SG Budget 2023 – A helping hand for all

![]()

If you’ve only got a minute:

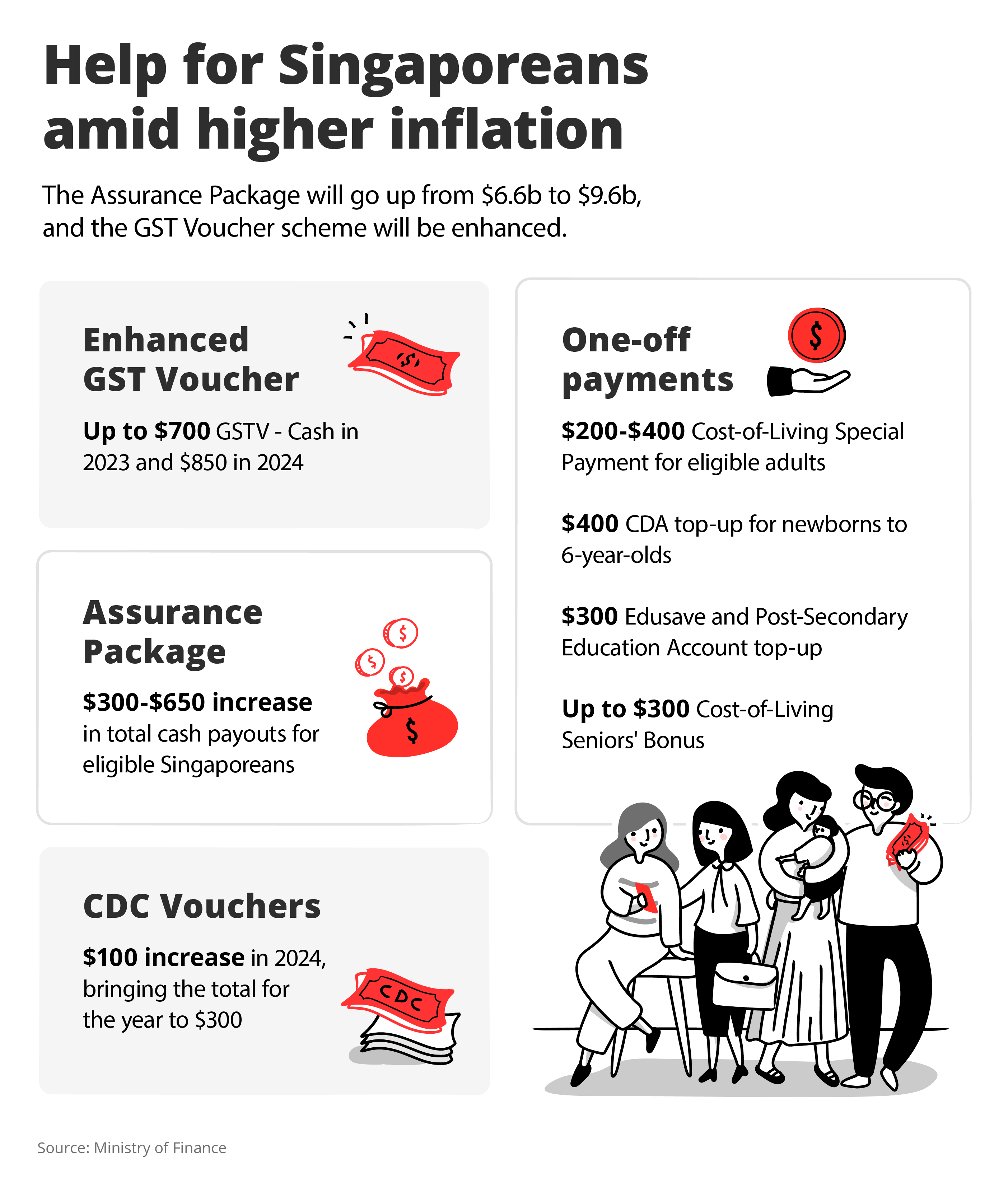

- This year’s Budget saw a boost to the Assurance Package and GST-Voucher scheme to help Singaporeans cope better with the higher cost of living.

- To defray the cost of parenthood and help parents achieve a better work-life balance, the Budgetary measures included financial support, doubling of paternity leave and unpaid infant care leave.

- As Singapore transitions to an ageing population, several enhancements were made to the CPF to boost retirement adequacy.

![]()

The widely anticipated Budget 2023 unveiled a slew of measures that addressed Singaporeans’ key concerns on inflation, offered support to parents, and aimed to enhance retirement adequacy, among other things.

1. Support measures for higher cost of living

To counter inflation the Assurance Package (AP) was boosted to S$9.6 billion to offset the impact of GST hikes. Some of the money will go towards increasing the cash payout under the AP by between S$300 and S$650 for eligible Singaporeans over the remaining years of the package.

