Global Minimum Tax

Impact for multinational enterprise operations

Summary

- As of October 2021, 136 countries have agreed to support rules that would subject Multinational Enterprises (MNEs) to a global minimum 15% tax-rate from 2023.

- Countries where MNEs are effectively taxed below the 15% minimum rate risk losing their appeal as companies re-evaluate existing and future legal entity and business operational structures in view of this development.

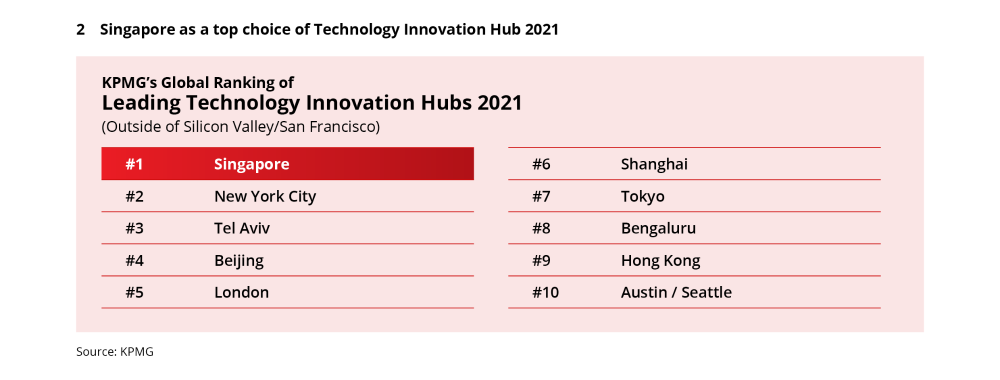

- Singapore remains attractive as a business hub in the Asia Pacific region due to its excellent infrastructure, skilled workforce, political stability as well as geographical proximity to the high-growth Asian markets.

- DBS Treasury Advisory and Solutioning can assist companies in potential business transformation, reviewing finance and treasury operation structures considering the global minimum tax.

Global minimum tax introduction

As of October 2021, 136 countries have joined an international tax reform agenda to establish a global minimum corporate tax rate of 15% with implementation starting in 2023. The goal of the global minimum tax is to discourage MNEs from shifting profits and tax revenues to low-tax countries and ensure that MNEs pay their fair share of tax in the jurisdictions where they generate revenues.

