Learn how to budget in your 20s

![]()

If you’ve only got a minute:

- Save before you spend and keep a close eye on your monthly expenses to ensure you have a healthy cashflow.

- Be conscious of seemingly small daily indulgences and irrational spending as they can easily add up.

- Using your credit cards wisely can get you the best bang for your buck in the form of rewards points, cash rebates or air miles.

![]()

Your 20s are the most important decade of your life. During this exciting phase, you are likely to experience many changes, including building a successful career, expanding your social circle and for some, getting married and having children.

With so many things happening along the way, how do you balance between achieving your goals and having fun?

At the heart of achieving financial freedom is a sound financial plan, which starts with honing your budgeting skills. Here are 10 things to consider as you start on your journey.

1. Save before you spend

In Warren Buffet’s wise words: “Do not save what is left after spending, but spend what is left after saving.”

Cultivating a habit of saving is key.

A good rule of thumb is to try and set aside at least 10% (or more, if you can) of your monthly take-home pay. Ultimately you should decide what ratio works best for you based on your goals and lifestyle needs. The aim is to not have to dip into your savings regularly to make up for shortfalls.

One tip is to keep your savings in a separate account, away from your spending account. Money that’s kept out of sight is kept out of mind.

Read more: Habits to embrace in your financial journey

2. List your monthly expenses, down to the last cent

Track your monthly expenses over time for a better picture of your spending habits and patterns. That way, you will know exactly where your money is going, and what you should be cutting back on, if necessary.

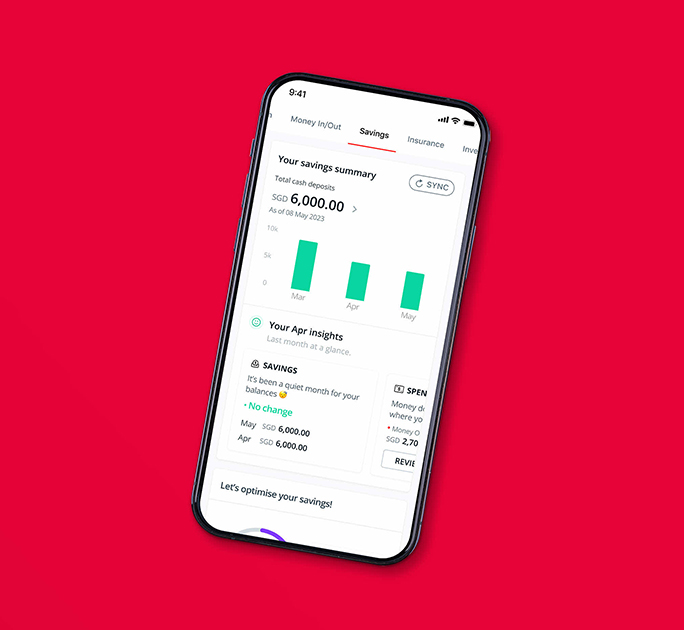

You may also find expense tracking apps useful when doing your monthly budgeting. The digital financial advisory tool on DBS digibank can help you track your saving and spending patterns, as well as monitor your incomes, expenses, and savings all in one place.

Read more: Track your savings and spending with digibank

Find out more about: Plan with digibank

3. Be conscious of your fixed and variable expenses

Knowing how your money is spent gives you a better idea of your different expenses. It may even help you to trim your annual expenses by hundreds, if not thousands, of dollars.

Although fixed expenses like rent, phone bills and monthly payments for a car loan cannot be reduced in the short term, being mindful of them can help you make a conscious effort to cut down on other expenses.

If you are not conscientious with your tracking, an expensive dinner or a new branded bag can easily cause your monthly expenses to spike up.

4. Sum up your daily small indulgences

As insignificant as they seem, small expenses like a daily cup of artisanal coffee can add up over the course of time. This money could be directed towards more meaningful things, such as paying off a credit card bill or achieving your savings goal. But it doesn’t mean that you need to give up your regular caffeine hit or small treats. Instead, you can explore cheaper alternatives like simplifying your Starbucks order, or grabbing a Kopi from the hawker centre.

5. Unfollow and unsubscribe from temptations!

The rule of ‘out of sight, out of mind’ works well here too! It’s all too easy to rationalise your next buy when you are constantly bombarded by the latest trends and promotional messages online. By scrubbing your social media clean of these enticing images, you are less likely to make impulsive and unnecessary purchases.

Another step you can take is to not link any payment methods to your shopping app to make it slightly less convenient to click and pay on impulses.

6. Make your credit cards work smarter for you

Credit cards do not have to be a gateway to debt. It may sound counterintuitive but credit cards also allow you to utilise offerings such as substantial discounts, reward points and cash rebates.

Choose credit cards that best suit your lifestyle needs so that you can enjoy better mileage for every dollar spent. What’s more, if you consolidate your spending on one or two cards, you can accumulate your points and rebates faster.

That said, do remember to pay your credit balances on time to prevent racking up on late payment charges and massive interest over time.

Read more: Use your credit card to your advantage

Rolling over credit card debt is no game

7. Reduce unsecured debt

The inability to repay loans and the corresponding accumulation of interest charges can be a constant source of distress.

If you have been racking up credit card bills or have taken up personal loans with Balance-To-Income ratio more than 12 times, consider consolidating these debts into a single loan plan by taking up a Debt Consolidation Plan (DCP).

A DCP helps to consolidate outstanding loans/balances you currently have with different financial institutions into 1 loan plan. This typically charges a lower effective interest rate (EIR) than what you are currently paying. You can apply for a DCP with just 1 bank to help you concentrate on paying off just 1 loan.

Read more: Ease your financial burden with a DCP

Find out more about: DBS Debt Consolidation Plan

8. Always have a contingency plan

If you are diligent with your savings, you may already have a comfortable sum to pursue your life goals, such as taking a sabbatical or buying your first car. But what if the unexpected happens, like a medical emergency or an unforeseen lump-sum expense?

Make sure you have sufficient money set aside for rainy days. It is recommended to have at least 3-6 months of emergency cash savings. You might not be able to predict when you need it, but having money on hand ensures that you can handle any contingencies.

9. Give yourself a treat

Budgeting sounds boring and restrictive, doesn’t it? You may feel deprived of the freedom to spend as and when you like. But let’s not take the fun out of living.

Even with all that budgeting going on, you can put aside small amounts of money for occasional treats or save towards a bigger reward like a dream holiday. When you know you have budgeted for the splurge, you will feel less guilty about putting your planning on hold for the occasional indulgences.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)