This will bring the total amount received by adult Singaporeans to between S$700 to S$2,250 over 5 years, depending on their income and property ownership. The amount will be distributed in the form of cash, account top-ups, rebates and Community Development Council (CDC) vouchers. The permanent GST Voucher scheme (GSTV) will also be enhanced.

Singaporeans aged 21 & above with assessable income of S$34,000 and below and living in a property with an annual value of S$13,000 & below will get S$700 in GSTV in 2023 and S$850 in 2024. Those living in a property with an annual value above S$13,000 and up to S$21,000 will receive S$350 in GSTV this year and S$450 in 2024.

In addition, the government introduced several one-off support measures to help Singaporeans cope better with the rising cost of living. These include:

- A Cost-of-Living Special Payment of between S$200 and S$400 for each eligible adult Singaporean.

- A Cost-of-Living Seniors’ Bonus of between S$200 and S$300 for eligible Singaporeans aged 55 & above.

- U-Save rebates provided to eligible households will amount to S$760 in 2023 over 3 tranches of disbursements.

- Each child aged 6 & below will get a top-up of S$400 to their Child Development Account. Each older child will get a top-up of S$300 to their Edusave or Post-Secondary Education accounts.

Tips:

With the uncertain economic climate, it is prudent to reduce discretionary spend and ensure that you set aside at least 3 to 6 months of emergency cash savings for rainy days.

Use the Budgetary handouts to enhance your financial wellbeing through boosting your cash reserves, closing any protection gaps, and investing your surplus cash wisely to beat inflation.

With another GST hike - this time to 9% - from Jan 2024, consider making your must-have big-ticket purchases before this year ends. Furthermore, take advantage of government support to upgrade your skillsets to boost employment security and empower yourself with knowledge to enhance financial resilience.

Leverage DBS digibank to help you keep track of your spending in different categories and make realistic adjustments. By engaging with the Singapore Financial Data Exchange (SGFinDex), you can have a consolidated view of your financial position across participating institutions like CDP, banks, insurers, CPF Board, HDB and IRAS.

Doing so will help you to review your needs, identify and close your money gaps.

To stay ahead of the market and achieve sustainable financial wellness, empower yourself with the knowledge and discipline to build a holistic financial plan that includes budgeting, protection, wealth accumulation, home planning, retirement and estate planning. In the light of today’s persistent high inflationary environment, stress test your finances and retirement adequacy with assumed inflation rates ranging from 3% to 4%.

The road ahead is still bumpy so keep a cool head, avoid speculative behaviours and invest carefully. Investing requires an understanding of investments, your behavioural biases, holding power and a focus on the fundamentals. Adopt a long-term and diversified approach via a dollar-cost averaging strategy to reap the benefits that come with the power of compounding.

Read more: Habits to embrace in your financial journey

2. Housing support measures

To address the issue of tightness in the HDB market and to help young Singaporean families purchase their first home, the CPF Housing Grant will be increased from S$50,000 to S$80,000 for eligible first-timer families buying a 2- to 4-room resale flat. Those purchasing a 5-room or larger resale flat will be able to qualify for an increase in the grant amount from S$40,000, to S$50,000.

Together with the Enhanced CPF Housing Grant (up to S$80,000) and the existing Proximity Housing Grant (up to S$30,000 for those living with or near their parents or children), eligible families can receive up to S$190,000 in total when buying a resale flat. Terms and conditions apply.

The government will also provide more support to specific groups by allowing for an additional ballot for their BTO flat applications. These groups include first-timer families with children, as well as married couples aged 40 & below who are purchasing their first home. Currently, first-timer homebuyers receive 2 ballot chances while second-timer applicants get 1 ballot chance.

Tips:

The housing support measures will provide some relief for those who have difficulties balloting for a BTO as well as young families looking for their first property. Prospective home buyers must do their sums to ensure the home purchase is affordable. Do note that HDB resale flat prices rose by 10.3% in 2022 despite the implementation of additional property cooling measures in September 2022.

With a lower loan-to-value ratio and rising mortgage rates, home buyers are advised to make their calculations carefully before making a property purchase.

Read more: 5 tips for first-time home buyers

Find out more about: DBS Property Marketplace

3. Supporting Parenthood

Young parents can breathe easier with the range of support by way of Working Mother’s Child Relief scheme, Child Development Account (CDA) top-ups, Baby Bonus and extension of paternity and unpaid infant care leave.

Change in Working Mother’s Child Relief (WMCR)

The WMCR is a tax relief to encourage women to continue working after they are married and have given birth to qualifying Singaporean children. The WMCR will be changed from a percentage to a fixed dollar tax relief for eligible working mothers in respect of qualifying children who are Singapore citizens born or adopted on or after 1 January 2024.