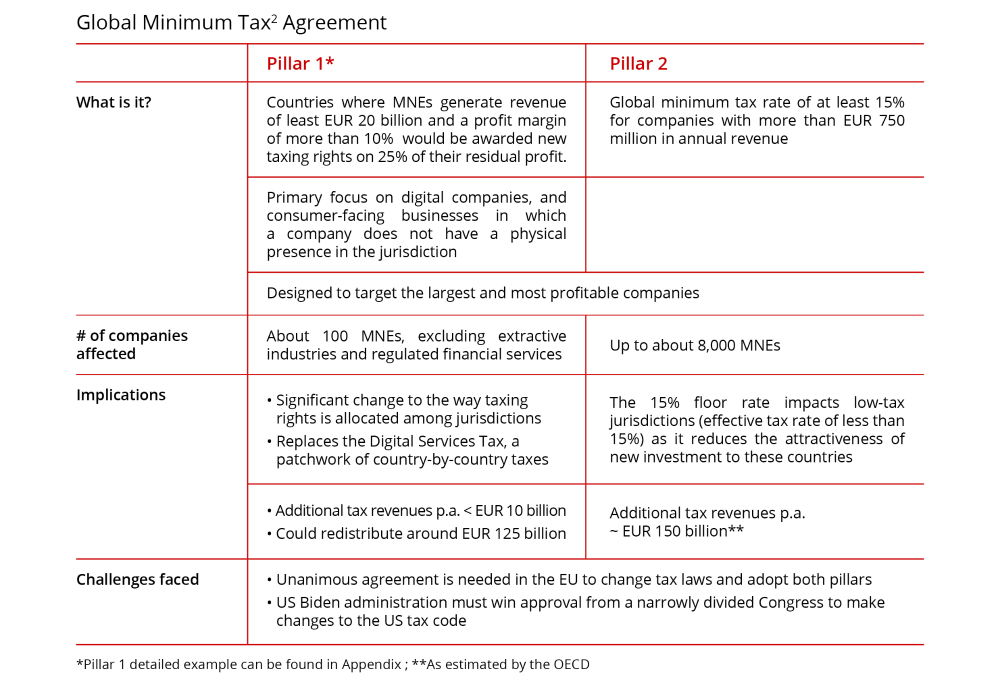

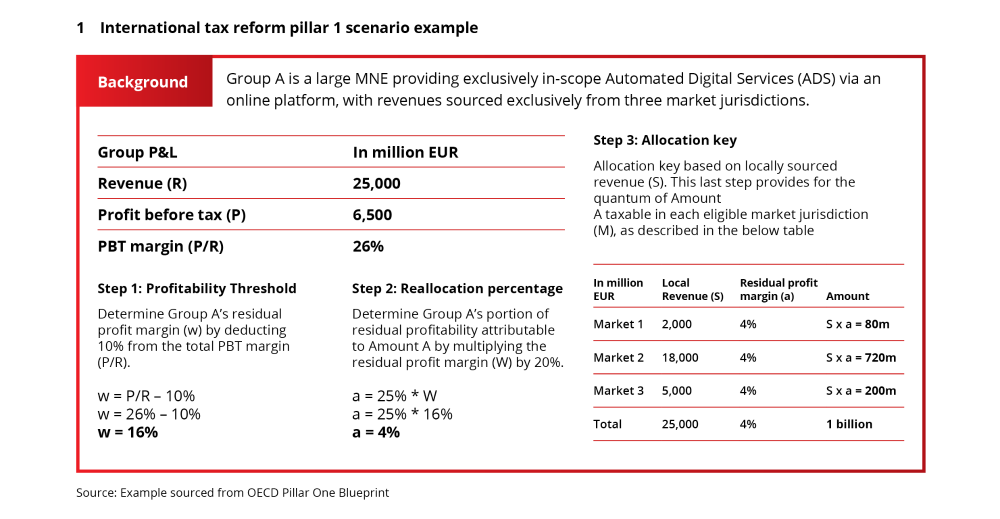

The international tax reform relies on a two-pillared approach1: (1) seeks to ensure a fairer distribution of taxing rights among countries and to reallocate some taxing rights over MNEs (revenue ≥ EUR 20 billion) from their home countries to their market jurisdiction where they earn profits, including markets where they do not have a physical presence. ; (2) introduces global minimum tax (at least 15%) to MNEs (revenue ≥ EUR 750 million) on a country-tocountry basis which will deter MNEs from shifting profit to low-tax environments for tax minimization purposes.

