Why Lasting Power of Attorney is not just for the elderly

![]()

If you’ve only got a minute:

- Take charge of your future by applying for a Lasting Power of Attorney (LPA) to designate decision-makers and safeguard your interests.

- An LPA ensures that your wishes are honoured, while protecting your loved ones, and avoiding unnecessary legal complications.

- Advanced Medical Directives (AMD) can help make your medical wishes known and spare your family from difficult decisions. Take steps to register your preferences as soon as you can.

![]()

We don't know what the future holds. It's one reason why we save for a rainy day or buy a life insurance policy. It’s also the reason why we should have our estate planning in place, but for most of us, it remains a distant thought.

But there are some things that we should look into today, because if something happens to us, “trust me" or "I know what he/she wants" doesn't work with courts, authorities or lawyers. It also removes the burden of guilt from family members faced with a “do not resuscitate” scenario.

Most of us have a vague idea that estate planning involves having a Will and CPF nomination. We associate Trusts with the wealthy, but that’s a misconception, as this article explains. Besides these, there are two other essentials: Lasting Power of Attorney (LPA) and Advanced Medical Directive (AMD).

What is a Lasting Power of Attorney (LPA) and what does it do?

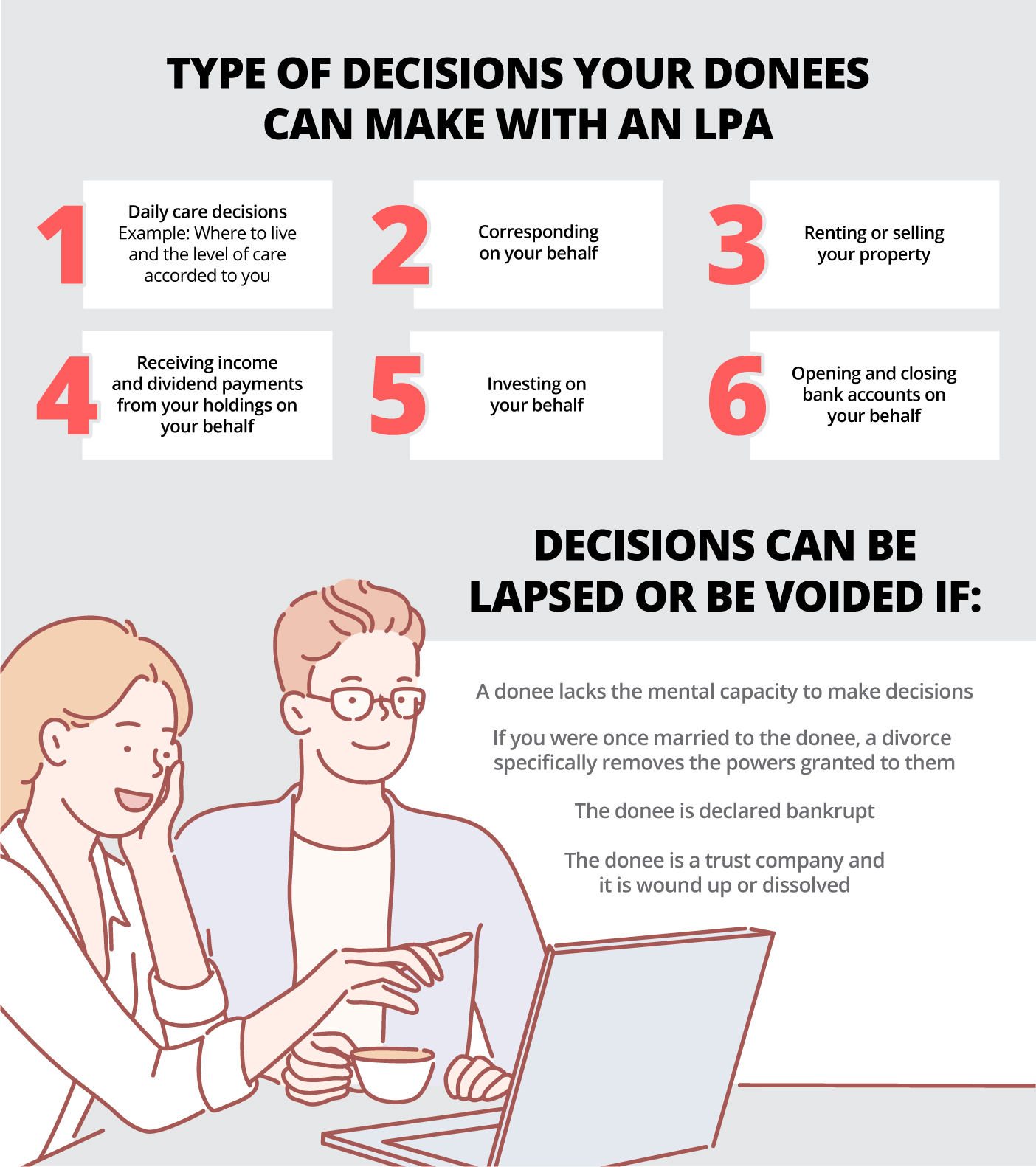

The LPA is a legal document that enables someone you trust to make decisions on your behalf about: your personal welfare, property, and financial affairs. An LPA must be registered by the Office of the Public Guardian (OPG) in order for it to be valid.

It is one of several financial tools available to everyone in Singapore.

Source: Data.gov.sg

Reasons to Consider an LPA

Having an LPA helps clear a path to looking after the donor, which refers to the person who initiated the LPA.

