SG Budget 2024 – Moving Singapore forward

By Lynette Tan

![]()

If you’ve only got a minute:

- The government continues to help Singaporeans cushion higher cost of living with a slew of measures, including more CDC vouchers, U-Save rebates and Cost-of-Living special payments.

- Workers are encouraged to upskill and re-skill with SkillsFuture top-ups, subsidised education and monthly allowances to stay relevant in a work environment that continues to be disrupted by new technology.

- The increase in the CPF Enhanced Retirement Sum to 4 times the Basic Retirement Sum offers an opportunity for CPF members to top up their Retirement Account for higher monthly payouts for life.

![]()

Budget 2024 is special as it is the first instalment of plans for the Forward SG Report. The latter is fundamentally about strengthening the broad middle ground and ensuring that governance and politics enjoy broad-based support and helps to galvanise the nation towards a unity of purpose.

These moves are part of an “ambitious agenda” to achieve the shared goals of building a nation that is vibrant and inclusive, fair and thriving, as well as resilient and united, said Deputy Prime Minister (DPM) and Minister for Finance Lawrence Wong.

It aims to increase confidence in Singapore’s future by equipping Singaporeans with more upskilling opportunities, empowering vulnerable segments of the society and making Singapore more family-friendly.

Here are 7 Budgetary highlights and financial tips to help you navigate the changes.

