Just started work? Save more with DBS Multiplier

![]()

If you’ve only got a minute:

- Save at least 10% of your salary and adjust your budget to accommodate the demands of adult life.

- Leverage DBS Multiplier to earn higher interest rates.

- Multiply your earnings over time by investing with DBS Invest-Saver and/or DBS Vickers.

![]()

Excited about that first pay check and wondering how to make the most of it? Here's how to get started.

Know where your money’s going

No one really likes adulting, but it is a part of growing up. One way to kickstart your financial journey is to save before you spend. Try to set aside at least 10% of your salary as soon as it is credited into your bank account.

It is also crucial to set budgets and monitor your spending. Consider adjusting your monthly budget to accommodate higher expenses - financial obligations like a new phone plan, increased transportation costs or even dining out with colleagues - compared to your student days.

We’ve got your back. To help you navigate these changes, we’ve developed the Plan & Invest tab in digibank, a financial planning tool that helps you keep track of where your money’s going.

Read more: Track your savings and spending with digibank

Upgrade your childhood savings account

Childhood savings accounts often have little to no interest because they are designed primarily for basic banking needs and typically offer minimal features for long-term savings or investment growth.

To enhance your savings potential, consider upgrading to accounts like DBS Multiplier.

If you’re a freelancer without a regular salary, you can direct any investment dividends as part of the “income” category.

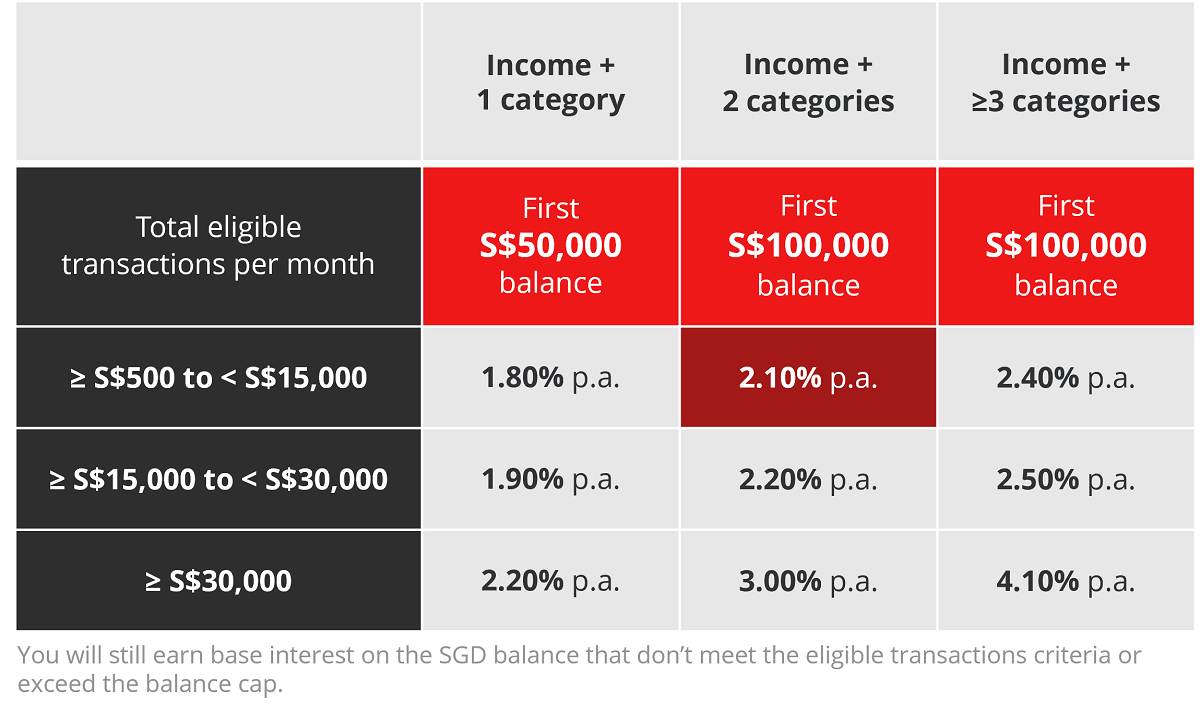

You can earn up to 4.1% p.a. by crediting your salary into your DBS/POSB account and meeting 1 or more of the qualifying categories: credit card/PayLah! Retail spend, an instalment, insurance premiums, and/or investments.

Engaging in these transactions can elevate your interest earnings, especially when your total eligible transactions exceed S$500 per month.

Remember, the more you engage with these activities, the stronger your interest earning potential becomes.

Applying for the Multiplier is hassle-free and can be done online.

If you’re age 29 or younger, the “fall-below” service fee is waived. The “fall-below” service fee is a service charge of S$5 per month, which applies only if your average daily balance falls below S$3,000 (inclusive of SGD equivalent of foreign currency balance).

Upgrade to your own credit card

As a new jobber, obtaining your own credit card marks a significant step towards financial independence. Moving beyond a debit card, a credit card offers numerous advantages such as accumulation of points, cashback, rewards and/or miles (travel benefits) on your purchases.

A standout option is the DBS LiveFresh Card, designed to reward you for both your daily lifestyle spending and your adventures abroad. It offers cashback on shopping and daily needs (public transport), unlimited cashback on all eligible spend and zero FX fees on overseas transactions.

More importantly, it also qualifies you for higher interest rate with the DBS Multiplier (no minimum spend on your DBS credit card required).

Example:

Jack is a first jobber who credits his monthly salary of S$3,500 into his DBS/POSB savings account and transacts across 2 categories.

His total qualifying transactions amount to S$3,800, earning him a bonus interest rate of:

- 2.10% p.a. for the first S$100,000 and

- A base interest rate for balances above S$100,000.

To unlock higher interest rates (2.10% p.a. to 2.40% p.a.), Jack can purchase an insurance policy for protection (transact across 3 categories).

Stay protected

Getting insurance when you’re young or have just started working is important for several reasons.

Life and term insurance premiums are generally lower when you’re younger and healthier and tend to increase with age or when health issues arise.

Additionally, an endowment policy can help you build wealth as it leverages compound interest, helping you to achieve milestones like marriage and first home goals sooner.

Lastly, buying an insurance policy from DBS not only helps you meet a vital protection need but also fulfils another DBS Multiplier criteria, allowing you to potentially earn higher interest rates. For example, Jack’s interest rate increases from 2.10% p.a to 2.40% p.a when he transacts in 3 categories instead of 2. (To see how much you can potentially earn, try our calculator here.)

Elevate your travel experience

Even if you’re just beginning your professional journey, it won’t be long before you find yourself yearning for a respite.

Elevate your travel experience by using the multi-currency feature available within your bank account. If you have the Multiplier account, simply lock in your preferred exchange rate, link it to a Visa debit card, and you’re equipped to transact seamlessly overseas.

Grow with the flow

One of the best financial moves you can make early in your career is to start investing for the long haul. A longer-term approach mitigates the impact of short-term market fluctuations, offers time to recover from downturns and typically yield better returns. In addition, giving your investments time to compound the interests/dividends definitely gives you more bang for your buck.

Consider DBS Invest-Saver, a regular savings plan that lets you invest a fixed sum regularly into your choice of investments, from as little as S$100 a month.

You can also use DBS Invest-Saver to invest in ETFs or make a lump-sum investment in unit trusts. Both qualifies you for the investment category in the months you transact.

Alternatively, consider stock trading via your DBS Vickers account (your stock purchases and dividends will contribute towards the Multiplier).

Read more: I'm ready to invest, how can I start?

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)