- Our wishes matter, and the LPA allows you to appoint someone to make decisions on your behalf in case you lose the mental or physical capacity to do so.

- If you have young children, an LPA gives you the chance to plan for them should you become mentally incapacitated.

- If you have elderly parents, an LPA helps you take better care of them. Unlike a Will, the LPA doesn't wait until the person passes away to come into effect. At a time of increasing incidences of dementia and mental illness, an LPA could prevent families from being locked out of accounts or assets unnecessarily.

- There is no automatic "right" for families to manage their loved one's affairs, even if they have their best interests at heart. Without an LPA, some families may get caught up in unnecessary and lengthy court proceedings for even the simplest things which we take for granted daily.

One other thing: once you regain your mental capacity, the LPA is no longer enforceable. Remember to inform the relevant agencies to deactivate the use of the LPA. Either you and/or your donee can do this. This is slightly different from a Trust, which continues to be in effect once it has been activated.

Applying for LPA in Singapore

A Singapore-originating LPA only works in Singapore. If you're spending time overseas, or intending to move there for work or other purposes, it is best to have an LPA in those countries.

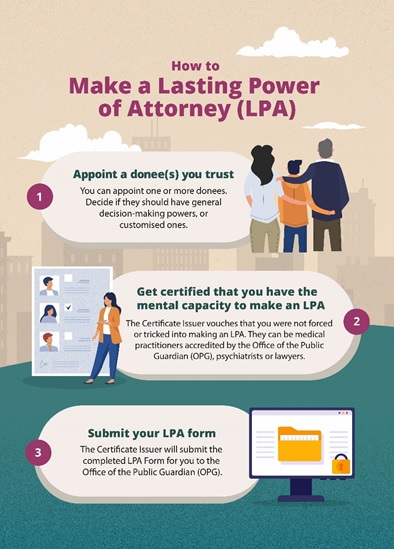

In Singapore, the process starts by appointing someone you trust to be the donee.

Number of donees

You can appoint more than one person to be your done. When it comes to decision-making, they must be in sync with the roles you specified, and not cross over into the other donee's area of responsibility.

If you have two or more donees and haven't specified what their roles are, Singapore law assumes they must cooperate to make a decision on your behalf.

Choosing between Form 1 and Form 2

In Singapore, you can choose to give your donees general or specific decision-making powers. Your choice determines if you should use Form 1 or Form 2. If you’re curious, 98% of Singaporeans have made an LPA using Form 1, according to MoneySense. These forms are available from the Office of the Public Guardian, Singapore.

|

|

Form1 |

Form2 |

|---|---|---|

| Powers granted to donee | General powers with basic restrictions | Customised powers |

| No. of donees | You can appoint up to two donees and one replacement donee | No restriction on the number of donees that you can appoint |

| Phrasing of the document | Standard wording | Requires a lawyer to draft the wording of powers in Annex 3 |

Choosing a Certificate Issuer

The Certificate Issuer vouches that you have the mental capacity to make an LPA, and were not forced or bluffed into doing so. They will also submit the LPA Form for you to the Office of the Public Guardian (OPG).

You can seek out three groups of people: medical practitioners accredited by the OPG, a psychiatrist or a lawyer*. To avoid any potential conflicts of interest, the Certificate Issuer cannot be a family member, your donee, or seen to benefit in any way. Refer to the Ministry of Social and Family Development’s guidelines for details of who qualifies – and who doesn’t.

* The lawyer must be a Singapore solicitor qualified to practice Singapore law in a Singapore law practice

Fees

To encourage more Singaporeans to apply for an LPA, the S$70 application fee for LPA Form 1 has been waived since 2021, and the waiver will last till March 31, 2026. The application fee for Form 2 is S$185 for Singaporeans.

Why also consider an Advanced Medical Directive

An Advanced Medical Directive (AMD) is a legal document that lets your doctor know you don't want life-sustaining treatment when you are terminally ill and in an unconscious state.

This removes any burden on your family members to make a decision that could create an immense amount of guilt and hurt. For some of us, such decisions could have serious repercussions: It could tear the family apart emotionally, or create unwanted financial burdens from live-preserving treatment or surgery.

The AMD also makes your dying wishes clear to all family members and medical staff should they be backed into a life-or-death decision.

How do I get an AMD?

Firstly, you need to be above 21. In Singapore, an AMD can be obtained from medical clinics, polyclinics or hospitals. Alternatively, it can be downloaded from this link.

Once you have decided on having an AMD, a licensed doctor in Singapore will have to determine three things:

- That you haven’t been forced into making the AMD

- That you have the mental capacity to make this decision

- That you understand what you have done

Then it needs to be registered with the Registrar of Advanced Medical Directives. Once completed, an acknowledgement of your medical wishes will be sent back to complete the AMD.

In Conclusion: When should I consider an LPA or AMD?

The short answer is “right now”. Under Singapore law, you can get an LPA or AMD if you're above 21 and capable of making decisions on your own with clarity. That means that you should be considering one right now.

If you have siblings or elderly parents to care for, an LPA or AMD will help you plan and ensure that, should anything happen to you, they will also be cared for.

And this holds true for those with elderly parents who face an increasing risk of dementia, mental illness or any other capacity-limiting illnesses like stroke. They need to know that you have been enabled to make the right decisions on their behalf when the time comes.

This article is Part 3 of 3 in a series about Estate Planning. For more in this series:

Part 1: The Importance of Estate Planning

Part 2: What is a trust, and why bother setting up one?

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)