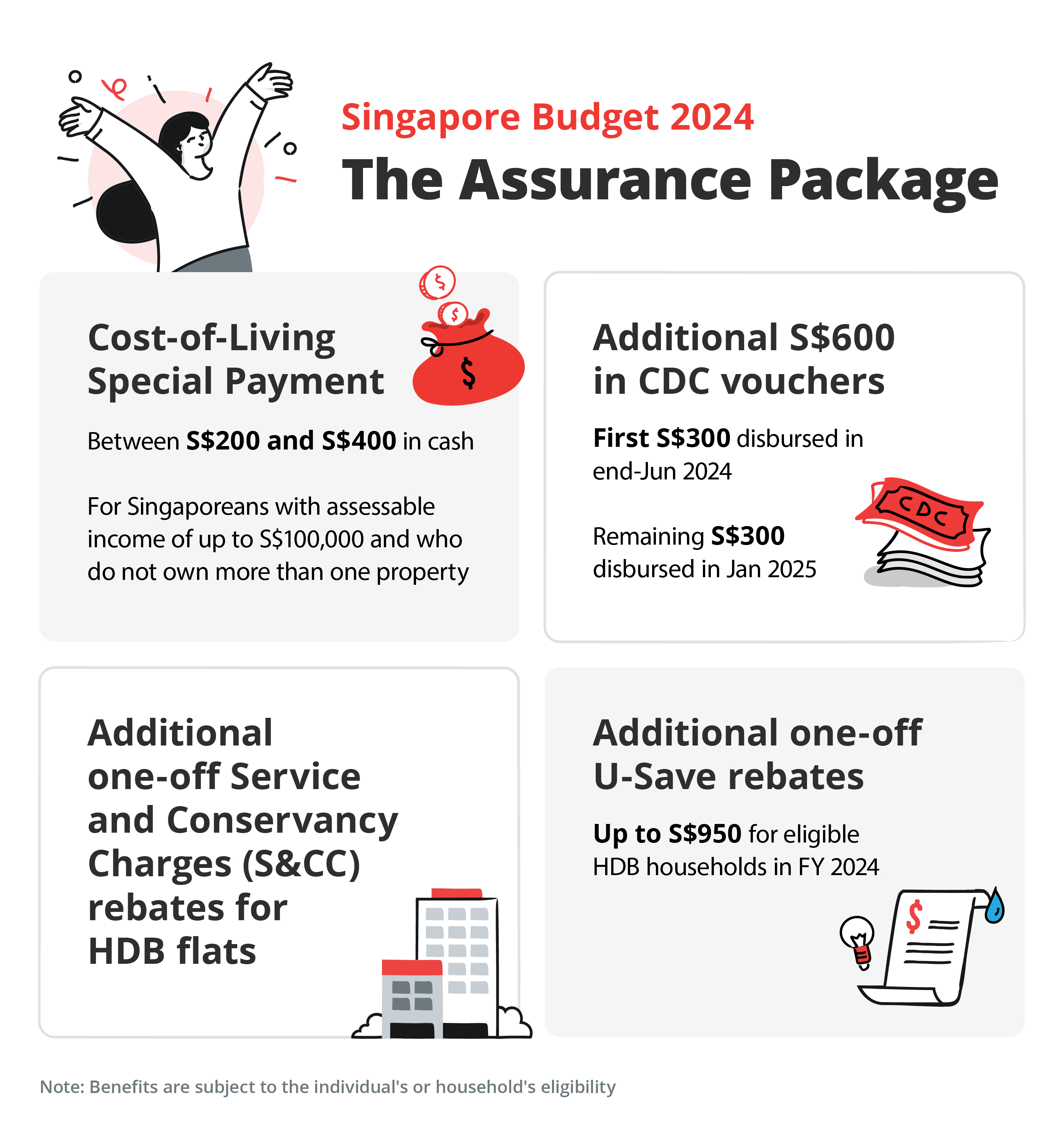

1. Enhanced Assurance package to tackle cost of living pressures

Singaporeans can look forward to more government support to cope with cost-of-living concerns amidst an uncertain economic outlook. This will come in a mix of cash, vouchers and rebates under a S$1.9 billion boost to the Assurance Package.

Some of these enhancements include an additional S$600 in Community Development Council (CDC) vouchers for about 1.4 million Singaporean households. The first S$300 will be disbursed in end-June in 2024, and the remaining S$300 will be disbursed in January 2025.

A Cost-of-Living special payment of between S$200 and S$400 in cash will be given to eligible Singaporeans in September this year. This will benefit Singaporeans aged 21 and above in 2024, residing in Singapore, who own not more than 1 property, and have an assessable income of up to S$100,000.

An additional one-off U-Save rebate will help over 950,000 Singaporean HDB households with increases in their utility bills. Eligible households can receive up to S$950 in rebates within this financial year. This will cover about 4 months of utility bills for those living in 3- and 4-room flats, and will be disbursed in April, July and October 2024, and in January 2025.

Tips: While the inflation rate is forecasted to be subdued, the higher cost of living continues to be a cause of concern, especially with the uncertainty in economic outlook and ongoing geopolitical tensions. It is prudent to continue to watch your discretionary expenses and ensure that you set aside at least 3 to 6 months’ worth of expenses as emergency cash savings for rainy days.

In addition, use the Budgetary handouts prudently to enhance your financial wellbeing. This can include closing the gaps in your insurance coverage to ensure sufficient cash reserves for emergencies and investing wisely.

Our experience of living within the constraints of social distancing due to the pandemic has taught us that it is possible to reduce discretionary spend when the need arises. You may turn these saving tactics to habits, such as cooking and eating at home, group tuition, self-care, less consumption on cosmetics and apparel, buying in bulk, and doing away with unnecessary subscription services, or swapping out brand-name items for generic ones where possible.

Leverage the digital financial advisory tool on DBS digibank to help you keep track of your spending in different categories and make realistic adjustments. By syncing with the Singapore Financial Data Exchange (SGFinDex), you can have a consolidated view of your financial position across participating institutions like CDP, banks, insurers, CPF Board, HDB and IRAS, for greater clarity.

Doing so will help you to review your needs, identify and close your money gaps.

Read more: How much emergency cash is enough?

Find out more about: Plan with digibank

2. Encouraging skills upgrade with S$4,000 SkillsFuture top-up and training allowances

With the constant flux and changes in technology, it is important for Singaporeans to continue to upgrade their skills to stay ahead of times and stay relevant in the work force. With more layoffs expected this year, the National Trade Unions Congress (NTUC) and Singapore National Employers Federation (SNEF) have also called for transition support packages for retrenched workers, including in the areas of upskilling and reskilling.