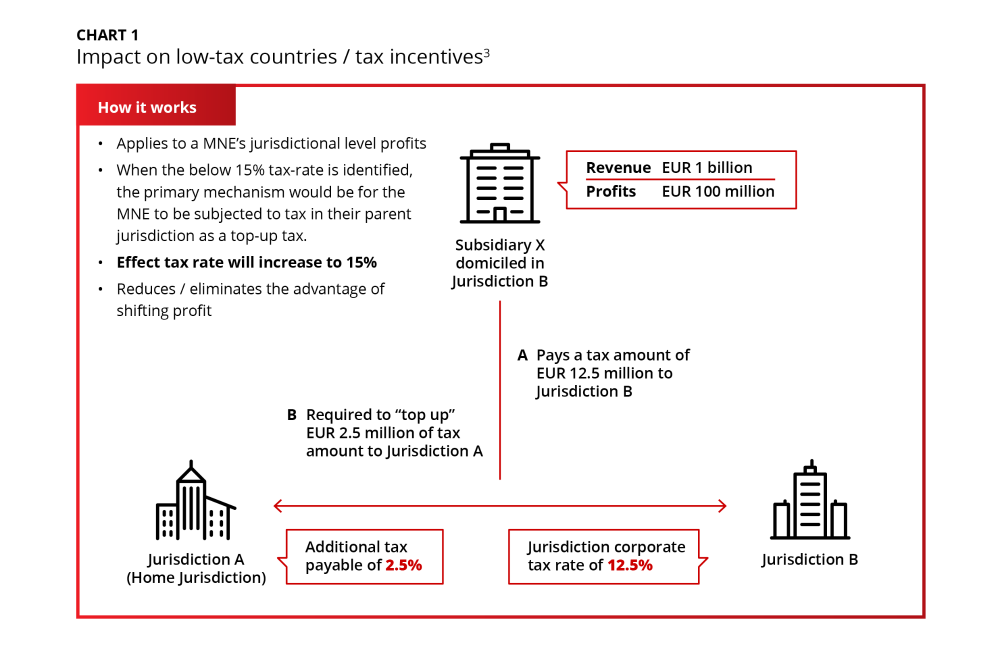

Impact on low-tax countries and tax incentives

Once international tax reform is enacted, we can expect a significant impact3 on low-tax jurisdictions. Low tax incentives will also be neutralised as an MNE cannot benefit from reduced rates of taxation. In Chart 1 below, the MNE will need to pay a “top-up tax” in their home country to meet the 15% minimum level of taxation required. If tax reduction has been the major factor in an MNE’s investment decision-making, we anticipate that the global minimum tax will deter further investment. We can also expect low-tax countries to review and consider other incentives as a counter to losing their attractiveness as an investment location of choice.

Considerations and implications for MNEs

Centralising business operations into low-tax jurisdictions will no longer be as straight-forward of a decision for MNEs going forward. More locations will be available for consideration, and the challenges expected are: (1) how to rapidly adjust overall corporate legal and tax strategy in response to the changing landscape, and (2) what business model restructuring may be required in current low-tax jurisdictions.

MNEs will no doubt start to rethink their strategies on headquarter and key business hub locations globally. They may relocate their business hub operation away from low-tax jurisdiction to another location with more strategic value based on business operational considerations. Specialized corporate functions, such as treasury centres will likely continue to develop and operate in current locations considering the skill sets and ecosystem needed to operate efficiently. The framework shown below is provided to help MNEs step through some major considerations in the strategic location re-think.

Based on the framework, MNEs can conduct a comprehensive analysis to assess the overall suitability of the new location:

- Business decision: Assess the fit for purpose, i.e. the company’s relocation suitability. Evaluate the business scope (increase or eliminate functions) due to different location advantages and new business goals.

- Maturity and potential of market: Locating the business function in either a target market or close to a number of target markets will accelerate future business growth.

- Competitive workforce: Conduct a cost-benefit analysis to understand potential labour cost and availability, before deciding to hire locals or transfer staff to the new location.

- Infrastructure: Assess the quality of the supporting infrastructure, in the context of building a new business operation and/or expanding business rapidly

- Business ecosystem: A thriving ecosystem is vital for companies to leverage in developing their target market(s) and in identifying new cooperation opportunities with business partners.

- Policies & regulations: Transparent and stable governance reduces uncertainty and unexpected disruptions in the macro operating environment. MNEs operate in a multi-currency environment, and must be aware of local regulations to operate their FX and transaction models accordingly.

DBS as your strategic partner

Many MNEs with entrenched structures are adopting a wait-and-see approach as international tax reform remains far from a done deal. However, MNEs, especially those that are transforming at this time can take advantage of this development to extract potential opportunity and prepare for threats in the rapidly changing landscape. DBS Treasury Advisory and Solutioning can help your company explore and manage the envisaged changes in order to seize the new opportunities ahead.

About DBS Treasury Advisory & Solutioning

The DBS Treasury Advisory and Solutioning team offers comprehensive Treasury Advisory services across Cash and Liquidity Management, Trade and Working Capital Financing, Risk Management as well as Treasury and Digitalisation transformation. Power your business growth in Asia by leveraging our team’s extensive expertise in Corporate Treasury and treasury centralization projects, drawing on more than 30 years’ of experience across industries.

Contact us at [email protected]

References

1OECD, 2021: International community strikes a ground breaking tax deal for the digital age

2(1) Wall Street Journal, 2021: G-7 Tax Plan: What We Know About the Global Corporate Tax Deal; (2) Guardian, 2021: G7 tax reform: what has been agreed and which companies will it affect?; (3) CNBC, 2021: Biden and G-7 leaders will endorse a global minimum corporate tax of at least 15%

3(1) KPMG, 2021: Global minimum tax: An easy fix?; (2) Reuters, 2021: Explainer: What is a global minimum tax and what will it mean?

4(1) CNA, 2021: Still too early to work out exact impact’ of global corporate tax reform: Lawrence Wong;

(2) The Straits Times, 2021: G-7’s global minimum corporate tax rate: What will it mean for Singapore?

Appendix

- Additional information links on Singapore’s competitive edge in the region

- Twin to win: How manufacturing companies in Singapore are growing in the region (edb.gov.sg)

- Singapore Tops Ranking for Technology Innovation Hubs - KPMG Singapore (home.kpmg)