How to invest in the S&P 500

By Lynette Tan

![]()

If you’ve only got a minute:

- The S&P 500 is one of the most widely used proxies for the overall health of the U.S. stock market.

- Investing in an S&P 500 index means investors will not have to hand-pick individual stocks on their own, which can be tedious and costly.

- Passively buying and holding an index saves time, money and offers diversification of risk.

- Do consider factors such as the expense ratio, liquidity, dividend withholding tax, foreign currency risk when choosing an ETF to invest in.

![]()

Investing may seem daunting to new investors who often wonder where to begin and what to invest in. Still, even experienced fund managers or stock analysts can make mistakes in their forecasts. Thus, one way for investors to start their investment journey could be to invest in a vehicle that tracks a broad-based stock index.

The Standard and Poor's 500, or more commonly known as the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed in the United States. It is one of the most followed equity indices.

A stock market index is a measurement of a market and is often seen as a barometer to what’s happening in the stock market. The S&P 500 is one of the most widely used proxies for the overall health of the U.S. stock market.

While we cannot invest in the index itself, there are Exchange-Traded Funds (ETFs) or mutual funds that track the performance of the index.

Constituents of the S&P 500

The S&P 500 index is made up of 500 of the leading U.S. companies, representing approximately 80% of available U.S. market capitalisation. It is often used as a gauge for the overall health of the U.S stock market.

S&P 500 stocks reflect the U.S. economy's growth drivers to a significant extent. For example, the top 10 constituents of the S&P 500 by index weight as of August 31, 2023, are as follows:

- Apple

- Microsoft

- Amazon

- NVIDIA

- Alphabet Class A

- Alphabet Class C

- Tesla

- Meta Class A

- Berkshire Hathaway Class B

- Exxon Mobil Corp

The companies in the index are mostly concentrated in the following three sectors – Information Technology (28.2%), Healthcare (13.2%) and Financials (12.5%).

Why invest in the S&P 500?

Investing in the stocks market via an index ETF such as the S&P 500 has several benefits.

Firstly, investors will not have to hand-pick individual stocks on their own, which can be tedious and costly. You gain exposure to the world’s leading companies without spending hours researching individual stocks. Passively buying and holding an index saves time, money and offers diversification of risk.

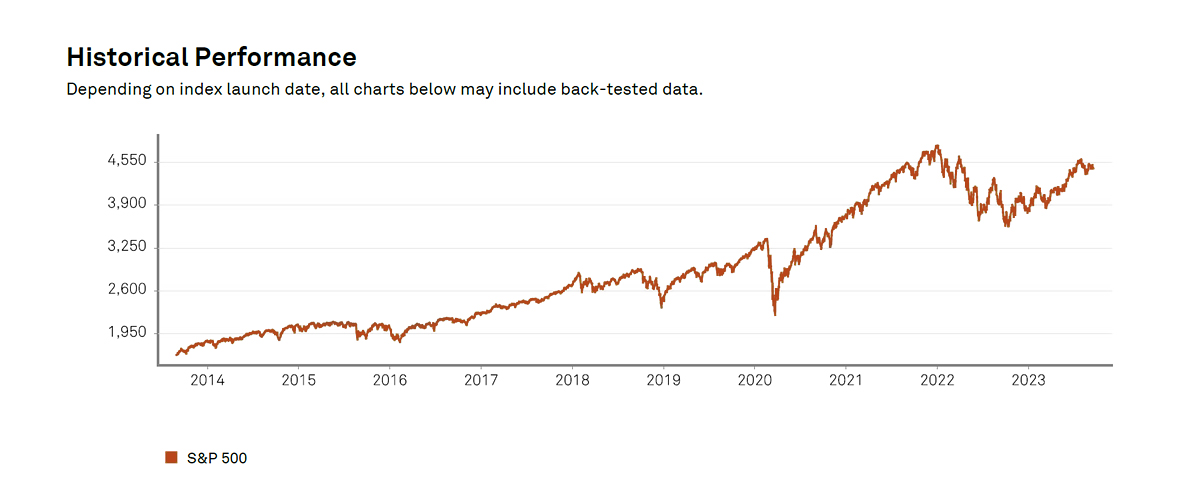

A buy-and-hold strategy also minimises the effects of market volatility and increases the odds of seeing positive returns over the long term – the 10-year annualised average returns of the S&P Dow Jones index is at 12.17%.

