![]()

If you’ve only got a minute:

- Review and track your expenses regularly to make adjustments.

- Besides reviewing your expenses and investments, there are ways to protect yourself from inflation.

- Investing can minimise the effects of inflation.

![]()

High inflation has been the talk of the town. Singapore’s headline consumer price index (CPI) and core inflation rate reached 6.7% and 4.4%, respectively, in June 2022 – the highest since the Global Financial Crisis period. High inflation erodes consumers’ purchasing power and undermines income growth.

Changes in consumption patterns brought on by the economy’s reopening complicate matters further and pent-up spending against a backdrop of high inflation could have major implications on financial wellness.

Economists have said that external inflationary pressures are likely to continue to be strong as global commodity prices stay elevated, with ongoing supply chain issues driven by both the Russia-Ukraine war and the regional pandemic situation.

Many Singaporeans may feel upset about the rising prices on everyday items, or defer travel plans even though most pandemic-related restrictions have been lifted. However, there are ways to combat inflation without taking drastic measures.

Here are 5 ways to start.

1. Reduce unnecessary spend

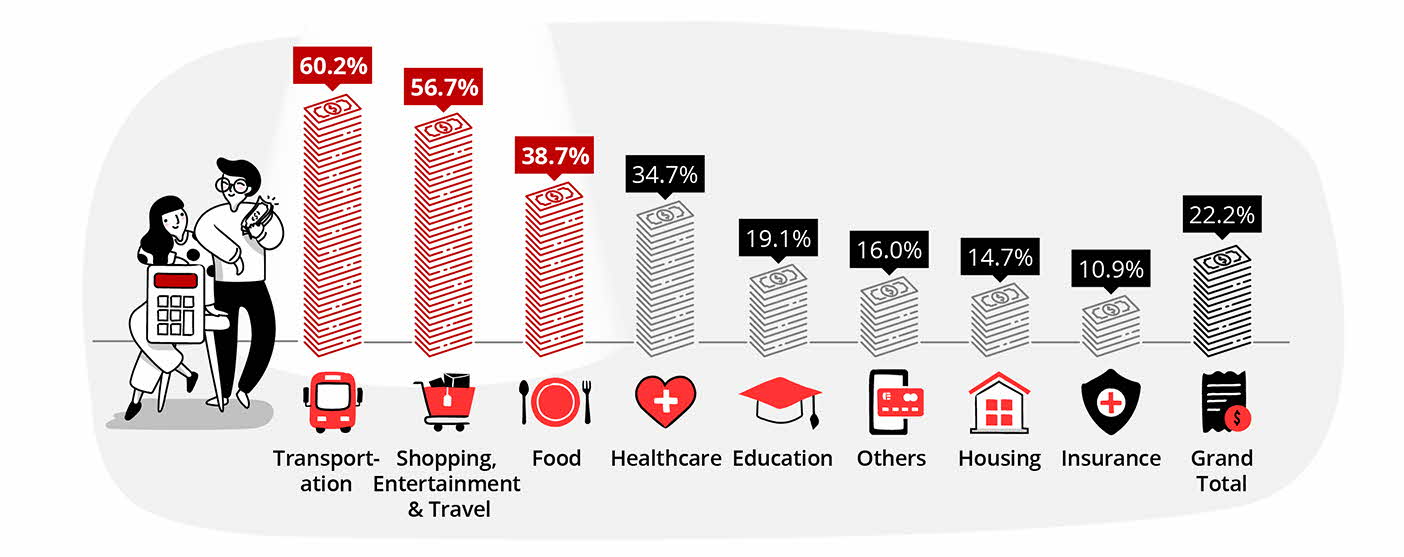

The DBS research report “Are you losing the race against inflation” saw double-digit growth in all expense categories over the past year. Apart from transportation (+60.2%), spending on discretionary expenses such as shopping, entertainment, and travel, witnessed the steepest increase (+56.7%).

With inflation likely to remain steady, and implementation of the upcoming GST hikes, it is important to establish a habit of looking through your expenses on a quarterly basis and make adjustments as necessary.

Your spending can be split into fixed expenses (e.g. utility bills, mortgage loan repayment) and discretionary expenses (e.g. entertainment, gym subscription). Discretionary expenses are non-essential expenses that you incur.

