Pros and cons of credit cards

![]()

If you’ve only got a minute:

- You can make the most out of expenses with a credit card by earning rewards points, cash rebates or air miles.

- A credit card is a loan from the credit card issuing company (e.g. Bank). To make full use of its advantages, your bills should be paid in full so that you avoid hefty charges.

- Your credit card bill shows a breakdown of your monthly transactions, making it easy to track your expenses for better financial planning.

- As some credit cards can offer a high limit, you must be watchful to ensure you don’t spend beyond your means.

With the easing of Covid-19 restrictions and re-opening of borders, the number of people who are “revenge travelling” has been steadily increasing. This might also mean you’re hearing more family and friends discussing their latest holiday plans, with some even bragging about “free upgrades” of hotels and flights using the miles and points they chalked up with their credit cards.

For those who are not “certified” credit card holders, you might be feeling the fear of missing out (FOMO). If you are feeling tempted to get a credit card, remember to do your own due diligence and understand the different types of cards that are available and assess which ones suit your spending habits best.

Also, it is imperative to have an awareness of their pros and cons, as well as your spending habits, before deciding.

Read more: Knowing the different types of payment cards

Pros

Here are 7 benefits of credit cards.

Sign-up promotions

Look out for sign-up promotions like physical gifts (e.g. travel luggage bags), store credits at a particular merchant, bonus miles or even direct cash rebates. These usually come with terms and conditions (T&Cs), such as meeting a required minimum spend on the card within a fixed time frame after activating it.

Convenience

Considered a type of contactless digital payment these days, credit cards provide convenience in your everyday transactions. No more worrying about queues at the ATM, or whether you have sufficient cash in your wallet when you head out for the day.

By making payments with your credit cards, you are able to make online purchases with ease, anytime, anywhere.

Read more: 6 benefits of going cashless

Rewards or rebates

One of the perks of having a credit card is that you are often able to make the most of your dollars spent. How?

Credit cards often offer rewards in 3 broad categories – cashback, rewards points, or air miles. There are also tie ups with merchants to provide promotions like 1-for-1 dining offers or discounts when you pay with a specific credit card.

If you play your cards right (quite literally!), you could be one of those flying for “free” due to air miles redemptions, redeeming staycations and/or meals. All this, without any extra spending on top of your usual expenses.

Now, you may be tempted to cast your net wide and apply for every type of card available to “get all your bases covered”. However, “the more, the merrier” does not apply in this case.

It helps to remember that there is often a minimum spend as well as other requirements that must be met before you are eligible to earn the rewards. In other words, spreading your spending too thinly across different cards may result in you not being able to maximise the benefits you can potentially get.

One strategy to consider is to focus on the type of rewards that are most relevant to you. This means taking note of your personal spending patterns and then consolidating your usage on just one or two cards.

If you are an avid traveller, chalking up miles might be the most applicable option for you. On the other hand, if you spend a lot on groceries or other daily items, a rewards card like the DBS yuu Card or POSB Everyday Card might be a better choice. You can also consider cashback credit cards if you are more focused on getting spending rebates.

Tip: Ensure you familiarise yourself with any T&Cs that come with the card so that you can make the most out of it.

Ease of access to credit

Having a credit card offers you easy access to a line of credit, which comes in handy especially when you need to make big-ticket purchases. (These are the best for chalking up points and miles at one go).

For example, if your car has been damaged and you need to send it in for repairs, which may require a significant amount in upfront payment, you can charge the cost to your card first to make use of the interest free period.

When your salary comes in or your emergency funds become available you can then pay it off (insurance claims tend to take longer to be processed). In this case, having a credit card provides an easy line of credit to tide you through the emergency.

You can also make use of DBS payment and instalment plans to split your big-ticket purchases and bills into smaller, interest free monthly instalments while still earning DBS credit card points.

With My Preferred Payment Plan, you can split your existing credit card purchases into 3 months of interest-free instalments. When shopping at DBS/POSB credit card participating online and retail outlets, you can choose to spread your big-ticket purchases into smaller, interest free instalments of up to 24 months, subject to T&Cs. This can help ease your monthly cashflows.

Read more: Use your credit card to your advantage

Find out more about: Payment and Instalment plans for your credit card

Better financial planning

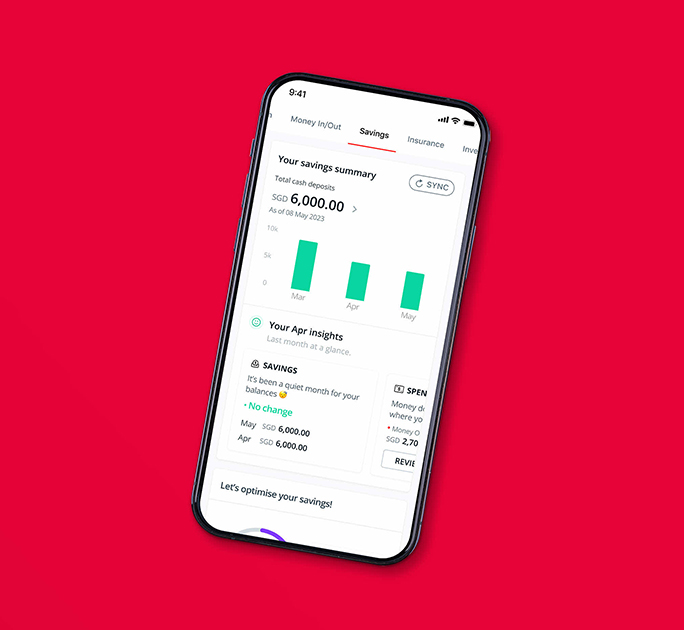

Being able to track your expenses goes a long way in helping you budget well. Each credit card transaction will be reflected in your monthly card statement and updated quickly on digibank, making it easy to monitor your spending habits.