WMCR amount for eligible working mothers with qualifying Singaporean children

| Child order | WMCR Amount For a Singapore citizen child born or adopted before 1 Jan 2024 |

WMCR Amount For a Singapore citizen child born or adopted after 1 Jan 2024 |

|---|---|---|

| 1st | 15% of mother’s earned income | S$8,000 |

| 2nd | 20% of mother’s earned income | S$10,000 |

| 3rd and beyond | 25% of mother’s earned income | S$12,000 |

Tips:

This will provide more support for lower- to middle-income working mothers. However, higher income mothers who have children on or after 1 Jan 2024 will not be able to enjoy substantial tax savings from the Working Mother Child Relief (WMCR). Instead, they will have to find other ways to reduce their tax bill, such as contributing to the Supplementary Retirement Scheme (SRS), cash top-ups to CPF accounts, and donations to charity.

Extension of S$3,000 Baby Support Grant (BSG) to babies born between 1 Oct 2022 and 13 Feb 2023

The Baby Support Grant (BSG) was a one-off cash payout of S$3,000 given to eligible Singaporean children born from 1 October 2020 to 30 September 2022, to ease couples’ financial concerns about raising a child during the Covid-19 pandemic.

The Government will extend the BSG to eligible children born from 1 October 2022 to 13 February 2023. The grant will be disbursed from the second half of 2023.

Increase in Baby Bonus Cash Gift (BBCG) by S$3,000 for babies born on or after 14 Feb 2023

Currently, the Government provides a baby bonus of up to S$10,000 to parents of eligible children, to support them in raising their child. The baby bonus will be increased by S$3,000 for eligible Singaporean children in all birth orders and disbursed on a regular basis every 6 months until the child is 6.5 years old.

The enhancements to the BBCG will apply to eligible Singaporean children born on or after 14 February 2023 and will be disbursed from early 2024.

Increase in Government Contributions to the Child Development Account (CDA)

The CDA is a special savings account for the child, which can be used for approved areas of child-raising expenditure, including healthcare and pre-school fees. The First Step Grant (FSG) is automatically deposited after the CDA is opened, and subsequent savings will be co-matched by the Government, up to a cap.

The increase in total government contributions is S$3,000 each for children in the first and second birth orders and S$2,000 each for children in the third birth order and after.

The enhancements to the CDA FSG and CDA co-matching cap will apply to eligible Singaporean children born on or after 14 February 2023 and will be implemented from early 2024.

Double Paternity Leave (GPPL) from 2 Weeks to 4 Weeks, on a Voluntary Basis

Currently, eligible working fathers of Singaporean children are entitled to 2 weeks of paid paternity leave.

To encourage fathers to be more involved in child raising and play a greater role by taking on more parental responsibilities, this will be doubled to 4 weeks for fathers whose children were born on or after 1 Jan 2024.

For now, employers who are ready to grant up to 2 weeks of additional GPPL to their employees will be reimbursed by the Government. Self-employed persons who have been engaged in a particular business, trade, profession, or vocation for a continuous period of at least 3 months before their Singaporean child is born are also eligible.

Extension of Unpaid Infant Care Leave to 12 days per year

Currently, each parent can take 6 days of Unpaid Infant Care Leave per year in the child's first 2 years. UICL will be extended by 6 days per parent per year, such that each parent can take a total of 12 days per year in the child’s first 2 years.

Employers will have to grant all eligible parents of Singaporean children this additional time off if they have worked for their employers for a continuous period of at least 3 months.

This will apply from 1 January 2024 onwards for eligible working parents with Singaporean children aged under 2.

Tips:

Raising a child is a long-term financial commitment. While the government support helps to defray some costs, parents play a critical role in ensuring adequate protection and have a sound estate plan so that their loved ones can carry on in the event of premature death. Parents need to adopt a long-term perspective in financial planning to be able to both fund their family expenses and prepare for their golden years.

Read more: Young Parents: Planning for finances in the now and future

Find out more about: Plan with digibank

4. Increase in Buyer’s Stamp Duty for higher-value properties

The Buyer’s Stamp Duty (BSD) for higher-value residential and non-residential properties was raised from 15 February 2023.

For residential properties, the portion of the value of the property in excess of S$1.5 million and up to S$3 million will be taxed at 5%, while that in excess of S$3 million will be taxed at 6%, up from 4%.

For non-residential properties, the portion of the value of the property in excess of S$1 million and up to S$1.5 million will be taxed at 4%, while that in excess of S$1.5 million will be taxed at 5%, up from 3%.

This increase is aligned with the announcement of increase in property taxes in Budget 2022. Back then, the Government announced an increase in property tax rates that would take effect over 2 years from 2023, with steeper hikes for higher-end properties, especially investment properties.

