One financial tip that changed our lives

![]()

If you’ve only got a minute:

- The start of a new year is a great time to review our finances and set new goals for the year ahead.

- Interest rates are likely to stay elevated with an uncertain economic outlook – it would be best to stick to prudent spending and stick to a long-term investing plan to grow our wealth.

- Hear from the DBS financial planning literacy experts on their best financial tip!

![]()

The economic outlook for 2024 looks exciting with rising expectations of the US Fed reducing rates in the second quarter. Meanwhile, interest rates continue to stay elevated, and the higher cost of living remains a concern for most people.

In times like these, we need to continue to exercise prudence in spending, ensure we have sufficient emergency cash and stick to a long-term investing plan to grow our wealth and build our retirement nest egg.

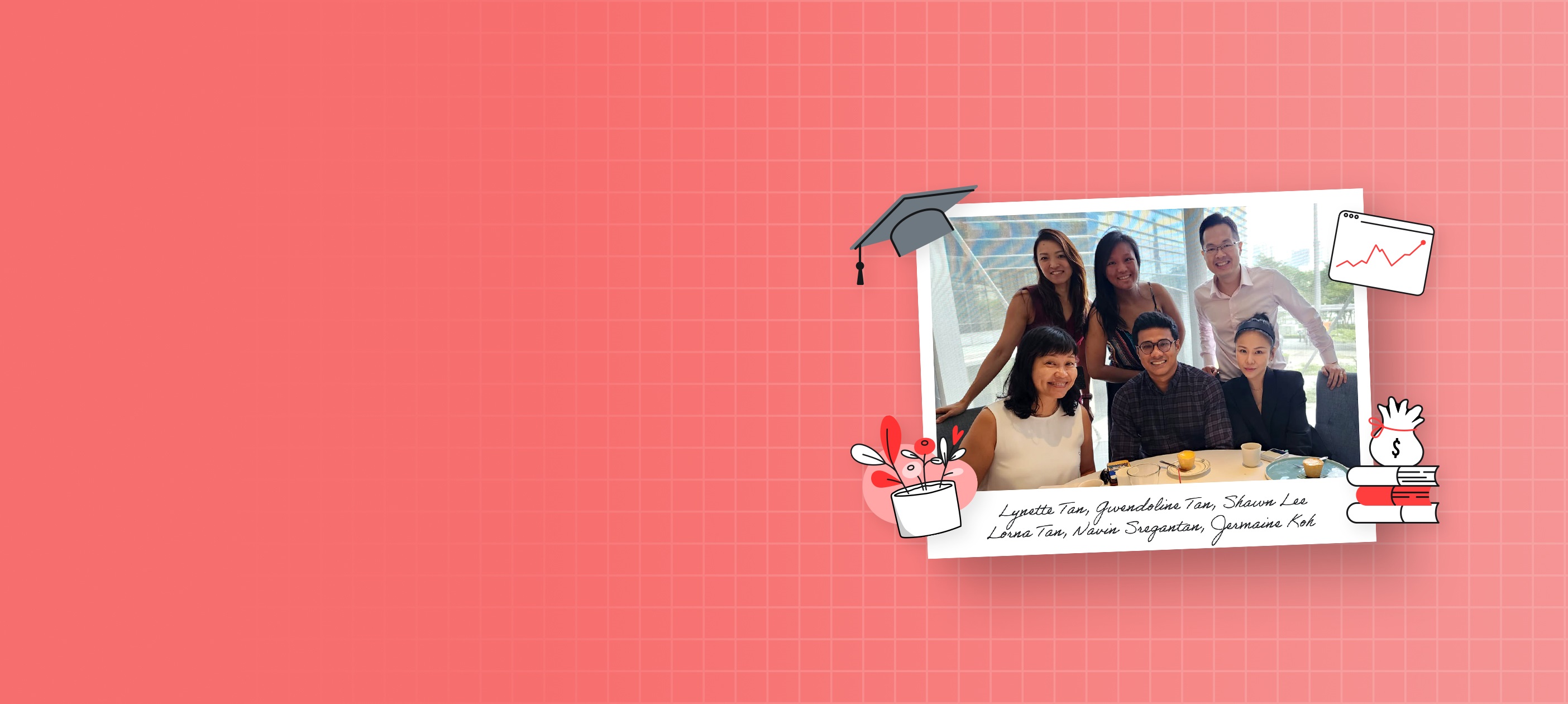

The start of a new year is a great time to review our finances and set new goals for the year ahead. This year, we have invited financial planning literacy specialists from the DBS Financial Planning Literacy team to share one financial tip each that has made a substantial impact on their money management.

