Quick guide to margin trading

![]()

If you’ve only got a minute:

- Margin trading is the practice of investing/trading using money borrowed from a bank or a stockbroker.

- Share financing is a particular type of margin trading, in which money borrowed from a bank or stockbroker is used to buy stocks or ETFs.

- While margin trading and share financing has its benefits, be careful that you never “leverage to the max” as the greater the loan relative to your total investment, the greater the risk.

![]()

You might have heard about the practice of borrowing at low interest rates to invest in higher-yielding investments. The difference you earn is “free money” – in a sense.

This practice is commonly known as ‘margin trading’.

While margin trading can greatly magnify your potential gains, it can also magnify losses if your investments go wrong.

With that important risk warning out of the way, let’s look at how it potentially builds wealth faster.

Same-same But Different: Margin Trading and Share Financing

Margin trading and share financing are often used interchangeably. But there is a key difference.

Margin trading is the practice of investing/trading using money borrowed from a bank or a stockbroker.

Share financing is a particular type of margin trading, in which this money is used to buy stocks or exchange traded funds (ETFs) . DBS is a rare share financing lender that allows you to choose your own broker.

There are 3 main reasons why investors may wish to engage in margin trading:

- To invest more than they would otherwise have been able to.

- Invest when valuations are cheap, even when they don’t have the cash immediately available.

- Free up cash for investors without having to sell existing investments.

How Share Financing Allows You to Get “Extra” Cash

Sometimes, you might need some extra cash for whatever reason. You can also use share financing to get this without having to sell your investments.

For example, if you have shares with a market value of $100,000, you can typically borrow 70% of the value of those shares, by depositing them with a bank/broker as collateral. The result: you can draw down on cash of $70,000, without having to sell your stocks.

