Investing tips for women

![]()

If you’ve only got a minute:

- Even though women are considered better savers than men, they tend to invest less of their funds and hold a higher proportion of their assets in cash or low-yield deposit accounts.

- If you have yet to start investing, consider dollar-cost averaging as it helps you build confidence in investing while being an affordable option.

- If you have already started to invest, consider taking a core-satellite approach to construct your investment portfolio.

- The digital financial and retirement planning tool in DBS digibank can provide you personalised investment options aligned with your goals, risk tolerance and financial situation.

![]()

The modern woman has multiple hats to wear, and they are different for each of you. You could be a sister, daughter, mother, wife, niece, friend, caregiver, career woman, home maker – all of which involve unseen cognitive labour that comes with managing your household, your family, and your relationships.

With all the effort that goes into balancing these hats while endeavouring not to turn into the Mad Hatter, it is no wonder that many women do not assign a higher priority to investing their funds.

While women are generally considered better savers than men, they tend to invest less of their savings. In addition, women who invest are more likely to be conservative, selecting less risky options than men typically would.

Some have suggested that this exercised caution could be due to the average woman feeling a greater need (than men) for a security net in the event you have to take a career break due to childbirth, caregiving or other domestic demands.

As such, women are more likely to hold a higher proportion of their assets in cash or low-yield deposit accounts than in more productive investments. However, amassing emergency savings alone is not ideal as the value of these savings will be eroded by rising costs of living and inflationary pressures over time, and in turn adversely affecting your retirement adequacy.

It is especially important for women to plan well and holistically for your future given your longer life expectancy than men. A key component of a robust financial plan is investing, which allows your money to work harder in the long run through re-investment and compounding of dividends and returns.

Keeping in mind the well-founded concerns that women may have and your need for liquidity, here are 7 tips to help you start investing and working towards your dream future.

1. Do your due diligence

Given that everyone has different investment objectives and risk appetites that change with their life stages, it is important to do a regular review to find out what investments are suitable for your financial needs, time horizon and risk tolerance.

The vast array of investment products available and the investment jargon can make even the thought of investing overwhelming for new investors. However, it is extremely important to understand the mechanics of what you are investing into, and the risks involved.

Some of the key information that you need to be aware of include understanding the products, fees and charges, the investment time horizon, the length of the lock-in period (if there is one) as well as potential gains and losses.

2. Have clear objectives

There are many reasons for investing like preparing for retirement, beating inflation, and meeting certain financial goals. Your objectives are likely to affect the type of investment you choose.

In fact, having a clear investment objective can help you streamline the products that are suitable for you. For instance, Amy who is 40 this year, would like to grow her retirement funds through an insurance plan to supplement her CPF LIFE payouts during her golden years.

A retirement plan like RetireSavvy could be suitable for her where she gets to customise her retirement insurance plan in line with her financial and retirement needs.

With RetireSavvy, she can make a premium top-up, choose a later retirement age, adjust her income payout period, and select her preferred combination of lump sum retirement payment and monthly retirement income by adjusting her retirement income rate.

Likewise, having a clear investment objective offers clarity on which products to choose and helps manage your expectations of potential returns.

Read more: Financial Planning for women at different life stages

3. Start with manageable amounts

It is a common misconception that you need a large sum of money to start investing. After setting aside an emergency cash fund of at least 3 to 6 months’ worth of expenses, you can start investing from as little as $100 a month.

You can do this with a Regular Savings Plan (RSP) like DBS Invest-Saver, which allows you to set aside a fixed amount of money per month (minimum of $100 per month) to invest on a regular basis.

Of course, you can always choose to take the lump-sum approach if you have a larger sum of money on hand and you are confident you are not buying at a high price.

Read more: What to know about dollar-cost averaging

Find out more about: DBS Invest-Saver

4. Put your emotions out of the way

It may sound funny, but investing can be an emotional roller coaster ride!

Even the most experienced investors would have, at some point, panicked and made hasty decisions when their investments faced large fluctuations or selloffs. If the price runs too high you might be tempted to sell too soon, and when the price heads south you might try to cut losses too early.