If you are a new investor, you can also use the dollar-cost averaging approach to buy into an S&P 500 ETF by investing a small amount each month instead of taking the lump-sum approach.

Find out more about the advantages of dollar-cost averaging.

S&P 500 Performance in the last 10 years

Source: https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

When held over the long term, an S&P 500 investment can be the core holding of any portfolio, especially for new investors looking to build wealth for the future.

As with every investment, there are disadvantages of investing in the S&P 500 as well. The index is dominated by large-cap companies, and this restricts exposure to small-cap or mid-cap stocks which some investors may prefer.

The index is also concentrated in U.S-based companies and will provide limited exposure to companies in other countries.

How to invest in the S&P 500?

You cannot invest directly in an index because it is simply a measure of the performance of its constituent stocks. What you can do is invest in the index through ETFs or mutual funds that try to replicate the performance of the index.

ETFs are generally low-cost and trade just like stocks listed on stock exchanges. Consequently, they are highly liquid and subject to intraday price fluctuations. Index ETFs focus on passive index replication, exposing the investor to all stocks in that index. You can invest in the Singapore-listed SPDR® S&P 500 ETF Trust through a DBS Vickers Account.

S&P 500 mutual funds tend to have slightly higher fees compared to ETFs. Furthermore, a mutual fund has a slightly different structure, thus only allowing investors to make their purchase at the day’s closing price, which is based on the fund's net asset value (NAV).

Which S&P 500 investment should I choose?

