3 ways joint accounts work for couples

![]()

If you’ve only got a minute:

- With a joint account, you and your partner can simplify your finances, keep track of your expenses and spending habits, and grow your savings faster than you would on your own.

- Carefully consider the type of joint account to better suit your needs and preferences.

- Establish clear guidelines on how the account will be used and managed to avoid any potential financial misunderstandings and conflicts.

- Communication and trust is key to making joint account works.

![]()

What is the best way to manage your finances? It's challenging enough to do this alone; and with your spouse, there are so many more factors to consider! That’s because your decisions on how you spend your time and money will now impact others, and the impact lasts.

One of the best ways to begin this new chapter of life is with a DBS joint account where both of you credit your salaries and dividends. But to really maximise your joint account in Singapore, you’ll want to ensure it earns the highest interest rates and rewards you for planning your finances as a new family unit.

This combination comes in handy: a joint account with individual DBS Multiplier Account for each of you.

Building a life together involves a myriad of spending and savings choices. And the DBS Multiplier helps you take advantage of these choices, letting you unlock interest from paying your utility bills, charging to your DBS credit card to buy the anniversary gift, or in time to come, paying for the kid's tuition fees.

What is a joint account?

A joint account is similar to a savings account that you may already have on your own – but with at least 2 people having access to it. This type of account allows you to combine forces into growing your savings a little faster than you would on your own.

Find out more about: DBS Joint Account

Advantages and disadvantages of joint accounts

There are many other advantages to joint accounts. It helps with budgeting and reduces the hassle of transferring money to your spouse for household bills. A joint account also allows both parties to have an overview of the family’s financial health. You can even open a joint account before marriage! This provides the transparency that can help couples build trust.

Are there disadvantages? Some couples prefer to keep their finances separate and cite privacy as one reason. Another concern is that the joint account may have to be unravelled if your relationship status changes.

But what happens to a joint account in Singapore when someone dies? In the event of death, the joint account balance will typically be passed to the surviving owner.

Joint account vs. Joint-alternate account

When applying, you'll have to choose between a "Joint account" and "Joint-alternate account". The difference is that with a "joint account", all account holders must agree to all transactions.

On the other hand, a "joint-alternate account" allows you to perform transactions independently and you do not need consent from the other account holders. (It's probably polite to let them know though, to build trust and transparency!)

Benefits of a joint account + Multiplier account

Here are some tips to help you get more benefits by combining the use of a joint account together with a personal Multiplier Account

1. Earn higher interest by "stacking" your salaries

Typically, couples manage their joint accounts in one of these ways:

- Both contribute a fixed percentage

- Both contribute a fixed amount; or

- Both credit all their salaries and investment dividends

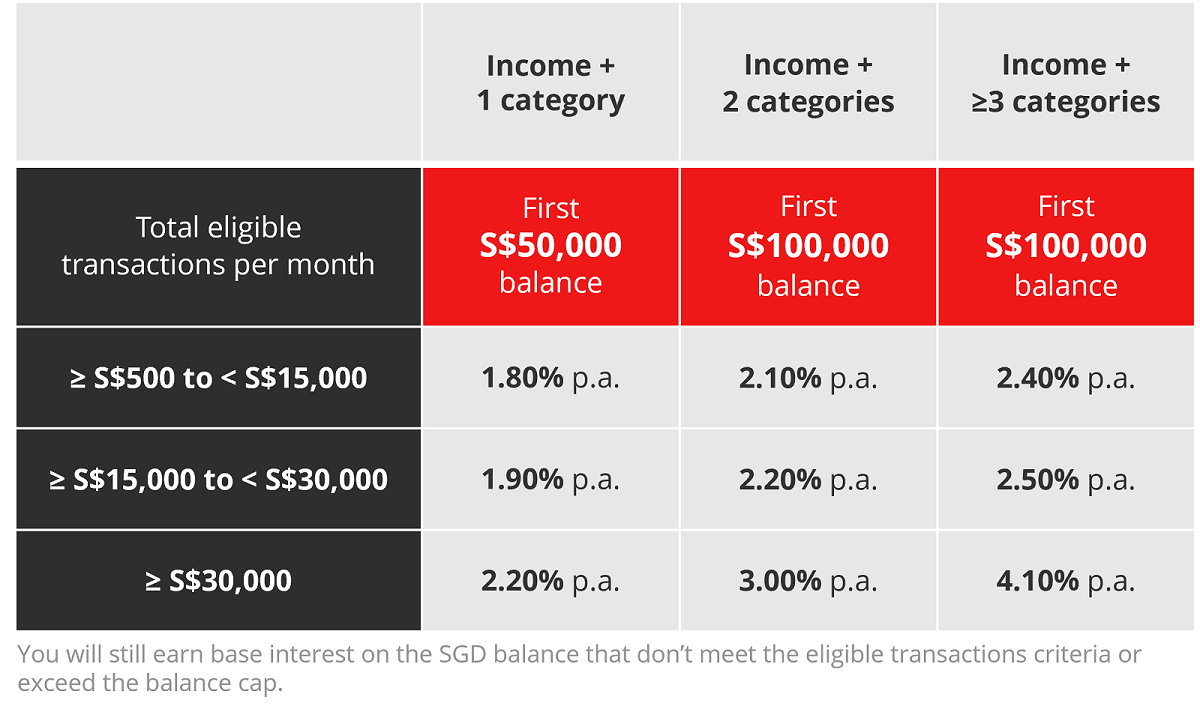

You can maximise the interest earned with your personal Multiplier Account. Here's how it works: Bank your salaries into a joint account such as My Account to qualify for higher eligible transaction tiers and earn bonus interest on the average daily balance in your individual DBS Multiplier Account.

Here’s an example on how a joint account can benefit you:

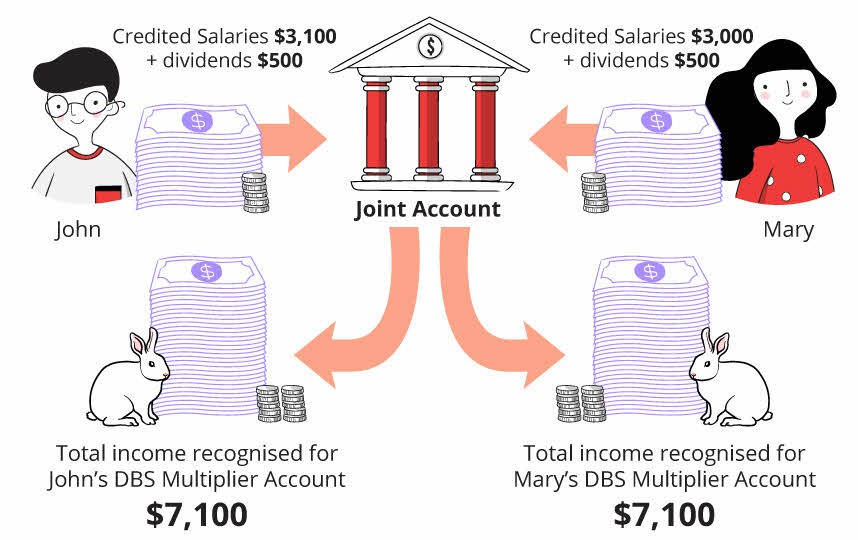

Scenario 1: Both John and Mary credit their salaries and dividends into a joint account. They also have a personal Multiplier Account each.

In this scenario, the bonus interest earned on their individual Multiplier Account will be based on the combined credited salaries and dividends (S$7,100), instead of just their individual salary and dividends.