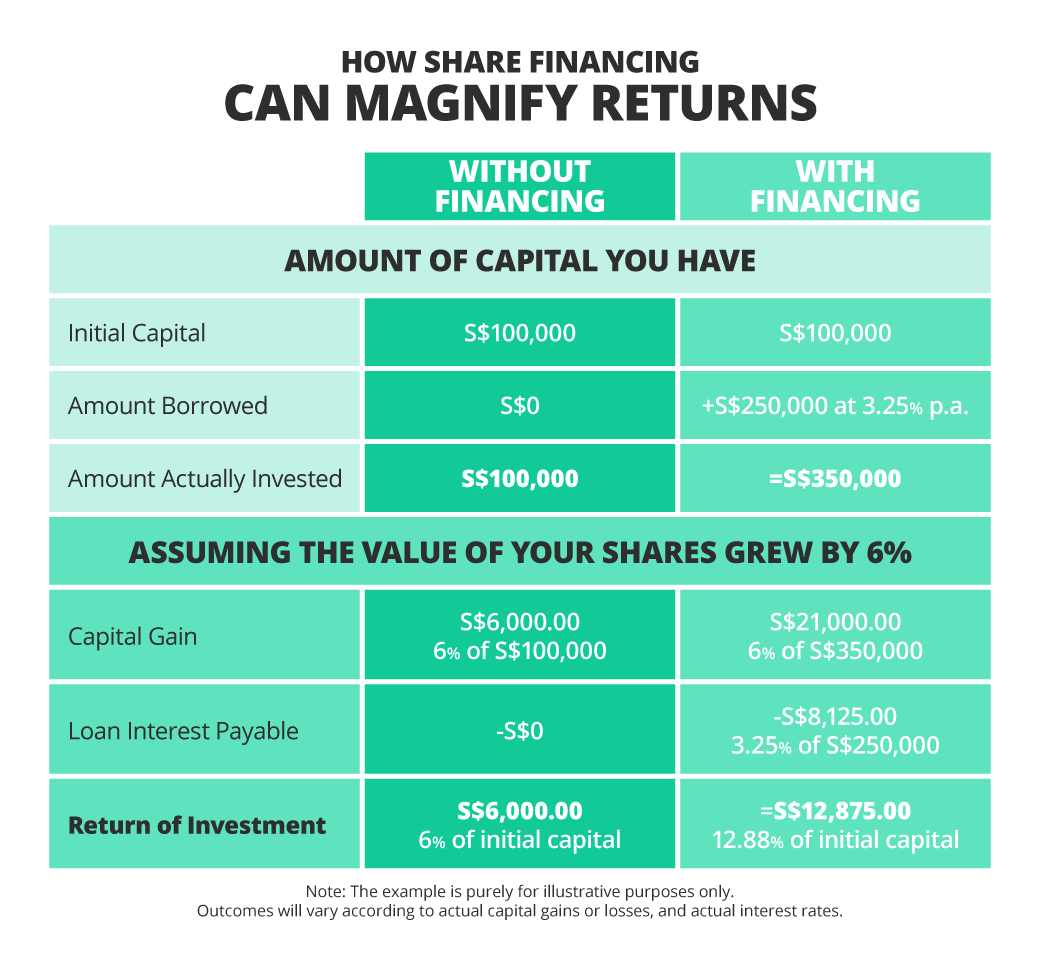

The Mathematics Behind the Stronger Investment Firepower

But most investors who engage in share financing do so to boost the firepower of their investment.

And before going any further, it is important that you understand how it impacts you.

Different limits for different types of collateral

Lenders typically have different limits on the amount you can borrow. In Singapore, the common industry practice is 3.5x leverage for cash deposits and 2.5x leverage for shares deposited as collateral.

This means that if you made a cash deposit of $100,000, you can invest up to $350,000. If you used shares worth $100,000 as collateral, you can invest up to $250,000.

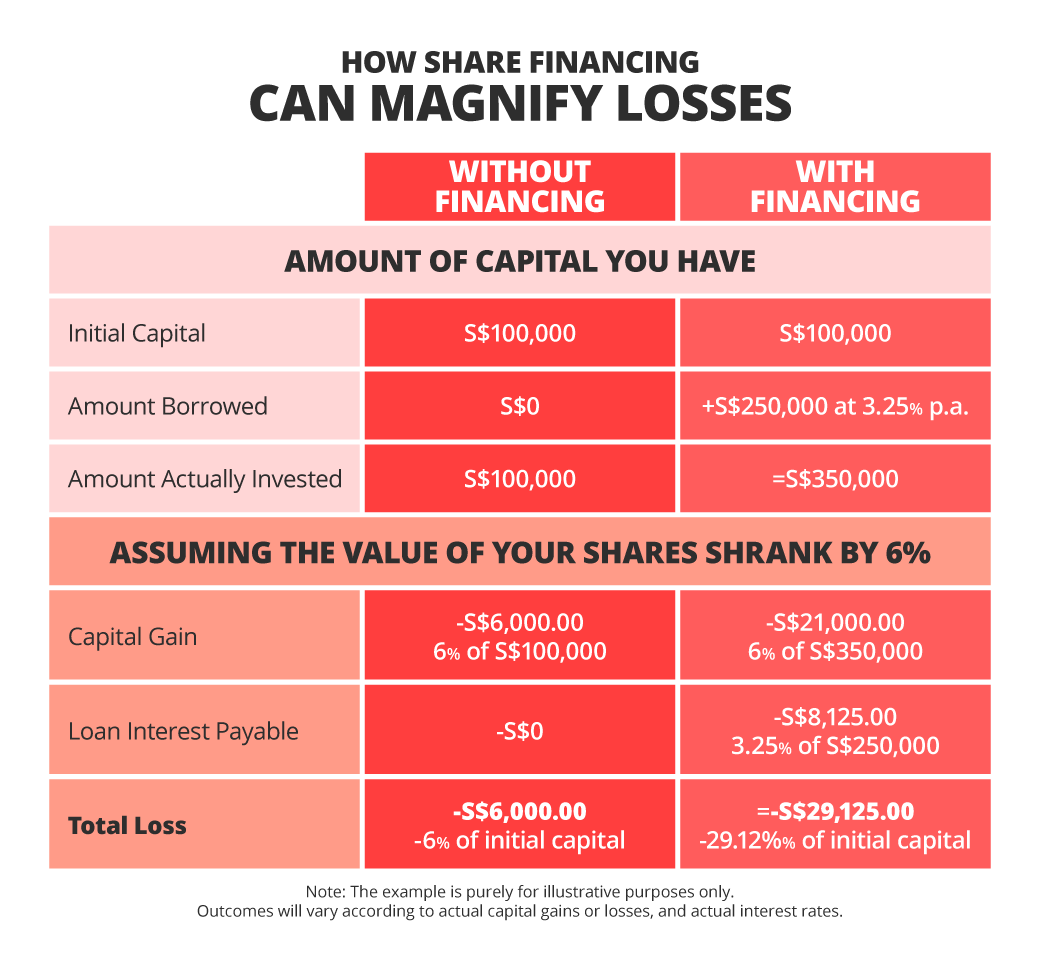

“Gearing Effect” Magnifies the Gains – and Losses

“Leverage” and “gearing” both refer to the magnification of returns from investment.

