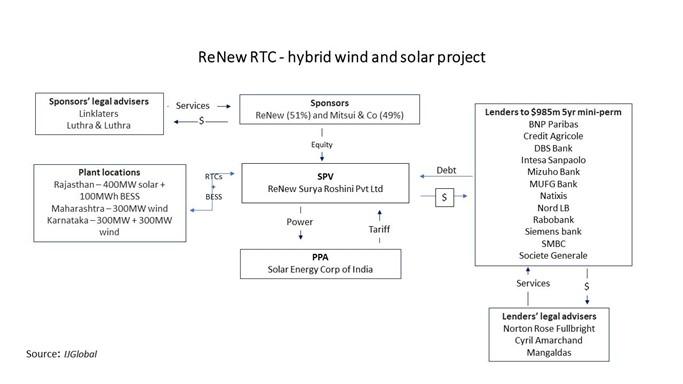

Credit Agricole is part of the 12-bank club that provided a $985 million, 5-year mini-perm financing to the project, that achieved financial close earlier this year (2023).

As RTCs solve the biggest challenge of renewable projects – of providing nonstop power – the Indian government wants to come out with 3-5 RTCs every year, helping the country meet its net zero GHG-emission target of 2070 (with renewables contributing 500MW).

“RTC renewables align very nicely with India’s net zero targets,” says Rajiv Vishwanathan, executive director of project finance in the institutional banking group at DBS Bank.

As the country of more than 1 billion people still heavily relies on thermal power, India Inc is betting big on RTCs to help the country meet its energy transition needs.

Hybridisation of renewables is necessary to achieve a longer period of firm power supply through the day with storage systems addressing the intermittency issues, reckons Vishwanathan.

“Ultimately, RTCs are a response to the net zero theme. These solutions address the challenges pertaining to the need for firm base load power for longer part of the day”.

Rajiv Vishwanathan, Executive Director

Project Finance, DBS Bank

Overcoming initial challenges

Kailash Vaswani, president corporate finance at ReNew (formerly ReNew Power) recalls discussions with India’s Ministry of New and Renewable Energy (MNRE) ahead of the Solar Energy Corporation of India (SECI) releasing the RTC tender for the project on 18 October 2019.

At that time the hybrid projects (at planning stage) still had a plant load factor (PLF) of 30-40%, falling short of resolving the grid requirements as coal projects were operating at a PLF of 70-80%, reckons Vaswani.

Overcoming the intermittency of power generation and providing stable power to the grid round the clock is the biggest hurdle that renewables needs to overcome.

The central government-controlled nodal agency, SECI, also wanted to achieve a minimum PLF or capacity utilisation, of 70% per month for the RTCs.

However, for RTC to generate a standard capacity – the on-ground capacity is usually 2.5 to 3 times higher. This meant that optimising capacity and keeping the tariffs reasonable was another big challenge to overcome.

From the developer’s side, the proportion in which the wind, solar and the battery storage was to be set up, would impact the cost. Sorting this combination hasn’t been an easy task.

“We had to do a lot of modelling simulation to reach an optimum solution so that we could basically use as much of renewable energy and as little of battery or storage capacities to reach the same outcome,” said Vaswani.

The process helped ReNew to remain competitive, helping the company to bag India’s first RTC project.

In June 2020, ReNew won the bid, pipping 3 others contenders (Greenko Energies, HES Infra and Ayana Renewables). Under the bid terms, ReNew is supposed to provide 400MW of power to SECI.

“The key challenge with RTCs is to develop a project that has components complementary to each other,” says DBS’ Vishwanathan. For instance, for the RTC project incorporating solar and wind sites, the optimal synergy arises when wind power becomes operational in sync with the cessation of solar power, he added.

ReNew is setting up 900MW of wind capacity and 400MW of solar capacity, further supplemented by batteries of 100MWph.This mix eventually helped the company bid the lowest tariff while promising to deliver the minimum capacity requirement of 70% to SECI, ensuring enough power was generated during a low-wind month and sell excess power during high-wind months.

A 25-year PPA was signed on 7 August 2021 with SECI. Under the agreement, ReNew will supply power in the first year at Rs2.90/kWh ($0.0352/kWh), with a 3% step each year for the first 15 years. After that, the tariff will stabilise for the rest of the 10 years.