Lorna Tan

Prior to joining DBS, Lorna was the Invest Editor at The Straits Times for 16 years, covering finance and consumer protection issues. She has won numerous awards for excellence in financial reporting and public service journalism, and is the author of four bestsellers: Money Smart-Own Your Financial Destiny, Retire Smart- Financial Planning Made Easy, More Talk Money and Talk Money.

As a wage earner, there’s only so much I can earn and save. This is why I realised that I would need to do more to be able to mitigate longevity and inflation concerns, and be able to fund my desired retirement lifestyle and that of my parents.

It helps that I have a money personality that naturally gravitates to being a disciplined saver with an innate curiosity on what’s new in the investment landscape. Change is the only constant so I keep myself plugged in by researching, reading, listening to podcasts and attending financial-related seminars. While I am mindful of my short- and mid-term financial goals, I have adopted a long-term diversified investment approach to achieve financial freedom. For me, financial planning must be deliberate and quantifiable, and I continue to track and refine it over the years.

I get restless when I have too much idle cash lying around and would constantly seek opportunities - after ensuring I have adequate insurance protection of course – to make my money work harder for me. Diversification is key. This includes optimising government schemes like CPF and SRS, and having a mix of asset classes like equities, fixed income, real estate, and private equity products.

Lynette Tan

Lynette started her career in a brokerage and has more than a decade of experience in the financial services industry in areas spanning personal finance and investment advisory. She is passionate about empowering people with personal finance knowledge to help them live a better life.

Coming from a brokerage background, my first foray into investing was to buy stocks. While it was a good start to break the inertia of investing, it was hard for a beginner to pick the right stocks. I have suffered losses over time, but also made gains over “hype” stocks through the years.

My one financial tip is to leave the stock-picking to experts and invest on a regular basis. I set aside a fixed amount every month to invest in a broad-based Exchange-Traded Fund (ETF) so that I can have a peace of mind without worrying about suffering substantial losses on a single stock.

Putting aside a fixed amount each month for investments also helped me build discipline, similar to how we build discipline in savings. By automating the process, I don’t even need a reminder to invest every month. Doing this also helps me feel better about not having my savings eroded by inflation if I simply leave them in a deposit account.

Jermaine Koh

Jermaine joined the financial industry since 2011 and is in her 8th year with DBS. She joined the financial literacy team in 2022.

The switch in career has made me more mindful of my expenditure. To gain better control of my finances, I have started tracking my money in/out religiously using budgeting tools on my mobile phone. This allows me to better understand my spending patterns and to plan my budget better. Doing so enables me to stay grounded and spend within my means.

I am also better at prioritising needs over wants. This is way better than relying on “girl math” and just spending/saving blindly (which was what I did before). Instead of indulging in wants, I try to set aside money to invest in low-risk instruments such as T-bills, bonds and fixed deposits, while I explore suitable higher risk investments. It’s a tiny step to growing my wealth, but it’s better late than never!

That said, I’d still like to reward myself once in a while. Instead of buying things (which I used to before), I prefer setting aside a travel budget. I have realised that the “happiness” that physical possessions provide, is temporary. Travelling, on the other hand, allows me to invest in time spent with my loved ones and/or myself and these experiences are unique and irreplaceable.

While the process of tracking expenses and budgeting might appear dull initially, it is crucial because it empowers you to gain control over your financial situation. By keeping a close eye on where your money goes, you can make informed decisions, identify unnecessary spending, and allocate funds for your priorities. This financial discipline not only ensures that you meet your financial goals but also provides the flexibility to treat yourself occasionally without compromising your financial stability. In essence, it's about finding a balance between responsible money management and enjoying the pleasures in life.

Gwendoline Tan

Gwen has more than 8 years of experience in the finance industry, mainly in business development, and as a relationship manager and has joined the DBS financial literacy team since 2022.

This simple, but important financial tip, was not one that I learnt from my years in finance, but rather one that was taught to me by my parents since I was in school. It is so simple and practical that even a primary school child (i.e. me) could put it into practice, and has remained relevant in my financial planning up till today.

When I was a child, my parents would give me a little more pocket money than I needed each day – say 10 or 20 cents – and let me decide how to use it. I could have bought myself a sweet treat daily but was instead always encouraged to save/ put it away first, so that I could build up the savings in my piggy bank, in case I needed spare cash one day. This is the basic principle behind “paying yourself first”.

It is common for many to think that “paying yourself first” equates to “giving yourself a treat” each time your monthly salary comes in. In reality, deciding on and consciously setting aside an amount of money each month the moment your paycheck comes in is ensuring that your future self is taken care of.