For example, if you invested $100,000 in cash and achieved 6% capital gains, the profit from your trade would have been $6,000. However, if you borrowed at say 3.25% to invest up to $350,000, you could magnify the capital profit (net of borrowing costs) to $12,875.

In this example, we haven’t taken into consideration dividends, which can contribute considerably to the magnification of total returns with share financing or leverage.

But do not rush to borrow money for investing. The magnification of outcomes works both ways. If the market goes against you, and you suffer a 6% decline in the value of your shares, share financing will magnify this 6% loss.

How much interest do you pay for share financing?

You pay interest for as long as the loan lasts. This is also known as “daily-accrued interest”.

In the above illustrations, the 3.25% p.a. loan interest payable is based on a full-year loan. But if you borrow for only 10 days, then your interest payable would be accrued at 10/365 * 3.25% of the loan amount.

Jargon, Simplified.

Two other terms you’ll hear are ‘margin maintenance’ and ‘margin calls’. Here’s why they are important.

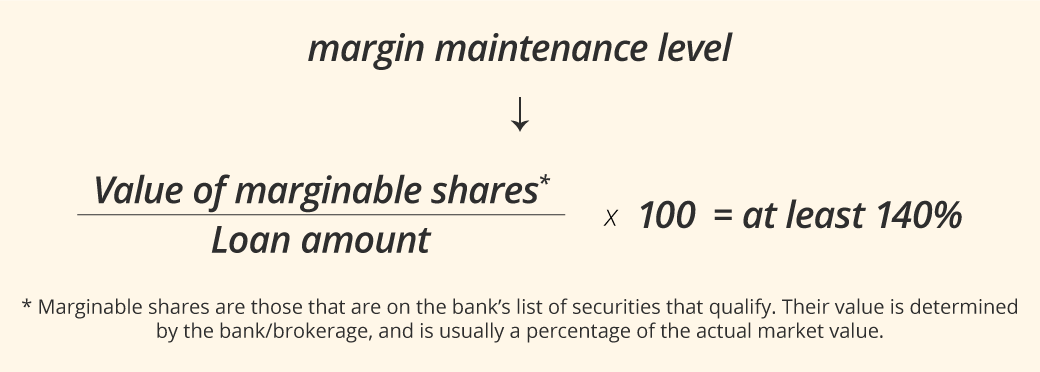

Margin maintenance

This is the minimum value of stocks that must be maintained in your margin account. In Singapore, most banks and brokers require you to have a 140% margin maintenance level (also known as the ‘margin percentage’).

Not all shares will count towards the margin maintenance level. To prevent surprises, check what you have against the list from your bank/brokerage. (For DBS’ list, click here.)

Margin calls and force-selling

Margin call describes what happens when the margin maintenance level falls below 140%.

This can happen when your trade goes against you, or if your marginable shares become non-marginable because of changes in the company’s financial health, illiquidity, trading suspension or other reasons.

When that happens, you’ll be expected to top up your margin account to by a certain time. This top-up can take three formats:

- Deposit more cash

- Pledge more shares (that qualify)

- Sell some shares in your margin account

If you miss the deadline for whatever reason, the lender may force you to sell some of the shares in your margin account. This is known as force selling.

If the margin maintenance level falls below 130%, you jump immediately to the force-selling stage.

How much should you borrow to invest?

There is no one-size-fits-all answer, as much of it has to do with your personal appetite for risk.

But investment advisors have a general rule: never “leverage to the max”. The greater the loan relative to your total investment, the greater the risk.

If you borrow to the max (around 70% of the total investment value1), you will be at the margin maintenance level of 140%. If the share price moves against you, it would immediately result in a margin call. There is no buffer.

But if you borrowed 50% of the total investment value, you would have a 200% margin maintenance level. There would be a substantial buffer before a margin call is triggered.

Notes:

1 Assuming a 3.5x leverage limit for cash deposits. Banks and brokers in Singapore are typically prepared to lend you $250,000 for every $100,000 cash you deposit. So that would translate to a loan-to-investment value of around 70% (($250,000/$350,000) x 100).

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on DBS NAV Planner to receive specific investment picks based on your objectives, risk profile and preferences.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)