Therefore, it is important to be aware of investor biases, carry out your due diligence and adopt a diversified investment approach to help you to make better investment decisions.

5. Be wary of products that promise too much

There are many investment scams these days and even well exposed and educated professionals fall prey to them. Admittedly, it can sometimes be tough to identify potential investment scams but if the potential returns sound too good to be true, they probably are.

Higher returns in investment often mean higher risks involved and there is no such thing as a high profit investment with low or no risk involved.

Similarly, be wary of investment schemes that claim to be capital-guaranteed while promising attractive returns. Verify how the scheme can generate such high profits and find out what the risk is like of investments with similar returns. If you are doubtful, do not rush into investing.

Always ask, check, and confirm if you have doubts.

Read more: Insurance for Women – what are your specific coverage needs?

6. Your investment approach

There are a variety of ways you can invest – buying single stocks, exchange-traded funds (ETFs) using a robo-advisor like digiPortfolio or buying a retirement income plan. The key is to do your own research, understand the products and stick to the plan.

There are also different types of investment approaches to take. Here are 2 investment approaches for you to consider.

Dollar-cost averaging

This involves investing fixed amounts at regular intervals into the same investment over a period, regardless of market conditions. Dollar-cost averaging (DCA) is a long-term approach that helps you build discipline in your investment journey and takes the guesswork out of timing the market.

Having a disciplined investment strategy reduces the incidence of making emotional investment decisions since you will not be tempted to buy and sell your investment holdings each time the market moves. DCA smooths out fluctuations and volatility as you buy more shares when prices fall and fewer shares when they rise, eventually “averaging out” the investing cost over the longer term.

An example of an RSP that can help you implement a DCA strategy is DBS Invest-Saver. It allows you to make regular investments of as little as $100 per month into exchange-traded funds (ETFs) and/or unit trusts of your choice.You can invest into several different ETFs or unit trusts that match your risk profile, affordability, and investment goals, enabling you to build up your portfolio steadily and progressively.

If you are thinking of investing but have yet to start, consider investing using DCA in a number of ETFs and unit trusts at once. Given that the minimum monthly investment per ETF and/or unit trust is at a fairly affordable at $100, you can build the discipline to set aside a fixed amount of savings to invest each month in a few of these diversified investment products.