A new Level-Up programme under SkillsFuture will see all Singaporeans aged 40 and above receive a S$4,000 SkillsFuture credit top-up in May 2024 . This S$4,000 can only be used for selected training programmes, including part-time and full-time diploma, post-diploma and undergraduate programmes, as well as courses for the Progressive Wage Model sectors.

These training programmes are geared towards helping workers achieve better employability outcomes after graduation.

The government will also provide subsidies to all Singaporeans aged 40 and above to pursue another full-time diploma at polytechnics, Institutes of Technical Education (ITE) and arts institutions from the 2025 academic year.

Furthermore, Singaporeans aged 40 and above who enrol in selected full-time courses will also receive monthly training allowances. The training allowance will be equivalent to 50% of the individual’s average income over the latest 12-month period, capped at S$3,000 per month, up to 24 months.

The government is also working on a new temporary financial support scheme to help retrenched workers while they undergo training or look for another job. Details will be announced later.

Tips: The increase in SkillsFuture credit provides a great opportunity for mid-career workers to enhance their skillsets and build future-ready skills to ensure their relevancy in the future job market. Take advantage of government support to upgrade your skillsets to boost employment security and empower yourself with knowledge to enhance financial resilience.

For those who are in the gig economy or who are at risk of retrenchment, it is crucial to ensure that you have your emergency cash set aside. For those without a stable income stream, it is advisable to set aside at least 12 months’ worth of expenses as emergency funds.

Read more: Coping with retrenchment – 7 financial tips

4 tips for freelancers and gig workers

3. Tackling inequality by uplifting lower wage workers

Low-wage workers who earn S$3,000 a month or less will be eligible for the Workfare Income Supplement scheme from January 2025. The current qualifying monthly salary is S$2,500.

The Workfare Income Supplement scheme was introduced in 2007 to provide lower-wage citizens with cash payouts and Central Provident Fund (CPF) top-ups to encourage them to keep working and saving for retirement.

DPM Wong said that “simple handouts do not solve poverty”. Thus, it is important that we uplift lower wage workers to reduce income disparity.

For firms that employ foreign workers, the local qualifying salary will be raised from S$1,400 to S$1,600 for full-time workers from July 2024, while minimum hourly rates will increase from S$9 to S$10.50 for part-time workers.

4. Creating a “Singapore, made for families”

To boost social support, attending pre-schools will become more affordable thereby providing support to lower-income families.

The maximum daily childcare rates for government-funded preschools will be lowered in 2025. Rates anchor operators will be lowered by S$40 to S$640, while prices for partner operators will be lowered to S$680. These numbers exclude childcare subsidies.

Lower-income families will also receive enhanced pre-school subsidies. Higher subsidies are given to children with working mothers but this will be extended to all children from lower-income families, including those with non-working mothers.

There will be enhancements made to ComLink+ packages for eligible lower-income families with young children. The main objectives are to support these families in pre-school education, employment, financial stability and saving for home ownership. Some of the measures are:

- A one-off top-up of S$500 to the Child Development Account when the child is enrolled in a pre-school from age 3 years old

- Up to 2 working adults will receive a combination of cash and CPF payouts amounting to S$450 to S$550, for every 3 consecutive months of employment. If 2 adults are working, each will receive S$50 more per quarter.

- Those who make voluntary contributions to their CPF accounts will receive matching grants from the government to grow their savings.

The total payout across the employment and savings packages is capped at S$30,000.

As for families of persons with special needs or disabilities, the maximum monthly fee at special education schools will be reduced to S$90 from S$150.

Meanwhile, adults with disabilities will receive more support for their employment and integration into the community. The government will expand spaces in sheltered workshops and day activity centres where they can receive training and launch more Enabling Services Hubs where they can get community support.

Read more: Financial planning with a special needs child

5. Higher CPF retirement sum ceiling from 2025 to boost retirement adequacy

The Enhanced Retirement Sum (ERS), which is the maximum amount members can save in their CPF Retirement Account (RA) to accrue interest and receive payouts, will be pegged to 4 times the Basic Retirement Sum (BRS) from Jan 2025. This is up from 3 times currently.

