Inflation - How it messes with your retirement planning

![]()

If you’ve only got a minute:

- To plan for a secure retirement, account for inflation by doing a realistic projection of your savings and expenses.

- Shield yourself against rising medical costs by assessing your insurance coverage. Essential insurance coverage in retirement includes having suitable hospitalisation and long-term care plans.

- Start planning for retirement early by developing a clear plan that involves disciplined saving and investing.

![]()

It is no mean feat trying to tackle retirement planning. Part of the difficulty lies in getting to the starting line - determining how much you need for retirement. This entails picturing your retirement lifestyle, your health in retirement and how long you are likely to live.

Many Singaporeans worry about their retirement future. A 2023 survey by Manulife revealed that only 35% of respondents have a retirement plan in place and just 26% said they set aside funds for retirement.

The impact of inflation

One reason for this low proportion of people having a retirement plan in place could be the other financial priorities the Singapore respondents contend with. 44% of respondents reported that saving for a rainy day is also important to them, besides retirement saving. While 34% said the same to maintain their current lifestyle, on top of 26% who also prioritise their medical needs.

Most respondents in Singapore recognise the importance of saving for retirement, but their other financial needs can get in the way, reflecting the priorities they have to juggle. Retirement planning must start early so that you have a longer runway to grow your retirement funds. While there are many urgencies in life, it is important to prioritise retirement planning so that you are able to enjoy your golden years.

Let’s assume you are age 27, and plan to retire at age 62 in 35 years' time. We can apply Singapore’s long-term inflation rate of 2.7% p.a. to determine the future amount required. To buy the same amount of goods and services with S$16,548, we need a sum of S$42,045 at age 62.

And with each passing year, the amount that one needs in retirement will continue to increase due to inflation. To fund a basic retirement lifestyle at age 62, you may need a retirement nest egg of S$1.3m.

Estimated amount a retiree needs:

|

Year in Retirement |

Amount Needed Per Year |

|

1 (Age 62)

|

S$42,045

|

|

2 (Age 63)

|

S$43,180

|

|

3 (Age 64)

|

S$44,346

|

|

… |

… |

|

23 (Age 84)

|

S$75,555

|

|

Total over 23 years

|

S$1.3 million

|

Interested in finding out how inflation affects your retirement? Try out our online retirement calculator!

Increasing life expectancy

Singaporeans have outlived the Japanese to have the longest life expectancy in the world – at nearly 85 years3.

If we retire at 62 with a life expectancy of 85 years, we could expect to spend 23 years in retirement. With medical advancement and an increase in life expectancy, we could expect to spend longer periods in retirement and hence require a larger retirement nest egg in future.

Rising medical costs

The average Singaporean still suffers 10 years of ill health before death, given that the average lifespan here is about 84 years, and the average health span is 74.

Medical cost inflation has been far outstripping general inflation rates throughout the world. From 2003 to 2023, the cost of healthcare has increased by 57.5% The healthcare inflation rate in 2023 was 4.50%.

It is important to be aware of healthcare risks and assess your insurance coverage. Essential insurance coverage in retirement includes having suitable hospitalisation and long-term care plans.

Start planning for retirement early

There is no magic solution. But there are ways you can better prepare yourself for retirement. Taking small steps in the right direction is always a good idea.

- You need to develop a clear plan – one that involves disciplined saving.

- Illnesses and accidents can disrupt even the best-laid plans. You need to protect your financial plan by insuring adequately to cover you for life’s unfortunate events.

- Invest. Make your monies work harder and make use of compound interest.

Every step counts towards your dream retirement!

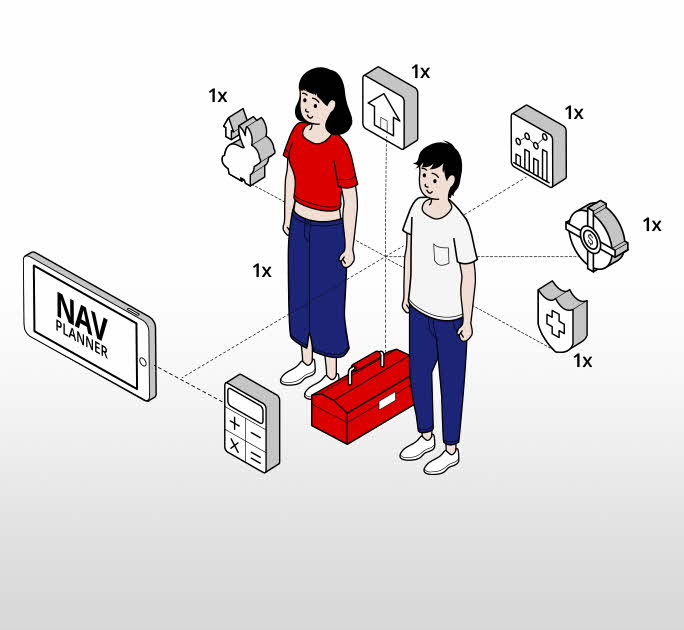

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Sources:

Manulife, Manulife's survey on Singaporean retirement planning 2023, retrieved 24 May 2023

MOH, Average Healthcare/Medical Inflation Rate in Singapore (2024) (smartwealth.sg)

MOH | News Highlights, retrieved 24 May 2024

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)