IJGlobal understands SECI signed back-to-back PPAs with discoms

- UPCL – Uttarakhand

- IPCL – West Bengal

- WBSEDCL – West Bengal

- Indian Railways

ReNew is expected to sell almost 20% of the power generated from the RTC in the open market, another unique feature of the project.

Addressing financing amid complexities

Not only the planning but structuring and executing the RTC has been a complex process given its various moving parts.

For instance, on the technical side, the project configuration is complex with multiple technologies (solar, wind, and battery), locations across multiple states and some merchant risk, said Hong Kong-based Credit Agricole’s Bharathidasan.

The small element of merchant risk in ReNew’s project was addressed by assessing it through market studies and had a higher debt sizing criteria compared to the contracted revenues, Bharathidasan reckons.

Another unique element was the hybrid nature of the project, she said. “The project had to ensure that in the unlikely event of a partial commissioning, the constructed project would still continue to provide round-the-clock power supply, and the financing structure was adapted accordingly,” she added.

Pointing to one variable that impacts most renewable projects is the cost economic predictions, says Noida-based Abhishek Singh, co-founder and CEO of OGO Energy, an energy storage system integrator.

From the bidding to the procurement stage, cost of batteries may change. As most power projects have a minimum capacity requirement (of around 80% generally), the battery storage costs become critical, according to Singh.

ReNew addressed the intricacies of the project structuring. The company adopted turnkey solutions to address project complexities. Local, international as well as in-house resources are being tapped to ensure timely commissioning of the project. Each of the solar, wind and BESS components are procured through dozens of project contracts, and this also meant curtailing the financing structure to address all the risks.

Nasdaq-listed Fluence will be providing the storage products to the RTC through a new JV set up with ReNew.

Not to mention, each project involves obtaining land and transmission approvals among many other procurement needs, making the RTC more complex.

From the financing perspective, the key factor lies in the analysis of the individual underlying projects or power source within the RTC's projects and how these components integrate to stretch the sun hours and eventually meet PPA requirements, reckons DBS’ Vishwanathan.

The Indian RTC also had to overcome the hurdle of rising interest rates. “We wanted to use LC (letter of credit) structures, which are not fund based to have the arbitrage on ECB (external commercial borrowing) vs LC based financing structures,” said ReNew’s Vaswani.

Irrespective of the complexities and that RTCs are still untested fully, the financing of the $1.32 billion was well-received. Credit Agricole’s Bharathidasan credited the response to appetite for well-structured projects.

Strong developers such as ReNew which have experience in developing renewable projects across technologies can address all the nuances and bring it all together, Singapore-based Vishwanathan said.

DBS is one of the lenders to the RTC project providing syndicated project finance facilities and is the letter of credit issuer. The complexity of the RTC was addressed by incorporating additional risk mitigation structures to minimise delays and cost overruns to meet ReNew’s commitments, said Vishwanathan.

Given its strong standing in the market, ReNew got the pricing it desired, though Vaswani agrees that the lenders did a heavy credit lifting by taking a view on merchant revenue, the RTC, the modelling work and how price escalation will work.

The 5-year mini-perm loan pays a margin of 225bp over Sofr, IJGlobal understands. The loan may get refinanced after year 3, likely with a bond.

In April 2022, Mitsui Power India Co partnered with ReNew to buy a 49% in the SPV.

What the future holds?

OGO Energy’s Singh says battery augmentation is another area to watch for in renewable projects.

Batteries need augmentation each year. Depending upon site conditions, Singh says, degradation of lithium batters can be in the 2% to 5% range.

“Augmentation is crucial to maintain a consistent throughput and prevent any power supply issues,” he added.

OGO has a 100MWh battery manufacturing plant in Uttar Pradesh in northern India and the company plans to set up a 1GW factory with indigenous battery management system by Q2 of 2024.

“It remains to be seen how big RTCs will function alongside their augmentations issues,” Singh said.

According to DBS’s Vishwanathan, in future, technological advancements – especially on the power storage front – will be a key factor to watch. As RTCs continue to grow in size, storage capacities and their costs will be more relevant for the success of such projects, he said.

Meanwhile, the construction of ReNew’s RTC is progressing well. “We are looking forward to seeing how the project actually works operationally when it connects to the grid and starts producing power,” Vishwanathan added.

This article was first published by IJGlobal in July 2023.

The information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only.

The information is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

DBS Bank Ltd. All rights reserved. All services are subject to applicable laws and regulations and service terms. Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by DBS Bank Ltd and/or its affiliates/subsidiaries.