This will put the ERS at S$426,000 in 2025, instead of S$319,500.

Another change in the CPF system is the closure of the CPF Special Account (SA) when the CPF member reaches age 55. This will take place from 2025 onwards.

SA savings will be transferred to the RA up to the Full Retirement Sum, while the remaining SA savings will be transferred to the OA.

The implication is that only savings that cannot be withdrawn on demand (RA) can earn the long-term interest rate, and savings that can be withdrawn on demand (OA) will earn the short-term interest rate.

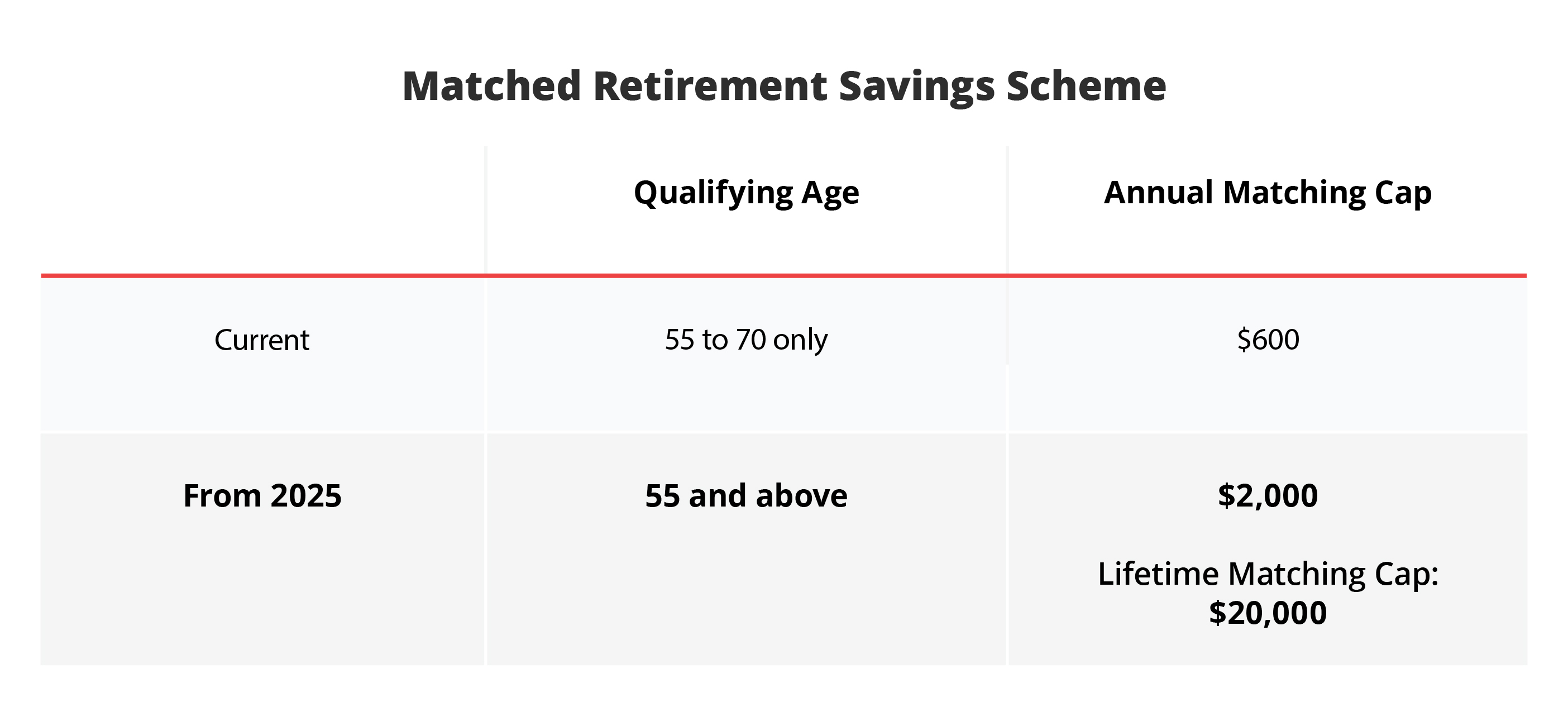

The Matched Retirement Savings Scheme (MRSS) will also be enhanced to provide better retirement support for seniors who do not currently meet the BRS.