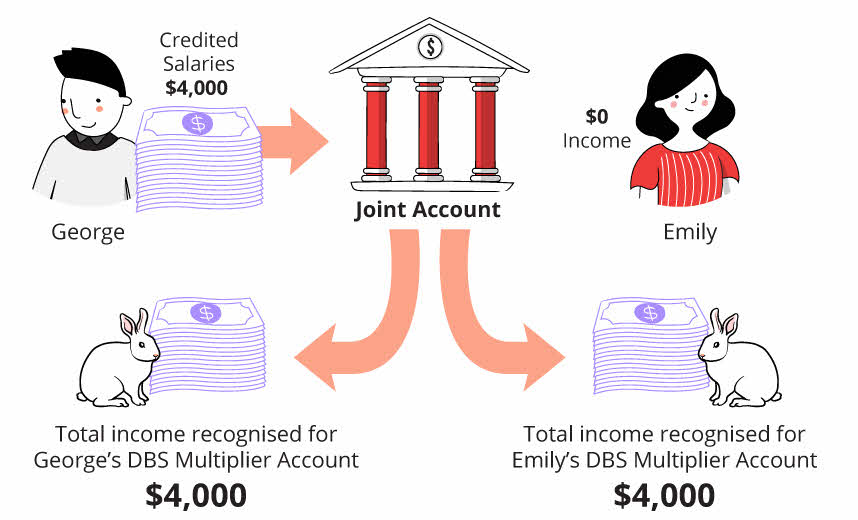

Scenario 2: Both George and Emily have a personal Multiplier Account each. Only George credits his salary into a joint account.

In this scenario, the bonus interest earned on their individual Multiplier Account will be based on George’s credited salary (S$4,000).

Even though Emily does not draw a salary, she still gets to enjoy the bonus interest in her personal Multiplier Account.

You can still benefit even if you're a gig economy worker or are in-between jobs. Here's how:

- If you do not have a regular salary, you can still make use of any investment dividends or annuities as part of the “income” category as long as they are tagged with the qualifying transaction codes or descriptions.

- Using your PayLah! to pay for your purchases at retail shops will count for another category. Make sure that your total amount of eligible transactions adds up to at least S$500 each month.

- If your employment situation changes and you start drawing a salary, your DBS Multiplier Account is smart enough to figure out the best route to higher returns for you and bae.

2. Get more out of your spending with Multiplier

Starting a life together is likely to lead to additional payments, premiums, and overall costs. This includes life insurance, mortgage payments, utilities, and groceries, among others.

Make the most of these expenses through the Multiplier account.