Tips:

The increase in BSD translates to a higher cost of holding on to luxury properties as well as lower the attractiveness of physical property as an asset class to accumulate wealth. Property owners should do their sums and consider other wealth generating instruments such as a diversified portfolio, Reits, index funds and ETFs, to achieve their financial goals.

Read more: How to build passive income streams

I’m ready to invest, how can I start?

5. Lower income gig workers to contribute to CPF

Platform workers - private-hire car drivers and freelance delivery workers - who earn a monthly wage of less than S$2,500 will need to contribute at higher CPF rates starting from 2H2024.

The good news is that for the first 4 years after the higher CPF rates are implemented, this group of lower-income gig workers will get additional support in the form of Platform Worker CPF Transition Support. It will offset a portion of the additional CPF contributions for these workers and cushion the impact on their reduced take home pay.

Currently, self-employed individuals are required to contribute up to 10.5% of their net trade income to their CPF MediSave account.

The Ministry of Manpower has said changes to the CPF contribution rate for platform workers will take place over a 5-year period, with the contribution rate increasing from a lower base by 2.5 to 3.5 percentage points per year until it reaches parity with other sectors.

The higher CPF contributions will be compulsory only for those who are below 30 when the changes kick in. Everyone else will have an option to opt in.

Tips:

Gig workers are particularly susceptible to changing economic conditions. Without a fixed salary, it is advisable for gig workers to set aside at least a year’s worth of average income as emergency savings. This sum of money can be used to tide over periods when income is low, or during a medical or job crisis.

The impending increase in CPF contributions may mean a lower take-home pay, so platform workers will need to set aside more savings to cushion the impact. On the other hand, contributing more to your CPF account is positive as your CPF funds earn a risk-free interest of at least 2.5% and can compound over the long term to help you build your retirement savings.

Read more: 4 tips for freelancers and gig workers

6. Boosting retirement adequacy

As Singapore transitions to an ageing population, several enhancements were made to the CPF to boost retirement adequacy.

CPF monthly salary ceiling to rise

To help middle-income Singaporeans save more for their retirement and keep pace with rising salaries, the CPF monthly salary ceiling will be raised from S$6,000 to S$8,000 by 2026. The increase will take place in 4 steps.

Apart from the CPF monthly salary ceiling, the CPF annual salary ceiling sets the maximum amount of wages that would attract CPF contributions. There will be no change to the CPF annual salary ceiling for now.

To ensure that employees earning the same annual salary receive the same CPF contributions regardless of their salary structure, the CPF monthly salary ceiling will eventually be set at 1/12 of the CPF annual salary ceiling.

| CPF Monthly Salary Ceiling | CPF Annual Salary Ceiling | |

|---|---|---|

| Current | S$6,000 | S$102,000 |

| From 1st September 2023 | S$6,300 | |

| From 1st January 2024 | S$6,800 | |

| From 1st January 2025 | S$7,400 | |

| From 1st January 2026 | S$8,000 |

Increase in Senior Worker CPF Contribution Rates

In 2019, the Government announced that CPF contribution rates will be raised gradually for CPF members aged above 55 to 70. This will allow those aged between 55-60 to have the same contribution rates as younger workers by 2030.

The next increase in senior worker CPF contribution rates will take place on 1 January 2024. Similar to previous increases in 2022 and 2023, the increase will be fully allocated to the CPF Special Account to help senior workers save more for retirement.

Current and Target CPF Contribution Rates (Employer + Employee) by Age Band

| Age Band | 2016-2021 | Current CPF Contribution rates (as of 1st Jan 2023) | By 2030 |

|---|---|---|---|

| ≤55 years old | 37% | No Change | |

| >55 to 60 years old | 26% | 29.5% | 37% |

| >60 to 65 years old | 16.5% | 20.5% | 26% |

| >65 to 70 years old | 12.5% | 15.5% | 16.5% |

| >70 years old | 12.5% | No Change | |

Senior Employment Credit to be extended to 2025

To encourage companies to take on senior workers, the Senior Employment Credit Scheme will be extended to 2025. The scheme will help to provide wage support to employers who receive wage offsets for hiring Singaporean senior workers aged 55 & above and earning up to S$4,000 a month.

The Part-time Re-employment Grant will also be extended to 2025 to motivate employers to offer part-time re-employment and flexible work arrangements to senior workers.

Tips:

The increase in CPF contributions resulting from raising the CPF monthly salary ceiling to S$8,000 in 2026 as well as the increased CPF contribution rates for those aged 55 and above will help to boost retirement adequacy for all.

CPF is the bedrock of our retirement planning and everyone should consider other ways of topping up their CPF savings for higher lifetime pay-outs and build upon them with other streams of income to fund their golden years.

The increase in CPF monthly salary ceiling – which will take place progressively from 1 Sept 2023 – will also translate to a reduction in disposable income for members. As such, there is a need to review your budget and cashflow needs.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)