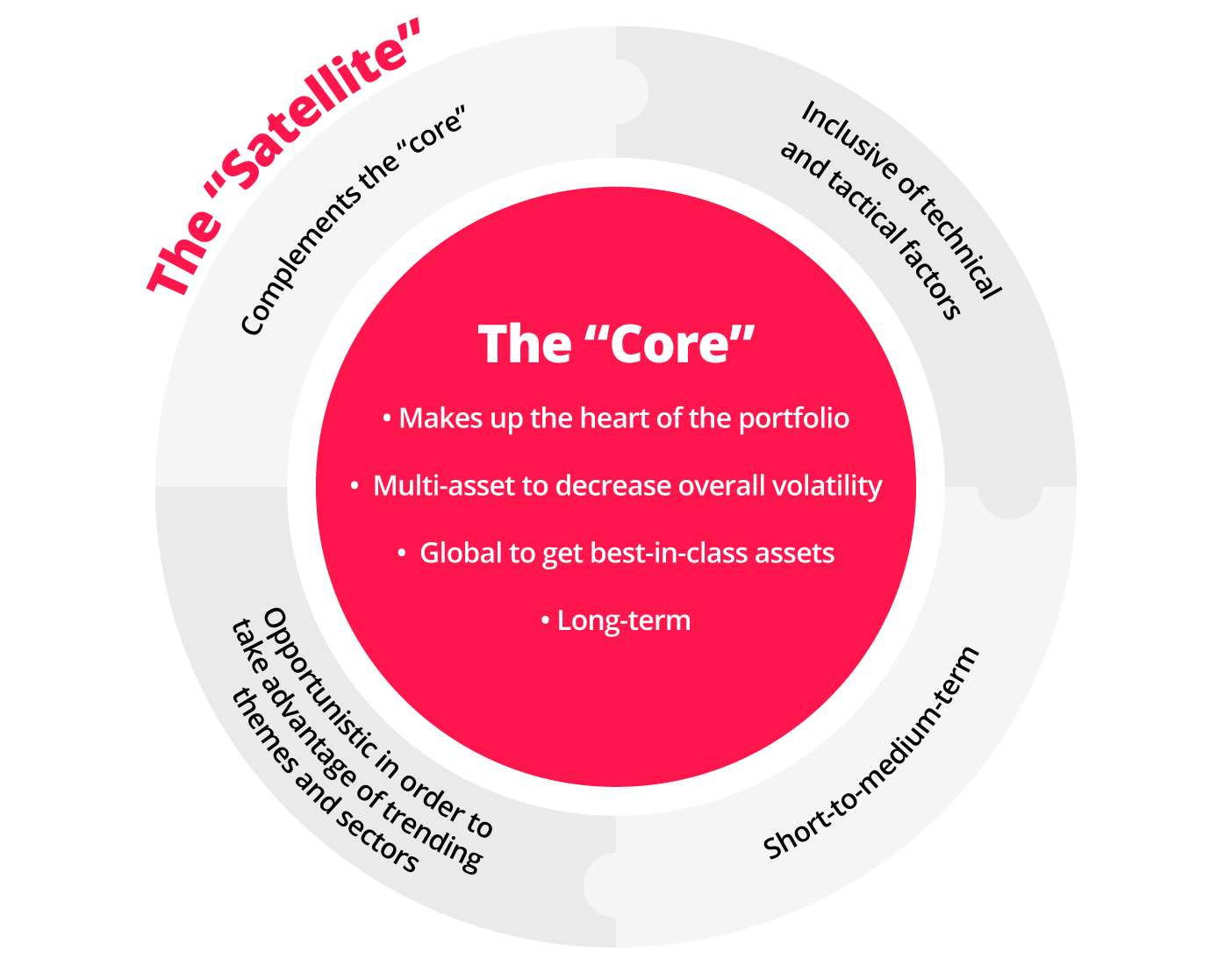

A core-satellite strategy involves constructing your portfolio with a stable, well-diversified “core” and a complementary “satellite” that can offer higher returns (but also correspondingly higher risks).

You can construct the “core” with a combination of pooled investment funds like ETFs and unit trusts that track equity indices like the S&P 500 and Straits Times Index. Using these types of pooled investment instruments help investors to minimise overall trading costs and volatility as compared to individual stock picking.

The allocation of investible funds to the “core” of the portfolio can range from 50% to 70% of the investment portfolio depending on your risk tolerance as well as your financial planning goals.

With the core-satellite strategy, you are able to generate consistent returns from the “core” of the portfolio while potentially enjoying better-than-average returns from the “satellite” component. It also provides diversification and allows each investor to design an investment portfolio according to individual goals, preferences, risk tolerance and investment time-horizon.

This strategy can also be implemented using a barbell construct, which has investment exposures at 2 ends of the risk spectrum, namely high-growth stocks and income generating investments.

The barbell approach has been especially useful during times of heightened market volatility as the portfolio can capture potential gains from outperforming sectors while balancing out the accompanying risks with dividend yielding investments.

7. Use digital tools to aid in your investing journey

The digital financial and retirement planning tool in DBS digibank is designed to help you in your financial planning journey.

Used hand-in-hand with the Singapore Financial Data Exchange (SGFinDex), it consolidates your personal financial information across different financial institutions, insurers, CDP, CPF Board, HDB and IRAS to give you a holistic view on your financial position. This helps you monitor your cashflows, identify and close gaps and offers customised tips.

It also has a “Make Your Money Work Harder” feature which is backed by DBS investment experts. It helps to recommend investment funds and portfolios based on your personal goals, risk tolerance and financial wellness. All you have to do is answer a few simple questions and let the planner do the rest.

Read more: How you can retire well as a woman

In summary

All women are “superwomen” in their own right, with the number of tangible and intangible roles and responsibilities they diligently and successfully juggle.

Prioritising investing and financial planning for yourself should not be seen as another responsibility adding to the existing laundry list, but instead as your growing reward at the end of the tunnel.

After all the hard work you have put in, what can be better than to reward yourself with a financially secure and well-designed retirement to close the chapter?

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)