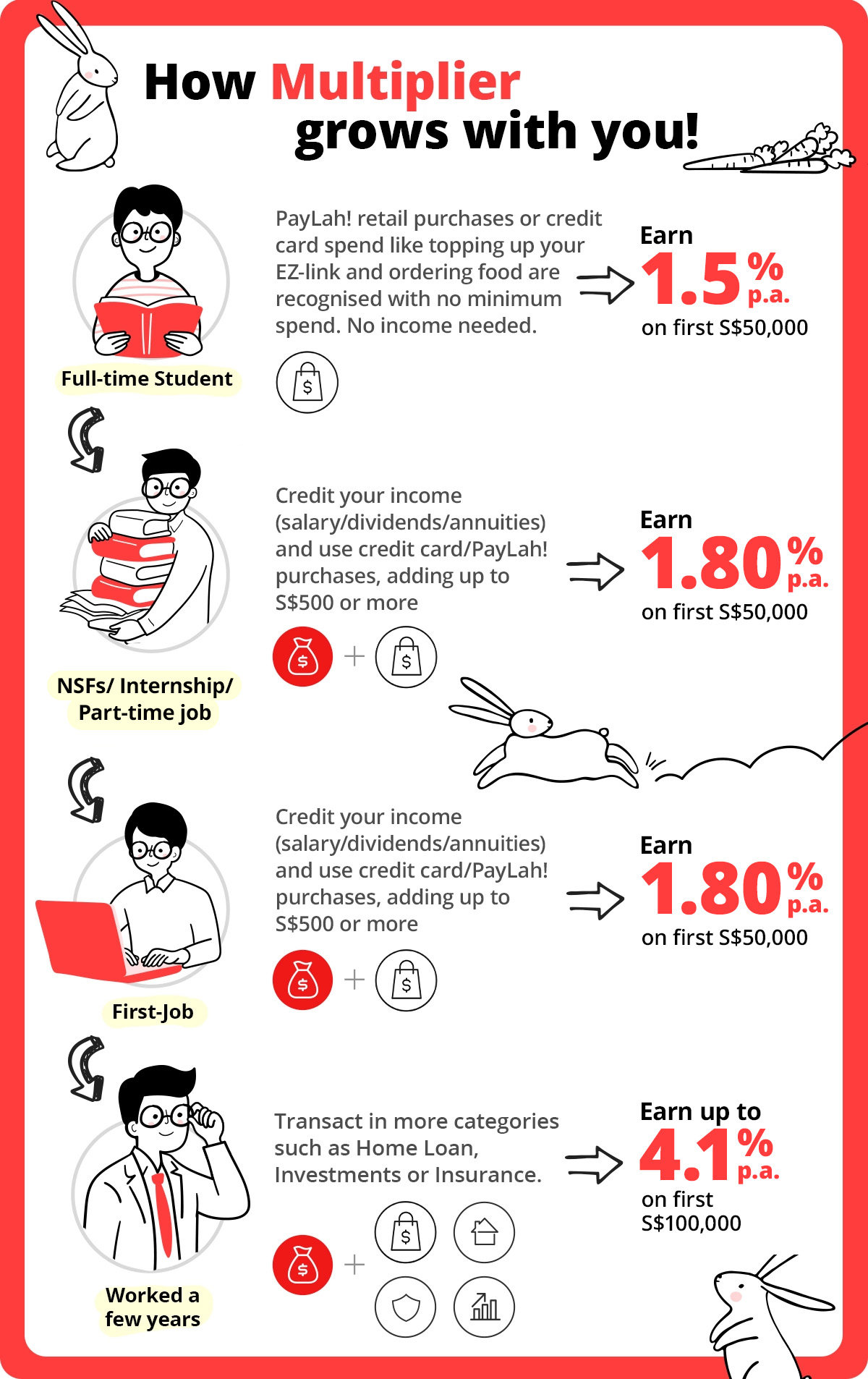

With the DBS Multiplier, qualifying payments and purchases in the relevant categories can help to earn bonus interest of up to 4.1% p.a.. These categories include credit cards/PayLah! retail spending, instalment payments for a DBS/POSB home loan, as well as selected insurance and investment products.

You can also use the interest calculator to get an estimate on the interest could earn each year.

Read more: How can Multiplier work for you if you are in your 30s?

Find out more about: DBS Invest-Saver

3. Plan better for your life together

Money can be a major source of conflict between couples - having a joint account creates transparency (and builds trust), while helping you and your partner grow your little nest egg.

In addition, setting couple goals create financial discipline, encouraging you to work within your budgets and save for something much bigger like a new house, the bucket list vacation in Machu Picchu, or more tuition classes for the kids as their major exams approach.

Read more: Managing money as a couple

Find out more about: Open a joint account today!

It's easy to apply for DBS Multiplier and joint account

How do you open a joint account in Singapore? At DBS and POSB, everything is done online in a safe, secure manner. You never have to visit a branch if you don’t want to, fill in dozens of forms or make a thousand declarations after the one you've already made to the "one". You can even open a joint account before marriage, which is so useful for wedding and marital home furnishing expenses.

What do you need to open a joint bank account? Existing DBS/POSB customers can apply for a joint-alternate My Account here. New DBS/POSB customers will need to submit a few more documents so you’ll want to prepare for that with this list.

A joint account, with all the benefits you gain through your individual DBS Multiplier Account, is one of the best ways to kick-start your savings journey and at the same time look to get something back through your spending.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)