The digital financial advisory tool in DBS digibank reflects a detailed breakdown of your spending and their categories. Use it to have a consolidated overview of your financial habits, financial wellness and any potential money gaps that need to be addressed.

Safety

In contrast with cash, credit cards provide consumer protection against fraud and theft. In the unfortunate event that your wallet is stolen or lost, all the cash inside would certainly be gone.

With credit cards, there are protective measures you can put in place, like opting to receive a notification each time a transaction is charged to your card. If unauthorised charges are made, you can call the card company immediately to inform them of the transaction and it can usually be waived. After this, the credit card issuer will put a hold on the said card to prevent any further transactions from going through.

Many credit card companies also monitor suspicious activity on your credit cards and will inform you if they detect any unusual or suspicious transactions being made.

On top of this, some cards come with purchase protection, extended warranties, and protections against identity theft.

Build personal credit score

When you apply for a loan, financial institutions refer to your credit report to help determine whether to approve it, at what rate and the loan amount. Kept by the Credit Bureau of Singapore (CBS), this credit report is based on your credit payment history on a 12-month rolling basis.

By using your credit card and paying your bills in a timely manner, you are adding to the length of your credit history and reliability in terms of repayment. This in turn builds your credit score and will help in your future loan and job applications too.

Read more: Why is my credit score important?

Cons

While there are many upsides to owning and using a credit card, here are 6 drawbacks to be aware of so that you are not caught off guard in the event that they happen.

Potentially high fees and charges

Unlike debit cards, credit cards are not linked to any bank account. When you spend using a credit card you are essentially borrowing money from the card issuer or bank.

At the end of each monthly billing period, you will receive a credit card bill indicating a minimum sum payable and a total amount payable.

If you pay only the minimum sum stated before the due date, you will avoid being charged a late payment fee (typically upwards of $100) and corresponding administrative charges.

However, the remaining amount outstanding will attract a high interest charge ranging between 26% and 28% per annum, which is calculated on a daily compounding basis. This means that the amount payable is growing each day and can quickly snowball into high amounts of debt.

You must be mindful to pay off the credit card bills in full and before the due date to avoid this.

Read more: Rolling over credit card debt is no game

High annual fees

Many credit cards are subject to annual fees which can often be waived, depending on the card issuing company and the type of card you hold. You can call the relevant company to find out if you are eligible for a waiver on these fees.

High foreign exchange rates

While having a credit card does make purchases in foreign currencies seamless, they tend to come with relatively high foreign exchange fees and a less than favourable foreign exchange rate.

One way around this is to use the DBS Visa Debit Card for your foreign currency transactions. With a multi-currency account (MCA) that is linked to your DBS Visa Debit Card, you have access to 12 currency pockets for ease of your spending.

All you need to do is to exchange currency any time the rates are favourable. When you spend overseas with your linked card, the foreign currency will be deducted directly from the respective currency pocket without incurring any additional conversion fees.

May encourage overspending

When you apply for a credit card, based on your personal credit score and financial situation, the bank can offer you a monthly credit limit of up to 4 times your monthly income. With this, it is easy to overspend or have a mistaken impression that you have a much higher budget than you really do.

If you are a person with a high propensity to overspend, you can consider requesting the bank to lower your credit limit to one that is within your budget or opt not to use a credit card at all.

Potential of card identity theft

Using credit cards, especially on online platforms that may not be secure, opens the possibility of identity or card theft. Your credit card information can also be compromised if you are making purchases on an unsecured WiFi network or simply if your physical card falls into the wrong hands.

In such instances, is a good idea to disable your card for overseas use and to only enable it when you need it. This will reduce the chances of your card being used to make unauthorised overseas purchases.

The digibank app allows you to change your card settings easily, including blocking it if it gets lost or stolen, and disabling or enabling it for overseas use.

Read more: 6 online banking safety tips

Find out more about: Stop the phish with DBS Payment Controls

Not available to all consumers

Since a credit card is essentially a short-term loan from the card issuer to the cardholder, it is mandatory for the card issuer to run credit checks and financial health checks in accordance with regulations set by the Monetary Authority of Singapore (MAS), before determining whether to approve the issuance of a card.

This is largely dependent on the income, personal credit rating, and age of the applicant. Applicants who are unemployed or below the age of 21 are not eligible for a credit card.

In summary

Credit cards offer a variety of conveniences, but if not used carefully, they can be a double-edged sword. How you wield it will make all the difference in determining whether you get the most out of your spending or find yourself knee deep in debt.

While credit cards may provide a convenient line of credit, they should not be used as replacement of a long-term loan due to their high interest charges. Rather, use it as a tool to help manage your short-term cash flows and chalk up some benefits.

It is important, then, to remember to be the master of your credit card, and not let it be the master of you. Use it with intention and discipline, and keep a keen eye on your finances, cash flows and bill payments to ensure that your fairy-tale shopping dreams with all its rewards does not end as a horror story instead.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)