Expense growth rates (by categories) for an average customer

By definition, since discretionary expenses are not essential, these are the expenses you should work on reducing first. Having said that, it is not necessary to cut them out completely, especially if it impacts your standard of living drastically.

You can begin with simple steps like reviewing your subscriptions – cancel any that you are no longer using. Common examples of this include gym memberships, streaming services, and online software subscriptions.

For other expenses, you can work on switching to more budget-friendly options or reducing the frequency of the expense. An example would be driving your car only on weekends and taking the public transport to work on weekdays instead. This way, you can save on petrol and parking costs.

Those who are servicing their home loan may consider refinancing or repricing if they are out of the lock-in period. Do a cost-benefit analysis first and consult a home loans specialist to decide if a fixed or floating rate loan makes more sense for your financial situation during this period.

Use the digital financial advisory tool on digibank to help you keep track of your expenses and set up a budget.

Read more: Let’s get better at money: Beyond budgeting

Find out more about: Plan with digibank

2. Shop smart

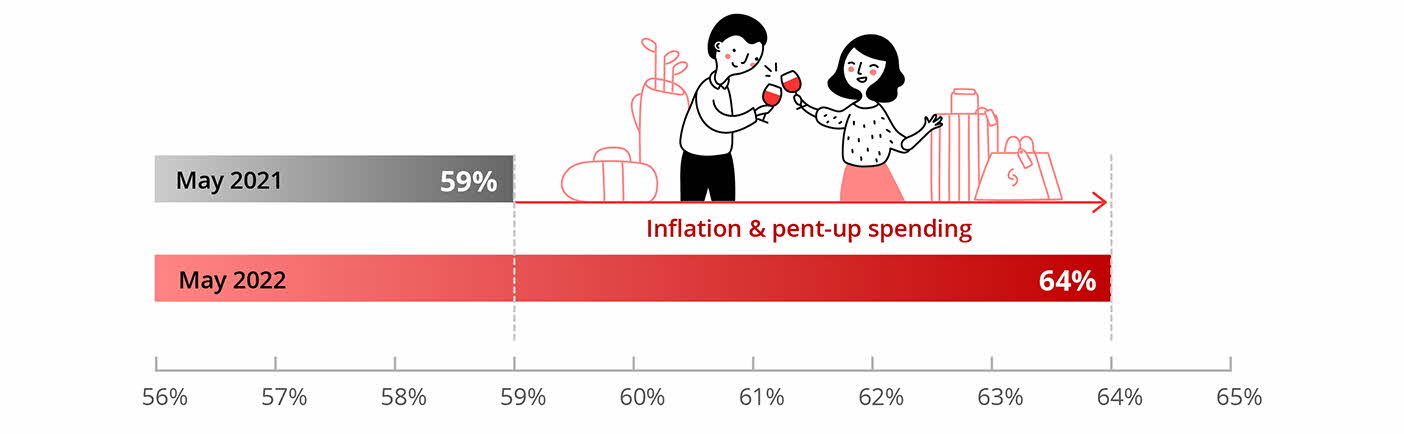

In May 2022, consumers were spending 64% of their income, vs 59% a year ago. The rising proportion of expenses to income suggests that the growth rate of expenses has outpaced that of income. This means that due to inflation, consumers on the whole are saving less.

Expenses-to-income (%) of an average customer in May 2021 versus May 2022

There are many ways in which we can shop more wisely to reduce our everyday expenses. Here are 5 hacks to consider:

- Buy house brand products at supermarkets.

- Buy in bulk if there is significant discount, especially for non-perishables and if you have storage space (e.g diapers, detergent, toilet rolls).

- Shop nearer to closing time – many shops like bakeries and supermarket deli counters offer discounts towards the end of the day.

- Consider buying pre-loved items via platforms like Carousell. Sometimes, you can even find brand new items that are cheaper than retail price. It is also more eco-friendly!

- Use credit/debit cards that are more suited to your lifestyle to earn cashback.

Bear in mind that credit cards are double-edged swords, so only use them if you have control over your spending. If poorly managed, credit card debt can snowball quickly.

Read more: Pros and cons of credit cards

Rolling over credit card debt is no game

3. Inflation-proof your savings

If you have a healthy amount of savings (3-6 months of emergency cash and more), kudos to you! While emergency cash should be kept liquid, keeping the rest of your savings in a simple savings account will not preserve your purchasing power, especially when inflation is at an all-time high.