Tips: The increase in CPF ERS offers an opportunity for CPF members to top up their RA for higher monthly payouts for life. This will go a long way to increase the retirement adequacy for all.

CPF members who are above age 55 can opt to voluntarily transfer their OA savings to the RA up to the prevailing ERS to earn higher interest and receive higher retirement payouts.

Alternatively, CPF members can consider other investing options for their CPF monies, depending on their risk profile and understanding of suitable solutions.

Read more: CPF Changes in SG Budget 2024

6. Making healthcare more affordable

Singaporeans aged 21 to 50 will receive a one-time MediSave Bonus of up to S$300, among various enhancements to healthcare benefits aimed at making healthcare more affordable.

The bonus will be tiered by the year of birth, the annual value of one’s residence as well as whether they own more than 1 property as at 31 Dec 2023. It will be credited to their CPF MediSave account in December 2024.

In addition to the MediSave Bonus, the government will update the per capita household income thresholds for healthcare and associated subsidy schemes. These schemes include MediShield Life premium subsidies, Community Health Assist Scheme (CHAS) subsidies for primary care, and subsidies for outpatient and inpatient treatment at public hospitals.

The monthly per capita household income threshold for each subsidy tier will be increased, ranging from S$100 to S$800.

Tips: Healthcare costs remains as one of the major concerns amongst most Singaporeans. Besides relying on government subsidies, it is crucial to ensure sufficient insurance coverage. This is because on top of the distress caused by the illness, the financial burden adds unwanted anxiety at the worst possible time.

It is prudent to familiarise yourself with the national healthcare schemes and consider if you need additional coverage to cover large hospitalisation bills. Furthermore, if you have dependents, ensure that your insurance coverage provides for critical illness and death coverage so that your dependents can continue to maintain their quality of life should the unfortunate happen to you.

Read more: Navigating healthcare costs

7. Property tax changes to ease homeowner’s tax burden

For homeowners who qualify, they will be happy to benefit from paying less property tax next year as the government raise the annual value (AV) bands for owner-occupier properties in 2025.

From Jan 2025, the lowest AV band threshold will be raised from S$8,000 to S$12,000. The highest threshold will increase from over S$100,000 to over S$140,000. Property taxes are calculated based on AVs, which are based on the estimated yearly rent if a

New annual value bands for owner-occupied properties

| Property tax rate | Current annual value band | From January 2025 |

|---|---|---|

| 0% | S$0 to S$8,000 | S$0 to S$12,000 |

| 4% | >S$8,000 to S$30,000 | >S$12,000 to S$40,000 |

| 6% | >S$30,000 to S$40,000 | >S$40,000 to S$50,000 |

| 10% | >S$40,000 to S$55,000 | >S$50,000 to S$75,000 |

| 14% | >S$55,000 to S$70,000 | >S$75,000 to S$85,000 |

| 20% | >S$70,000 to S$85,000 | >S$85,000 to S$100,000 |

| 26% | >S$85,000 to S$100,000 | >S$100,000 to S$140,000 |

| 32% | >S$100,000 | >S$140,000 |

In addition, there is an extension of Additional Buyer’s Stamp Duty (ABSD) remission to single Singaporeans aged 55 and above, with effect from 16 February 2024.

They can claim the refund if they sell their first property within 6 months after purchasing a lower-value replacement private property. The measure works to support seniors looking to “right-size” their home for retirement.

With the slowdown in economic growth, it will be prudent to leverage government support to upgrade your skill sets to boost employment security, keep a tight rein on your spend, and empower yourself with knowledge to enhance financial resilience.

To achieve sustainable financial wellness, continuously empower yourself with relevant knowledge and inculcate the discipline to build a holistic financial plan that includes budgeting, protection, wealth accumulation, home planning, retirement, and estate planning.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)