Managing money as a couple

![]()

If you’ve only got a minute:

- Money can be a source of conflict for couples so it makes sense to have a common understanding of how you want to manage finances as a couple.

- Everyone views money differently – try to show empathy and judge less.

- Set up a financial plan early to achieve short and long-term goals like retirement, after setting aside emergency funds.

![]()

There are many ways to manage your money with your significant other. Some prefer to keep their finances separate while others may choose to combine their finances, or it may be a combination of both.

Regardless, having the “money talk” with your significant other is never easy especially when your relationship is just starting to get serious. Conflicts over money issues rank high among couples, so it makes sense to start talking about finances early.

This Valentine’s Day, why not consider a gift that goes beyond the material and make financial planning a gesture of love?

Skip the expensive gifts and take a moment to discuss your dreams, goals, and aspirations as a couple. Discussing financial goals as a couple can strengthen your relationship and help ensure you are on the same page when it comes to money matters.

Whether it's saving for a dream vacation, buying a home, or planning for retirement, aligning your financial goals can contribute to a healthier and more secure future together.

Here are 7 tips to help guide your “money talk” with your partner!

1. Understand that everyone views money differently

Varying backgrounds and life experiences can shape individual attitudes toward finances. While you may see money as a means to enjoy the present (yolo!), your partner might prioritise saving for future stability. These disparities, if not addressed openly, may result in conflicts.

Since everyone has a different view on money, it is important to have empathy when starting the ‘money talk’ with your partner.

Recognise that your partner may be experiencing a different financial situation, and avoid jumping to conclusions, especially if, for example, they've maxed out his/her credit cards.

Instead, consider working together to overcome such financial hurdles by setting achievable milestones and/or short-term financial goals like clearing all credit card debts. Don’t forget to take the time to celebrate the small achievements along the way.

Doing so, creates a positive atmosphere and can contribute to a healthier and more supportive relationship.

This is also a good time to align financial goals and find a common ground to proceed as a “team”.

2. Avoid financial infidelity

We all know how important it is for couples to be truthful with each other; this includes your financial status as well. Avoid financial infidelity such as lying about debts or putting on a show of “wealth”.

Such dishonesty can undermine the level of trust between a couple and can potentially lead to a breakdown in the relationship. After all, how sustainable is it to always be dining at high-end restaurants if your finances simply don’t allow for it?

Trust between you and your partner is a two-way street. Having conversations about your financial past and journey can deepen your understanding of each other, shedding light on the reasons behind your money habits and beliefs.

Remember, when it comes to money, communication is key.

3. Agree on how you’ll split the household bills

As your lives intertwine, there would be more items to pay for such as household bills for your groceries, petrol and mortgage, amongst other things.

Here are some common ways couples split their bills:

- 50-50 split (everything is split evenly)

- Divided based on income level (you earn 10% more so you contribute 10% more to household expenses)

- By item (i.e. one takes the mortgage, the other pays for groceries)

In instances where incomes differ, especially if one of you earns much more or had experienced periods of unemployment, deciding on a fair approach to shared expenses can be challenging.

If you’re the main provider (breadwinner), it may be difficult to strike a balance that feels fair and this can potentially lead to hidden feelings of resentment over time.

Do work together to establish a system that considers the needs of both parties.

With many joint expenses to pay, this is when a joint account could come in useful and while you are at it, you could get one that maximises the benefits for both of you.

For instance, your partner and you could get your individual Multiplier accounts and credit your income into the joint account. This maximises your benefits as the Multiplier account will recognise the combined income and calculate interest based on this amount. You could get even higher interest rates when you buy groceries using a credit card, take a home loan, buy life insurance or invest through POSB/DBS.

Read more:

How can Multiplier work for you if you are in your 30s?

3 ways joint accounts work for couples

4. Be accountable to each other

In most cases, there is no need for couples to be accountable to each other for all purchases as this could give rise to undue pressure.

However, depending on the couple’s financial situation, it is advisable to set a threshold amount and give a heads up whenever a big-ticket item purchase goes beyond the pre-determined amount.

Most importantly, you should discuss finances together regularly with your partner to ensure that both of you are on track to achieving the financial goals that you have jointly agreed on.

5. Plan for the worst

Given the uncertainty in life, it is also important to plan for the worst especially if your partner or you belong to the sandwich generation. Ensure that you are adequately insured such that the family can carry on with their lifestyle even if you are no longer around. This means having insurance cover for hospitalisation, critical illness and death which cover the loss of future income so that your partner would not have to suffer financially in the event of an untimely demise.

Read more:

Insurance needs for different life stages

Insure to ease the squeeze

At the same time, it is important to have emergency funds to help tide over any medical crisis that could occur or if one party loses his or her job.