Navin Sregantan

Navin has been with the financial planning literacy team with DBS since 2020 and works on various projects aimed at making holistic financial planning content more accessible to all DBS clients and members of the public.

Previously, he was a journalist with The Business Times and The Straits Times covering listed companies, financial markets, investments and corporate social responsibility initiatives.

The financial tip that changed my view on financial wellness is that investing should be treated as a journey and not a sprint. Just like in life, there will be lots of ups and downs, as well as disappointments and moments of triumph. What’s most important is to stay focused on meeting your long-term goals and steer the course.

As a first jobber, it helps to start investing as soon as you can, and I probably sound like a broken record here but “time in the market is better than timing the market”. In other words, the best day to start investing is today. This doesn’t mean that you must make a large, lump-sum investment. Instead, get into the habit of setting aside money to make regular investments through dollar-cost averaging. It’s ok to start small and build your confidence and knowledge up.

Don’t be obsessed with trying to successfully time the market. This is very difficult to accomplish and even highly skilled professionals often fail to achieve this. Moreover, efficient financial markets often price in information so quickly that investors are unable to perfectly buy at its trough and sell at its peak. What is most important is to have skin in the game by being invested.

The global economy historically sees longer periods of growth than recession, and stock markets see longer “bull” phases (uptrends) than “bear” phases (downtrends).

Much like in life, you will most certainly make mistakes in your investing journey. You might lose confidence and feel that investing is not for you but don’t give up too easily due to these setbacks.

Don’t let bad experiences dissuade you from investing. Instead, focus on learning from your mistakes as after all, we tend to learn more from our mistakes than our successes. By learning from your mistakes, understanding yourself better and being more well-researched, you have the opportunity to be “greedy when others are fearful”.

Market peaks and troughs are expected. They are caused by various factors, such as economic indicators, political developments, and company announcements. When markets go awry, it is easy to panic and sell your investment to trim losses. But cutting loss too early may prevent you from potentially enjoying a price recovery later.

Shawn Lee

Shawn has a decade of experience in financial advisory and education. Previously, Shawn was Lead of the Client Advisory team at MoneyOwl, a financial advisory firm under NTUC Social Enterprise. He led the comprehensive financial planning team to deliver personalised advice to thousands of clients.

Shawn is also a Certified Financial Planner (CFP®) and a member of the Financial Planning Association of Singapore.

One of the most important financial skills is getting the goalpost to stop moving. It’s also one of the hardest.

“When you realise how powerful expectations are, you put as much effort into keeping them low as you do into improving your circumstances. Happiness, contentment, joy … all of those things come from experiencing a gap between expectations and reality."

Morgan Housel

Manage your expectations by thinking deeply about how you can “upgrade” your lifestyle slowly. Ensuring that at each level of lifestyle, you can sustain the financial commitments for the rest of your life.

Because what happens when you perform an "upgrade" is that you find the burst of excitement fleeting away all too soon. Remember each time when you got a new mobile phone?

So for example, even if you could take a loan to get a new continental car now instead of taking public transport, consider upgrading your lifestyle slowly over the years, so that you extend your happiness when the time comes for each "upgrade" and that it is sustainable.

Over the years, you could:

1. Take a private hire ride/taxi when you are tight on time

2. Book an hourly rental car

3. Purchase a used Asian car that is older

4. Purchase a used car that is newer

5. Purchase a brand new Asian car

6. Purchase a brand new Continental car

While a new and flashier car was tempting in our buying journey, my wife and I decided to purchase a 13-year-old used Asian car as our first car when our second child came along during the pandemic. And while making the financial commitment, we are also aware that we are ready to go without the vehicle when the kids are independent or if our financial situation does not allow for it. This allows us to stay on track to accumulate towards our financial goals such as retirement and the children’s education.

Beyond a car, the above "upgrades" can span many areas. Our mobile phones, clothes, laptops, watches, holidays, bags, fine dining, accessories and the frequency we have them.

As we see too often in the case of some, if you are not able to sustain the payments of what you "upgrade" to, because life is never certain, you could lose what you have and feel miserable.

So, perhaps to extend your happiness through life, consider the following:

- Instead of choosing to "upgrade" immediately, what can you upgrade slowly today?

- How about donating what you have to your preferred charitable causes so that you can help those in need?

- Knowing that happiness is fleeting, what if you choose to be contented with what you have now and not need any "upgrades"?

Do these financial tips resonate with you? Have you set your financial goals for 2024 yet?

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)