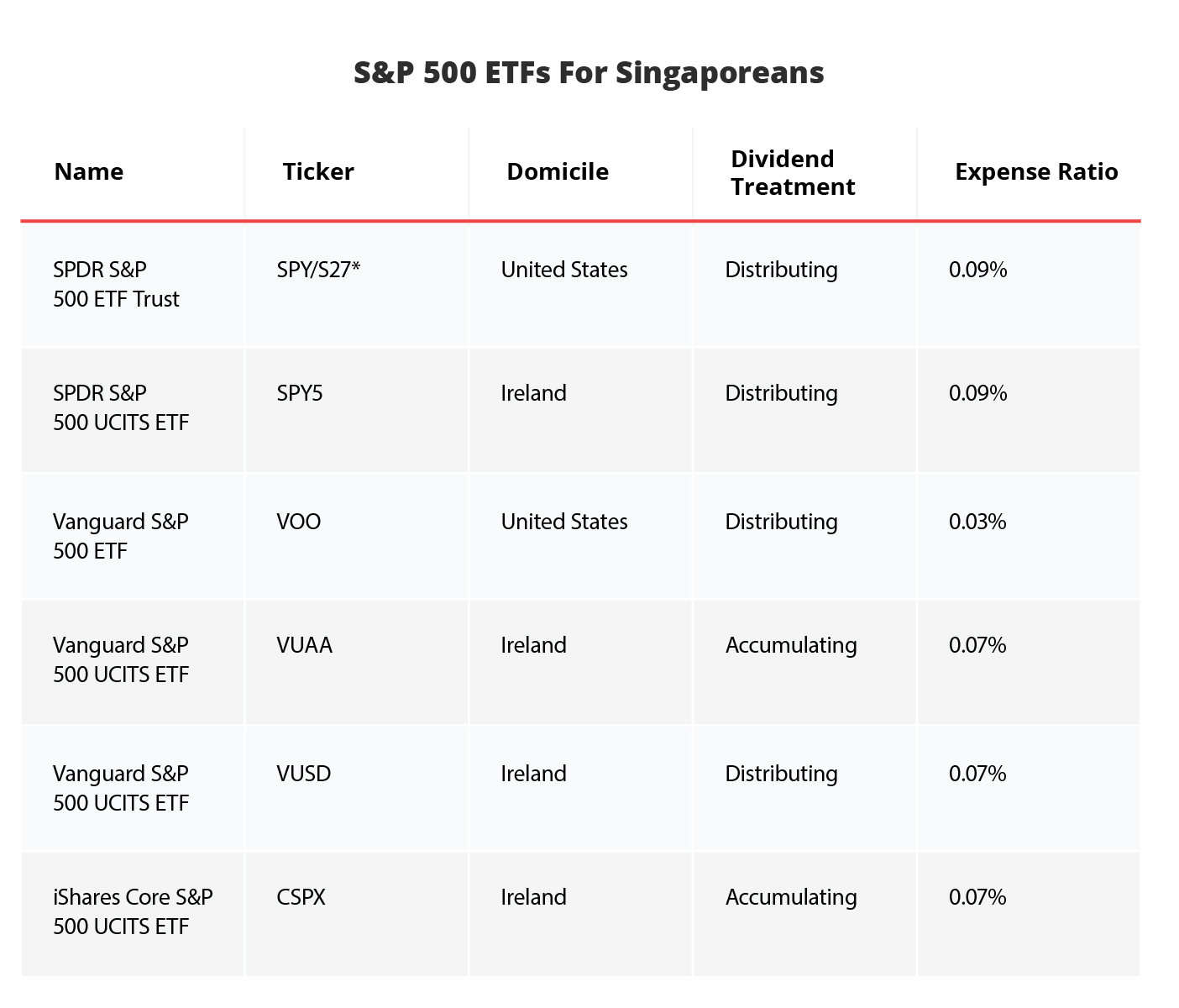

Since the S&P 500 is a popular market index, there are several ETFs and mutual funds that provide direct exposure to the index. Here are 5 key factors to take note when choosing an S&P 500 vehicle to invest in:

1. Expense Ratio

The expense ratio measures how much of a fund's assets are used for administrative and other operating expenses. Investors typically use the expense ratio to determine if a fund is an appropriate investment for them after fees are considered. As such, an expense ratio as low as possible is deemed favourable to the investor.

For most of the S&P500 ETFs, their expense ratios range between 0.03% to 0.09%

2. Liquidity

Liquidity is an important consideration for investors so that they are able to sell their positions whenever they need to. It is thus better to invest in ETFs with higher liquidity.

3. Dividend Withholding Tax

Singapore currently does not impose withholding tax on dividends so if you are investing in an ETF listed in Singapore, there is no tax to pay. However, if you decide to invest in an ETF listed in another country, you may be liable to taxes on the dividends.

For instance, Singaporeans investing in the US markets are liable to a 30% withholding tax on their dividends. This means for every $100 dividend you get from investments in the US markets, you will only get $70.

The Irish have a tax treaty with the U.S. and are subjected to a discounted dividend withholding tax of 15%. This means that Singapore investors get to enjoy the discounted rate as a Singapore investor.

4. Foreign Currency Risk

For ETFs that are denominated in a foreign currency, investors may be exposed to risk of currency fluctuations.

5. Accumulating or distributing ETFs

You may notice that there are 2 types of ETFs – those that distributes their dividends regularly and those that accumulates. If you want your investments to grow and accumulate over time without actively managing them, you may choose an accumulating ETF. If earning steady dividends is your aim, choosing a distributing ETF may make more sense for you.

* Although it is listed on the Singapore exchange, do note that SPDR S&P500 ETF (S27) is still subject to 30% dividend withholding tax as it is domiciled in the US.

Whether you are a new investor or a seasoned investor building up an investment portfolio, adding an index ETF like the S&P 500 ETF offers an affordable way to invest in a basket of stocks as well to accumulate wealth in the long term. To learn more about how to start investing in ETFs, read here.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on the Plan & Invest tab on the digibank app to receive specific investment picks based on your objectives, risk profile and preferences.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)