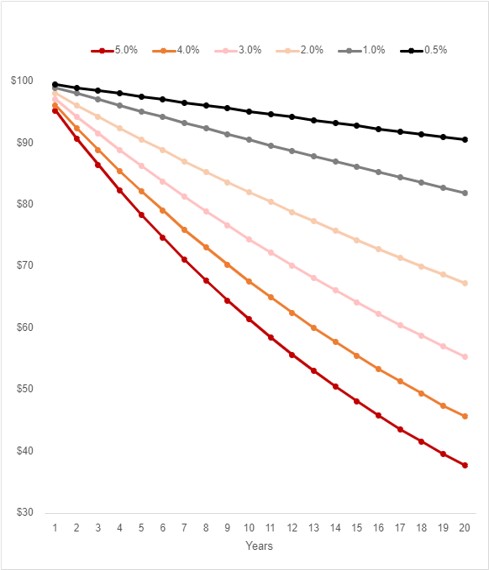

Time value of money, assuming different rates of inflation

This is because inflation erodes the value of your cash over time. For example, assuming an inflation rate of 5%, S$100 in your savings account now will amount to a mere S$38 in 20 years’ time.

So what can you do to preserve the value of your savings over time?

The more risk-averse individuals can put their funds in higher-interest accounts like the DBS Multiplier Account, or invest in low-risk instruments like Singapore Savings Bonds, endowment insurance plans or money market funds.

Beyond saving, start investing your money over the medium to long term for a better chance at beating inflation and making some returns to fulfil your financial and retirement goals.

Never tried investing? It’s not as daunting as you think.

Read more: Getting more interest out of your idle cash

Find out more about: DBS Multiplier Account

4. Start investing

The DBS report indicated growth in total investments of customers by 24.5%, outpacing the growth in expenses of 22.2% over the year. In a high inflationary environment, investments can potentially generate higher returns that beat inflation. This will help mitigate the depreciative effects of inflation on your wealth.

If you’ve never invested before, now is the best time to start! For beginners, you can consider methods which offer diversification and do not require you to stock-pick. One approach is to invest through a regular savings plan (RSP) like the DBS Invest Saver.

A RSP lets you invest a fixed sum on a fixed date each month, starting from S$100 per month. This amount is invested into exchange-traded funds (ETFs) and/or unit trusts of your choice. This helps you accumulate your investment steadily and progressively.

This method of investing a fixed amount at regular intervals into the same investment over a period is known as dollar-cost averaging (DCA). This removes the need to time the market, allowing you to buy more units when prices are low and less units when prices are high. Over time, the average cost of your investment could potentially be lower vs a one-time, lump sum investment.

You can also consider DBS digiPortfolio, a hybrid robo-advisory platform. It combines the best of human expertise, and algorithms based on robo-technology, to curate a robust investment portfolio for you.

Our team of portfolio managers monitor the markets regularly, then carefully select underlying investments in line with our Chief Investment Office’s views to achieve an optimal portfolio that suits your investor profile.

This is designed for investors who do not have the time to watch the market or prefer to leave the decision making to the experts.

Read more: I’m ready to invest, how can I start?

For seasoned investors, you may be looking for investing ideas in this inflationary environment. According to the DBS CIO office, the listed sectors are typical beneficiaries of a rising inflation environment:

Commodities: With supply shortage and disruption, oil, base metals, and gold will typically outperform.

Energy Majors: Rising energy prices is one of the main factors leading to the current inflationary environment. Not surprisingly, investors can hedge their portfolio against inflation by gaining exposure to energy majors.

S-Reits: They have provided stable dividend yield between 5% and 6% and have had a strong track record over the last decade with consistent dividend payouts and capital gains. S-Reits serve as a good inflation hedge given that rental and property values tend to rise in tandem with rising inflation.

5. Increase your income

Last but not least, finding ways to earn extra income can help to relieve some of the pressure from the increased cost of living. If asking for a pay raise is not quite possible, you can explore various sources of side income.

Some examples include tutoring, using your car for private hires, selling items that you no longer use or making some money out of a hobby like baking. Beyond these side hustles which might sap too much of your energy, one alternative is to work your money harder via a diversified portfolio of investments.

Read more: How to build passive income streams