The rule of thumb is to set aside at least 3 to 6 months of emergency savings to keep your lifestyle and investment plans on track. For those who are self-employed, it would be good to have at least 12 months of emergency cash.

Read more: Making financial planning simple

6. Retirement planning

For young couples, retirement may seem distant. Still, it is prudent to start discussing your retirement expectations early and review them regularly as it would provide you with a longer runway to accumulate wealth.

Planning early (saving or investing) means you have more time and opportunities to grow your savings and make your money work harder.

Furthermore, young couples have a longer investment horizon to reap the benefits of compounding and ride out market volatility, so they can afford not to be too conservative when investing. The key to successful investing is often summed up by the saying, "Time in the market, not timing the market."

By deciding on your desired retirement lifestyle, you can match them with multiple income flows from a diversified portfolio of savings and investment tools such as stocks, unit trusts, exchange-traded funds, bonds and real estate.

Read more: Retiring well – 10 guiding principles

You can also consider using government schemes like the Central Provident Fund (CPF) and the Supplementary Retirement Scheme (SRS) to help grow your nest egg while enjoying tax reliefs.

Read more:

9 CPF "hacks" to grow your nest egg

Retire smart with SRS

For example, CPF Lifelong Income For the Elderly (CPF LIFE) is a national longevity insurance annuity scheme that provides you with monthly payouts from the age of 65 till death so you will not have to worry about outliving your savings.

Find out more: CPF LIFE or Retirement Sum Scheme?

7. Share openly about caring for your parents

Your partner and you may have different views on financial support for your parents due to the difference in upbringing. Your parents might also expect you to provide for them during their retirement or have made their own plans. However, with rising costs, the reality is likely to fall somewhere in-between.

It is important to openly communicate with your partner about the expectations that your parents have of you and what you are committed to.

Conflicts can arise as one set of parents could demand more from their child than the other and hence, mutual understanding and compromise should be reached by the couple on how they would like to take care of their parents together.

Single income couples

For families with a sole breadwinner, it is even more important to maintain an adequate emergency fund to withstand unexpected financial shocks. Single income couples should consider the number of dependants when working out the amount of emergency cash to be set aside.

Another tip is to top up your spouse’s CPF account especially if he/she has low CPF balances. They get to earn attractive interest rates and you get to enjoy tax reliefs as well!

Read more: 6 ways to optimise your CPF for retirement

Although estate planning is important for everyone, there is a greater urgency for single income couples to ensure that a will, a Lasting Power of Attorney (LPA) and CPF nominations have been set up. This will enable proper and smooth distribution of the breadwinner’s assets and avoid disrupting the family’s lifestyle and financial well-being.

A will takes effect after death, while an LPA helps you appoint people you trust to act on your behalf should you lose mental capacity. A CPF nomination helps to specify who will receive your CPF savings which cannot be distributed via your will.

Read more:

Why Lasting Power of Attorney is not just for the elderly

The importance of Estate Planning

Much like the constant effort to cherish and appreciate each other daily, regularly discussing (such as organising regular financial date nights!) and managing finances should extend beyond special occasions.

Not only will it reinforce your commitment to financial planning, it will also help create shared moments of success and teamwork with your partner.

Ready to start?

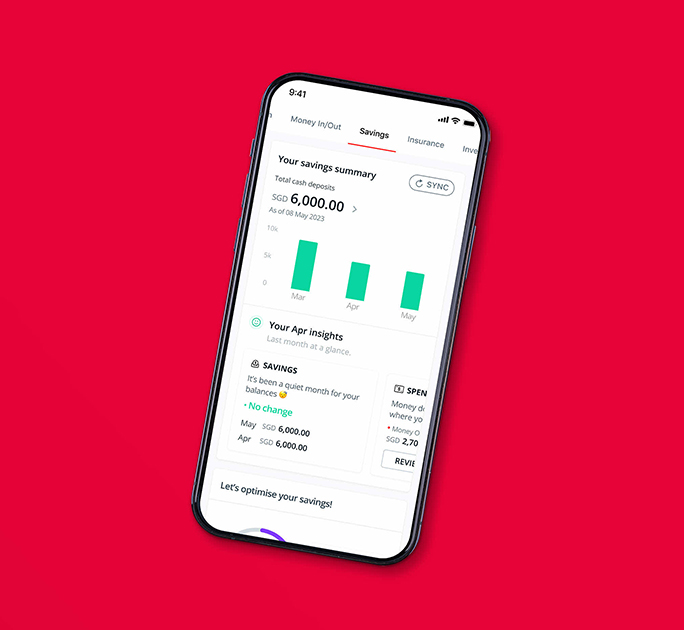

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)